Fortune 100 response to DE&I pressures

Cryptocurrencies are booming around the world. This article, part one in a mini-series, analyzes Canadian legislation for cryptocurrency businesses, focusing on securities laws and regulations.

This is the first article in a three-part series. You can find parts two and three below.

Part 2: Canadian Anti-money Laundering Regulations For Cryptocurrency Businesses

Part 3: Canadian Tax Rules For Cryptocurrency Businesses

Earlier this year the world’s first directly backed Bitcoin Exchange Traded Fund (ETF) was approved in Canada, demonstrating a shift in regulations, and enhancing access to cryptocurrencies for all investors. On February 11th, Purpose Investments Inc. was given the green light by Ontario Securities Commission (OSC) to launch the Purpose Bitcoin ETF (BTCC), following months of close collaboration. On February 18th, the fund started trading on the Toronto Stock Exchange (TSX), and in its first two days, it managed to collect CAD 421.8 million in assets under management (AUM).

Bitcoin and cryptocurrencies have been gaining popularity among the investing public as well as traditional institutions, and the launch of the first crypto ETF opened the gate for similar products in Canada. In fact, only a few days later, another Bitcoin ETF, known as Evolve ETF (EBIT) had started trading on the TSX, and as of April 16, 2021, Canada approved world’s first Ether ETFs for retail investors.[1]

Following these significant milestones, we see value in examining the current regulatory framework surrounding cryptocurrencies in Canada and providing a high-level overview of related legislations from securities law to anti-money laundering and taxation. This first piece of our miniseries will particularly focus on understanding and applying Canadian securities rules to cryptocurrency entities.

Under the Bank of Canada Act, cryptocurrency is not considered legal tender in Canada. Therefore, from a tax perspective, the asset is treated as a commodity, rather than “money”. Under securities laws, Canadian crypto exchanges or “tokens” are classified as securities and are subject to securities requirements. Finally, from an anti-money laundering (AML) perspective, cryptocurrency entities are considered money services businesses, and are bound by strict AML regulations.

Even though the legislative field is still playing catchup, with respect to recent players and activities in the crypto field, there have been enforcement actions and a renewed focus on regulating virtual currencies across all pillars.

Canada primarily regulates cryptocurrencies under securities laws, which are enacted on a provincial and territorial basis. Unlike most countries, Canada lacks a federal securities regulator. Yet with the existence of the Canadian Securities Administrators (CSA), an unofficial organization that coordinates all provincial and territorial securities regulators, Canadian securities rules are largely harmonized. As an example, Purpose Investment’s receipt of approval for its Bitcoin ETF from the Ontario Securities Commission (OSC) was filed under a multilateral instrument passport system across multiple Canadian jurisdictions.

While the CSA coordinates initiatives across Canada, provincial or territorial regulators, as illustrated below, handle all complaints regarding securities violations in their respective jurisdictions as well as enforcement of securities regulations, providing a more direct and efficient service since each regulator is closer to its local investors and market participants.

| Province / Territory | Securities Regulator |

|---|---|

| British Columbia | British Columbia Securities Commission |

| Alberta | Alberta Securities Commission |

| Saskatchewan | Financial and Consumer Affairs Authority of Saskatchewan |

| Manitoba | The Manitoba Securities Commission |

| Ontario | Ontario Securities Commission |

| Quebec | Autorité des marchés financiers |

| New Brunswick | Financial and Consumer Services Commission (New Brunswick) |

| Nova Scotia | Nova Scotia Securities Commission |

| Newfoundland & Labrador | Office of the Superintendent of Securities, Service Newfoundland & Labrador |

| Prince Edward Island | The Office of the Superintendent of Securities (Prince Edward Island) |

| Northwest Territories | The Office of the Superintendent of Securities, Northwest Territories |

