Carbon Capture, Utilization, and Storage (CCUS):…

An insight into the developments of cashless society in Belgium. Why is a cashless society is worthwhile and what are the main benefits of excluding – or at least drastically reducing – cash from our society.

In a previous article, we answered several questions around why a cashless society is worthwhile and what the main benefits are of excluding – or at least drastically reducing – cash circulation. Because of the fast-changing society we live in, this follow-up article provides an overview of how our society has evolved in terms of cash usage and how the overall view of a cashless society has changed in the past two years where Covid-19 changed our outlook.

It may not seem like a long time ago, but in 2018 digital transactions were often accompanied by overcharges. Moreover, it was common for digital transactions to take several days to transfer an amount to the recipients’ bank account. However, this changed in 2019. The year 2019 was marked by both regulations on removing overcharges for card payments and a general agreement by Belgian banks to participate in the “instant payment scheme” from the European Payment Council (EPC). These events meant that digital transactions as of then were no longer subject to overcharges and that basic transactions worth less than €15,000 would be transferred between bank accounts instantaneously. Those were significant steps towards reducing cash usage and a massive contribution to increasing the popularity of digital payment methods.

This brings us to 2021, where Belgian society is still bouncing back from a now two-year-long covid-19 pandemic. The pandemic brought along, among other things, the massive discouragement of cash payments in stores, restaurants, and other public places. The global health crisis pushed many people towards using digital payment methods.

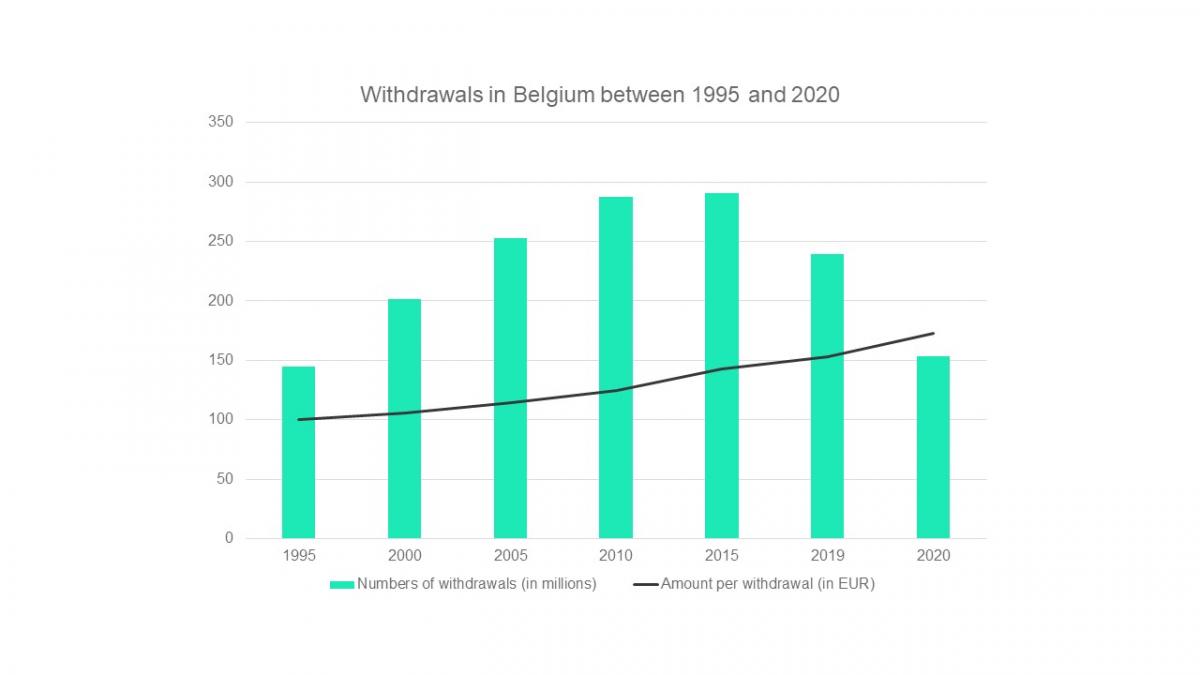

The reduction in cash usage is also reflected in the total number of cash withdrawals in Belgium. We see a drop of around 36% in 2020 compared to 2019. Both the number of withdrawals as well as the total amount withdrawn have significantly decreased, in such a strong manner that they have reached levels similar to 1995, making a strong case for a decrease in the interest the average consumer has for cash. In contrast, the amount per withdrawal has increased from around 143 in 2015 to 173 in 2020.

