Control Room of the Future

The continued introduction of distributed generation will affect the electricity transported on the transmission grid. Sia Partners estimates that, in the coming four years, this will result in a loss of revenues for Elia of about EUR 60 million, compared to 2013.

This study shows that an accurate estimation of the development of renewable generation on the distribution grid is needed for adequately designing the 2016-2019 transmission tariffs.

Traditionally, the power system is designed to have big, centralized power plants directly connected to the transmission grid. The transmission grid transports the generated energy to local distribution grids, where it is distributed to the end-user for consumption. However, over the past few years, an increasing share of electricity has been generated by photovoltaic (PV) panels and wind turbines, among which about 80% is installed in a distributed way, directly connected to the distribution grid. A large part of the distributed renewable energy production is consumed locally and never reaches the transmission grid.

This study investigates the effects of this trend on the transmission grid and more specifically on the revenues for the Belgian transmission system operator (TSO). As the Belgium TSO is currently revising its tariffs for the period 2016-2019, it is important to have an idea of this impact. The focus is here on the energy generated by PV and wind, since this is expected to increase more in the coming years.

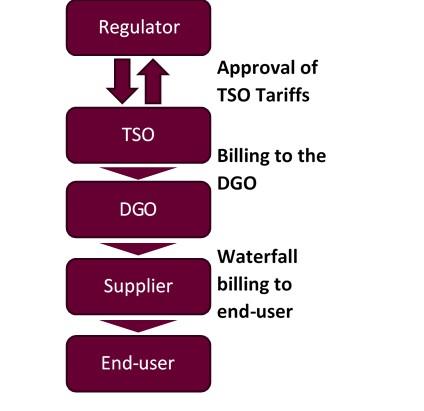

Every organization willing to inject or withdraw energy on the transmission network has to pay the tariffs for the use of the transmission grid charged by the TSO. In Belgium, these tariffs are negotiated between the TSO (Elia) and the regulator (CREG), and must reflect the real expenses incurred by the TSO. Since all parts of the distribution grid are connected via a node to the transmission grid, the TSO will charge each distribution grid operator (DGO) for the use of the transmission grid at this node. The DGO will pass on these charges to the end-users that are connected to the distribution grid, through the electricity supplier (Figure 1).

Figure 1: Billing of transmission tariffs

The tariffs charged by Elia to a DGO can be divided into two main categories: energy and power. In total four tariffs are billed, as explained in Table 1. The tariffs for system management and ancillary services are depending on the net energy taken off the transmission grid at the connection node. As most of the renewable production is consumed locally, this net offtake of energy can be expected to decrease with increasing penetration of renewables. The tariff for power subscription is depending on the power peaks measured at this node. This is a reasonable metric, since the grid actually has to be designed to be able to support this use, even it occurs only a few hours per year. The tariff for power put at disposal at the transformer only depends on the maximum power of the transformer itself, which is assumed not to be impacted in this study.

Table 1: Tariffs for the use of the transmission grid

As part of the EU2020 targets, the European Union aims to have 20% of its gross final energy consumption coming from renewable energy sources by 2020. For Belgium, this translates into a requirement of 13% of Belgian electricity consumption that should come from renewable sources [2]. To achieve this, a considerable amount of additional PV panels and wind turbines has to be installed each year. Figure 2 shows this expected evolution of PV and wind capacity installed on the distribution grid. It is assumed that all PV is installed in a distributed way. By 2020, this means about 5,800MW of PV and 2,200MW of wind capacity, or a doubling of PV capacity and even a tripling of wind with regard to 2013.

Figure 2: Expected amount of Wind and PV installed on the distribution grid in Belgium (Sources: Elia [5], Eurostat [3], Nationaal Actieplan [4])

Figure 3: Effect of renewable generation on demand in a node (Source: Sia Partners' analysis)

Sia Partners modeled the impact of distributed renewable energy sources by calculating the revenues for the TSO on an average node connecting a distribution grid to the transmission grid. A consumption profile of 2013 is complemented with a PV and wind production profile, according to the desired installed capacity, to obtain a net offtake profile. Profiles for 2016-2019 are estimated by modifying the installed capacity to the foreseen deployment of RES (Figure 2). PV capacity is assumed to be distributed evenly over Belgium, while wind power is modeled by wind farms of 12MW. The stochastic influence of weather and randomness in consumption profiles is treated by performing Monte Carlo simulations of 100 scenarios. These results are then extrapolated to the national level. It is important to bear in mind that this estimate is based on the current transmission tariffs.

Figure 4: Difference in revenues for the TSO with regard to 2013 (Source: Sia Partners' analysis)

The impact of distributed renewable production on the TSO consists of two parts. An obvious effect is the reduction of energy taken off the transmission grid, as can be seen by the area decrease under the demand curve of Figure 3 (about 19%). Moreover, a more subtle impact is present. The peak power does not only decrease in magnitude (about 12%), but also displaces in terms of timing (in Figure 3 from Tuesday evening to Thursday evening).

The resulting revenues for the Belgian TSO from all DGOs show a clear decrease year by year (Figure 4). By 2019, it is expected that the difference in TSO-DGO billing will amount up to EUR 21 million on a yearly basis, or almost 4% of the yearly amount. One can see that more than 70% of the loss can be attributed to the tariffs linked to energy. The revenues from the tariffs based on power are also decreasing, but represent a much smaller part of the total.

This study clearly shows that there is a significant impact of distributed renewable generation on the revenues for the TSO. As Elia is currently revising its tariffs for the period 2016-2019, Sia Partners estimates that for these four years the total decrease in revenues coming from DGOs will amount up to EUR 60 million if Elia keeps the same tariffs. As the TSO is anticipating this decrease in revenues, tariffs are expected to change. A basic augmentation of all tariffs would be a simple but coarse solution. A switch in tariffs from energy to power could be a more refined approach, not only mitigating the effect of a lesser amount of energy withdrawn from the transmission grid, but also encouraging DGOs to avoid power peaks.

Obviously, this increased amount of renewables also has an impact on the DGOs themselves. On the one hand, they will have to pay less transmission charges, and thereby face a decrease in costs. On the other hand, integrating renewable generation in the distribution grid implies investments that will increase costs for the DGOs.

For the end-user, the net result will thus depend on the interaction between these two effects. Their respective orders of magnitude nevertheless make it rather unlikely to see a global decrease in electricity costs.

In all cases, accurately foreseeing the deployment of renewable generation is key for all stakeholders. Not only this is important for adequately designing the transmission tariffs, but also to be able to estimate future costs, both on TSO as on DGO level.

Jean Trzcinski, Jonas Engels, Alexandre Viviers

[1] "Elia.be - Tariffs," [Online]. Available [Accessed 03 April 2015].

[2] "European Commission," 2015. [Online]. Available [Accessed 02 April 2015].

[3] "Eurostat," [Online]. Available. [Accessed April 2015].

[4] M.-P. Fauconnier, "Nationaal Actieplan," FOD Economie, 2010.

[5] "Elia.be - Grid Data," [Online]. Available [Accessed April 2015].