Carbon Accounting Management Platform Benchmark…

On February 24, 2021 the DTCC (Depository Trust & Clearing Corporation) released their approach to shorten the US settlement cycle to T+1 and presented the benefits of such a move, while simultaneously highlighting the risks and barriers that firms and the industry will need to traverse.

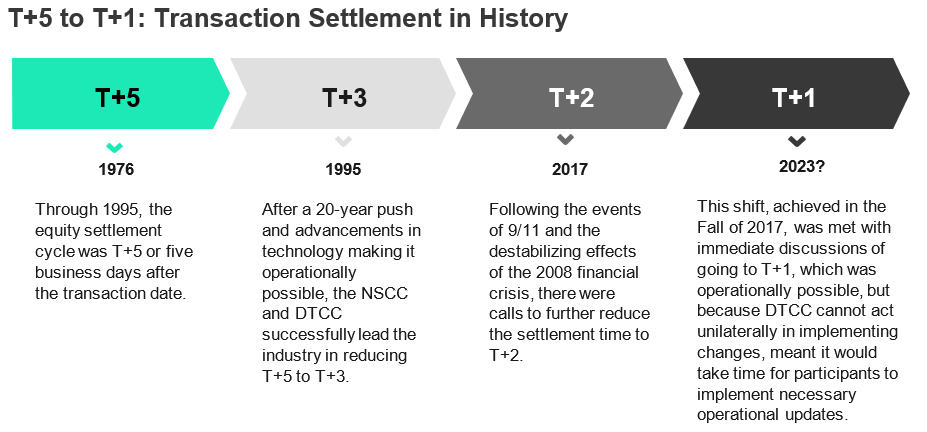

The DTCC’s (The Depository Trust & Clearing Corporation) recently released a white paper, Advancing Together: Leading the Industry to Accelerated Settlement in which the clearing house outlines a two-year, industry-wide plan for the industry to adopt T+1. The adoption of T+1 would mean the shortening of settlement cycles from the current two business days to just one for US securities following the execution of a trade. This proposal comes amid tremendous market volatility over the last several years, exacerbated by the pandemic and compounded by back-and-forth swings in the price of GameStop (NYSE: GME) and other stocks with relatively small amounts of revenue and negative earnings. The result is the required margining in an increase to cover this volatility, creating an incentive for the industry to decrease the effective time to settlement. [2]

The push for T+1 comes from the numerous benefits that are accessible due to advancements in technology.

The principal benefit is efficiency; mitigating systematic risk frees up liquidity and a shorter settlement window means reduced operational costs. As firms and subsequently larger markets have become more efficient operationally, processing costs have reduced already. However, liquidity margining, which protects against market movement over the settlement period and covers open buy orders, has become more costly.

$13.4 billion on average is held in margin every day and according to the paper released from DTCC, this could be reduced by up to 41% by switching to T+1. The combination of increased market volatility, market value, and the capital required to support the margining has increased, meaning the true cost comes from having more liquidity tied up.

A shortened settlement cycle would mean less need for liquidity overall, savings that would be passed back to the market.

Many firms appear ready to start revising their processes. Shortened settlement times will reduce market risk and margin requirements, which will provide numerous opportunities. Securities clearing and settlement is part of a much larger ecosystem of linked financial markets:

While NSCC and DTCC can support T+1 and even same-day T+0 settlement today using existing technology, the current T+2 settlement cycle is a convention of market practice, and shortening that period as regular-way for all market participants will require industry coordination.

The migration from T+3 to T+2 formally commenced in Q2 2015 and completed in Q3 2017 involving many thousands of participating firms. The industry discussion started back in 2012, and by the time the project was formally kicked off in 2015, the Industry Steering Committee (ISC) and Industry Working Groups were already in place, the business case for the migration had already been socialized across the industry, and a comprehensive roadmap had been developed and agreed upon:

Overarching governance industry-wide does not exist today for T+1 even though several major banks are involved in DTCC’s pilot testing for Project Ion. Given a projected 2023 implementation date, the industry should establish equivalent governance as soon as possible. On April 29, DTCC, SIFMA, and ICI announced that they are working together on T+1, with a target to complete analysis by Q3, 2021, followed by the development of a transition roadmap.

A key aspect of the move to T+2 was the extensive regulatory and rule changes required by the SEC, FINRA, MSRB, and SROs. Many rule changes required are most likely to be similar to those implemented for T+2. Regulatory rule changes have mandatory public consultation periods. The development of rules for T+2 required over a year of public consultation and rule approvals.

For T+2 the testing process took the entire 30 months to complete:

Much of the T+2 systems and procedure testing playbook can likely be leveraged for T+1 purposes. The Industry Steering Committee needs to establish the testing roadmap as soon as possible, starting with DTCC and major vendors, to achieve the 2023 objective of the T+1 settlement. The industry will need to move to real-time for key processes and the firms will need to replace batch systems. The regulatory bodies will need to review all events in the securities life cycle and their potential impact on SEC rules 15c3-1 and 15c3-3.

Sia Partners has extensive experience and thorough end-to-end understanding of the US Securities Industry, from the Institutional Broker-Dealer, Wealth Management, Asset Management, Clearing Broker, Hedge Fund and Prime Broker perspectives.

Our strong credentials and experience with major banks and broker-dealers on the T+2 implementation in 2015-17 would provide your firm in depth analysis, planning, and execution of the many challenges ahead over the next 2 years in implementing T+1.

Sia Partners has strong experience with technologies including blockchain, cryptocurrencies and smart contracts. Our knowledge and expertise in working with these technologies spans all stages of a product cycle including development, deployment and testing.

Our experience includes delivering solutions on various open-source technologies including Hyperledger Fabric, Ethereum, Corda and Tezos and consists of both backend and UI development.

Sia Partners has achieved considerable knowledge of the financial services space by working extensively with US banks, foreign banks, central banks, startups, and stock exchanges. We have a successful history constructing proposals on technical architectures enhancement particular to the bank’s goals and needs.

[1] DTCC. (2021). Retrieved from http://www.dtcc.com/~/media/Files/Downloads/Settlement-Asset-Services/S…

[2] DTCC. (2021). Retrieved from http://www.dtcc.com/~/media/Files/Downloads/Settlement-Asset-Services/S…

[3] DTCC. (2021). Retrieved from http://www.dtcc.com/~/media/Files/Downloads/Settlement-Asset-Services/S…

[4] DTCC. (2021). Retrieved from http://www.dtcc.com/~/media/Files/Downloads/Settlement-Asset-Services/S…

[5] DTCC. (2021). Retrieved from https://www.dtcc.com/news/2021/february/24/dtcc-proposes-approach-to-sh…