Figure 1 (Atos Worldline et al.,2020)

This move away from cash payments came together with another payment habit that has influenced today’s society: contact-free payments. Although Belgium was a late adopter in implementing contactless payments, more than 86% of Debit cards are, as of 2021, equipped with the technology. And this had an impact. A survey conducted by Bancontact, Payconiq, Febelfin, Mastercard, Visa, and Worldline, together with the Free University of Brussels, shows a rapid increase in contactless payments over the past three years because of the covid-19 pandemic and banks actively facilitating contactless payments. In 2019 only 33% of respondents claimed to be familiar with contactless payments. Whereas, in 2021, this number surged to 70% as shown in figure 2. These figures show amongst Belgian residents a fast-paced change in habits and perspective, accelerated by the pandemic.

Figure 2 (Febelfin et al.,2021)

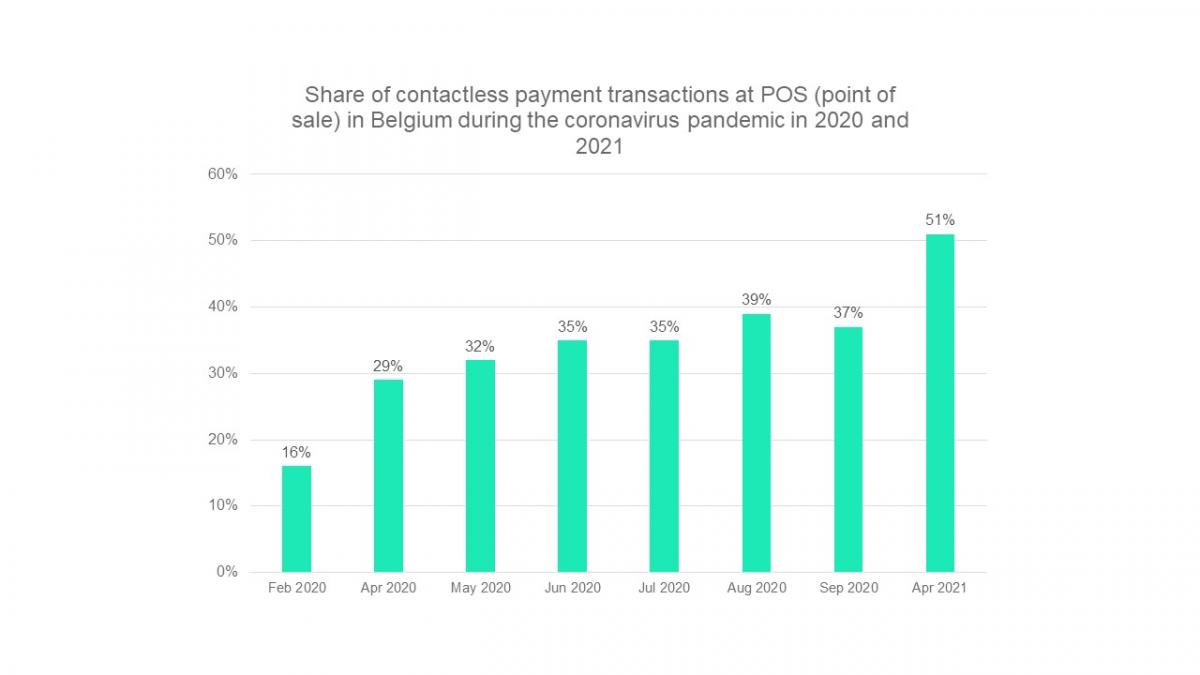

Recent data published by Febelfin and Worldline supports these findings. The data shows that the share of contactless payment transactions at points of sale in Belgium rose from 5% in 2019 (Worldline, 2019) to 16% at the beginning of February 2020 and then reached an all-time high of 51% in April of 2021 (Febelfin, 2021). Over half of card transactions are now contactless, suggesting a fast-paced adoption of this faster and more efficient payment method over the past three years in Belgium. This increases the pressure on cash as it further facilitates transactions by card.

