Agentic AI: Are you ready?

In this article, we look at the impact on the surge in gas prices due to several global factors and why shale gas is not the answer to this increasing demand.

Over the past year global gas prices have surged as a result of:

It is unlikely gas prices will moderate in the short to medium term and may even increase further over a sustained period due to the Russian/Ukraine conflict and restrictions on the consumption of Russian gas.

As a result, proponents of shale gas in Great Britain (GB) have called for the lifting of the moratorium on its development. Such action is unlikely to alleviate high gas prices nor make a material difference to the supply of gas.

Estimates of Shale Gas reserves in GB vary widely. Experience from Australia and the US is that it is difficult to determine the actual commercially viable amount of gas to be extracted until significant levels of testing and fracking occur.

The GB market consumes about 70-80 billion cubic meters of gas a year. A recent study from the Warwick Business School has estimated shale gas reserves could supply between 17%-22% of demand per year. However, this would require significant drilling of a shale gas well, literally 10s of thousand and a significant rate of gas extraction success.

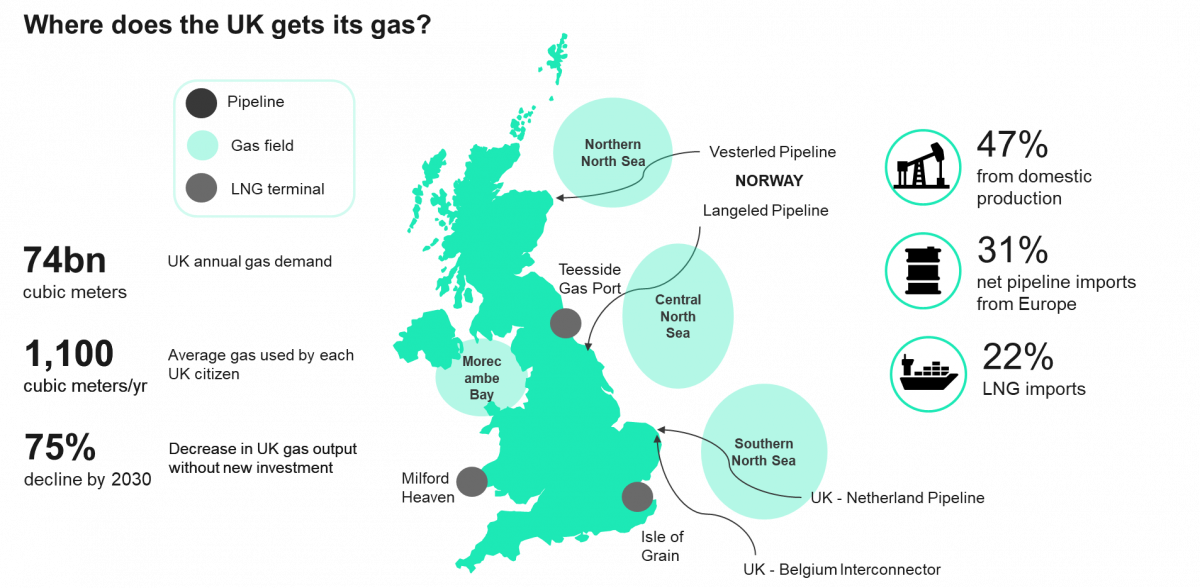

The chart below illustrates the reliance on imported gas for the GB market, although Russian gas is a very small proportion. The market now relies upon imports from Norway, Belgium and LNG. Twenty years ago GB supplied all its own gas.

Source: https://oeuk.org.uk/how-does-the-uk-get-its-gas/ (Jan 2022)

Proponents of shale gas ignore the fact that vast numbers of wells are required to extract the gas. It is unlike natural gas where a small number of large wells can extract significant quantities of gas. Fracking for gas means drilling into the coal seam and disrupting the gas.

Shale or coal seam gas has been successful in Australia and the US. Unlike GB the areas where extraction occurs are vast. In Queensland for example gas is extracted from the Surat and Galilea basins, an area covering 517,000 KM2. This is 2,5 times the area of the entirety of GB. It has a population density of fewer than 20 people per square KM compared to 280 people per square KM in GB.

The process requires large-scale drilling rigs to traverse the British countryside to undertake the development. The thousands of wells required to produce significant quantities of gas means the process is just not feasible. Britain is a small and crowded country.

A by-product of fracking for gas is water extraction. Fracturing the seam destabilizes the water table and as well as gas, water is also extracted. Sometimes this is fresh, often it is saline. Generally, it is unusable and requires disposal.

In Australia, this is undertaken through vast evaporation ponds, a reasonably feasible process in hot and dry central Queensland. In wet, cold and crowded GB this would be totally unfeasible. Proponents argue there are commercial uses for the water but this requires processing and adds to cost.

Even in the vast areas of Queensland and the US, there has been controversy over water extraction from the process. There is some evidence that water tables have been disturbed, salinity levels have increased and land degradation has occurred. Again the impact would be amplified in GB.

The geographical and environmental restrictions mean that Shale gas is never likely to supply a large proportion of the GB market for gas. There may be reasonable quantities of shale gas to be extracted but it is unlikely to be commercially or environmentally viable.

The UK Government is correct to continue with its moratorium on fracking and the production of shale gas. The evidence is it will benefit a small number of developers, produce small amounts of gas compared to total consumption and is unlikely to alleviate high gas prices.