Fortune 100 response to DE&I pressures

From the introduction of this regulation to the upcoming challenges of the market participants, this article aims at providing the reader with an idea of the immediate changes of EMIR.

It has been 3 years since the European Market Infrastructure Regulation (EMIR) has been adopted by the European Parliament.

Back in 2008, opacity prevented the regulators from identifying the risks that were building up in the OTC derivatives markets. Consequently, this led to numerous defaults in major counterparties, highlighting how much financial institutions were interconnected and how exposed the stability of the system was.

Initially conceived by the G20 as an answer to the 2008 financial crisis, the purpose of EMIR is to reduce risks linked to the use of OTC derivatives by supporting transparency and implementing a clearing system for standardized OTC derivatives contracts within the EU states.

This regulation is based on 3 main pillars:

1. The clearing of OTC derivatives contracts through Central Counterparties, which reduces risk between market participants compared with a complex web of bilateral trades.

2. The exposure of uncleared OTC derivatives to margin requirements, which ensure incentives in managing risk and demands central clearing.

3. The reporting of all derivatives to Trade Repositories, which enables a localization of the risks in the system.

On 21 May 2015, the European Commission launched a public consultation on EMIR. The purpose of this consultation is to prepare a general report on EMIR, assessing the impact, efficiency and further necessary requirements of this regulation.

The scope of this consultation is limited to:

- Requirements and procedures that have already been implemented (such as the trade reporting).

- Requirements and procedures that are yet to be implemented (such as the mandatory clearing and the margin requirements).

Based on the various views and experiences of different stakeholders, the regulators expect to be provided with comments about the rules in place and with solutions for potential improvements.

Interested parties are invited to send their contributions by the 13th of August 2015 through the online questionnaire provided.

As required by the Regulation, the EU Commission is seeking views from the European System of Central Banks (ESCB), the European Securities and Market Authority (ESMA) and the European Systemic Risk Board (ESRB) to make sure the next phase of EMIR is inclusive of the concerns of market participants.

Based on questions about the implementation of EMIR on ESMA’s website, as well as the various inputs provided by the stakeholders, the subjects under review should include at least the following points:

EMIR should make clear the OTC derivatives contracts that are voluntarily given up to a Regulated Market for execution and clearing by a CCP but that are not OTC derivatives. In addition, references to MiFID should be adapted to reflect the new provisions of MiFID II (January 2017).

Consistency between the concepts of Group, Intra-Group transactions and Control in EMIR and other EU legislation should be improved and harmonized.

The EU Commission is constantly wondering whether the thresholds put in place by EMIR effectively capture systemically important nonfinancial counterparties and if the rules targeting those non-financial counterparties have had an impact on their use of OTC derivatives.

Additionally, EMIR should include a requirement for ESMA to develop a guidance or methodology for the calculation of the notional value.

EMIR should explicitly include portfolio hedging as an appropriate manner to account for risk-reducing transactions. Counterparty netting according to existing business practice should be recognised.

Risk-mitigation techniques should be more developed so that stakeholders are provided with solid guidelines while encountering difficulties.

The clearing obligation process may need to be reviewed to give ESMA more flexibility in the administration of the public register.

EMIR should make available of the data reported to trade repositories to the entities that should have access to such data. Many elements of trade reporting remain unstable (LEIs, UTIs, etc.). More details about the consequences of meeting the reporting obligations to the trade repositories is also highly expected.

Above all, the reporting regimes and data fields of REMIT and EMIR should be compatible and aligned as much as possible.

According to the European Commission, the OTC derivative market has reached $630 trillion in 2015 and while good progress has been recorded with nearly half of this market centrally cleared, more needs to be done in the future.

The results of the consultation paper must be seen as an opportunity to face the issues of yesterday and to seize the biggest challenges of tomorrow.

On 17 August 2015, the European Commission will review and prepare a general report on EMIR and submit this report to the EU Parliament and Council with any necessary proposal.

Following the public hearing and the outcome of the public consultation, the European commission shall draft a report to be submitted to the European Parliament and to the Council in the course of the year.