Figure 3 (Febelfin, 2021)

The Covid-19 crisis has had a striking impact on general payment methods, as shown by figure 4. Card payments and ATM withdrawals both sank in the early weeks of the pandemic. However, after a couple of weeks, card payments bounced back and even surpassed their initial pre-crisis levels, whereas ATM withdrawals are to this day still unable to fully recover.

Figure 4 (Febelfin, 2021)

What role does cash still play and continue to play in our society and markets? To illustrate its evolution, we focus on the positioning of institutions in terms of cash, as well as how shares of cash in payments are evolving.

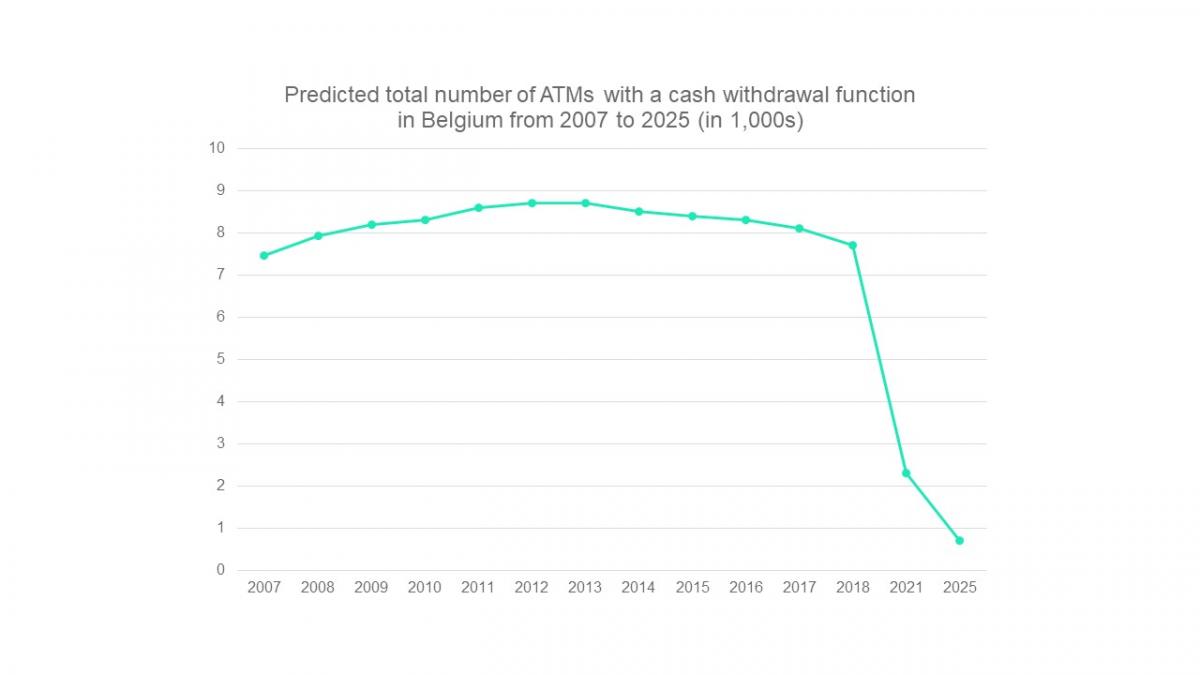

Major Belgian financial institutions including Belfius, BNP Paribas Fortis, ING, and KBC will join forces via their mutual subsidiary “Batopin” in order to reshape the current ATM landscape towards a more sustainable and modern approach. By 2025 the number of ATMs in Belgium is planned to drastically lower from 2300 in 2021 to 700 (Roelens et al., 2021).

