Control Room of the Future

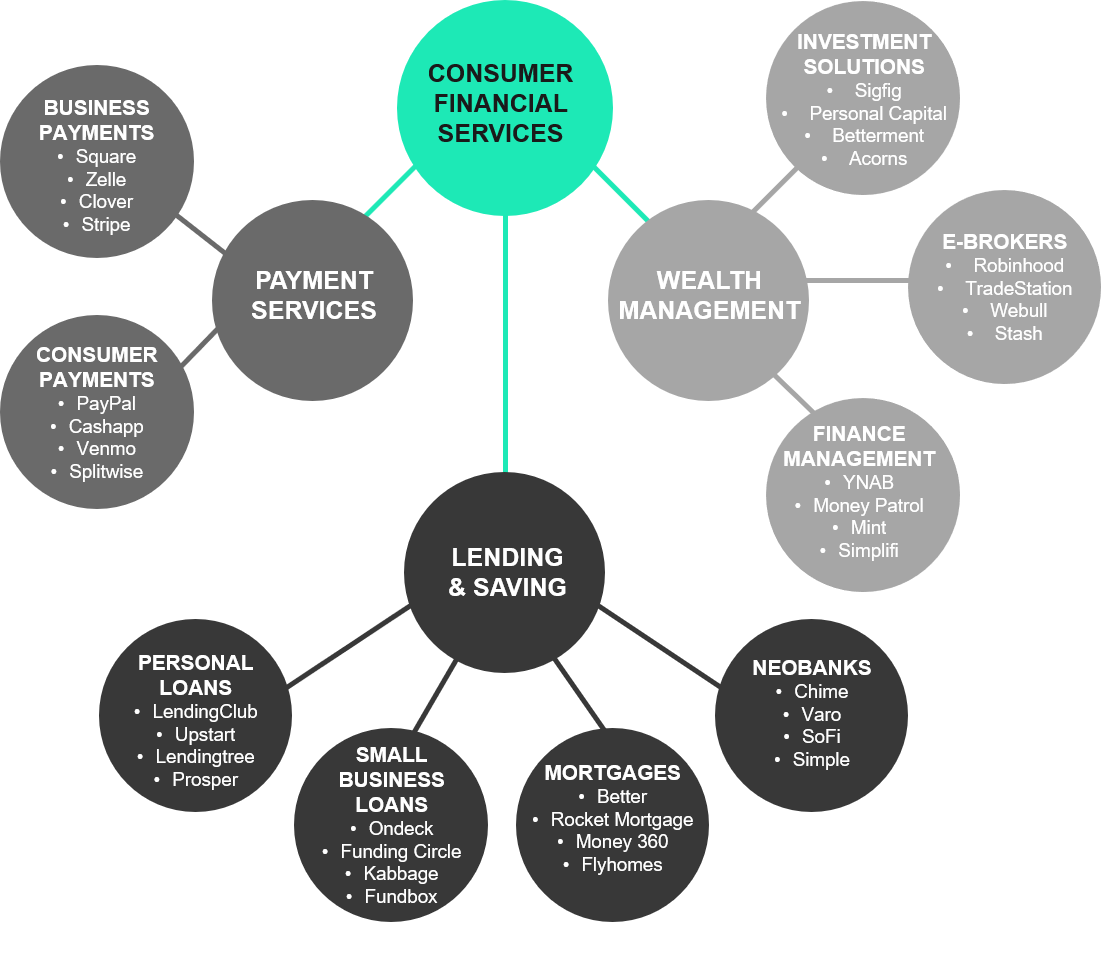

Traditional financial services are constantly disrupted with the acceleration of technology. Fintech evolution has shifted client banking preferences to a more convenient, easily accessible digital experience. Sia Partners highlights where Fintechs have caused disruption in traditional banks.

The financial services industry is being disrupted by a wave of technological development. For the past decade, digitalization of banking across the globe has progressed due to multiple factors including, the emergence of new technologies, evolution of client expectations, regulatory revisions, and availability of digital wallets. The COVID-19 pandemic has accelerated these trends. Digital banking platforms are pulling clients away from traditional financial service firms through new technology with an emphasis on client experience and low fees.

