Carbon Accounting Management Platform Benchmark…

Does your firm want to begin investing sustainably but is unsure how to navigate the rapidly changing ESG regulatory landscape, or is it in need of effective tools to report quality ESG data? Sia Partners can be the perfect partner to adapt your firm's strategy towards a more ESG-focused approach.

Although many Asset Management firms understand the benefits of implementing an ESG strategy, few have effectively put it into practice. Does your firm want to begin investing sustainably but is unsure how to navigate the rapidly changing ESG regulatory landscape, or is it in need of effective tools to aggregate and report quality ESG data to investors?

Sia Partners can be the perfect partner to adapt your firm's operational and investment strategy towards a more ESG-focused approach that maximizes the value creation process—and right now is a more crucial time than ever.

Over the past 12 months, U.S. regulators have drastically increased their focus on greenwashing and misleading statements by Fortune 500 companies on their ESG practices, or lack thereof. In combination with increased investor demand for concrete ESG action because of worries over climate change, Private Equity firms face heightened scrutiny and pressure to develop a more proactive and systematic ESG investment process.

This increased pressure means Private Equity firms will need to ascribe increasing efforts to ESG disclosures to position themselves ahead of the curve, not to get caught behind the changing ESG regulations or miss out on attracting capital.

Executing on ESG can be complex and confusing, given the different standards and approaches both domestically and abroad. ESG is no longer an ad-hoc approach but rather an all-encompassing methodology that needs to be embedded throughout an entire firm.

Collecting and interpreting ESG data can not only be cumbersome but developing these metrics into meaningful and impactful ESG disclosures can also be an arduous and labor-intensive process.

Allow Sia Partners to help your firm see the benefits of well-crafted ESG disclosures and partner with us to overcome the challenges of this developing and challenging to navigate industry.

In both Private Equity and the broader finance industry, the question of how best to integrate qualitative influences into fundamental analysis is more pressing than ever. As a means of quantifying corporate environmental and social responsibility, ESG behavioral scoring systems increasingly indicate a positive correlation between ethical investing and overall financial performance. From 2003-2019, STOXX global ESG leaders index outperformed the STOXX Global 1800 index by 37%. This phenomenon is not unique – a joint study by DWS and the University of Hamburg found in a 2,000-participant survey that 63% showed a positive correlation between ESG investing and returns. In comparison, only 8% showed a negative effect.

Accounting for ESG factors can reduce risk across the firm and portfolio companies. Firms that have invested in better social and governance policies may be more adaptable in the face of crises, enjoy better employee performance, and benefit from better marketing communications and public relations with the customer base. Analysis shows that the top quartile of public rating provider Sustainalytics ESG performers had a 4.4% lower 10-day average volatility than the bottom ESG performers during the steepest COVID-19 pandemic sell-off in March 2020. Such a trend is also evident in general market conditions – the top quintile ESG companies demonstrated 28.67% lower average volatility in returns while reflecting a 7.67% higher Sharpe than the overall market.

As these benefits of integrating ESG influences into financial analysis become increasingly evident, capital has begun to flow rapidly towards ESG-related investments. Global assets under management using ESG standards reached $40.6 trillion in 2020, almost doubling over just the last four years. This trend is expected to continue globally, with the "absolute level of those ESG assets [expected to] triple to between 41% and 57% of the total in funds in Europe by 2025, reaching between €5.5tn and €7.6tn." As this trend continues to develop, pressure has begun mounting on regulators to guide this growing industry.

