Fortune 100 response to DE&I pressures

We examine the road ahead for Managers, Fund Administrators and Broker-Dealers as well as industry challenges and potential operational improvements

The Alternative Investments industry is struggling to keep up operationally in the era of digital transformation. In order to deliver a seamless client experience, support business growth, and drive margin expansion, firms must make strategic shifts towards implementing new and scalable technology.

Ever since the 2008 financial crisis, investors have looked for ways to grow their assets while safeguarding them from the volatility of public markets. Today, while inflation and rising interest rates continue to affect global equity markets, alternative investments, such as private equity, private credit, and real estate, have become increasingly popular.

As investors allocate large sums to alternative investments, broker-dealers and wire houses have struggled to meet demand. The increase in transactions has created technical and operational challenges, stressed legacy systems, and overworked human capital.

To meet these challenges, alternative investment firms have tried to bulk up their teams and invest in new technology to streamline clogged workflows. Since last fall, Merrill Lynch and Fidelity have hired several hundred experts to service the demand for their alternative investment products.

Consultants and third-party vendors have also helped fill staffing holes and supplement full-time employees. Without bringing in immediate help, firms risk straining customer relationships and missing out on new business as the alternatives industry continues to boom.

This article provides insights into the opportunities and challenges of scaling an alternative investments business, including:

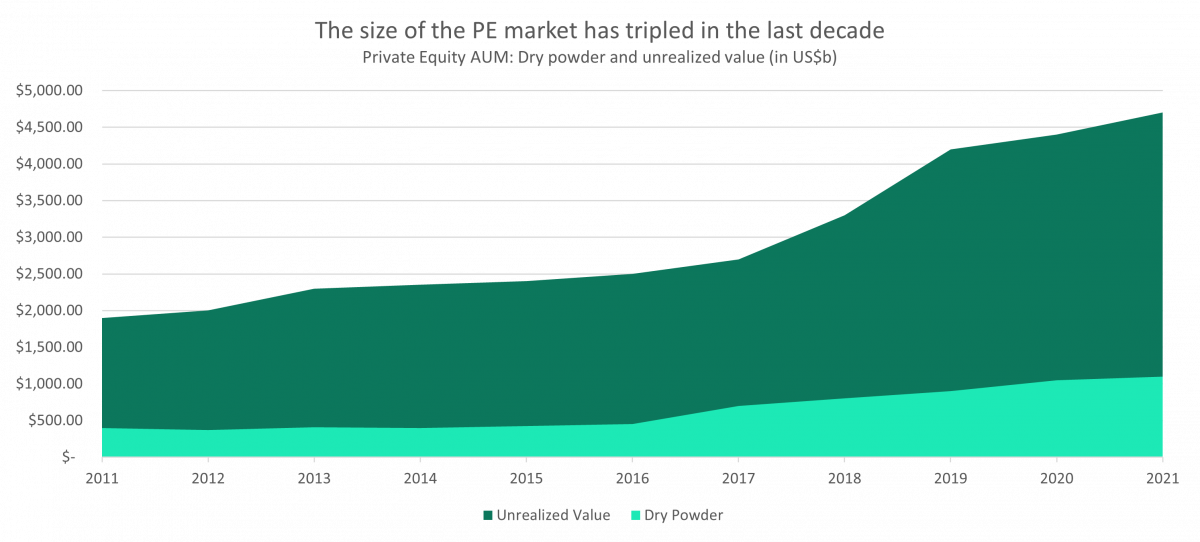

The demand for alternative investments is currently high and only getting higher. At its pre-financial crisis peak, the alternatives industry managed $2.2 trillion in AUM. At the end of 2020, alternatives firms globally held $10.8 trillion in assets. Demand is expected to rise to $17.2 trillion by 2025. Hedge funds and real estate have been growing at a healthy clip, but the fastest-growing segments of the alternatives sector are digital assets and private equity. Cryptocurrency AUM has ballooned from $100 billion in 2019 to almost $1 trillion today, while private equity AUM is projected to grow from $4.4 trillion in 2020 to $9.1 trillion by 2025.

Traditionally, large institutions have been the biggest customers of alternative investment funds. But retail investors’ interest in alternatives is starting to grow. Lower management fees and pooled investment funds have increased retail investor accessibility to alternatives. Hedge fund management fees were down to 1.37% in 2020, from a longtime industry standard of 2%. The rise of “passive” funds, regulatory changes, and technological changes (such as increased automation and the advent of low-cost Robo-advisors) have all played a part in driving down fees.

In recent months, several alternative investment firms have purchased other asset managers or partnered with third-party vendors for much-needed support:

The large influx of investment into alternatives has increased the number of transactions that firms must process, creating opportunities to use technology to automate the process. Multiple third-party vendors now offer services that allow asset managers to outsource part of their operational processes, from subscriptions and capital calls to redemptions and fee processing. Vendors have embraced technology, using machine learning, artificial intelligence, and blockchain to automate workflows.

Blockchain technology could become standard practice in alternative investments. Smart contracts and distributed ledgers on the blockchain can execute operational processes- enabling timely compliance and accuracy while minimizing manual interventions. They also can verify identity, reduce the burden on legal/admin, assist with the time and cost of the reconciliation process, and mitigate other risks for issuers and fund administrators.

The rapid growth of the Alternative Investments industry and the entrance of new funds has contributed to a lack of standardization across investment platforms. Some of the resulting challenges include:

Firms with unorganized workflows risk costly errors and stressing operational and technological support. Fund-specific workflows across various products will increase onboarding and processing costs.