Figure 5 (National Bank of Belgium, 2020)

Still, it remains a priority to make an ATM available for everyone within a 5 km radius, showing that cash continues to play an important role in Belgian banks. For the near future, at least.

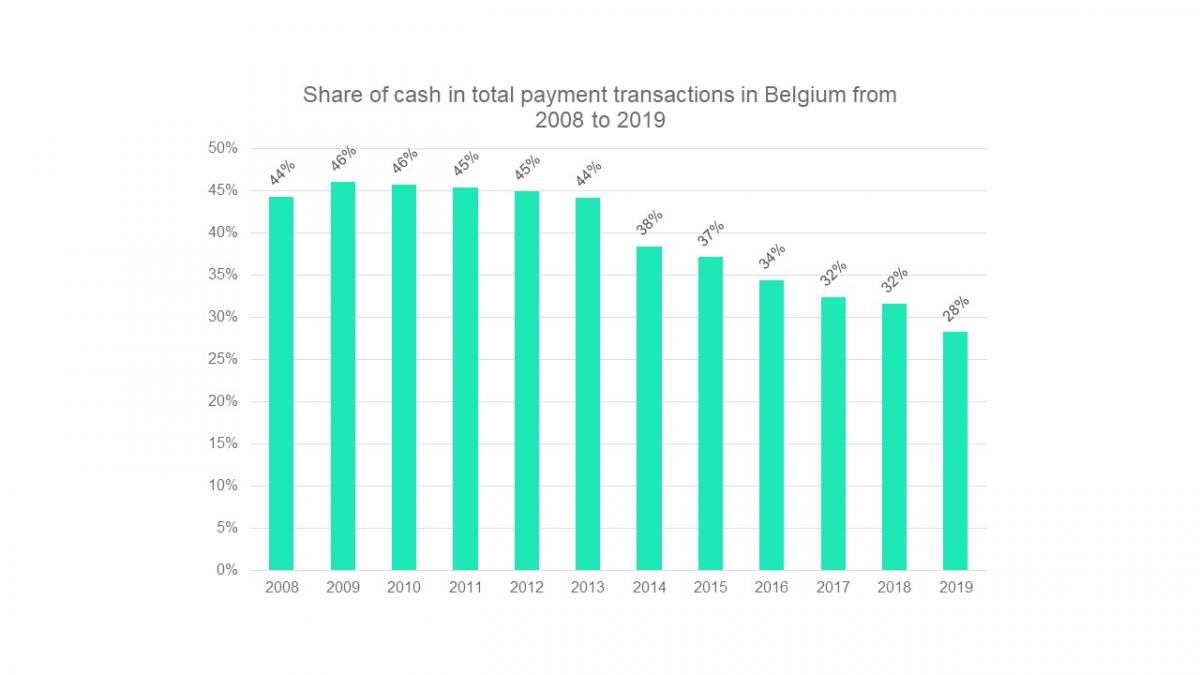

Regulatory and financial institutions are still implementing regulations and plan to maintain the use of cash (European Central Bank, n.d.), in an effort to satisfy those who still favour cash transactions. Nevertheless, bills and coins are less and less convincing in the eyes of Belgians. Figure 6 shows the continuous decrease of cash in payment transactions since 2009, even before the Covid-19 pandemic. The covid-19 pandemic has only accelerated this downwards trend further reducing the share of cash in transactions.

Figure 6 (Statista, 2020)

Regardless of which role cash plays in the eyes of financial institutions, it goes without saying that its market share is becoming increasingly under pressure.

Although historically, cash was competing against cards, more and more alternatives are being developed, tested, and introduced into the payment markets. We have exemplified one earlier with contactless payments; let us now dive into some other payment methods eyeing breakthroughs in the Belgian market.