| Yukon | Office of the Yukon Superintendent of Securities |

| Nunavut | Office of the Superintendent of Securities, Nunavut |

Canadian Securities Law for Cryptocurrencies

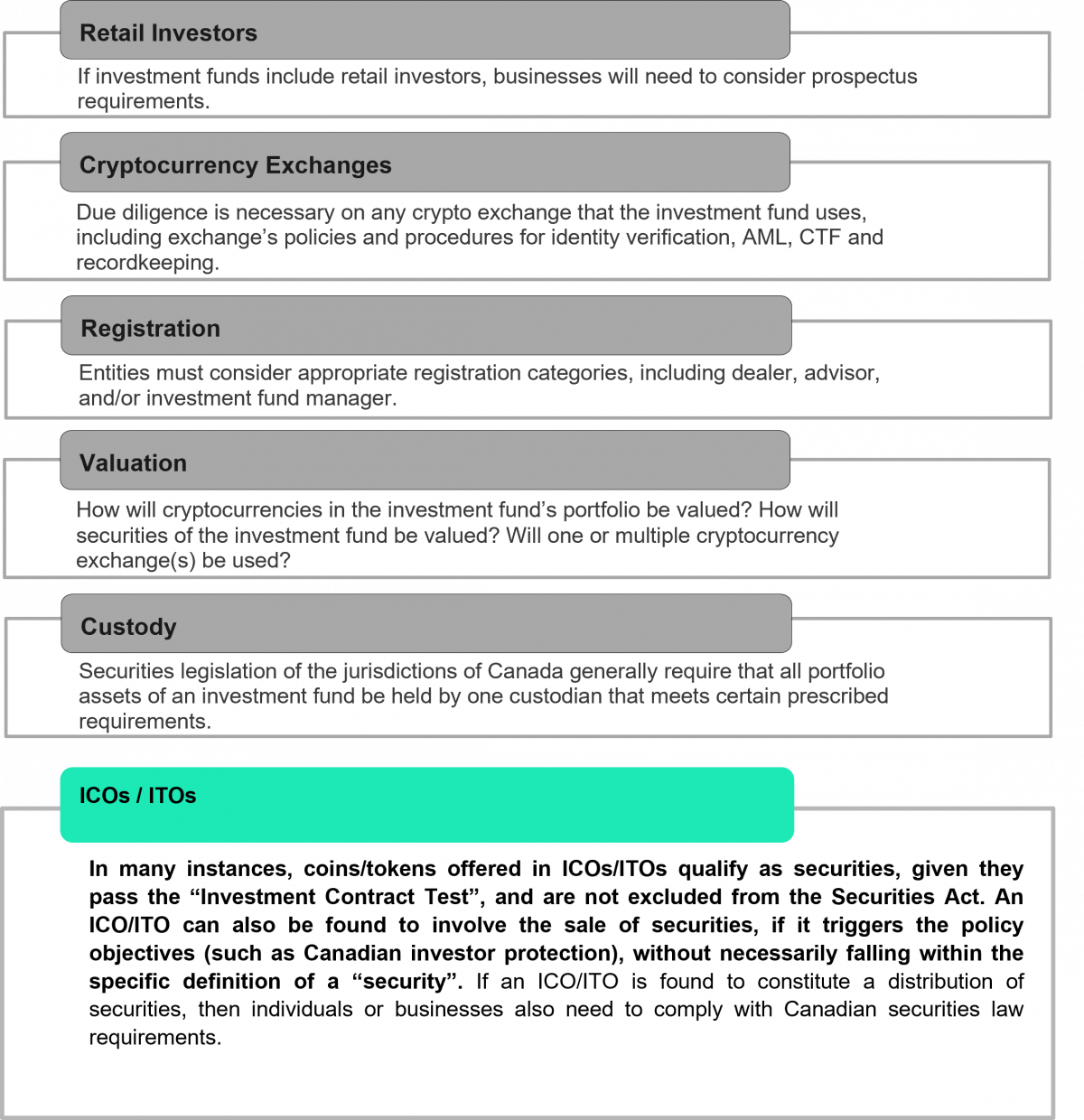

Based on the “Investment Contract Test”, most crypto assets qualify as securities. This was first clarified by the CSA in August 2017, through Staff Notice 46-307 Cryptocurrency Offerings, outlining how securities law requirements may apply to Initial Coin Offerings (ICOs), Initial Token Offerings (ITOs), crypto investment funds and cryptocurrency exchanges trading these products. Almost a year later, in June 2018, CSA issued Staff Notice 46-308 Securities Law Implications for Offerings of Tokens, providing additional guidance on token offerings, including “utility tokens”. The overall takeaways from both notices are as follows:

Fintech businesses looking to establish cryptocurrency investment funds should consider the following (non-exhaustive) list of matters:

The securities requirements include the following, and entities failing to meet these requirements could face significant legal and financial penalties:

Prior to legally distributing the security and obtaining approval from the relevant regulator

If they are in the business of securities distribution or advising others regarding securities

Reporting & Compliance Duties

Once registered with securities regulators

Even with all of CSA’s policy efforts, the current regulatory practice is still to apply and adapt existing laws, such as the Investment Contract Test, to transactions involving virtual currencies that resemble traditional securities. Consequently, Canadian securities regulators are obligated to analyze ICOs on a case-by-case basis, rather than using a check-box solution to decide whether they qualify as a securities distributor. As a result, the CSA advises that entities contact their local securities regulatory authority to determine whether their activities trigger securities legislation requirements, and if so, the appropriate steps to comply with the regulations.