Manual processing and the lack of automation slow down the investment process and stresses human capital. Without automated systems to streamline the investment and operational process, the firm risks:

These roadblocks result in the rekeying of information to consolidate statements and prepare data reports leading to higher operational costs and potential errors. It is costly to require two full-time employees to review and/or approve data prior to consumption or sharing externally. Human error and a bespoke process that requires custom solutions for individual Fund Admins with no real-time confirmation

Lack of data standardization, manual data collection processes, multiple operational systems, and tighter regulations have created significant data governance challenges for firms. Complex reconciliation requirements across several reporting systems require manual operational intervention and constant reformatting. The operational process can become non-functional if key employees leave the firm.

Firms are unable to meet the increasing investor demand for greater transparency, risk management, compliance, internal controls, performance evaluation/attribution, portfolio accounting, and regulatory and investor reporting. As alternative firms grow, the AI Product Suite must meet investor demands. Without standard and automated processes, the business will not be able to scale to its potential.

Most alternative investment firms have not adopted automation solutions - in a 2018 survey from Prequin, only 9% of alternative fund managers currently used AI or Machine Learning processes, and 26% planned to within the next 5 years. 57% did not plan to at all.

The opportunity to automate the activities carried by fund managers can be the difference between fund managers favoring one service provider from the other. As the investor generation transitions from boomers to millennials, many are expecting investment technology to match the other platforms they use. Failure to adopt new technologies can easily hurt the client experience, especially during a time of industry growth and hiring difficulties.

Aging legacy systems are too rigid to meet the unique investment requirements of new assets and products. Many managers have modified their own software to intake private equity and hedge funds, including liquid and illiquid funds. However, with this adaptation, many of the nuances of handling alternative investments have been left to the operations department, slowing down, and delaying the necessary deliveries to the fund managers.

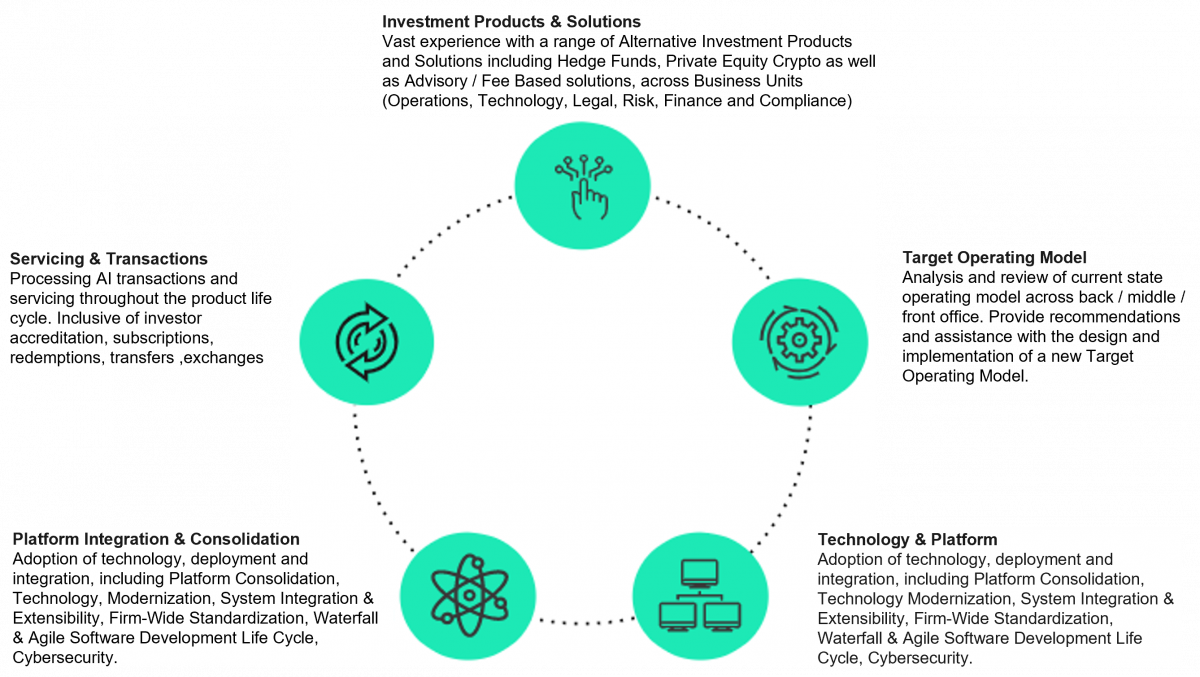

Sia Partners has extensive experience delivering Alternative Investment Solutions and has a strong understanding of industry best practices.

SIFMA’s Asset Management Group commissioned Sia Partners to develop a framework, catalog key operational pain points, and work with the group to determine potential solutions / best practices to the common challenges facing the industry.

In an evolving landscape, we are on the front lines assisting clients on both the “Buy” and Sell” side with initiatives including current and target state assessments, vendor analysis and implementation / transformation, and operational business support.

Sia Partners has an in-depth knowledge of the vendor landscape within Alternative Investments. We have reviewed 10+ leading vendor solutions and assessed their capabilities and viability for different areas of the firm to best add value, drive operational improvements, and improve the overall FA-Client experience.

Our consulting experience spans the following facets of the Alternative Investment Business:

Internal Links:

M&A:

Market Data:

Fee Compression:

Blockchain: