Control Room of the Future

Private equity funds are coming to understand the high value of data and business analytics. As institutional capital flows more readily into the private capital sphere, stakeholders are demanding greater transparency in reporting standards and more insight into valuation processes.

The Private Equity industry is rapidly realizing how invaluable data is to effectively drive decision making concerning portfolio company monitoring and acquisition due diligence. Tech giants like Google and Facebook have shown the value that can be accrued through data and information. Proper leverage of data can lead to more risk-averse, and higher grossing, decision-making. Data is found in each step of work that a PE firm faces, so being able to gather larger groups of data for more advanced manipulation will provide a more efficient and profitable business. However, while data is the topic of conversation in the PE markets, the question of whether sufficient infrastructure exists in order to realize the quality needed to drive a more informed investment theses is still up in the air. Many firms who are looking to utilize data analytics to derive more substantial investment rationale will require infrastructure upgrades in order to realize the true potential of their data.

The type of data required to drive analytical functions in private equity is often market and industry-specific, unique in nature and can typically be considered a commodity. In a field that is rigorously competitive and, in recent years, has seen a significant uptick in investor demand for better performing deals and asset classes, access to better quality data can give firms a viable upper hand in this quest for enhanced returns. Access to data can arm fund managers with the tools needed to rapidly complete the due diligence process and more successfully manage existing portfolio companies.

As technology grows at an exponential rate, some of the more common burdens investors are faced with when researching prospective deals are now being slowly automated and integrated with advanced data processing tools. According to The Wall Street Journal, 77% of PE executives conducted due diligence data analytics, while 68% utilized it during negotiations[1]. As more data analytic tools are being introduced, reports indicate that private equity firms are behind on the adoption curve given that they are hesitant to adopting technology they believe is “unproven.” It is fair to assume that there is an additional knowledge barrier PE firms would need to hurdle, lacking the skills necessary to transition out of legacy systems will likely exist as another obstacle moving forward as data science progresses.

Private equity firms have their ears open to the digital revolution and opportunities exist to completely transform their digital landscape, by providing them with new tools to aggregate their data and upgrade their existing infrastructures to properly collect information generated through operations in order to drive more analytically focused and sophisticated investment decisions predicated upon this knowledge.

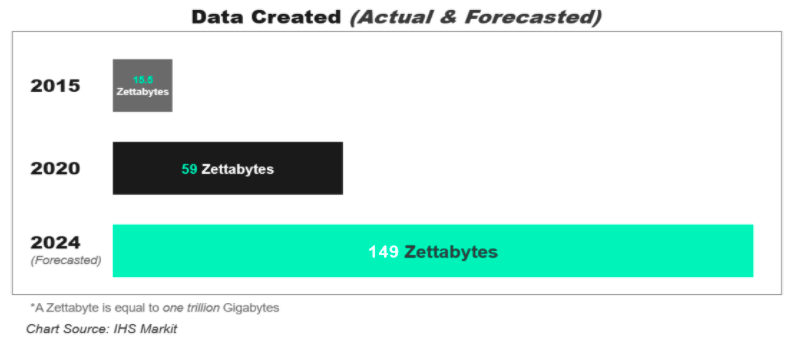

The sheer amount of data created over an annual basis throughout the world is incredible in magnitude, to say the least. In 2020 alone, in excess of 15.5 Zettabytes of data were created (this is equivalent to 15.5 Trillion Gigabytes)[2], which leads to the compelling question, of whether companies in the private equity industry (whether firms or their portfolio companies) are optimally refining this data in order to drive their decision making processes. Private equity firms are confronted with rising pressure to utilize both data generated from operations and industry on two fronts—Internally and externally. Without the ability to analyze vast and rapidly growing volumes of data in order to make more informed decisions regarding acquisitions, private equity firms may find them at a disadvantage relative to their peers. On an introspective note, firm management needs to understand the value of their data generated through internal operations and how this might affect the information provided to investors and key stakeholders.

While the attractiveness of data analytics continues to drive PE firms to reconsider the way they form decisions about portfolio companies and throughout the due diligence process, many firms have not made any advancements towards their infrastructure, disabling them from seeing the possible upside from this technology. 30% of PE firms surveyed believe that in the past 12 months [3], they have seen no further importance towards analytics in their work, whereas the other 70% have seen some additional sense of importance for analytics within their work[4]. Additionally, PE firms have seen more success and greater development towards their performance analysis with the implementation of advanced data analytics, like machine learning and AI. These tools have been found most valuable for PE firms within performance analysis, back-office management, portfolio management, and risk management, respective of effectiveness. 20% of surveyed PE firms have seen a high level of effectiveness with advanced data analytics implemented within performance analysis[5].