Despite the pandemic or possibly because of it, the adoption of digitalization of the consumer finance industry has accelerated. Research published by the Swiss Finance Institute found that with more time spent at home, during COVID-19 pandemic, the daily average rate of Fintech app downloads increased from 29.2% to 32.8%. Fintechs are also growing outside of app downloads. Many banking institutions are partnering with Fintech firms to enhance their current banking functionalities. Institutions are realizing that consumer brand loyalty is decreasing, while a demand for speed, accuracy, transparency and high tech, is increasing. Adapting to market demands is crucial in today’s post COVID-19 digital age. This article illustrates the effects that the COVID-19 pandemic has had on consumer banking and the acceleration of the Fintech industry.

Financial Difficulties During the Pandemic

Fintechs have faced their own challenges in dealing with the COVID-19 pandemic. In a recent study conducted by the World Bank, The Global Covid-19 FinTech Market Rapid Assessment Study, FinTechs reported a 5% average increase in agent or partner downtime and a 7% increase in the number of unsuccessful transactions, queries or access requests compared to the same period in 2019. These operational difficulties in addition to increased expenses have hindered FinTechs growth. Additionally as much of daily life has moved online FinTechs have seen increased fraud and cybersecurity risk. FinTech firms have also been under greater amounts of financial stress as there has been a modest fall in financing deals and valuations. In the World Bank survey about half of FinTech firms identified COVID-19 having a negative impact on their balance sheets. Despite these difficulties many different types of FinTech firms experienced significant growth in 2020.

Note: Although sections are divided there is significant overlap in services offered by these companies

Neobanks are online-only financial institutions with no physical branches. Most neobanks do not hold their own banking charter, so they typically partner with chartered banks to hold their customers’ deposits. These firms have been emerging across the globe and chipping away market share from incumbent banks. Data presented by Trading Platforms indicated seven American neobanks cumulatively recorded a user growth of 39.28% between 2019 and 2020. These virtual banks offer many of the same services as traditional banks including checking accounts, credit cards, loans, and refinancing.

Many of these digital banks cater to niche market segments – such as immigrants, teens, and freelancers – that are typically underserved by the traditional banking business. Neobanks operate solely digitally and have no physical branches to maintain. Due to these circumstances, they are able to offer their customers perks including high interest savings and checking accounts, little to no fees, and money-saving and budgeting features.

Although many digital banks struggled during 2020, SoFi continued to grow and acquired a community lender to obtain a banking charter. SoFi has grown from a student loan lender to an established neobank, offering a wide range of banking and investment services. Due to their success, they have announced plans to go public with an $8.56B valuation. Other neobanks, including Chime, Vero, and Current, won over US customers by processing stimulus payments faster than their traditional counterparts. Investors are increasingly pushing these challenger banks to demonstrate that they are able to monetize their products and eventually become profitable, as neobanks have historically prioritized growth and customer acquisition over profitability. Only a few neobanks, including Revolut and U.S. based Chime, have even achieved operational break-even.

Neobanks have seen significant market share growth, but the negative impacts of COVID-19, new regulatory issues, and increased competition have reinforced the imperative for neobanks to earn investors returns. Some potential paths for neobanks to reach profitability are through boosting lending to small and medium enterprises, adopting niche selling points, introducing premium accounts, and changing fee structures. However, customers typically do not use neobanks as their primary bank accounts so introducing fees may lead to decreased customer satisfaction and increased churn. The players who eventually turn profitable will be successful in the long term, while the ones who do not shift the focus to profits may ultimately fail.

There has been a massive surge in FinTech lending in the last decade. FinTech lenders originated 38% of total personal loans in 2018 compared to less than 1% in 2010. These companies leverage technology, machine learning, digital marketing and alternative credit data to better serve lenders. This technology has allowed these firms such as LendingClub, Kabbage, and Ondeck, to reduce processing time and paperwork while offering competitive interest rates.

Online lending firms cover all types of borrowing including personal loans, student loans, mortgages, and small business loans. Fintech lenders offer faster and easier approval as well as reduced rates and fees, resulting in lower closing times as well as expanded lending to underserved groups. Fintech lenders such as Kabbage and Ondeck lend to small businesses where funding has historically been challenging. They require less documentation, less collateral, offer personalized payment structures, and provide expedited access to funding.

During the COVID-19 pandemic, many FinTech lending platforms offered their customers access to government relief funds in the US through Payment Protection Program (“PPP”) loans. However, many lenders were also victims of the crisis. Many firms paused or scaled back financing offers in March and April 2020. The World Bank survey observed a 13% year-on-year H1 increase for defaults and a 19% increase in arrears or late payments for North American digital lenders and reported similar trends across the globe. FinTech lenders may be particularly vulnerable to the economic stress surrounding COVID-19. Researchers at Harvard University found that consumers who borrow from FinTech lenders are more likely to rack up debt, overspend, and ultimately default. Their research found a 25% increase in risk of default compared to borrowers with similar credit profiles at traditional banks.

