Control Room of the Future

FinTech and Social Media are driving high investment volumes and high volatility in the markets. What are the consequences? How should institutional investors and brokerage firms deal with these new market phenomena?

During the week of January 25th, U.S. stock exchanges experienced extraordinary volume and volatility.

The stock prices of GameStop (NYSE: GME), AMC Entertainment (NYSE:AMC), Nokia (NYSE:NOK), Blackberry (NYSE:BB), and other heavily shorted stocks have experienced extreme volume and volatility recently. But what caused these stocks to spike in price when no recent news forecasted a higher company valuation? GME traded up from a price of $18.84 on 12/31/20, to a peak of $483 on 1/28/21, fell to $60 a few days later and at the time of writing trades at around $43.

The mania in these stocks was driven in part by the rise of FinTech and the collective market power individual investors now have through technology and social media. Over the past several years, we have fully transitioned into a digital age and legacy institutions must understand these changes--the rising popularity of Fintech startups, the ability of social media to mobilize millions of investors, decreased investor and consumer brand loyalty to established firms, and the desire for transparency.

In light of these developments and the extraordinary market volatility that has arisen from them, financial institutions need to adapt and overcome current market challenges including important new competitors.

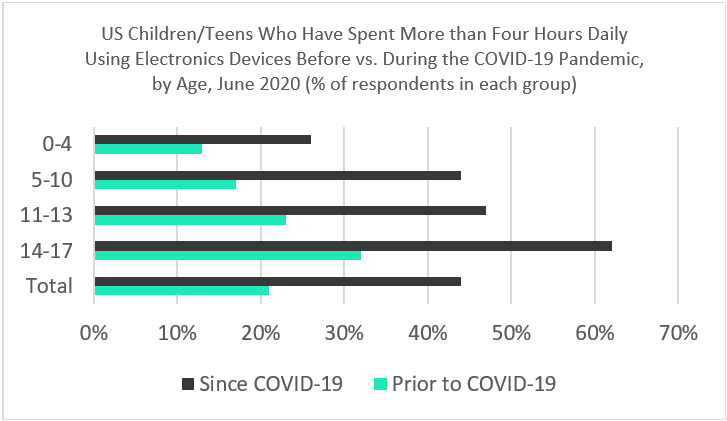

On January 07, 2021, Forbes released the most downloaded apps of 2020. In order, TikTok led the charge, followed by Zoom, Instagram, Facebook, Facebook Messenger, Cash App, Snapchat, and WhatsApp. The COVID-19 pandemic forced users to go mobile and working/schooling remotely gave them more free time. Since the beginning of COVID-19, a study by eMarketer found that screen time has increased in children and teens by 4 hours as compared to the same period in 2019 (eMarketer).

NB. Devices include tablets, smartphones, etc. according to parents.

Source: Ispos and the Global Myopia Awareness Coalition (GMAC), July, 2020259210 www.eMarketer.com

Concurrently, personal savings (as a percentage of disposable personal income) increased by 8.9% in 2020 (BEA). Average consumer saving increased from 7.5% in 2019 of DPI to 16.4% of DPI in 2020 according to the U.S. Bureau of Economic Analysis (BEA) report released on January 21, 2021 (BEA).

This increase in DPI is a direct result of the pandemic—with restaurants, movies, sports events operating at limited capacity, people canceling their vacations, and young people saving on rent by moving in with their parents.

As a result of more time on social media, and extra personal savings, it should be no surprise that retail investing has increased in users and in investment amount. There are anecdotes of people taking their stimulus checks and investing them on Robinhood.

The week of January 25th, WallStreetBets and other Reddit forums drove up the price of Gamestop stock by 400%. While many retail investors use social media to discuss their investment ideas, other more novice retail investors use social media to figure out what investment trends to hop onto.

Some other examples of social media groups and influencers creating large spikes in investments include:

Although the GameStop bubble has popped, we believe that the combination of social media and disruptive fintech platforms will continue to have a powerful impact on equity markets going forward.

Over the past decade, there has been a sharp increase in retail investing. During the first six months of 2020, individual investors accounted for 19.5% of the shares traded in the U.S stock market. This is up from 14.9% from 2019 and nearly double the level from 2010. On some days 25% of the market volume was individual investor activity. (Source: Wall Street Journal)

Access to trading has become easier than ever with added gamification attracting an entirely new age of investors. Apps such as Robinhood, E*TRADE, TD Ameritrade, Fidelity with other gamified apps such as Stash, Acorns, Betterment, and the list goes on.

Robinhood gives users the ability to conduct commission-free trades in stocks and ETFs. The platform allows users to purchase fractional shares and introduced an entirely new demographic to the stock market. As a result of the app’s popularity and the launch of similar apps, markets experienced an influx of novice traders using apps, many of whom relied on peer-to-peer stock advice instead of traditional valuation-based research. At first, the influx of retail traders did not significantly impact market activity. However, as shown by the Gamestop stock mania, it seems these traders are driving market behavior in new ways.

In 2020, social media platforms were the most downloaded apps. On top of preserving social interaction during the pandemic, social media also bolstered discussions about stocks. Some of the most popular retail-trading stock threads can be found on Twitter, Reddit, and Instagram.

Users on the popular Reddit WallStreetBets came up with the idea to execute a ‘short squeeze’ trade on Gamestop stock (GME) and other heavily shorted stocks in late 2020. As of January 2021, the forum had over 8 million members. With the goal of outperforming the market and punishing the investors who can gone short, WallStreetBets and its members mobilized users to aggressively buy Gamestop shares and execute a massive short squeeze.

