Fortune 100 response to DE&I pressures

The US withdrawal from the Paris agreement – aiming at fighting climate change and dealing better with its impacts – in June 2017 certainly raised many questions about the future of renewable energy in the country.

However, the strong demand for sustainability, social and environmental responsibility, as well as diversity and security of supply, remain. Renewable energy matches with three powerful words: Decarbonization, allowing to reduce polluting emissions; Decentralization, allowing the power grid to be more decentralized, but with large investments needed; Digitalization, as digital tools are mandatory to ensure a reliable integration. Forecast, for instance, is a very strong asset to predict power load and generation and thus to facilitate the grid’s management at all time horizons. Renewable generation, which reached 18% of the whole power generation in 2017 in the USA, is strongly led by conventional sources. The sector growth is in particular driven by solar photovoltaic (PV) and wind generation. Renewable generation, though, faces several challenges, particularly to ensure the grid’s reliability and assets’ competitive energy efficiency. Resources variability and uncertainty impose to find more and more efficient and affordable electricity storage and to use balance management tools (such as Demand Response). Technology evolutions help face these technical challenges, improving storage and using the benefits of smart grids. But of course, to ensure a sustainable development of renewable energy, regulatory and financial incentives are key enablers. So are Accords signed between countries and regions – like the Paris agreement –, and Conventions – like the UNFCCC, United Nations Framework Convention on Climate Change – allowing their gathering.

The raise of environmental concerns has started building a clean energy culture globally. Within the UNFCCC framework, the adoption of the Paris Agreement in 2015 was a big step in gathering most worldwide countries’ efforts to keep a global warming rise below 2 ͦC compared to pre-industrial levels, by limiting greenhouse gas emissions. Renewable generation is of course part of the solution: it limits climate change and pollution, allows to decentralize the electricity network and increases the diversity of supply, which means more security. Most countries worldwide have thus set national renewables targets and policies in order to increase their social an environmental responsibilities. The USA currently does not have any target or policy in force at the Federal level, but most States have adopted policies of their own with renewables generation/supply targets: Renewable Portfolio Standards (RPS). Private entities also turn to renewables; the biggest utilities worldwide take big commitments. For instance, Engie, the world’s 4th largest utility in terms of revenue in 2018, is ceasing all its coal assets and is planning to dedicate 50% of new electricity project to renewables. In the USA, some of the biggest utilities – such as AES, NextEra, Duke Energy, PG&E – are also investing massively in renewables.

The US electricity generation mix has evolved in line with the global change. The coal-based generation started shifting to natural gas in 2007. Since 2015, natural gas has reached comparable levels to coal powered generation, and has even overtaken it as the primary generation source. In the meantime, the overall share of thermal generation has decreased, to the benefit of renewables. These trends are expected to continue and even to increase.

EVOLUTION OF GENERATING CAPACITY IN THE USA - FOCUS ON RENEWABLES - Source: Sia Partners analysis from National Renewable Energy Laboratory