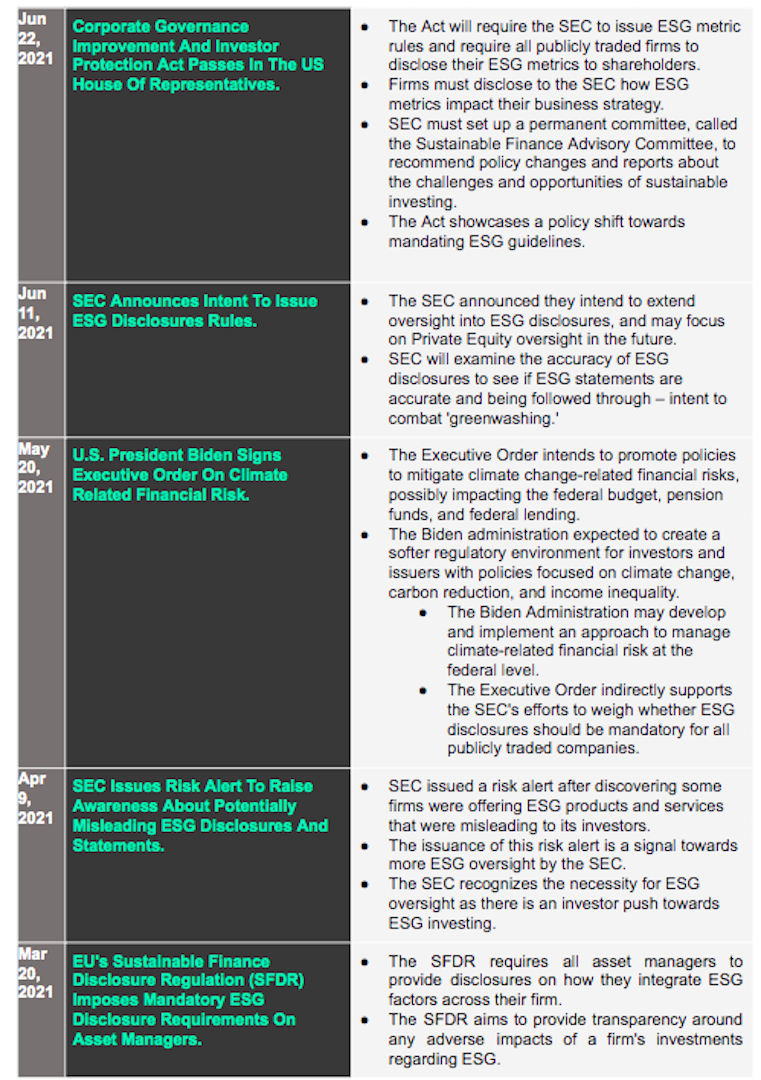

In the world of finance, increased financial growth is almost always accompanied by additional regulatory compliance. In the face of increased worries over climate and change and misleading statements by Fortune 500 companies on their ESG practices, government agencies worldwide have begun to ramp up efforts to mandate ESG disclosures for publicly traded firms. However, the regulations are fast approaching Private Equity as well Below are recent updates from major regulatory agencies on ESG and ESG disclosures:

Although there are currently no required ESG frameworks for Private Equity, GPs should anticipate coming changes to the regulatory environment by adopting independent regulatory frameworks such as the PRI, GRI, TCFD, or the SASB and partner with a trusted advisor to plan. Sia Partners can help you choose which regulatory framework is suitable for your firm.

ESG disclosures not only convey critical information to investors and GPs but also support further ESG investment by helping firms to benchmark future projections to past performance.

Without an acute and rapid focus on developing ESG disclosures, Private Equity firms risk missing out on attracting capital and getting left behind by changing ESG regulations.

There can be a steep learning curve for GPs when it comes to ESG. GPs need to determine which ESG inputs are material to their specific investments and may not know where to look for ESG data or may ask portfolio companies the wrong questions. Fast-moving market conditions also means that PE firms need expertise for fast turnarounds in short timeframes.

Sia Partners can be your perfect partner to navigate these coming regulatory changes and take advantage of increased investor appetites towards ESG investing.

At Sia Partners, 12% of our revenue is generated from business related to climate change, offering clients in both private and public sector navigation in the on-going global transition to a low carbon economy.

Sia Partners offers a variety of services that can lead your firm in these endeavors, such as our expertise in Business Transformation, Compliance, Data Analysis, AI, Reporting, Corporate Strategy, H.R., as well as our Climate Analysis Lab. Sia Partners has teamed up with Greenly to offer you a carbon footprint calculator and new ways to address new challenges and regulations. Wherever your company is, we can help better it, from Turnaround to Growth Strategy within the light of ESG.

Let us develop the perfect ESG reporting system for your company, allowing you to incorporate ESG into your risk management or due diligence. We can provide you with impact assessment as well as governance integration, allowing you to see beyond the ESG reporting scores, and see it’s factors and actionable items within your company to improve scores for you, and your portfolio companies.

Investing With Impact: Today’s ESG Mandate - Private Equity | Bain & Company

Why Private Equity Firms Should Be Embedding ESG In Their Portfolio | EY

The Intersection Of Operational Resiliency And ESG Scores | Sia Partners

Firms Ignoring Climate Crisis Will Go Bankrupt, Says Mark Carney | The Guardian

Banks Must Cut The Flow Of Funding For Fossil Fuels | Financial Times

Larry Fink's 2021 Letter To CEOs | Blackrock

Journal Of Sustainable Finance And Investment, 2016 Vol. 6, No. 4, 292-300.J

The ESG Trend Is Here to Stay – Which Means Complying With SFDR Is essential | Intertrust Group

What is the SFDR? Sustainable Finance Disclosures | KPMG Ireland

SFDR Brings New ESG Disclosure Rules For Asset Managers | Bovill

ESG Disclosure Bill Passes House By One Vote | AI CIO

Biden May Give a Boost to Private Equity’s ESG Push | WSJ

Here's How Biden's Presidency Could Be a Boost For Impact Investing | CNBC

Biden signal Is Green For ESG | Features | IPE

New SEC Regimes Private-Equity Take Shape | WSJ

The SEC Risk Alert – What It Means For ESG | Gob