Mobile payments are more and more popular, available, and efficient in Belgium. However, payment services such as Apple Pay and Google Pay face a growth barrier: Bancontact. The country-wide presence of its network thwarts candidates from grasping potential customers. This is increasingly strong now that they are equipped with contactless technology. Even Bancontact’s own mobile payment app Payconiq, is still miles away from the amount of Bancontact card transactions, contactless or pin (1,706 million against 8.6 million in 2020 (National Bank of Belgium, 2021)). Despite experiencing exponential growth in the number of transactions (see figure 7), it is seemingly not yet taking considerable market shares away from card transactions. It is important to note that the penetration rate of mobile payments in Belgium is increasing, from 1.2% in 2017 to 17.5% in 2021 (Statista, 2021), meaning that more and more Belgians are using mobile payment methods.

Figure 7 (Bancontact Payconiq Company, 2021)

Since the introduction of Bitcoin in 2009, several cryptocurrencies have been developed, contributing to the utopia of a cashless society. A cryptocurrency is a digital or virtual currency protected by encryption, making counterfeiting or double-spending practically impossible. Cryptocurrencies are distinguished because they are typically not issued by any central authority, making them potentially impervious to government meddling or manipulation.

Within the European Union, regulated exchange platforms such as Coinbase and Kraken have made cryptocurrency investments and payments easily accessible to end consumers. Besides buying and holding various cryptos on these platforms, it is also possible to obtain a Visa card to use cryptocurrencies in the "real world". In the case of Coinbase, you can get a Visa debit card funded by your Coinbase crypto wallet that allows users to spend their crypto worldwide easily.

Figure 8 (Statista, 2021)

Within Banking, the cryptocurrency disruption created a new concept in finance called Decentralized Finance (DeFi), providing users with functionalities typically performed at banks.

Besides paying with crypto through Visa debit cards, more and more businesses are open to accepting crypto directly as a means of payment. Figure 8 shows the number of businesses per country accepting cryptocurrencies as payment per 100,000 inhabitants.

A hot topic in the current European financial system is the issuance of the digital euro - an initiative of the European Central Bank (ECB). The digital euro will try to provide an answer to the high digitalization of our society and act upon the popularity of cryptocurrencies. Contrary to what some people may think, implementing the digital euro is not aimed at eliminating cash in Europe. The ECB has made it clear in its communication that it would not be replacing cash but would complement it. The ECB wants the banks to keep control and the digital euro to act as an alternative currency next to existing ones. Therefore, the institution is considering implementing a maximum amount per person of 3.000 digital euros. This maximum amount reduces the impact of the digital euro and limits the possibility of it entirely replacing cash in our society. Moreover, the idea of a digital euro is still in full development, and there is no exact date set for when it will be available and operational for the public. Still, implementing a digital Euro would provide European citizens with yet another form of digital payment method that further reduces the need and attractiveness of cash.

To add some perspective, it is valuable to compare Belgium with its fellow European countries. Data from 2019 shows that the European average for the share of cash in in-store payments is 47%. In contrast, the Belgian average was floating around 28.2%, according to the latest data from Statista (Statista, 2020).

Despite being well below average in 2019, the country's share of contactless card transactions has now skyrocketed to 51% in 2021. Although Belgium is edging closer to the European average, its gap with the leaders is still significant.

Last, mobile payments are on the rise both in Europe and in Belgium, with Belgium's mobile payment penetration rate - the percentage of people making at least one mobile transaction in the past year - of 17,5% being slightly above the European average of 14,4%. However, the gap remains large compared to, for example, Scandinavian countries like Norway, Denmark, and Sweden. Still, Belgium outperforms major economies like France, Italy, and Germany and is on par with Spain and Finland.

Figure 9 (Statista, 2021)

In other words, it seems like Belgians are using less cash, carrying out a comparable share of contactless card payments, and proceeding to similar levels of mobile payments than the European average.

Over the past years, we have witnessed a movement in the Belgian payment landscape. This change was initiated by emerging new technologies and fostered by the Covid-19 pandemic. In our current Belgian society, most of the transactions can be done via digital payment methods, being it by card - contactless or not - or by mobile. This encourages consumers to move away from cash.

Although financial and regulatory institutions are not planning on banning cash from our society, we see a steep decline in its use. However, because small shops, typically where cash was most accepted, closed because of covid-19, it remains to be seen whether the recent trends we have observed will be confirmed in the future or not. That being said, it seems covid-19 has accelerated an ongoing trend, not created on. Our firm is convinced that there also exists a cultural gap in our society in which a vast majority of young people are way less inclined to use cash than previous generations.