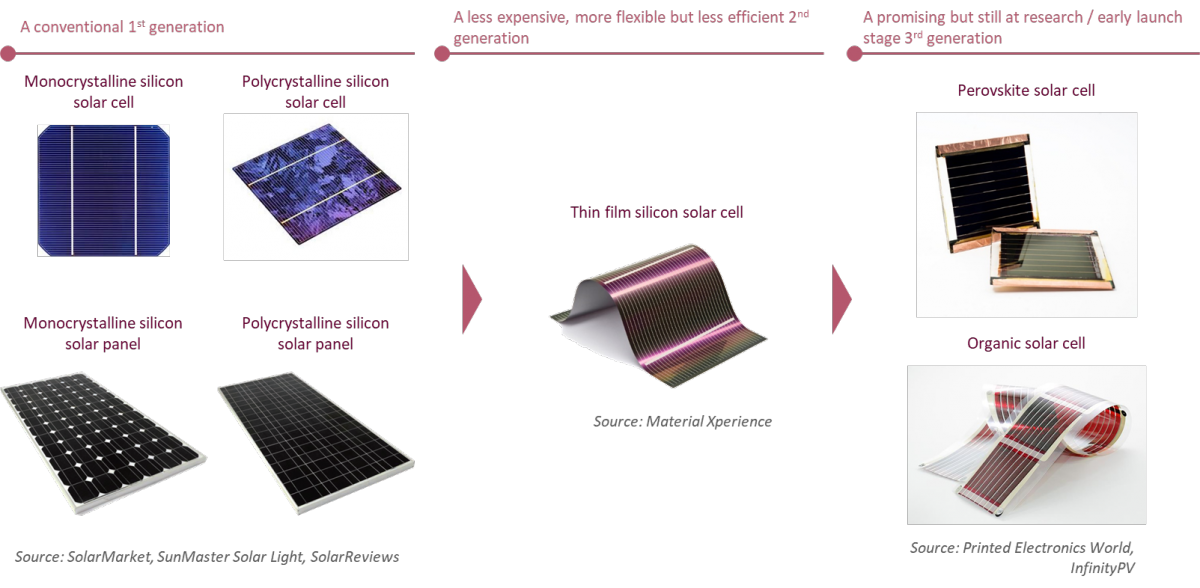

EVOLUTION OF SOLAR PV CELLS

In 2006, 3/4 of the installed renewable capacity in the US was hydropower. Ten years later, this share has dropped to 35% as wind and solar PV installed capacities have skyrocketed. Investments in hydropower assets have not stopped, but investment in renewables have been bigger on wind and especially solar PV since 2012.

This rise of renewable generation has been driven by, apart from sustained high oil prices and environmental concerns, the advancement of technology reducing the cost and efficiency of solar and wind power generation. In solar PV, prices have even been dropping much faster than expected: the US hit the SunShot 2020 solar price target three years ahead. This is mainly due to technological breakthroughs regarding solar cells, leading to a higher efficiency and/or a lower cost. Though traditional rigid silicon cells are still predominant in the market, many innovations opened new perspectives for solar hardware. Second-generation cells – thin film solar cells – are lighter, more flexible and easier to integrate in locations such as rooftops windows (with semitransparent modules), but this comes with a lower efficiency. Third-generation cells, mainly still at the research stage, use other materials and could reach new efficiency records. Perovskite cells progress, for instance, has been outstanding and these cells overcame 20% efficiency in a short amount of time. There is still work to do to ensure the stability and affordability of such cells but they offer promising opportunities when they become more broadly commercialized. A drop in labor costs also participated to make the sector more cost competitive.

Regarding wind now, onshore wind is actually one of the most affordable energy sources. In fact, in some parts of the USA, wind generation has become the least expensive source of electricity. The absence of fuel cost for wind reduces the OPEX, which allows consumers to sign long-term PPA, because they know the price of electricity for the duration of the contract; and PPA prices have been dropping since 2009. This price drop in wind generation is mainly explained by lower costs of wind turbines, which represent the majority of the costs. Wind turbines also become more and more efficient, thus making a better use of the existing resource. Longer and lighter blades, higher towers, turbines moving according to the wind are examples of such improvements.

In addition to the lower costs, the federal incentives participated to the development of renewable energies. The US Department of Energy loans program, created in 2005 and boosted by Obama, aims at supporting the commercial deployment of innovative energy projects. This program granted many loans and now manages a 30 loans portfolio of more than $30 billion, including some of the biggest wind farms and solar projects in the United States. It still has $4.5 billion to grant for renewable energy and efficiency. Some argue this loans program could be at risk with the current government; however, since it does not only focus on renewables but on also on vehicle manufacturing projects and fossil and nuclear energy, it is likely to stay in force and still participate in the drop of renewables costs.

Clean energy investments dropped in the US in 2016 and 2017. However, this was expected: the federal investment tax credit (ITC), supposed to end at the end of 2016, was extended for five more years at the end of 2015. Investors were thus able to slow down their on-going and scheduled projects instead of rushing to finish them before the end of 2016. This program extension if a good incentive for solar PV, but a reduction in the pace of solar investments is still to anticipate because of the new tariffs set by President Trump for solar material trade. These do not really favor the sector, but the market is still expected to grow each year.

NET ANNUAL GENERATING CAPACITY ADDITIONS - Source: Sia Partners analysis from U.S. Energy Information Administration

Renewables, if initially developed for decarbonization, also have other benefits. They are a great opportunity to reduce dependence on fossil fuel, meaning increasing the diversity of supply and thus the security. There are economic benefits for producers who can inject their generation into the grid – usually through a PPA – or self-consume it. In most States, they can inject their surplus to the grid – usually via net metering[1] billing system. . As an example of renewables benefits, migrogrids are grids where renewable if produced, and which are also capable of isolating themselves from the main power grid. They can thus be self-sufficient. Micro-grids are more and more developed across organizations that need resilience even in crisis situations (caused by natural disasters such as hurricanes, flood, fires, etc., or by attacks). For instance, they are particularly adapted for medical and military facilities, but also in remote areas. These grids aim at avoiding power outages and many demonstrations of their usefulness have been shown.

