The Era of Agentic Commerce: A Strategic…

The third Basel Accord, Basel III, is the latest in a line of regulations introduced by the Basel Committee for Banking Supervision (BCBS) to combat the misconduct in the financial system.

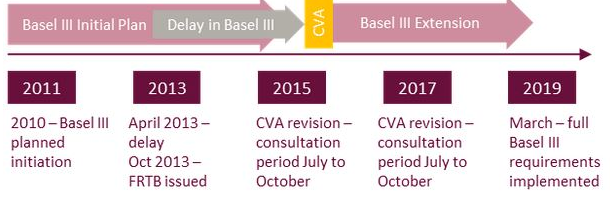

It was conceived in the wake of the 2008 financial crisis and has gradually been introduced over the last 2 years, with full implementation due by the end of March 2019, after two revisions of the timeline.

An area the BCBS is targeting is the use of the Credit Valuation Adjustment (CVA) on Over-the-Counter (OTC) derivatives. The CVA is an adjustment to the fair value (or market price) of derivative instruments to account for counterparty credit risk (CCR).

The volatility of fair value adjustments on OTC derivative portfolios was the most significant contributory factor of bank loss during the financial crisis. It has been estimated that two thirds of losses were felt as a result of the misapplication of CVA and that five times more loss was recognised by CVA volatility than counterparty default.

The aim of the following article is to define and assess the revised model because after the BCBS admitted to the shortcomings of the Fundamental Review of the Trading Book, they advised that an open and frank discussion dedicated to CVA management should be conducted. This is part of that open discussion. The reasons for revising the current framework are:

Banks need to incorporate exposure into their calculations

The main criticism of the current framework is the fact that it does not include a major driver of the CVA risk: exposure.

As exposure impacts transaction price through underlying market risk factors, accurate assessment of the CVA and resultant adjustment to price is essential.

All banks are now entering into new transactional activity in order to hedge the risk associated with the CVA. These transactions are not covered by the current framework. The new paper published by the Basel Committee will make sure these hedging deals are taken into account in the capital charge calculation.

Align with practices used in the accounting CVA

The CVA calculation is directly dependent on the notion of fair value. The second reason why the Basel Committee is amending the current framework is as a direct consequence of the previous point on exposure: the regulatory CVA calculated by the banks does not cover the transactions used in hedging.

Banks tend to use market-implied parameters in their CVA calculation. However some financial institutions use the Advanced Approach, as the use of the parameters is not a requirement but purely to simplify the process.

In the revision, the Basel Committee suggests that the starting point for capital consumption evaluation would be the use of accounting CVA standards. The aim is to achieve a unified model with minimal deviation and as such, the proposal includes conditions around neutrality, calibration and periodicity.

Coordinate with the Fundamental Review of the Trading Book (FRTB)

The Basel Committee has come to the conclusion that the accounting CVA could be treated in the same way as the instruments valued in the Trading book. Consequently, an alignment between the Fundamental Review of the Trading Book and a CVA framework seems logical, whereby there is a close link between the FRTB and the market risk capital charge.

Therefore, the Basel Committee has proposed a ‘FRTB-CVA Framework’, whereby the requirements in the CVA and the FRTB are coherent. Although this could encourage duplication, the use of a ‘Chinese Wall’ has been suggested by the committee. When calculating the capital charge, financial institutions will have to ensure all eligible hedges are removed from the FRTB to the CVA Capital Risk calculation.

Challenges faced in Implementation

The first challenge to be negociated revolves around Data; primarily in the identification and collation of vast amounts of data to be used in the modelling of expected exposure. This presents a significant challenge to banks as their different business streams will send vast data sets in different formats and file types (dependent upon their specific needs).

Furthermore, the data will need to be clean and any ambiguous or misleading data disregarded. As a result, the data will have to be organized and manipulated so that the data can be presented logically for analysis.

This will require a significant upgrade in the IT systems of the majority of banks.

This upgrade in IT is the second main challenge faced. Banks will require far more up-to-date systems, in terms of both hardware and software, to process the vast amount of data within their simulations. Simulations such as cross-asset Monte Carlo would be inefficient that banks would not be able to utilise the results they produce or provide regulators with required infirmation.

Banks need to update and upgrade systems so that they are producing results in near real-time (end target).

The final challenge banks will face is building teams with the quantitative analysts and researchers to manage the entire CVA analysis process as well as governing the regulatory changes into the future, so that the bank becomes and remains fully compliant.

Sources

Protection of personal data, https://ec.europa.eu/info/law/law-topic/data-protection_en