SEC Division of Examinations Releases 2026…

The Consumer Financial Protection Bureau (CFPB) is proposing new oversight rules to ensure large tech companies offering digital wallet and payment app services adhere to the same supervisory standards as traditional financial institutions.

The Consumer Financial Protection Bureau (CFPB) is proposing new oversight rules to ensure large tech companies offering digital wallet and payment app services adhere to the same supervisory standards as traditional financial institutions, aiming to create a level playing field and enhance consumer protection in the evolving digital payment landscape. The proposed CFPB rule is the sixth aimed at defining key players in significant consumer finance markets, following rules on consumer reporting, debt collection, student loans, money transfers, and auto financing. This proposed oversight is targeted toward nonbank financial companies, such as Apple, Meta, Google, and other big technology companies that manage over five million transactions annually. This initiative by the CFPB aims to establish uniformity in the financial landscape by creating a regulatory environment these 'larger participants' will be required to adhere to, just like large banks, credit unions, and other financial institutions already supervised by the CFPB are required to.

The COVID-19 pandemic pushed digital transactions and mobile payments to the forefront of the e-commerce industry and introduced new customers, firms, and various types of products to this method of payment. The digital payments market size by transactions was valued at $2,476.8 trillion in 2023 and is expected to grow at a compound annual growth rate of 14.3% over the forecast period, resulting in an estimate $5,848.5 trillion by 2030. With this massive growth, the CFPB recognizes the importance of implementing sophisticated regulatory strategies, mirroring the rapid progress in the payment services domain.

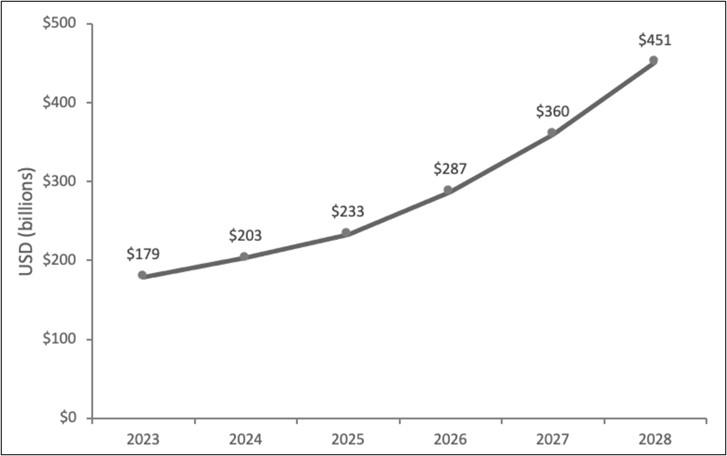

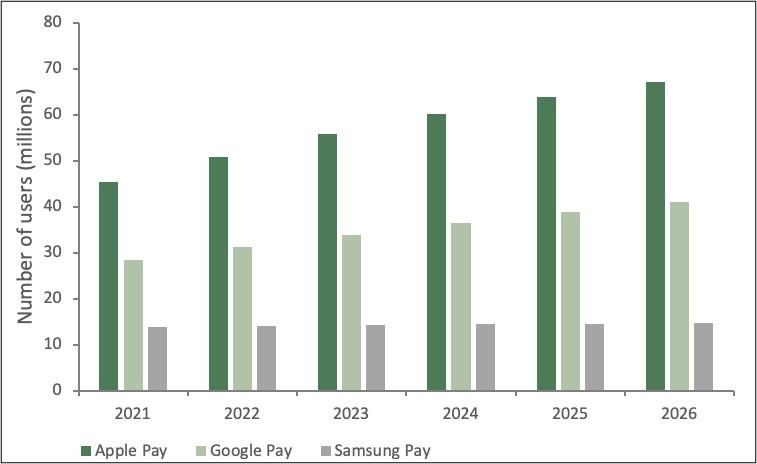

The below charts further highlight the growth of digital wallets including Figure 1 which depicts the forecasted growth of the U.S. Total Digital Wallet Near-Field Communication (“NFC”) Transaction Value, expected to surge to $587.52 billion by 2030, and Figure 2 which illustrates a dynamic expansion in the mobile payment industry between some of the largest non-financial

The below charts further highlight the growth of digital wallets including Figure 1 which depicts the forecasted growth of the U.S. Total Digital Wallet Near-Field Communication (“NFC”) Transaction Value, expected to surge to $587.52 billion by 2030, and Figure 2 which illustrates a dynamic expansion in the mobile payment industry between some of the largest non-financial companies. These graphs further stress the importance the CFPB's proposed regulatory oversight has in aiming to fortify consumer protection and uphold the integrity of the market as digital payment platforms continue to integrate into the fabric of daily financial transactions.

Figure 1: Forecast U.S. Total Digital Wallet NFC Transaction Value

Digital Wallets Market Statistics 2023-2028

Figure 2: Forecast U.S. Mobile Proximity Payment Users by Digital Wallet

The CFPB's 6th proposed rule will require significant organizational recalibrations for large tech companies, potentially leading to profound impacts across their operations including:

1. Sophisticated Governance Structures:

2. Intricate Compliance Architecture:

3. Compliance:

4. Consumer Protection:

5. Operational Structure:

6. Risk Management:

7. Intensified Internal Monitoring and Auditing:

These instances underscore the CFPB's commitment to protecting consumers and ensuring financial institutions adhere to their legal standards and serve as a warning to these digital payments companies that these regulations once passed will be imperative to be adhered to.

At Sia Partners, we provide a vast suite of services designed to bolster risk management strategies, from rigorous documentation and record retention to advanced risk analysis. Our team consists of former regulators, industry professionals, and skilled data science experts dedicated to assisting large technology companies with the latest regulatory implementation support. With our experience, Sia Partners is well-equipped to navigate nonbank digital payment entities through the complexities of the CFPB's proposed regulations, and our commitment to innovation is aimed at helping these institutions achieve operational efficiencies while ensuring compliance with the latest regulatory standards. For more information on our innovative solutions, please visit our website Heka.

Associate Partner, Financial Services | New York

Zoya is an Associate Partner in our Financial Services Practice leading the Legal and Compliance unit.