Control Room of the Future

The Netherlands is one of the countries in Europe leading in the adoption of a cashless payment environment. What are key trends driving this development and what role does cash continue to play in society? This article takes a deep dive into these key developments.

Globally, we are observing a transition to a low-cash society. Mobile payment developments, contactless payments, and the closing down of ATMs are trends moving us away from a cash reliant economy. This in turn has been further accelerated by the global pandemic, whereby contactless payments are considered faster and cleaner. The Netherlands is one of the countries leading the adoption of a cashless payment environment. This article attempts to give an overview of key trends in the Netherlands regarding a cashless society. At the same time, cash continues to play an important role as a backup for electronic payments, accessibility for vulnerable people, and as a public means of payment.

Is a cashless society worthwhile, and what benefits and disadvantages does it bring along? This article ties in closely with “The evolution to a Cashless Society in Belgium”.

Over the past decade, cash usage in the Netherlands has been steadily declining. In 2002 cash accounted for 85% of Point-of-Sale (POS) payments. However, the years after marked the initial movement away from cash. In 2005, the Payment Covenant was implemented which resulted in lower fees for merchants in completing debit card transactions. By 2007, cash accounted for 72% of POS payments. Additionally, the Single Euro Payments Area (SEPA) was introduced and enabled easier domestic and cross-border transactions. The overall perception of cashless payments was then switching to safer, cheaper, and faster. The strong decline continued in the following years, and in 2016 only 45% of payments were made in cash (DNB, 2018).

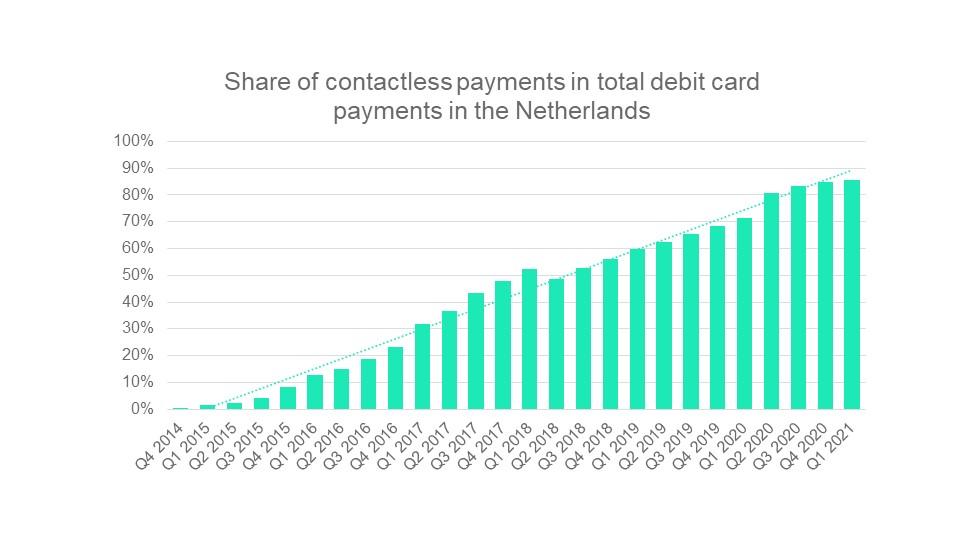

Today, cashless payments have once again increased in popularity. In part, Covid-19 has further accelerated an existing trend in the Netherlands. According to Statista, 91% of the Dutch use online banking apps and features (Statista, 2021). During the pandemic, the use of cash payments was strongly discouraged in stores, restaurants, and other public places, causing a surge in the use of digital payments. By the end of 2020, 85% of all debit card payments were contactless, compared to 69% in 2019. The Netherlands also increased the contactless payment limit during the pandemic, from €25 to €50.

Figure 1 (Statista, 2021a)