Hedge Fund Melvin Capital, along with other Hedge Funds, had a massive short-position in GME and reportedly lost 53% on what was then an AUM of $12.5 billion (Business Insider). In total, Hedge Funds borrowed and sold short an estimated 139% of GameStop’s market value in common stock for a total of $11.7bn (Business Insider). As a result of GME’s rocketing price, Hedge Funds were forced to cover their shorts and put up more collateral to support their trades. Calling on Point72 and Citadel, Melvin Capital raised an additional $2.75bn in new capital on Thursday 1/28 (MSN).

As a result of extraordinary volume and volatility in GME and similar stocks, on Thursday 1/28 the Depository Trust & Clearing Corporation (DTCC) required several member firms to put up additional collateral to clear trades in volatile stocks.

Robinhood and other brokerage firms such as Charles Schwab, TD Ameritrade E*Trade, Interactive Brokers, and WeBull curtailed trading in certain stocks to reduce the collateral requirement. During the interruption, GME and other high volatility stocks experienced massive selloffs. Robinhood was able to raise $3.4 billion of additional capital from its investors, allowing it to post collateral and reduce trading restrictions. Investors resumed new trading activity and GameStop, and other stock prices, rebounded sharply (Robinhood).

We provide a technical analysis on the credit risk and settlement mechanics underlying these events, as well as potential regulatory issues,in our article What's Going on with GameStop, Robinhood and Hedge Funds?

Many Robinhood day traders, consider themselves “outsiders” to the traditional financial system. Robinhood markets itself as a free trading platform with the ability to trade fractional shares.

When the platform ceased trading activity, it angered many who signed up for the platform because it marketed itself as a ‘democratized trading platform’ that supports ‘investing for everyone’.

During trade outages on Wednesday 1/27, Robinhood users voiced their anger by tanking the app's reviews, filing lawsuits, and venting on social media. In total, there were more than 120,000 tweets during the week of 1/25 that mentioned the hashtags #boycottrobinhood, #deleterobinhood, and #cancelrobinhood

Anecdotally, many day traders moved their accounts and activity to other brokerages such as WeBull. On the other hand, all the free (adverse) publicity resulted in lots of new customers

According to research from SimilarWeb and JMP Securities LLC, Robinhood was downloaded more than 600,000 times on Friday 1/29- the day after Robinhood was trending across social media for restricting trades. That was almost four times more than its previous best day in March

What is the plan going forward? What can brokerages do to reduce risks to their business? Limit transactions? Place maximums on transactions based on income? Flag for review? In the event of extraordinary volume and volatility brokerages should have plans to mitigate the risks in these high volume/high volatility scenarios

Stock trading volumes are hitting record highs in 2021. Equities and options continue to rise at a strong pace due to increased accessibility to electronic brokers. Much of the market volume increases are driven by retail investors.

| 2019 | 7 Billion |

| 2020 | 10.9 Billion |

| 2021 (so far) | 14.7 Billion |

The average daily volume of the largest e-brokers in December was 6.6 million shares, a record. In January, average daily trades are at 8.1 million, a 23% increase.

Sia Partners has developed a customizable sentiment analysis bot to catch trends on and through various platforms.

Regulators continue to debate and evaluate the extraordinary volume and volatility in the GameStop stock and others during the week of 1/25. The rising popularity of stock trading along with the e-broker gamification aspects are all under review. Gary Gensler, the nominee to be the next head of the Securities and Exchange Commission said the agency under his watch would review issues surrounding protection and fairness for retail investors. On March 2nd Gensler stated that the SEC will study how balloons and confetti dropping on the free-trading app when a transaction is complete, affects retail trading behaviors.

Could any of this activity pose a systemic risk? What rule changes are necessary to protect novice investors? To prevent market manipulation, including social media-driven pump and dump schemes?

The ability of retail investors to manipulate a stock through coordinated trading.

Stricter enforcement of existing rules around coordinated trading and front running by internet influencers, possible violations of advertising rules, suitability/best interest/reg SHO requirements by brokers, control over options trading, best execution vs payment for order flow, etc.

Market Limits

The ability of Hedge Funds to manipulate stock through paper trading, short more shares in a company than the entire float.

The rise of bots/shell users on online investment forums/social media sites that create fake posts to try to get investors to buy stocks in which the controller of the bots has a position in the stock.

Assess need for new rules and begin the rulemaking process: gamification of trading, limits on short-selling, tightening the limit up/limit down rules to include dark pools, options trading, payment for order flow.

As with brokerage firms, institutional investors and Hedge Funds may also want to implement tools to monitor social media chatter to detect investment trends.

Recently, a New York-based quantitative Hedge Fund Cindicator Capital has moved their practices to apply sentiment analysis to the WallStreetBets Subreddit. They are looking to bring in a sentiment trader focusing on the WallStreetBets subreddit community as an attempt to dive into a new industry of speculative trading.

Brokerages, regulators, and institutions all need to try to stay ahead of imminent technological changes in the finance industry in order to better retain and attract clients as well as to manage risk. As retail trading, social media, and FinTech continue to develop rapidly, legacy financial institutions and traditional investors may experience extreme volatility and detached asset prices.

An innovative global consulting firm that is ahead of the curve, Sia Partners can assist your business in anticipating imminent social, cultural, and regulatory changes to strengthen your business and reduce risk. Please feel free to contact us using the form below, or reach out to our contributing authors of this article for more information.

John Gustav

Partner

+ 1 (516) 810 8719

John.Gustav@sia-partners.com

Gordon Wong

Manager

+1 (647) 917 7791

Gordon.Wong@sia-partners.com

Joseph Willing

Managing Director

+1 (347) 380 3960

Joseph.Willing@sia-partners.com

Virginia Sideleva

Consultant

+ 1 (203) 274 2127

Virginia.Sideleva@sia-partners.com

Evan Manafort

Junior Consultant

+1 (860) 966-5486

Evan.Manafort@sia-partners.com