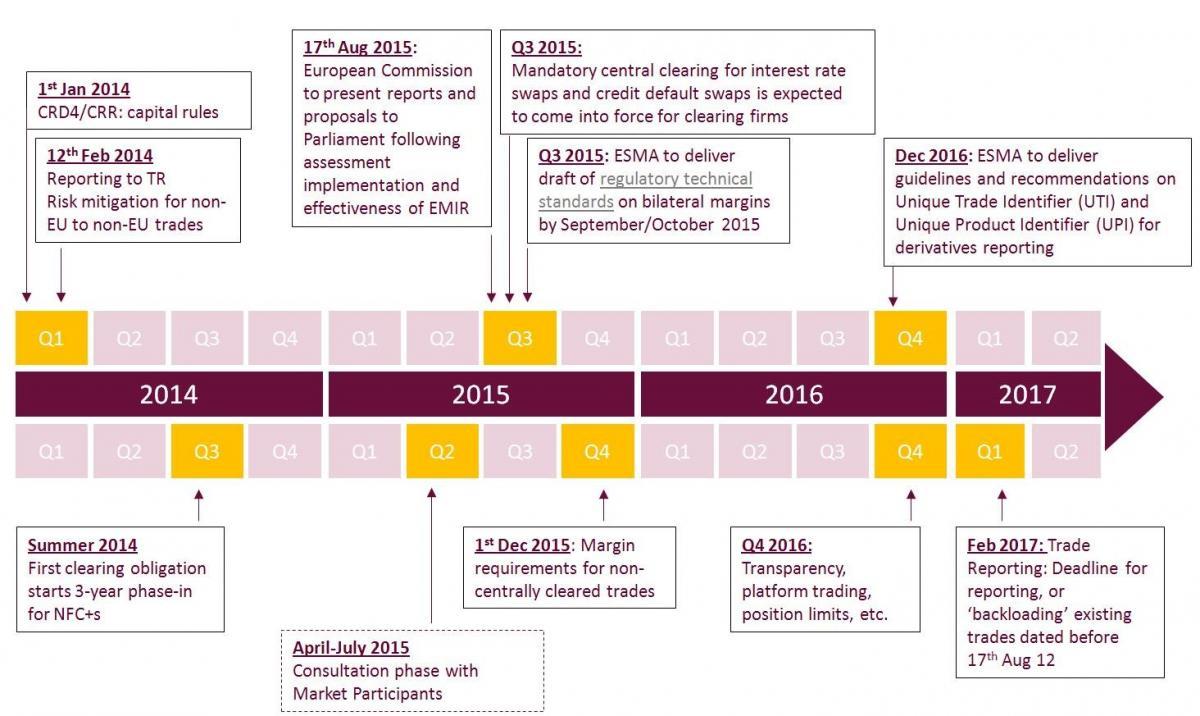

The following timeline represents the action plan of ESMA on EMIR regulation:

Since the EMIR reporting regime has been in place (February 2014), ESMA and EU regulators have received around 10 billion reports from six authorized trade repositories at a daily rate of around 60 million. It is no exaggeration to state that from a regulator’s perspective, it takes a huge amount of resources to cope with the received data and to map it with the regulatory requirements.

EMIR requires both counterparties of a trade to report to the Trade Repositories, where its American equivalent, Dodd-Frank Act, requires only one side to report.

Double-sided reporting necessitates additional work for market participants, while also increasing the risk of duplication and omission of trade data, making it more difficult for regulators to piece together information from repositories.

There is therefore a common action coming from both the industry and the regulators to implement a single sided reporting from EMIR.

Additionally, ESMA indicates a problem of data quality in the data reporting system, underlining the fact that: «it is rare to see data quality at an acceptable level».

Since the implementation of EMIR, ESMA has also been assigned by the European Commission to provide technical advice on the equivalence between the third countries regulation and EMIR.

This mission is of crucial importance to avoid double reporting, conflicting rules and loopholes in definitions of OTC Derivatives transactions between European counterparts and their third country’s counterparts, for intragroup as well as extra group transactions.

The Commission’s equivalence decision will be based on ESMA’s advice and an assessment of the outcomes of the third country’s rules, including whether or not the rules mitigate any risks faced by market participants in the EU to the same extent that the EMIR rules are intended to do so.

Both the Commission and ESMA have reiterated that ESMA’s technical advice should not prejudge a final decision on equivalence. The advice is nevertheless a clear indication of those areas where equivalence decisions are likely to be in conflict with EMIR.

However, certain rules such as margin requirements differ between many countries and any equivalence decision not yet made by the Commission for the CCP regime of a third country is likely to remain pending until a thorough assessment has been made of the final rules.

EMIR regulation is in early stages of implementation. Firms should be ready to develop their businesses based on the ability to leverage compliance across different regulatory regimes. While the cost of implementation might be significant, there will be competitive advantage for well-positioned global firms.

The European Commission now has the opportunity to bring clarity into the regulatory processes while requiring more transparency and commitment from the market participants. The latter expect not only clear guidelines but also sustainable changes after the first 4 years, making it easier, practically, to comply with the requirements from ESMA.

Sources: