Navigating Tariff Turbulence: Optimize Your…

According to the European Network of Transmission System Operators (ENTSO-E), Europe could lack up to 47 GW generation capacities by 2020. This significant figure reflects the tough economic conditions faced by power plant operators.

Market spreads on futures markets are often negative for baseload & mid-merit gas-fired generation units. This uncertainty leads to put on hold investment decisions.

In this perspective, market operators and authorities have started looking for a few years at the other side of the market: the demand. Raising this question: What if retail consumers could also delay or even reduce their consumption? Recent pilots and market developments have proved that this is feasible. But to what extent?

In this article, Sia Partners proposes a possible answer by gaining a glimpse into the potential of Demand Response at both European & Belgian levels.

The importance of intermittent renewable production in Europe is growing rapidly. According to ENTSO-E, wind and solar capacity could increase respectively from 117 GW and 80 GW in 2014 to about 193 GW and 114 GW in 2020 . The official target is to raise the share of EU energy consumption produced from renewable resources to 20% by 2020 . Facilitating the integration of these unpredictable energy sources and achieving the equilibrium between production and consumption will become increasingly challenging. The current lack of peak capacity, mainly caused by the decommissioning of old coal and gas-fired power plants, the non-integration of generation scarcity in market prices and a small but consistent growth of demand for electricity, is likely to subsist and even increase in the future.

In order to cope with these challenges, policy makers and energy actors consider Demand Response (DR) as part of the solution. The DR concept refers to "a series of programs sponsored by the power grid, the most common of which pays companies (commercial DR) or end-users (residential) to be on call to reduce electricity usage when the grid is stressed to capacity" . This means that customers voluntarily deviate from normal consumption behavior to obtain lower electricity prices and to support Security of Supply. Exploiting the DR potential flattens the load profile and avoids more expensive investments in new power plants. Moreover, opting for DR measures reduces CO2 emissions.

The potential for DR in Europe is assessed in this article. Sia Partners presents a custom top-down approach to calculate the DR potential in Europe. This methodology is illustrated in Figure 1.

Figure 1: Sia Partners' top-down approach - Source: Sia Partners

The starting point of the analysis is the estimation of the industrial, tertiary and residential electricity consumption . The total consumption per sector is then distributed over the main processes . In a next step, processes with DR potential are isolated for analysis . Typically, these are processes with storage possibilities or inherent thermal inertia . Selected processes are shown in Table 1.

Table 1: Processes with DR potential - Source: Sia Partners

Research enable to obtain the electricity consumptions for each process . Installed capacities per process are then calculated by assuming an average load factor per process based on literature data. The capacity guaranteed at peak is then evaluated. For baseload processes, the average load factor is applied . Corrections for seasonal patterns, weekly patterns and daily patterns are also applied.

Finally, available capacities at peak are multiplied with the reduction potentials per process. Total DR potential is finally obtained by summing up all processes.

Based on the selected approach, Sia Partners identifies at European level (EU28) a total consumption of about 800 TWh of electricity in 2012 for processes with DR potential. This represents 29% of the total electricity consumption. Figure 2 shows the distribution over the different processes and reveals that the three sectors have similar shares. Four processes found in tertiary & residential sectors account for 42% of the DR potential: refrigerators & freezers (12%); heating systems and boilers (10%); space & water heating (10%); ventilation (10%).

Figure 2: Electricity consumption of processes with DR potential - Source: Sia Partners

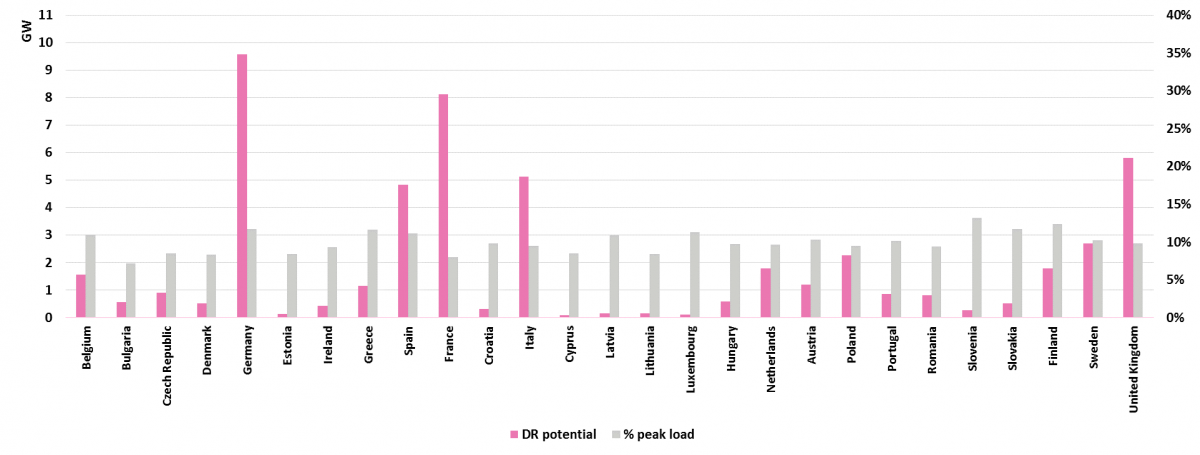

After having consecutively determined the installed capacity per process, the capacity guaranteed at peak per process and the reduction potential per process, Sia Partners estimates that total DR potential in Europe amounts 52.35 GW, as shown in Figure 3. This figure represents 9.4% of the peak load estimated by ENTSO-E for its 34 represented countries. Looking at the share per sector, 42% of this potential comes from residential applications, 31% has for origin the industry and 27% is to be found in the tertiary sector.

Figure 3: Total DR potential - Source: Sia Partners

DR potentials per country vary significantly in absolute terms, reflecting the differences in energy consumption. Largest potentials are observed in Germany (9.6 GW), France (8.1 GW), United Kingdom (5.8 GW), Italy (5.1 GW) and Spain (4.8 GW). In relative terms, expressed in % of the peak load, DR potential represents around 7.5% for most countries. Figure 4 shows that Belgium, Greece, Spain, Luxembourg, Slovenia, Slovakia and Finland present more DR potential, above 10% of peak demand on average.

Figure 4: DR potential per country - Source: Sia Partners

Belgium currently deals with severe security of supply issues due to the lack of investments in new generation facilities. Moreover, the available capacity has been drastically reduced due to the unexpected outages of three major nuclear power plants between 2012 and 2014. The winter 2014-2015 is said to be at risk for the power supplies of end-consumer during three weeks. The next winter could be even worse, based on forecasted availabilities and market economics. Gas-fired power plants do not run sufficiently to recover their costs. This is the reason why capacity remuneration mechanisms are currently introduced throughout Europe and Belgium.

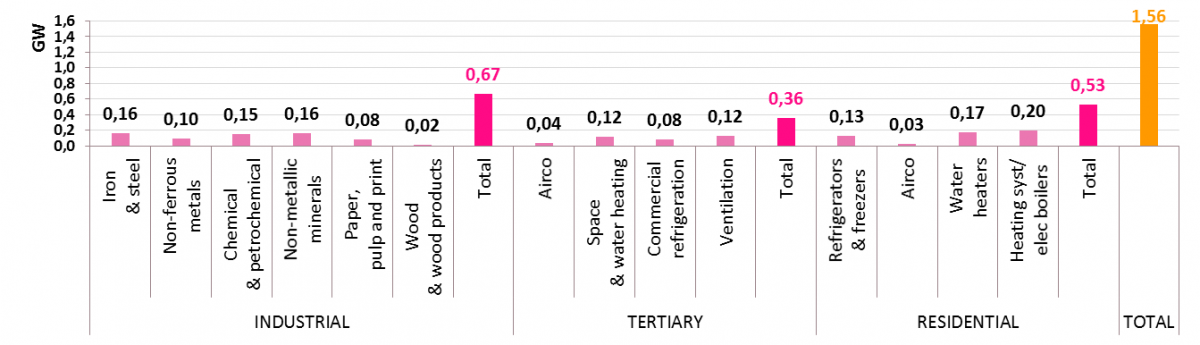

To mitigate these capacity shortages, Demand Response can be particularly interesting. It is an economical alternative to investing in new power plants. DR potential for Belgium is given by Figure 5. For the selected processes in all three sectors, Sia Partners estimates it around 1,56 GW, which represents 11% of the peak load. The industrial sector corresponds to 43% of the total share, while tertiary and residential sectors are respectively equivalent to 23% and 34% of the DR potential.

Figure 5: DR potential in Belgium - Source: Sia Partners

In terms of generation facilities, DR potential in Belgium represents 4.5 times the capacity of open-cycle gas turbines connected to Elia's grid. That goes without saying that the exploitation of this potential would help address the current security of supply issues.

As a matter of fact, Elia, the Belgian TSO, started in 2013 to considerably extend the demand response contracts used for the ancillary services (in order to balance the system). Originally addressing large industrial consumers, new DR contracts developed by Elia (after approval by the CREG, the Federal Regulator for Energy) are nowadays contracted by Flexibility Service Providers (FSPs) that aggregate DR on both the Transport and Distribution grids. In addition, a strategic reserve has been defined by the Belgian Authorities to guarantee the security of energy supply. Out of the 850 MW constituted for the winter 2014-2015, about 100 MW have been contracted with DR aggregators. In total, DR contracts between Elia and FSPs would represent about 438 MW in 2014, which corresponds to a bit more less a third of the DR potential calculated by Sia Partners for the selected processes.

Considering that Belgium also depends on net importations, DR potential in neighboring countries also gives an interesting picture (see Figure 4). It represents quite a substantial quantity, amounting to 25.3 GW (1.78 GW in the Netherlands). All the neighboring countries are (France & the Netherlands) or will be (Germany & UK as from 2019) interconnected with Belgium. The deployment of their DR potential could also play a role in the improvement of Belgium's security of supply.

Demand Response has become an important topic for policy makers throughout Europe. Many countries currently define mechanisms that introduce and valorise energy curtailment. In Belgium, Elia has introduced since 2013 new ancillary products that rely on DR, representing more than 150 MW. In this context, assessing the size of the available flexibility for the market is crucial to open new perspectives on the matter. Based on its research, Sia Partners estimates that DR in EU28 could have a potential of 52.35 GW, considering the selected processes. At the level of Belgium, France, Germany and Netherlands, the potential could represent 21.5 GW. The economic value associated to this potential could be substantial. Especially when one takes into account that the exploitation of this potential would avoid large investments in peak CO2-emitting capacities, with large opex costs. European utilities transforming their business models already look at these developments. And this raises questions: What would be the necessary timeframe to be able to seize a significant ratio of the potential? In a period of expected consolidations of European utilities, how to assess the economic value of a portfolio of flexible consumers? How to facilitate the exploitation of DR from a regulatory perspective, while protecting the consumers' interests? The only certainty is that Demand Response will remain an important topic in the coming years.

Entso-E, Scenario Outlook and Adequacy forecast 2014-2030, June 2 2014

European Commission, The 2020 climate & energy package, consulted

Bertoldi Paolo, Introduction to the International Workshop on Demand Response, Ispra 3-4 March 2010, consulted

Eurostat

Gils HC, Assessment of the theoretical demand response potential in Europe, Energy (2014)

Bertoldi P, Atanasiu B, Electricity Consumption and Efficiency Trends in European Union - Status Report 2009, JRC Scientific and Technical Reports, European Communities, 2009

Element Energy, Demand side response in the non-domestic sector - Final report, De Montfort University Leicester, 2012

Fraunhofer, Load Management and Demand Side Management in Germany and other EU countries, Fraunhofer Institute for Systems and Innovation Research, 2012

Energuide, How much energy do my household appliances use?, 2012

Ecolife, Elektriciteit (2011)

Flynn BY, McNamara CJ, Perdue BB, Konecny FC, Electric Water Heaters for Residential Use