Canadian Hydrogen Observatory: Insights to fuel…

A shift towards open banking and granting consumers control of their financial information

Currently, financial institutions control access to consumer financial data. Section 1033 of the Dodd-Frank Act aims to create a more transparent and competitive financial ecosystem in an open banking environment.

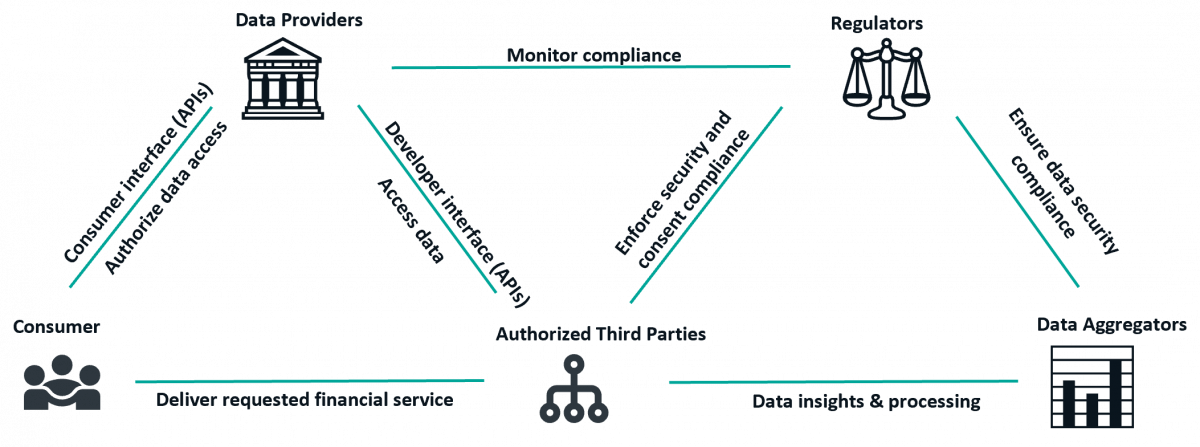

Rule 1033 strengthens the open banking ecosystem by enabling consumer-authorized data sharing with a focus on security and collaboration among consumers, data providers, third parties, and aggregators. It drives innovation, competition, and transparency while ensuring robust data security and regulatory compliance across all participants.

The CFPB’s final rule on financial data rights was issued on October 22, 2024. CFPB Rule 1033 implements Section 1033, which allows consumers to access and securely share their financial data (“covered data”) with third-party services and is intended to facilitate open banking. Key takeaways of the rule include data safety, clear consent, and giving consumers more control over their information:

| Data Providers | Authorized Third Parties | Data Aggregators |

|---|---|---|

| Make certain types of financial data available to consumers and authorized third parties upon request. Categories: Depository Institutions Banks and savings institutions holding consumer accounts under Regulation E. Non-Depository Institutions Credit card issuers regulated under Regulation Z | Establish clear guidelines on use and retention when accessing financial data . Categories: Financial Service Providers and Fintech Companies Obtain explicit consumer consent, provide clear disclosures, renew consent, annually, and adhere to data security standards. | Facilitate secure and transparent consumer data access. Categories: Data Aggregation Platforms Specialized in collecting and securing data from institutions in a unified format for authorized third parties |

Data providers must provide consumers and authorized third parties with access to:

Rule 1033 facilitates open banking by enabling secure sharing of consumer financial data. Under the rule, data providers are required to maintain a consumer interface and a developer interface. Interface requirements include data formats (machine-readable files), performance conditions, and security specifications.

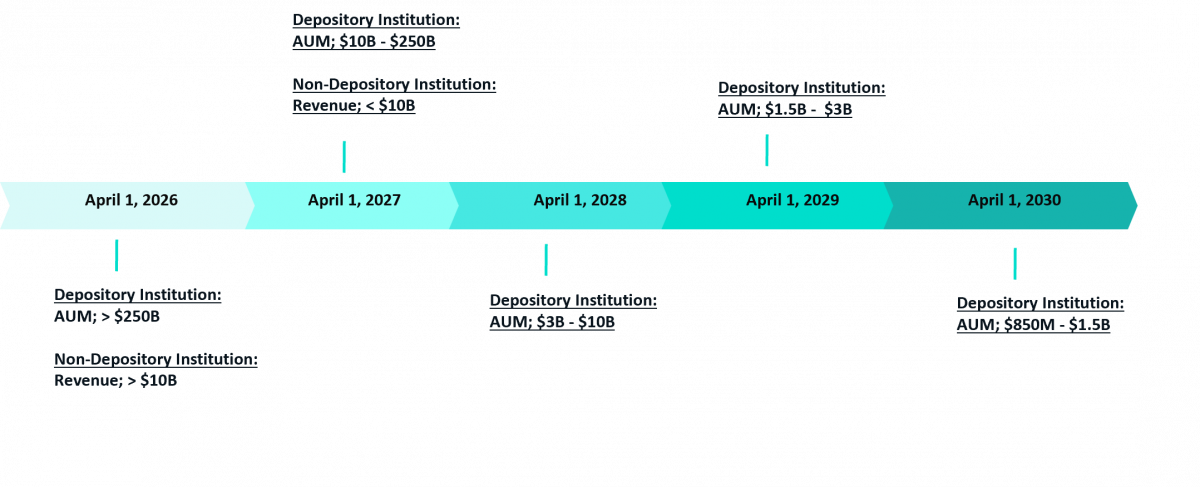

The rule has a phased rollout, determined by annual revenue or asset size.

Larger institutions are subject to implementation by April 1, 2026.

The fate of the rule hangs on two challenges. In October 2024, the rule was immediately challenged following its release. A Kentucky-based national bank, along with groups such as the American Bankers Association and The Bank Policy Institute filed lawsuits asserting that the CFPB was overstepping in its authority and concerns about liability and cost remained unaddressed. The CFPB filed an answer to the amended complaint in late December 2024, and the courts directed the involved parties to confer regarding a case schedule. The second challenge arose with the change in the presidential administration and Congress, and the expected changes at the CFPB. Now that Congress is in session, it may disapprove of any rule finalized by the CFPB within the last six months of the former presidential administration. Whether Congress will reject the open banking rule remains to be seen. Adding to the already uncertain future of the rule, the incoming CFPB director may use the lawsuit to determine the fate of the rule.

Regardless of what happens to Rule 1033 and whether the CFPB will get to enforce it, the concept of open banking is likely here to stay. As industry groups and regulators work toward a resolution, financial institutions should assess ways to comply as data providers in an open banking environment.

By combining expertise in regulatory compliance, data privacy, and technology integration, Sia can help data providers navigate the complexities of Rule 1033. Our services would enable data providers to efficiently manage consumer data access, enhance transparency, and maintain compliance with evolving regulations.

Our team members have a practical, deep understanding of embedding regulatory requirements into our tailored, data privacy and cybersecurity solutions. From a readiness assessment and gap identification to a customized target operating model recommendation and full-scale implementation, we are equipped to confidently support clients with every step of this complex rule implementation.

We have a solid understanding of the ever-evolving regulatory landscape and strive to keep abreast of industry trends.

Regulatory Watch

Reg Review AI

Smart Data Quality AI

Contract review & third-party assessment

Sanction Challenger

Change Management (with Nod-A)

Quantum Lab & DeepTech Lab