SCALES FOR RENEWABLE ELECTRICITY GENERATION: CHARACTERISTICS AND STAKES

However, raising the renewable electricity penetration rate in the generation mix is challenging on multiple levels. The electricity grid’s flexibility and reliability are mandatory, which leads to a number of challenges regarding renewables. The integration of such projects to the grid comes with technical requirements: the grid needs to accept backwards electricity circulation and to be fit for enough capacity. The US power grid was born by the connection of locally managed isolated grids in the 20th century. It was designed with centralized generation connected to distributed passive loads through one-way flow. The multiplication of generation points, including renewable generation, is one cause for many evolutions of the grid, including its decentralization and reinforcement which require control technologies and costly improvements. The challenge is thus to manage the integration of renewable resources while keeping reliable and economic operations of the grid.

A whole lot of challenges linked to renewables come from balancing generation and supply. Power stays a commodity difficult to store; as affordable and scalable storage solutions are still being engineered, power generation and consumption need to be balanced at all times. In this it is fundamentally different to gas which, for instance, is stored easily during summer or order to be used in winter when needed. Balancing power generation and load becomes more difficult when renewable generation increases, because this generation is variable and uncertain. It is variable – or intermittent – because it depends on external conditions, mainly weather related. It is uncertain because the variations are difficult to predict. Variability and uncertainty can lead to oversupply – which can even lead to negative renewables prices in some cases. To face oversupply, operators may have to curtail renewables resources, which means they reduce their output, not using them as much as they could have, and thus reducing generation efficiency ratio. Curtailment can usually reach 2% of renewable generation. It is expected to occur more and more as new wind and solar resources are added to the grid, meaning that even large renewable installed capacities do not lead to high penetration rate without adapted solutions and management. Variability and uncertainty can also lead to a lack of generation, which triggers the need for flexible generation assets, such as combustion turbines, that can be switched on and off quickly and easily to compensate the renewables fluctuations.

To face the challenges of renewables, technology is a strong asset. Renewable resources intermittence is the reason why research has focused so much on storage lately, with the aim of industrializing large-scale solutions at an affordable cost. To face renewables uncertainty, forecasting is a powerful tool allowing to predict renewables generation. Demand response and load shifting solutions also facilitate the balancing of generation and load. Demand response is based on the adaptation of generation to load or the contrary. Within this framework, consumers can for instance, and with a financial incentive, reduce their electricity consumption if load is exceeding generation to bring back the balance. They can also be asked to shift their consumption from a high-demand time to an off-peak time, which is load shifting.

To sum up, renewable generation relies on three pillars, especially for private operators: decarbonization, decentralization, and digitalization. Renewables allow then to decarbonate their activities, decentralize the grid if they invest enough, and they need digital tools to manage the integration of renewables.

Forecasting has proven to be an effective tool to enable more efficient integration of renewables into the grid. Load forecasting has been used by energy companies for a long time. Consuming patterns are quite easy to identify over time, given that they are seasonal and also depend on days of the week (week vs week-end) and hours of the day. Load forecasting is based on these data, combined with metadata (number of people in the perimeter, activities, information about the facilities, etc.) and some weather data (mostly temperature). Recently, developments in forecasting methodologies and tools has been highly effective to predict power generation as well. Forecasting had already been quite widely adopted to predict wind generation, and has now started to become more and more widespread for solar generation as well.

System operators use forecasts to facilitate network management. Generation forecasts help on several issues depending mainly on their time horizon. Very short term forecasting (i.e. intra hour forecasting) is fundamental to ensure supply and demand balancing and real time dispatch. Intra day forecasting also helps to avoid congestions occurring on some part of the network because of a big output from one single asset. The more we extend the time horizon, the more planning it allows. Day ahead forecasting is useful to manage the generation assets – their schedule and maintenance works – and supply on the energy markets (market trading). Long term forecasts (up to several months or years) is used to develop the network: new assets, new interconnections, etc.