In response to the pandemic, many customers with an existing relationship with a FinTech lender have required more funds and have turned to their Fintech lenders to obtain them. The World Bank study noted that during COVID-19, the number of loans issued rose by 14% in the US, and while the number of new borrowers decreased by 6%, the number of repeat borrowers increased by 19% nationally, indicating that while there were more defaults and fewer new borrowers, repeat borrowers were also borrowing significantly more than what had been seen historically.

While increased borrowing may provide borrowers short term relief, the resulting spike in defaults could cause trouble for consumer credit lenders. Additionally, the mass unemployment brought on by the pandemic, and the heightened uncertainty surrounding who will be able to pay the loans back moving forward could spur credit losses, especially for the high-interest, high-risk loans. Despite these short term issues we expect that in the long term FinTech lenders will generally be able to weather the crisis and that in particular lenders with large cash reserves will be well situated to expand as more people have grown accustomed to conducting their finances online.

Consumer payments services make it easy to transfer money between customers. Services like Venmo and CashApp give consumers the ability to send and receive payments between bank accounts, credit cards and ecommerce vendors. These companies earn revenue primarily from transaction fees and have been growing in popularity and introducing new services.

Both Venmo and CashApp have recently started to add services traditionally provided by retail banking such as checking accounts, debit cards, mobile check deposit, and FDIC insured deposits. These services have built a foothold by providing payments services and are now attempting to leverage that foothold to cut into traditional retail banking services.

During 2020 Venmo and CashApp both saw an increase in users and transactions. This growth was driven in part by their ability to receive direct deposit of stimulus payments and their accessibility for the traditionally unbanked. They have also been seen as being useful for transferring money while maintaining social distancing. Square (CashApp’s parent company) disclosed that in April 2020 as cities went into lockdown to prevent the spread of COVID-19, the direct deposit volume on CashApp tripled and customers moved to store more than $1.3 billion in aggregate balances on their app. Around the same time, PayPal (Venmo’s parent) Chief Executive Dan Schulman said that Venmo has “become much more central to people’s management and movement of money instead of just being a social payment [service].” As many other aspects of daily life have moved to the internet more people are using online services to manage their finances. As lockdowns end and the world returns to normal, many people will continue to use these new services, and will expect to be able to quickly transfer money between accounts. Traditional retail banks need to recognize growing customer expectations regarding the ease and speed of transfers and payments. If they are unable to keep up customers are more likely to conduct transactions and hold balances in payment apps, outside of traditional banks.

In addition to consumer apps like Venmo, companies like Stripe and Square are used by vendors to accept e-commerce and mobile payments payments, the companies also provide customers a physical card reader. Both companies focus on making the payments process as easy as possible for startups and small businesses. These firms are beginning to act like neobanks and are now providing services such as corporate debit cards and small business loans. Additionally, both are starting to offer a variety of other business services (payroll, analytics, benefits, marketing, fraud protection) to their customers.

Both services have performed well through the 2020 pandemic as business has moved online. Stripe provides payments for services that have seen a large increase in usage during the pandemic, notably the video conferencing platform Zoom and grocery delivery service Instacart. Square has also become a provider of PPP loans through their Square Capital business. The financial services products that Stripe and Square are adding to their business makes these services an attractive alternative to more traditional small business banking. By moving to combine financial services products with other back-office services, these firms will compete with the banking options typically available for small to medium enterprises.

PayPal Total Payment Volume (TPV) is the value of payments, net of payment reversals, successfully completed by PayPal or enabled by PayPal.

Square Gross payment Volume (GPV) is the total dollar amount of all card payments processed by sellers using Square, net of refunds. Additionally, GPV includes Cash App activity related to Cash for Business and peer-to-peer payments sent from a credit card.

Robo-advisors provide investment solutions through online platforms, reducing the need for direct interaction with financial advisors. Robo-advisory services include automated asset allocation, trade execution, tax-loss harvesting, and portfolio optimization rebalancing. They typically have low fees and low account minimums compared to traditional wealth management services. Many of them use low-cost, diversified index mutual funds or ETFs to manage a diverse range of asset classes. Their low-cost structure helps robo-advisors reach underserved populations, such as the mass affluent or mass-market segments.

