Fortune 100 response to DE&I pressures

A new client base, increased competition from new entrants and the evolving emergence of new technologies ensure that incumbent insurers need to rethink their traditional pricing strategies.

Pricing of insurance products hasn’t changed in decades. The historic cost model has reigned supreme over the industry to provide every person with an equitable pricing point. But a new wave of clients is entering the insurance market and their demands are very different from previous generations. They require products that fit their needs exactly and will only pay for what they use. As the one size fits all product approach no longer suffices, products need to become modular so that clients can cherry pick the features that are appropriate for them. As such, what does that mean for pricing?

Millennials and Generation Z clients will soon become the most dominant client population in the insurance market and they have very different needs in respect to previous generations. No longer accepting the one size fits all product approach, they are looking for modular products they can package together to fit their needs exactly. By consequence, they only want to pay for the risks they are likely to incur, whether in life or non-life insurance products.

But this new product approach requires a very different way of looking at pricing. Whereas insurers today have gotten good at estimating their risks by anticipating the number of claims based on historical group data, the new product approach entails more uncertainty from the get-go. Indeed, the decomposition of the traditional products into individual features requires risk estimates for each component level, but once repackaged into a deal that fits the individual client, we cannot set the price with a simple summation.

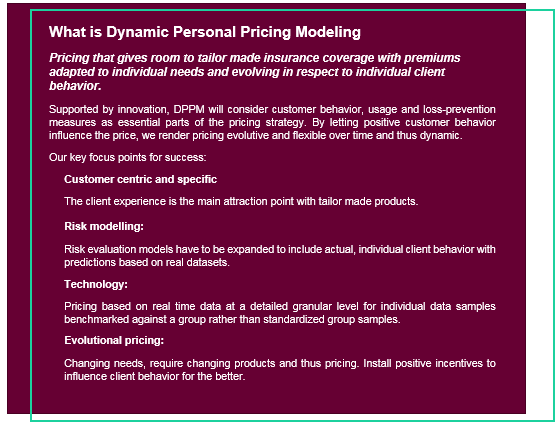

The Dynamic Personal Pricing Modelling (DPPM) allows us to look at pricing as more than a simple one plus one, because it considers one key component that has been largely ignored in traditional pricing models, namely the clients’ behavior.

Data collection based on the predication of the client’s willingness to share

New technologies are giving insurers previously unseen insights into how client behavior impacts their decision making. Advances in Biotech and Infotech are allowing insurers to assess the veracity of client’s claims and data, thereby permitting personal prices to be set.

These new technologies are further fueling new generations to track and record vital information about their lifestyle, life events and personal and societal engagements. Moreover, the increasingly expanding millennial and gen Z demographics, those most exposed to the social media culture, have shown less objections with regards to sharing their personal data if there is proven value to be returned.

Therefore, we have seen the emergence of several successful market entrants, known as insurtechs revolutionizing the insurance industry by offering personalized products that speak directly to the needs of an essentially digital client base.

In order to understand just how this eclectic mix of new entrants, technologies, and clients are pushing the world of insurance towards a new pricing model, one needs to understand how these factors are challenging the incumbent insurance pricing market practices.

Maximizing the data usage for pricing automation via DPPM

Traditionally, insurance companies defined the premiums paid by clients based on the cost-oriented pricing model, using an actuarial view based on internal data sources and adding the additional costs and expected profit percentage. In addition, the internal data used to define the premium is a statistical sampling of historic and static group data, with a heavy reliance on risk pools and risk costs.

This means that the forecast of an array of probable future outcomes, relies mostly on past performances and an averaged benchmark, leaving little room to interpret the nature of a client’s life and its natural evolution through his or her changing needs.

Personal pricing models are different in that the client needs are the main attraction point, as products are tailored to each client’s personal preferences and behavior. Furthermore, rather than calculating it based on static data used for multiple hypotheses, we let the risk model consider several new variables to further finetune the pricing point and to reduce the risks, as we propose to enrich the current datasets with real-time individual data points.

The DPPM requires a mental shift from insurers as it incites them to start looking into dynamic, real time data points on client’s behaviors and sentiments, to regroup these individual data points into malleable and exploitable data sets and to leverage all this new information to enrich the current pricing strategy before returning a highly personalized quote to the client. This dynamic view on pricing enables on-demand innovation for each individual client that will further result in increasingly precise predictors of future customer behavior.