Belgium closed the gap it previously had in terms of digitization of payments and currently sits near European averages. It is now challenging its neighbours on some aspects and lagging on others.

Bancontact and its derivatives remain the leading actors in the market despite the introduction and growth of mobile solutions, as well as the potential development of emerging technologies like the digital Euro. Sia Partners recognizes the traction cryptocurrencies are pulling and is closely monitoring the implementation of new solutions promoting its day-to-day use.

We believe that cash will keep holding a market share in the payment world. However, as new technologies improve and multiply, other means of payment will become more attractive, accessible, and simple to use, eroding little by little the use of bills and coins without ever fully removing them from our society.

Atos Worldline, Bpost, & Febelfin. (2020). Retraits aux guichets automatiques. Febelfin.be. https://www.febelfin.be/sites/default/files/2021-10/mrvad2020_f_-_chapi…

Bancontact Payconiq Company. (2021, June 18). Total number of Payconiq transactions in Belgium from 2017 to 2020 (in million) [Graph]. Statista. https://www-statista-com.eu1.proxy.openathens.net/statistics/1032915/nu…

Coinbase. (2020, October 28). Coinbase Card launches in the US. Coinbase.com. Retrieved November 09, 2021, from Coinbase Card launches in the US

ECB. (2021, July). Payments Statistics (full report). ECB. https://sdw.ecb.europa.eu/reports.do?node=1000004051

European Central Bank. (n.d.). We ensure the availability of euro cash. The Eurosystem cash strategy. https://www.ecb.europa.eu/euro/cash_strategy/html/index.en.html

Febelfin. (2021, May 21). Coronamonitor. Febelfin. https://www.febelfin.be/sites/default/files/2021-05/Dashboard-2021-05-2…

Febelfin, Bancontact Payconiq Company, Mastercard, Visa, Worldine, & Vrije Universiteit Brussel. (2021, May 15). Belgen zetten massaal de stap naar digitaal betalen. Febelfin. https://www.febelfin.be/nl/press-room/belgen-zetten-massaal-de-stap-naa…

ING. (2020, June 30). Future of payments. ING.be. Retrieved November 10, 2021, from https://www.ing.be/en/retail/my-money/Future-of-payments

National Bank of Belgium. (2020, January 16). Total number of ATMs with a cash withdrawal function in Belgium from 2007 to 2018 (in 1,000s) [Graph]. Statista. Retrieved October 28, 2021, from https://www.statista.com/statistics/664888/number-of-atms-with-a-cash-w…

National Bank of Belgium. (2021, May 26). Total number of offline and online processed card payment transactions in Belgium from 2010 to 2020, by payment scheme (in millions) [Graph]. Statista. https://www.statista.com/statistics/864090/bancontact-visa-mastercard-m…

Roelens, T., Adriaen, D., & Cockx, R. (2021, April 24). Grootbanken garanderen automaat in de buurt. De Tijd. https://www.tijd.be/ondernemen/banken/grootbanken-garanderen-automaat-i…

Statista. (2020, November 4). Share of cash in total payment transactions in Belgium from 2000 to 2019. Statista. https://www-statista-com.eu1.proxy.openathens.net/statistics/1094676/ca…

Statista. (2021). Statista Digital Market Outlook. Statista. Retrieved October 18, 2021, from https://www-statista-com.eu1.proxy.openathens.net/outlook/dmo/fintech/d…

Statista. (2021, March 9). Number of businesses that either have a cryptocurrency ATM or offer crypto as an in-store payment method as of March 9, 2021, by country. Statista. Retrieved November 12, 2021, from https://www-statista-com.eu1.proxy.openathens.net/statistics/1222684/firms-with-crypto-payment-solution-country/

Worldline. (2019, April 23). 89% of Belgians prefer to pay electronically even though a majority of payments is still done by cash. Worldline. https://be.worldline.com/en/home/newsroom/general-press-releases/2019/p…