HOURLY LOAD CURVE - FORECASTED VS ACTUAL DEMAND - ON ERCOT PERIMETER FOR ONE WEEK

MAIN TYPES OF RENEWABLES FORECASTS AND THEIR APPLICATIONS

Most of US grids operators display data about the grid they manage: grid’s status, demand, supply, prices, capacities, emissions, etc., sometimes with forecasts. For instance, ERCOT, Electric Reliability Council of Texas, displays generation and load actuals and forecasts (day ahead and intraday). CAISO, California’s ISO, uses forecasts to manage the grid but does not display generation forecasts. However, it publicly displays demand forecast (with comparison with achieved), actual generation updated every 5 min, along with many KPIs, reports and daily watches.

Renewable electricity generation is very dependent on weather conditions. Solar PV generation depends strongly on cloudiness and irradiation, while wind generation is strongly related to wind – but other weather data, such as pressure or precipitations, are also used to forecast generation. These conditions are difficult to predict and can change very quickly. Weather data are combined with metadata relative to the generation facilities, such as location, capacity, size, scheduled interruptions due to maintenance for instance. The last type of input is feed-in data: live data coming from facilities allow to adjust the previously scheduled generation to improve the forecast; historical data allow to adjust the result based on the power generated in situations with similar weather conditions.

Weather forecast are usually available on the Internet in local points. What is harder to obtain is a comprehensive grid of weather forecasts. Generation forecast is more accurate if centralized, because it combines data from multiple facilities and areas. It thus needs to be based on geographical-wide weather forecasts. But weather forecast is not that easy to industrialize: it needs a lot of data and high computational power. Few organizations have their own weather model. In the USA, the NOAA displays weather data from it GFS model. Météo France displays forecasts using several models (ARPEGE worldwide, ATOME in metropolitan France). At the European scale, the ECMWF has its IFS model.

WEATHER FORECAST FEEDING RENEWABLE GENERATION AND LOAD FORECASTS - EXAMPLE OF SIA PARTNERS WEATHER FORECAST BOT

One of Sia Partners first bots was designed to provide weather forecasts to some of our clients in France, Belgium and Saudi Arabia. Power generation and consumption forecasts can thus be produced based on these weather forecasts. Our weather forecast bot collects and processes Météo France forecast data to display a complete weather forecast grid at an hourly time step up to 4 days (short term forecast). The forecast is updated every day with the newest open source data from Météo France. This bot delivers a significant added value by automatically collecting updated data, which requires a powerful calculation core, and displaying a clear and usable visualization through graphs and maps.

The USA, with almost 3.8 million mi2, has obviously uneven wind and solar potentials across the whole country. Some States have much more potential than other, but it is also about their use of this potential.

California is without any competition the most solar State of the USA. With its 13GW installed, it exceeds all countries in the world except for 4: China (78GW), Japan (43GW), the whole USA (42GW) and Germany (41GW). The UK (11GW), Spain (8GW), France (7GW), and all others, are overrun. Back to the USA, the Western States, North Carolina, Georgia and small States such as Massachusetts and New Jersey, also make a good use of their solar potential: they have the most significant solar PV installed capacities. Texas also receives a lot of sun throughout the year. However, even being the 2nd largest State in size, it is only the 9th State in the USA in terms of installed solar PV capacity. It has an installed capacity comparable to Georgia or New York States (4 to 5 times smaller). This difference between raw resource and actual installed capacity in Texas can be explained by several factors: first, Texas has focused on wind generation see later). The renewable generation target set by the Renewable Portfolio Standards (RPS) does not precise the kind of renewable resources power has to come from, which means Texas can meet this target with wind generation. Texas is also one of the few States without net metering system, which does not encourage residential and industrial actors to install solar PV systems.

SOLAR PHOTOVOLTAIC INSTALLED CAPACITY PER STATE IN 2016 - Source: Sia Partners analysis from US Department of Energy

The central and Western States are the windiest in the USA: the whole Western part of the USA receives much more wind than the Eastern (and especially the Southeastern) part. Looking at this map of wind installed capacity, it appears that some of these States, in particular Nevada, Arizona, Utah, Idaho and Montana, could install more wind capacity to make the most of this potential. Texas is by far the State with the largest installed wind capacity [1]. Texas’ installed wind capacity is actually larger than most countries in the world. Only China (169GW), the whole USA (82GW), Germany (50GW), India (29GW) and Spain (23GW) have larger installed wind capacity. The UK (15GW), France (12GW) and Canada (12GW), which follow, are overrun by Texas (20GW)[2].

