Control Room of the Future

Virtual Money can be defined as a digital representation of value that is issued and controlled by its developers, and used and accepted among the members of a specific (virtual) community.

Unlike regular money, it is relying on a system of trust and not issued by a central bank or other banking authority. In this article, Sia Partners explains why “Virtual Money” could become really important, which are the main products and players in the market today and what are their main characteristics, risks and advantages. We also explain key concepts related to Virtual Money, such as “Mining” and “Blockchain”.

A lot of confusion exists around the terms virtual money and digital money. When we are talking about digital money, this concerns the categories M2 and M3 of the financial system (M1 are the physical notes and coins in circulation). Worldwide, more than 95% of the currencies is digital. Virtual money originally only referred to the currencies that did not live in the real world and were only exchanged online (typically in gaming systems). In a later phase, virtual currencies started to expand to the physical world and blurred the line between virtual and digital money.

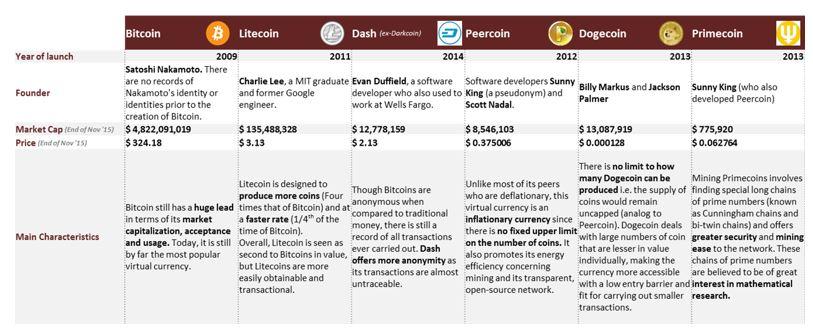

A lot of virtual currencies exist (see table for an overview of some of the most important players), and every virtual currency has its own way of functioning. Most of them are cryptocurrencies (digital currencies in which encryption techniques are used). Each virtual currency has its own founder(s), its algorithms and a varying level of anonymity. What they all have in common is their young age. Bitcoin for example, the most “settled” currency which is still – by far – the most important one in terms of Market Capitalization and popularity has been created in 2009. Since then, many virtual currencies have appeared as you can see on CoinMarketCap.com. Bitcoin today still accounts for approximately 90% (approximately $4.8bn out of $5.3bn), of total Market Capitalization which consists of more than 650 virtual currencies. Others however, like for example XenCoin, have only lived for a couple of months and reached a Market Capitalization of a mere $40k before disappearing.

Bitcoin is making use of peer-to-peer-technology, the processing and spending of bitcoins is happening collectively through a network. Every payment gets encrypted by a unique secret key and is send from one address to another over the blockchain, which is a decentralized public register that tracks everyone’s bitcoins. Miners verify for every Bitcoin whether the person who sends the money is indeed the owner of the money and every Bitcoins is send once by its owner. It is a very convenient way to transfer money all around the globe without passing by an intermediary.

The Blockchain technology used in Bitcoins and other VCs has an important advantage compared to existing technologies as it contributes to achieving a higher worldwide financial integration. VCs like Bitcoin are first of all “global” currencies (compared to the 200+ local currencies in use worldwide). They grant access to the financial system to anyone who has internet access, thus making (instant) international payments possible for almost everyone on the planet, without making use of the existing Financial System and Banking networks. This is particularly important given today, and according to the IMF, around 50% of the World’s adult population do not access formal banking services in any form.

Furthermore, the technology is intrinsically more resistant to manipulation as it does not require any kind of intermediary to perform a transaction. Moreover, Blockchain technologies can aid industry participants to adhere to a number of regulations including AML (Anti-Money Laundering) and T+2 Settlement (read more here). A sine-qua-non condition for this is off course that the technology provides (as in certain VCs today) visibility to view the full transaction history of every event throughout the chain.

VCs created with the Blockchain technology can also be customized ex ante regarding their inflationary or deflationary character, which makes the system less dependent on centralized monetary policies. The downside is however that intervention (on fluctuation, excess or lack of inflation/deflation…) might be more difficult…

Finally, transaction costs could be much lower than today, as the only cost would be to the (mining) network.

This new payment environment has the tools to completely disrupt the hierarchy in the banking system, as the use of the technology implies that no permission is needed from any third party to make a payment. It basically gives every actor in the system the same rights… and duties.

Proponents of VCs argue that regulators have failed to protect consumers in recent years and especially during the financial crisis. By making use of VCs, security in the financial systems would be each customer’s responsibility for his/her own payments. However, it remains to be seen how a highly deregulated system based on Blockchain technology would perform in terms of security.

With a mere $5.3bn Market Capitalization today, we cannot expect Virtual Currencies to really disrupt the traditional system in the following years. However, we are convinced that these currencies will mark the start of a new era, in which technology as a currency will gradually take its place in the traditional payment environment. As they are putting banks under pressure – offering an alternative for (instant) payments and showing new technologies like Blockchain – Banks and Fintechs will need to look towards the virtual alternative and decide how to position themselves in order to avoid missing the boat of the (mid/long term) future of payments. Meanwhile, the EBA and other regulators worldwide will first need to seek to implement the PSD2 regulation and set up a frame for Instant Payments.

Sources:

2. http://www.coindesk.com/european-banking-federation-bitcoin-regulation/

3. https://www.ecb.europa.eu/pub/pdf/other/virtualcurrencyschemes201210en…

4. http://www.cnbc.com/2015/10/22/bitcoin-now-tax-free-in-europe-after-cou…

6. https://www.cryptocoinsnews.com/proposed-bitcoin-regulation-bitlicense-s...