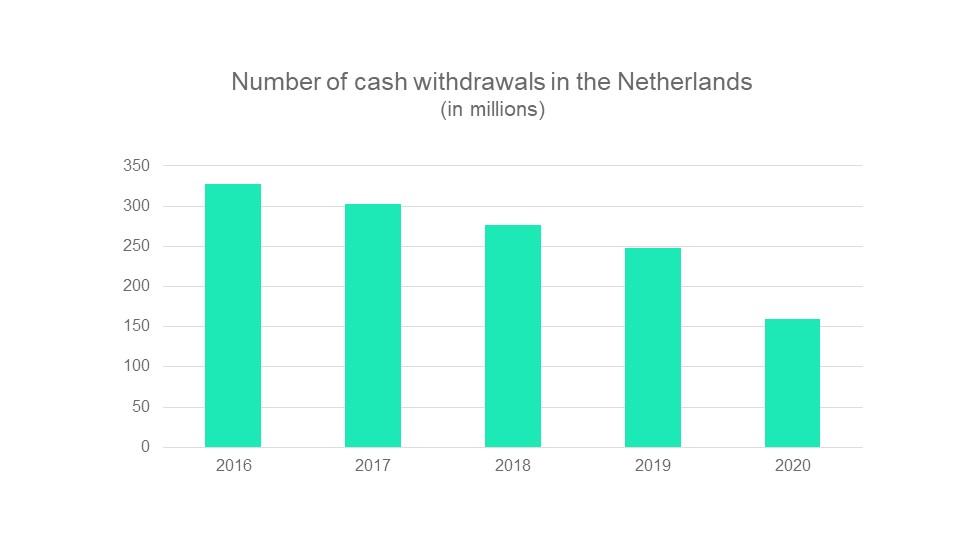

Whilst contactless payments strongly increased, the number of cash withdrawals decreased by 35% in 2020 compared to 2019, continuing the steady decline observed over the past years. In 2016, 328 million cash withdrawals were counted, accounting for €45 billion. In 2020 only around 160 million withdrawals were carried out, amounting to a total value of €28,5 billion, according to the Dutch Payments Association, as can be observed in Figure 2.

Figure 2 (Dutch Payment Association, 2021)

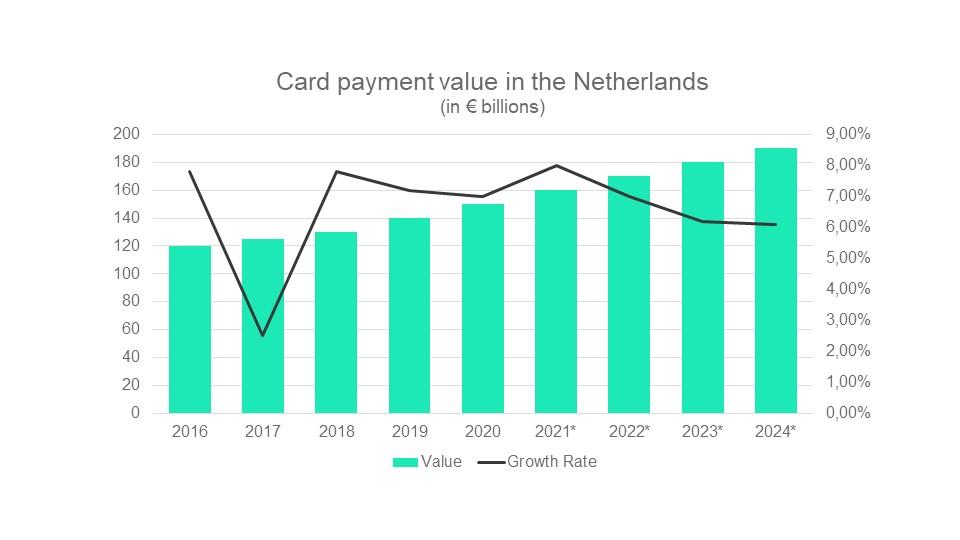

The card payments market in the Netherlands was projected to grow by 7.7% by the end of 2021, according to Global Data. The data analytics firm forecasts that the value of card payments is expected to reach €196,3 billion by 2024, up from around €120 billion in 2016 (Global Data, 2021). Thereby, the Netherlands is also the leading European country for contactless payments through the use of smartwatches. These account for 33% of total smartwatch transactions within Europe since most Dutch banks have adopted Fitbit, Garmin, and ApplePay functionalities (Statista, 2021b).

The average value of a cash payment grew to €16.40 in 2020, slightly higher than €14.10 in 2019. With card transactions, the trend was that often smaller amounts were being paid by card. In 2020 the average card payment increased for the first time, with 4% to an average of €25.73 compared to €24.64. This growth is attributed to the fact that during the pandemic, consumers made fewer payments at physical locations, but often bought more (DNB,2020). Overall we can observe that the need for smaller change and cash payments has reduced.

Figure 3 (Global Data Banking et al., 2021)

De Nederlandsche Bank (DNB) illustrates that most transactions in the Netherlands are made using a debit card (pin), with a declining usage of cash ever since the financial crisis in 2008. More specifically, this trend is driven by young and higher-educated people using more contactless and digital payment methods (DNB, 2020). The use of credit cards remains low in the Netherlands due to the cultural perception of debt.

Figure 4 (DNB, 2020)

The role of cash has been influenced by the pandemic, but also by the role of banking institutions and regulators. Due to changes in social consumption and the move towards card payments, Dutch banks have devised strategies in closing ATMs and physical offices across the country. This has also been triggered by a significant increase in ATM-bombings in the Netherlands, whereby ATMs are common targets of crime. This trend is illustrated in Figure 5, showing a decline in the number of ATMs since 2014, with a very sharp drop as of 2017. In 2020, only 5,297 ATMs remain, which is a 40% decrease from 8,811 in 2014 (MOB, 2011).