[1] Texas wind capacity is almost 3 times larger than Iowa’s, Iowa second largest installed wind capacity

[2] US Department of Energy, 2016 Renewable Energy Data Book

WIND INSTALLED CAPACITY PER STATE IN 2016 - Source: Sia Partners analysis from US Department of Energy

So where does this uneven development across the US come from, apart from raw resources? Well, States have adopted different regulations and policies. 29 States now have adopted non voluntary Renewable Portfolio Standards (RPS), also called Renewable Energy Standards (RES). These aim at increasing the amount of electricity generated from renewable sources: they require utilities to sell a certain amount of renewable electricity to their customers (usually in percentage or in total amount of electricity generated and supplied). 8 States have implemented voluntary renewable energy standards, and only 13 do not have any renewable target at all – these 13 States being mostly southeastern States). Without surprise, the States having the most developed renewables sectors are the ones with strong RPS. These policies are the most efficient when combined with financial incentives, such as Production Tax Credits (PTC) which allow renewable power producers to claim an income tax credit. To sum up, policies and financial incentives are main drivers for the development of renewables.

Another reason for these discrepancies is the fact that the US power grid was built by regions and is now managed by different operators in each region. They can be either independent operators such as ISO (Independent System Operators) or RTO (Regional Transmission Organizations), or individual utilities or utility holding companies. These operators face different opportunities and challenges depending on their nature, the State’s location, the grid’s condition or the amount of renewable resources. For instance, CAISO (California) has to integrate the electric vehicles in the equation, California being the USA electric vehicles leader. Electric vehicles represent a complementary load on the network. They add complexity for network management, but can also be seen as an opportunity to help balancing the grid. Indeed, the vehicles charging schedules can be modulated according to the network condition, using modelling tools. Sia Partners has for instance developed a bot aiming at modelling the impact of electric vehicles on the grid at a local level. One of ERCOT (Texas) challenges would be curtailments due to high levels of wind generation. The State had to face many curtailments between 2009 and 2012 due to its high levels of wind generation, but managed to reduce them by upgrading the grid. Texas is now equipped with modern smart meters and digital tools for the operations’ management.

Despite the withdrawal from the Paris Agreement last year and policy uncertainties, the US renewables sector, strongly driven by Renewable Portfolio Standards and Production Tax Credits, is still growing at one of the fastest rates worldwide (+13.4% between 2016 and 2017 for all renewables, +14% without hydropower) : the future of the renewables in the US looks bright. The development is still uneven across the States, but this tendency could decrease as interconnections between grids are reinforced. The integration of renewable resources will be eased with the development of digital capabilities and tools and with the upgrades of the grid.

Renewable Energy Surges to 18% of U.S. Power Mix - Fortune

- UNFCCC: United Nations Framework Convention on Climate Change, adopted in 1992. Kyoto Protocol and Paris Agreement have been adopted within this framework. The UNFCCC hosts a yearly Climate Change Conference.

Largest gas and electric utilities in the United States in financial year 2023, based on revenue - Statista

- The SunShot program was launched by the US Department of Energy in 2011 and set solar power prices targets for 2020 and 2030 for residential, commercial and utility-scale solar

- PPA: Power Purchase Agreement

- US Department of Energy, 2016 Wind Technologies Market Report

- Bloomberg study

- Solar Investment Tax Credit (ITC) - SEIA

- “Net metering is a billing mechanism that credits solar energy system owners for the electricity they add to the grid” (SEIA). They will thus only be billed for their net consumption. This system is used in most States.

- NREL, 2014 – Wind and Solar Energy Curtailment: Experience and Practices in the United States

- NOAA: National Oceanic and Atmospheric Administration

- GFS: Global Forecast System

- ECMWF: European Center for Medium-Range Weather Forecasts

- IFS: Integrated Forecast System

- Texas wind capacity is almost 3 times larger than Iowa’s, Iowa second largest installed wind capacity

- US Department of Energy, 2016 Renewable Energy Data Book

- Sia Partners analysis based on data from BP Statistical Review of World Energy 2018

- US Department of Energy announced in 2016 $220m to upgrade the US power grid: Power Technology