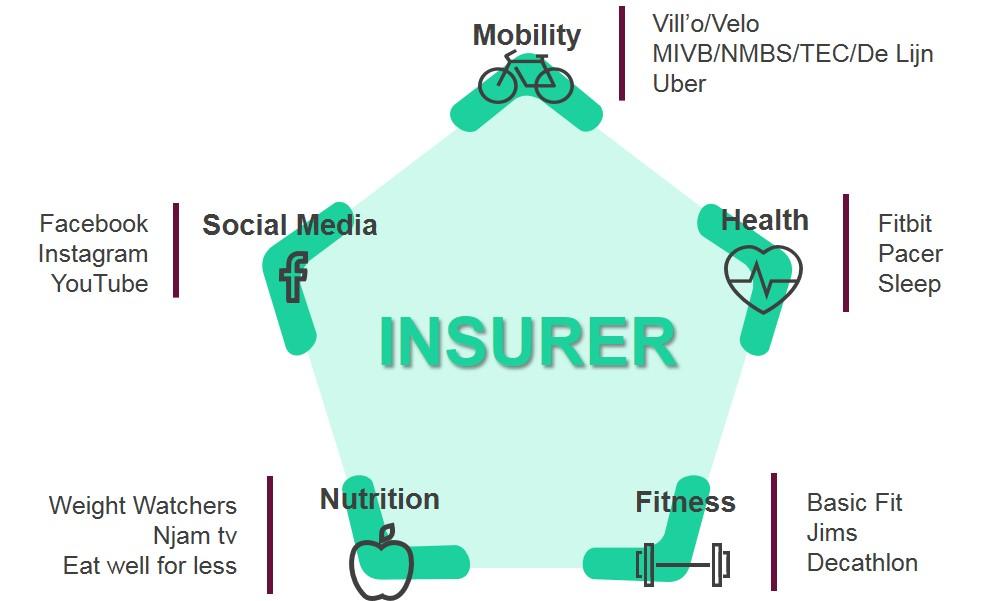

Figure 1.1 offers a high-level view on the types of data sources that are used within the DPPM paradigm for the price setting on life insurance. Ranging from product information, health information, social media information, distribution information, open source data, app-based information, etc. The large swathe of data from clients in general shows not only the vast nature of the data to which insurers will have access but also the variety of information that has become available.

With that understanding of what DPPM is, how to augment the client’s willingness to share? Which incentives do we need?

Figure 1.1 - The uses of client data sources for life insurance

Insurers no longer need a model solely based on the relationships that they build between their actuaries and their clients. The advances in insurtech, biotech and RPA (Robotic Process Automation) ensure that data collection is becoming easier, more efficient and further aid to accelerate the roll-out of a DPPM strategy.

Fortunately for insurers, the will to develop new ecosystems has already led to a series of mergers, acquisitions and partnerships that have enabled the pooling of such data, as shown in Figure 2.1. There is also an increasingly structured and expansive market for data that we at Sia Partners have closely followed in order to best advise our clients.

Figure 2.1 - The various potential sources of client’s data, the insurer’s ecosystem

Engaging with 3rd parties not only opens up a whole new world of data points, but also creates new ways to create value (client prospecting, cross-selling opportunities, commissions on the sales of other products and services such as movie tickets, gym subscriptions, etc.)

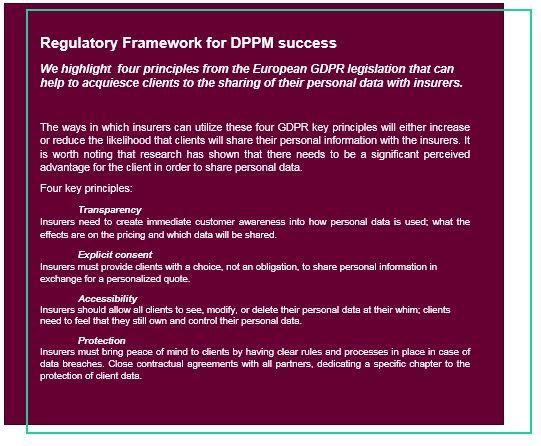

Nevertheless, having such easy access to client’s personal information does not come for free. More specifically, the legal and regulatory framework surrounding data sharing, pooling, and anonymization mean that there are specific hurdles to cross within the European, and indeed, global marketspace. But such hurdles need not be a deterrent to insurers but should rather be considered opportunities.

Pricing automation

Once the data has been collected, we adopt a measured approach so that insurers can gradually start automating and updating their pricing process. To do so, we have developed a three-step process that gradually increases the level of automation in terms of price calculation and data analysis. Moreover, our methodology will only impact the existing risk valuation models as of the 3rd phase.

Phase 1: Internal Pricing Automation

Automation of the current pricing strategy by implementing a Sia Partners bot, utilizing the current data entries, eventually enriched with new non-mandatory internally available data.

Phase 2: Augmented Ratio

Dynamic pricing automation by enriching the bot implemented in phase one with AI and self-learning mechanisms. A further increase in data volume will render the bot more accurate over time.

Phase 3: Behavioral Variables

Dynamic personal pricing automation by further enriching the bot with additional personal client information, both behavioral and sentient, collected through 3rd party engagements, biotech, etc. and with the explicit consent of the client.

By automating the most common cases, employees will be able to focus and intervene on the complex and challenging case files, which we estimate at about 30%.

Evolutional pricing

Opting to go down the road of DPPM also means stepping away from the idea that the contractually agreed upon price is a never changing given.

Through DPPM we are actively choosing to view pricing as a constantly evolving contract feature that can be directly impacted by positive client behavior (quit smoking, become more active, become a brand ambassador, etc.).

To further support clients in achieving these goals, the insurer can utilize his ecosystem to motivate clients and to generate additional value within the existing corporate structure or new revenue streams through 3rd party contracts and partnerships. In doing so, the insurer has the option to interact directly with clients through social media and receive instant feedback on ideas, products and services.

All these activities will help forge a stronger emotional connection with the company, increase the number of client touchpoints throughout the lifespan of the contract and help build a stronger customer loyalty framework.

The ways in which an insurer engages in DPPM is highly specific and there is not a one size fits all solution as the approach can vary per company, per business unit or even per product.

However, we see DPPM as an enabler to adapt the insurance pricing strategy to rapidly changing environments and client demands. Being able to swiftly respond to changing market conditions can give insurers a competitive edge in an industry in full, digital swing.

The combination of highly personalized products with immediate and visible pricing impacts through a modular approach, and this throughout the lifespan of the insurance contract, will help to increase the client retention rate and boost the cross-selling opportunities.

Copyright © 2019 Sia Partners . Any use of this material without specific permission of Sia Partners is strictly prohibited.

DAVINA DEMELENNE

Manager Insurance, Charlotte Office

+1 (704) 430-1525

davina.demelenne@sia-partners.com