In January 2020, the CSA issued Staff Notice 21-327 Guidance on the Application of Securities Legislation to Entities Facilitating the Trading of Crypto Assets. According to this announcement, entities facilitating transactions relating to crypto assets, including buying and selling crypto assets (collectively, Platforms) are subject to securities legislation if the following assets are:

Alternatively, platforms are not subject to securities legislation under two conditions, when:

While the regulators acknowledge that “there isn’t a bright-line test” to ask whether a contract or instrument makes immediate delivery of a crypto asset, given most cryptocurrency assets qualify as securities, the 2020 guidance suggests securities legislations apply generally to most Platforms.

When a customer buys crypto assets on a Platform, it is often that assets are not immediately transferred to a wallet controlled by the individual yet remains in a wallet controlled by the Platform. These platforms are also called “custodial platforms”. For instance, Purpose Bitcoin ETF’s Bitcoin holdings are kept in “cold storage”. This is an offline wallet used for storing cryptocurrencies on a platform to protect wallet from cyber hacks and other third-party risks, through using a digital wallet that is not connected to the internet. This feature gives the fund a strong selling point, as having “the most secure custody solution in the market”, yet it also blurs the lines around “immediate delivery”.

On March 29, 2021, the CSA and the Investment Industry Regulatory Organization of Canada (IIROC) published Joint Staff Notice 21-329 Guidance for Crypto-Asset Trading Platforms: Compliance and Regulatory Requirements (2021 Notice), providing necessary detailed guidance regarding the regulation of cryptocurrency-trading platforms (CTPs). This 2021 Notice does not introduce new rules – CTPs are already subject to existing securities regulatory requirements – but rather clarifies how existing requirements apply to crypto-trading business models, and how crypto-platforms currently operating in Canadian jurisdictions may or may not be following such regulations. As such, the 2021 Notice is to be considered alongside the prior 2020 guidance (SN 21-327). The 2021 Notice also emphasizes that Canadian securities laws apply to crypto-trading platforms serving Canadians, even if the platform is operating outside of Canada.

While the 2021 Notice acknowledges that each individual CTP business model may have unique features that may require tailored regulatory consideration, the 2021 Notice describes two broad categories of platforms for the purposes of the new guidance:

The regulatory requirements for both platforms differ, and the first step, as noted by the regulators, is to assess whether a CTP is a marketplace or a dealer platform, or some combination of the two – which can be complex despite fact-specific guidance.

These recent rules and publications by the CSA do not represent a conservative approach towards the emerging crypto market, but instead, a willingness to foster innovation while prioritizing Canadian investor protection. Additionally, various exemptions to securities regulation could be applied through initiatives by provincial authorities or the CSA, to encourage innovation and growth. To demonstrate, the CSA Regulatory Sandbox is an initiative with a goal to support fintech businesses, through providing exemptive relief for entities from securities laws requirements.

As an example, in September 2020, Wealthsimple launched Canada’s first regulated crypto exchange platform, obtaining approval for CSA Regulatory Sandbox. The firm applied for “exemptive relief” in all Canadian jurisdictions, as permitted in January 2020’s CSA Staff Notice 21-327, and was granted relief from certain registration, prospectus and trade reporting requirements for 24 months.

Looking at the overall regulatory field for cryptocurrencies in Canada, we see a fine balance between encouragement and caution. While regulators are effectively keeping up with the fast pace, and global nature of the industry, regulatory compliance for crypto businesses can still be a challenge.

From a securities law perspective, cryptocurrency entities must ensure they understand and fulfill their compliance obligations, as well as their exemption opportunities. This can be a demanding process and entities are advised to communicate with their securities regulators, due to certain “basket clauses” in regulatory language. For instance, crypto-assets can be considered securities, even if they don’t pass the “investment contract test”, given regulators are mandated to consider policy objectives and purpose of securities legislation first. Furthermore, with the 2020 CSA guidance, most crypto trading Platforms are now subject to securities legislation in Canada and must follow critical steps to ensure compliance.

Given the fast-moving and often vague regulatory field and significant penalties for non-compliance, working with Sia Partners can add crucial value to your business. With our extensive abilities in compliance, including former regulators on staff, Sia Partners is ready to assist you with all your compliance needs as a cryptocurrency entity. Sia Partners remains current on all federal and provincial requirements applicable to cryptocurrency businesses and can provide you with the best compliance solution in line with your business plans.