In part, the decline in ATMs is due to a unique collaboration between the large Dutch banks ABN AMRO, ING, and Rabobank. In 2017 the three main banks decided to work together to maintain the level of service for customers still wanting to use cash. Together they worked on creating a more efficient and bank-independent network of ATMs, known as Geldmaat in the Netherlands. As of 2019, bank ATMs were replaced by Geldmaat ATMs. These machines are spread more evenly across the Netherlands, making withdrawing and depositing money accessible to all (Geldmaat, 2021). When installing ATMs, Geldmaat looks at the five-kilometer standard and demand, meaning everyone should be able to access an ATM within a five-kilometer radius. If certain locations have a strong demand for cash transactions, an additional ATM can be installed to meet the demand. On the 1st of November 2021, 3813 ATMs remain in the Netherlands, with a coverage ratio of 99,62% (Ministry of Finance, 2021).

Figure 5 (MOB,2021)

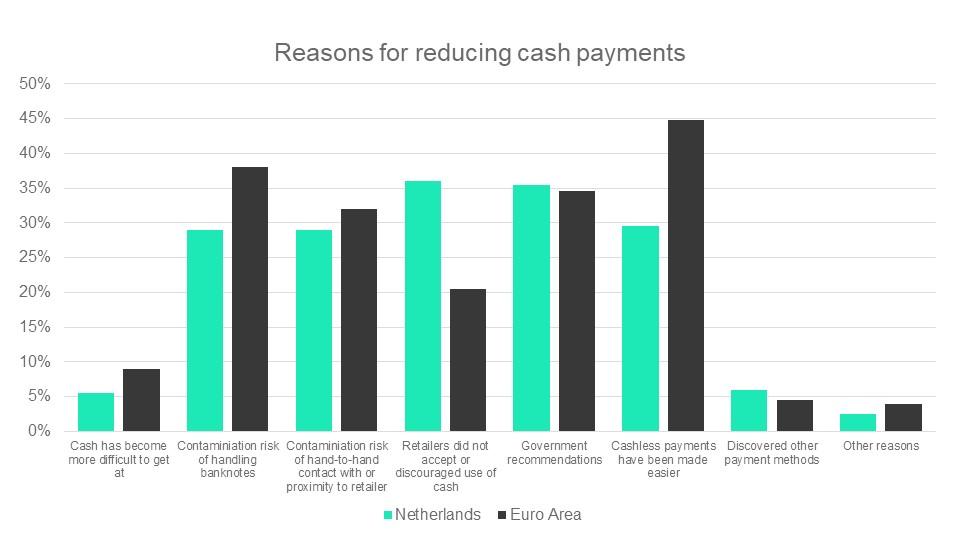

The Covid-19 pandemic has only fast-tracked this decline, further reducing the share of cash in transactions. This is illustrated by the results of the European Central Bank (ECB) Impact Survey conducted during the beginning of the pandemic. Respondents cited contamination risk of handling banknotes and government recommendations as leading reasons for reducing cash payments, as well as retailers discouraging the use of cash for safety reasons (European Central Bank, 2020).

Figure 6 (European Central Bank, 2020)

Cash, however, does still bring along specific advantages. Regulatory and financial institutions are still implementing regulations and plan to maintain the use of cash (European Central Bank, n.d.), to meet people still favoring cash transactions. The elderly and low-income populations are especially affected by the decline in cash. The Eurozone still emphasizes a strong cash strategy as cash is essential for financial inclusion. Cash allows people to make payments at no cost, allows access to funds for those who are unbanked, and permits those with lower digital skills to keep track of their money due to the physical aspect of cash (European Central Bank, n.d.). The DNB follows this advice and has therefore urged system providers in the Netherlands to ensure the wide availability of physical money. Not to mention, it's a fallback option if internet connections, energy supplies, or other systems fail (Cashmatters, 2021).

The DNB emphasizes that cash must remain accessible, available, and affordable. To quote Olaf Sleijpen, Director of the DNB, “In ten years, we will live in a less-cash society, not a cash-less one ” (DNB, 2021). According to Sleijpen, cash still fulfills three key roles in society. These are:

These three points determine the size and cost of the cash infrastructure in the Netherlands, and will likely stay that way for the foreseeable future (DNB, 2021). Additionally, the Dutch parliament and key regulators have made agreements on the accessibility and acceptance of cash with the Dutch National Forum on the Payment System (NFPS). This platform focuses on organizations representing providers and users of payment systems to ensure secure, reliable and accessible payments for everyone (Ministerie van Financien, 2021a).