Many robo-advisors also offer their customers the ability to sync their external accounts in order to budget and create financial plans without switching between multiple apps and accounts. These investing platforms, such as Personal Capital and Sigfig, aggregate and track all of investments and accounts, organize them by asset class, and compare investment performances to indexes. Similarly, financial management apps including Mint and Simplifi provide budgeting services, allowing customers to easily and efficiently track their spending, consolidate funds, and view and pay bills.

Robo-advisors have been adopted at an increasing rate during COVID-19. Despite poor market performance in Q1 many customers opened new accounts. To read more about the adoption of Robo advisors in 2020 see our article here: https://www.sia-partners.com/en/news-and-publications/from-our-experts/q1-2020-stock-markets-worst-quarter-1987-how-robo-advisors

Young retail investors have flocked to no fee brokerages such as Robinhood which have no fees and other attractive features including cryptocurrencies and fractional shares. Robinhood, Webull and others have pushed more traditional brokerages like Schwab to reduce their commission fees. TD Ameritrade, E*TRADE, and Ally Invest Also cut their commissions to zero at the end of 2019.

2019’s reduction in fees and 2020’s volatile markets have drawn many new retail investors into the stock market. Through its commission free trading and polished mobile app Robinhood typically serves new investors with an average age of 31. In 2020 they brought in over 3 million new investors to their app, over half of whom had no prior stock trading experience. Robinhood also allows commission free options trading which has led to elevated volumes of options trading throughout the pandemic. The volume of options trading in 2020 has broken records, and it is largely fueled by retail investors buying speculative investments. Specifically, they are largely buying out of the money options close to expiration. This activity has accentuated already volatile market conditions by forcing derivatives writers to make large buy and sell orders to hedge their positions.

Robinhood in particular has been the source of major controversies including the Gamestop controversy and regulatory issues regarding best execution and risk supervision. To read more about the issues surrounding Robinhood and Gamestop please read our insight here: https://www.sia-partners.com/en/news-and-publications/from-our-experts/whats-going-with-gamestop-robinhood-and-hedge-funds Regardless of whether Robinhood and other online brokerages are able to weather these controversies, their success has shown demonstrated a strong appetite for retail investors to have low cost expanded access to financial markets.

Over the past year the COVID-19 pandemic has dramatically impacted the financial services industry. Increased reliance on technology is spurring customers to move towards new FinTechs for their financial needs. Although the pandemic will end, many of these new firms are likely to continue to shape the financial landscape. The threats many FinTech and traditional financial services firms are facing will not disappear and their responses will be important to their long term success or failure.

Sia Partners is here to help our clients cope with this industry transformation to improve their competitive advantage, flexibility, productivity, and profitability. Our vast experience and expertise across multiple functional areas within the Financial Services industry in conjunction with our unparalleled technology capabilities enable us to deliver highly customizable strategic, operational and technology solutions to our clients. Our consultants partner with you to help your business navigate this uncertain environment and define and implement strategies and priorities for a new era in financial services.

How Stripe, CNBC’s No. 1 Disruptor 50 company, helped keep the U.S. economy afloat during pandemic: CNBC

U.S. Challenger Banks Record 40% User Growth to 39 Million Within a Year: Trading Platforms

Venmo and Square’s Cash App were going gangbusters before the pandemic — now they’re doing even better: Market Watch

You Checked Tesla The Most: New York Times

Robinhood Is Losing Thousands of Traders to a China-Owned Rival: Bloomberg

How the Little Guy Is Fueling the Stock Market’s Wild Ride: Barron's

US Challengers Grow Users to 39M in 2020: Banking Exchange

Fintech Startups Rush to Get Stimulus Payments Out: Wall Street Journal

Digital banks gain U.S. customers during pandemic, thanks to early deposits: Reuters

Europe’s digital banks got a ‘wake-up call’ in 2020. And consolidation could be coming: CNBC

Fintech in the Time of COVID-19: Technological Adoption During Crises: SSRN

How Covid-19 Is Impacting Fintech Financing: CBInsights

The Global Covid-19 FinTech Market Rapid Assessment Study: World Bank Group

8 Fintech Companies Offering Paycheck Protection Loans: US Chamber

The Dark Side of Fintech Borrowing: World Knowledge

SoFi Is Buying a Community Lender to Speed Up Banking Expansion: Wall Street Journal