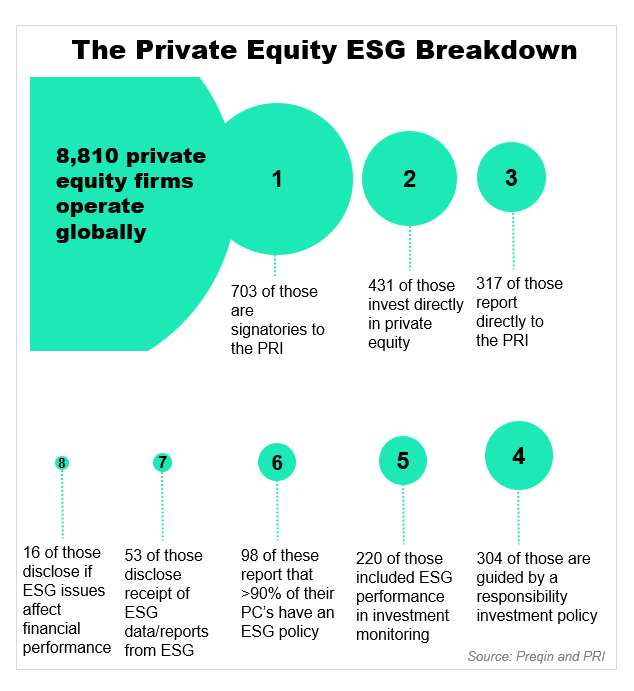

ESG (Environmental, Social and Governance) metrics have received a particular call-out by Institutional investors (pension funds and the like) for increased outlay in investor statements and it is up to private equity management in order to figure out how to best collate this information from the raw data generated through portfolio operations. ESG assets account to around one-third of investment AUM in the United States[6] and have become a matter of critical interest in determining investment theses and evaluation.

The collection of ESG information is difficult in nature, as methodologies differ in its measurement across industries, subscribing entities and management teams. With the plethora of data available and differing standards of measurement, PE firms and their management can often feel at a loss with regard to how to aggregate a collection of data sourced from a variety of different channels coherently and in a usable format.

ESG factors are becoming more mandated as time progresses, especially with energy funds, as they are more directly tied to possible environmental changes. Being able to collect and analyze ESG data, to create metrics easily able to be equated to a monetary amount – also known as “material metrics” – is a goal for PE firms moving forward, as investors are becoming more conscious towards the risks that can occur within the ESG space. The European Union is already creating sweeping rules towards having more transparency within European funds, as well as US fund managers that market funds in the EU, with the EU Sustainable Finance Disclosure Regulation taken into effect last March 10th. It is bound to occur that similar regulations will eventually take place in the US, and private equity firms should be ready when that occurs.

According to a study conducted by EY[7], although the majority of PE firms have tools that standardize reporting throughout their portfolio, less than 25% can use these same tools for valuing their portfolio for potential buyers. Not only do these analytics save time and hassle with creating financial reports, but they will improve the insights to executives to improve their compliance and the perspective that investors have on one’s portfolio.

In the wake of the 2008 Great Financial Crisis, increased cries for regulation and the US government’s mandate of reporting initiatives such as the Dodd Frank and Foreign Account Tax Compliance Acts have made regulatory compliance much more structured and costly for financial institutions to uphold their commitment to. Heightened compliance and regulation are speculated to be an ongoing trend as the financial markets (and particularly private capital) grow more far-reaching and sophisticated in nature and face an influx of offshore funds from overseas investors.

A study from Vistra.com shows that PE firms understand the value of data into the forthcoming years, with 85% of LP’s surveyed view it to be a major enabler of change. However, as it becomes necessary to adapt and stay updated, what are PE firms’ options regarding this change? They can build out new systems, buy out a software company, or acquire an outsource from a third party vendor, but these options become more limited when regarding small to midsize firms. Smaller firms would struggle with the capital-intensive internal investment as well as the pertinent issues for scaling. In Vistra’s study, 55% of correspondents believe that outsourcing to a third party was the preferred method of creating solutions for better data management. Furthermore, once that issue is solved, the next hurdle appears. With digitally enhanced internal systems, firms would have to worry about the oncoming threat of cybersecurity, which many view to be the most prominent threat for the next 3 – 6 years[8].

As funds weigh on the various impacts of increased regulation and heightened demands from investors and institutional managers alike, a record 1.9 trillion USD in dry powder[9] has raised battle cries for heightened investment activity from stakeholders, who are readily resulting in higher acquisition bids and stark competition amongst industry players. The ability to effectively amalgamate portfolios and industry data into more optimized, decision-driving information will undoubtedly continue as a key trend as fund management teams weigh on their existing toolkits and infrastructure to strive for competitive advantage. Funds can seek to improve the speed in which they gather, structure and analyze portfolio and market data through automation, a proven methodology for heightening efficiency in the financial services sector.