Historically, cash competed against card payments. However, plenty of alternatives are now being created, tested, and introduced into the payment markets. Contactless payments as discussed above are one example, but there are a few more alternatives in the market further accelerating the weakening role of cash in the Dutch market.

Mobile payments are gaining popularity in the Netherlands and are perceived as a safe and efficient method of payment. Hereby we refer to a financial transaction conducted through a mobile device. In the Netherlands, this can increasingly be done through Apple Pay and Google Pay as well as mobile banking apps. The Dutch also benefit from the iDEAL app, the predominant player in the Netherlands when it comes to payments, responsible for more than 900 million online transactions per year in 2020, 30% more than the year before (iDEAL, 2020). Other players include Payconiq and PayPal, although recently Payconiq announced it will stop operating in the Netherlands for undisclosed reasons.

The Netherlands ranks as one of the highest countries in Europe for online banking use, at 89%. Only its Nordic peers rank higher, as they have also observed a strong transition from cash to digital payments. The European average lies at 60% (Statista, 2021).

Figure 7 (Statista, 2021)

Aside from Bitcoin which was introduced in 2009, several other cryptocurrencies have been introduced in the market, contributing to making the payments system more efficient. Cryptocurrency, a digital or virtual currency protected by encryption, makes counterfeiting virtually impossible. Their value is based on the speculative assumption of their scarcity. Crypto distinguishes itself from regular currencies as the currency is not issued by a central authority, making them less vulnerable to government manipulation and regulation. However, it is expected that they will be subject to regulations soon (van der Steenstraten, 2021).

Regulated exchange platforms such as Coinbase and Kraken, which are active within the European Union, have made payments and investments with cryptocurrency more accessible to end consumers. On these platforms, you can buy and hold various cryptos. Additionally, one can obtain a Visa debit card which is funded through the Coinbase crypto wallet, allowing users to easily spend their crypto money worldwide.

The disruption caused by cryptocurrency led to the creation of a new stream within finance, referred to as Decentralized Finance (Defi). Defi providers users with common functionalities traditionally provided by banks. Beside using a Visa debit card to pay with crypto, crypto currencies are also becoming more widely accepted. Besides paying with crypto through Visa debit cards, more and more businesses are open to accepting crypto directly as a means of payment. Figure 8 shows the number of businesses per country accepting cryptocurrencies as payment per 100,000 inhabitants, whereby the Netherlands lies very close to the European average.

Figure 8 (Statista, 2021)

Another alternative, which currently is widely discussed in the news, is the development of the digital euro. The ECB has initiated a project into further research of a digital euro. This has been done to keep up with evolving needs whereby we are moving to a more digital payment environment and to provide a more regulated solution to the popular cryptocurrencies. CBDCs help retain the role of public money and are not aimed at eliminating the role of cash. Central banks see plenty of opportunities in implementing CBDCs. The Economist lists, among others, faster and more reliable payments, lowering illicit money activities such as counterfeiting and money laundering, and helping unbanked citizens gain access to the financial system (Economist, 2021). The project is still in its first phases and likely will follow developments of other global central banks who are further in the implementation phase, such as the Bahamian Sand Dollar and or the digital Yuan. The arrival of CBDCs provides citizens with a new payment method in the digital era, further reducing the need for cash.

The Netherlands has witnessed a transition in the payment landscape, moving towards a digital payment system. This has been accelerated by innovations in the payment market, regulatory changes, as well as the Covid-19 pandemic. At this point, most transactions in the Netherlands are completed via digital payment methods, such as card or mobile. The ease of payment and integration with wearables and smartphones has encouraged consumers to move away from cash. This adoption of the use of wearables as a payment method and high online banking penetration rates well above the European average has seen the Netherlands remain a leader in the transition to a cashless society.

Although financial and regulatory institutions are not planning on banning cash from our society, a steep decline in its use has been observed across markets. Financial inclusion among lower incomes, elderly and unbanked citizens remains a key topic slowing the complete transition to digital. Besides, cash will also continue to play a backup role for this electronic payments shift.

Benefitting the digital transition is the fact that mobile payments and the iDEAL payment system are strongly integrated into Dutch society. All are focused on easing the move to cashless and contactless payments. This does, however, make it harder for new innovative FinTech’s to breakthrough in the market, as consumers are happy with the current payment market. The impact of other innovations such as cryptocurrencies and the digital Euro are still to be observed in years to come.

Sia Partners recognizes the traction cryptocurrencies are creating and is closely monitoring the implementation of new solutions promoting its day-to-day use. At Sia Partners we believe that cash will continue to play an important role in society. However, as new technologies improve and multiply, other means of payment will become more attractive, accessible, and simple to use.