Data-powered investment is the future for the private capital industry, and the movement can be personified through the activity of firms such as Two Six Capital—an innovative fund which has been involved in over 27 billion USD worth of transactions since the group’s inception in 2013[10].

Transactional due diligence, in recent years has put the spotlight on data-driven methods of decision making in the private equity industry and the ability to better understand, calculate, and forecast the post-merger value creation possible through various acquisitions are critical aspects of the new paradigm for analytics-driven investment theory. Cited in a University of Pennsylvania article, Two Six Capital’s usage of “large-scale, cloud-based engineering” enables the fund to analyze massive datasets in short timeframes and under a variety of lenses. The nimbleness of cloud-based software and relative affordability of the tools lends itself to practical deployment—hands-on platforms which can be deployed by IT teams even at smaller firms entering the market with lower assets under management. It is clear that analytical cloud solutions have the potential to be an economical back-end driver of due diligence operations. As well, the standard, pay-as-you-go, SaaS (Software as a Service) aspect to cloud facilities means that funds of all sizes and structures have the ability to tailor their usage and expenditure around the solutions as their needs evolve and the potential transactions needing full analysis develop in scale and magnitude.

Funds are often limited by the amount of bandwidth their staff has in order to spread their time across deal analysis and the timeframes for the typical due diligence process lasts around four to six weeks to analyze a potential transaction[11] . Through deploying advanced statistical machine learning algorithms in order to better analyze customer data through cloud solutions, companies more thoroughly understand projected and current growth rates than before, rather than relying on standardized and adapted growth formulas that may have more traditionally been used throughout the analysis processes. Tracking and timing customer intake for potential acquisition targets that operate throughout varying geographical areas can provide further insight into how lucrative certain market segments are, and whether they may be worth investing in post-acquisition.

Funds have relied on spreadsheets via Excel and other common tools in order to build their analysis, which initially brought significant evolution to the degree of productivity capable of being achieved by private equity staff, but models are still maintained mostly by humans and error can occur. Introducing enterprise-wide spreadsheet management software can enable due diligence teams to link their existing sheets for further data drill-down and develop more efficient channels through which to intake raw data for analysis.

In closing, a well-grounded understanding of data analysis, AI and machine learning is emerging as a critical characteristic of the innovative private workforce. As Two Six Capital’s success in streamlining their due diligence and portfolio company monitoring process has illustrated[12], a shift to new enterprise tools may signal an innovation-centric shift from long-staling analysis processes, driven mainly by fundamental spreadsheet-driven forecasts and projections, often prone to error. As machine learning, AI and cloud solutions develop and the tools available to private equity investors begin to see upgrades in their usability and accessibility, hiring teams who understand the demand for the recruitment and retainment of employees who possess skills rooted in an analytics-driven approach to investment will be crucial in cultivating a culture dedicated to pushing their organizations to the forefront of data-driven investing.

While data analytics approaches exist and tools are readily available for funds, management must understand how to tailor their workforce recruiting to target individuals who have proven experience in pragmatically deploying these tools and amalgamating massive datasets in order to come to conclusions which will put them ahead in an industry plagued by stiff competition in recent years. As the inflow of institutional capital continues to overwhelm an industry with a record 1.6 Trillion in dry powder[13], data-driven investing may be the key that general partners are looking for in order to gain an edge and allocate investor capital.

Sia Partners’ deep experience across finance organizations with data and technology platforms positions us well to assist your company in employing effective data management practices, to include developing centralized data warehouses. From creating governance frameworks and target operating models, to complex systems and data integrations, we offer a wide range of solutions to address the full spectrum of our clients’ data management needs.

Our data management offering can assist in defining data models and processes to ensure centralized availability and homogeneous quality of data through your organization, priming your data for analytical utilization and fueling enhanced management decision making. We are also positioned to assist in achieving optimal data quality, developing tailored data models, refining data validation and controls and leveraging monitoring tools for internal data sets. Sia Partners can additionally deploy business process automation tools in order to expedite manually performed operational tasks, resulting in cost reduction. If you are interested in smarter reporting and analytics at your organization, reach out to us regarding our offering towards data visualization and reusable libraries for modeling via modern and best-in-class analytical solutions.

[2][3][6][9][13] https://ihsmarkit.com/research-analysis/under-pressure-are-private-equity-firms-prepared-for-the-data-.html

[4][5] https://www.privateequityinternational.com/deep-dive-better-dealmaking-through-data/

[7] https://www.ey.com/en_gl/divestment-study

[8] https://www.vistra.com/insights/four-technology-trends-impacting-private-equity

[10][11][12] https://knowledge.wharton.upenn.edu/article/data-analytics-slowly-transforming-private-equity/