Fortune 100 response to DE&I pressures

At Sia Partners, we receive numerous questions involving customer journey management and more precise, the willingness to fully understand and execute this in a highly data-driven fashion.

In the Netherlands, this belief is made widely popular since the article of Coolblue CEO Pieter Zwart, who stated that his hugely successful company is a “customer journey agency” operating “extremely data-driven” [1]. This article will shed light on the basics of customer journey management and the opportunities it brings to banks and insurance companies in particular.

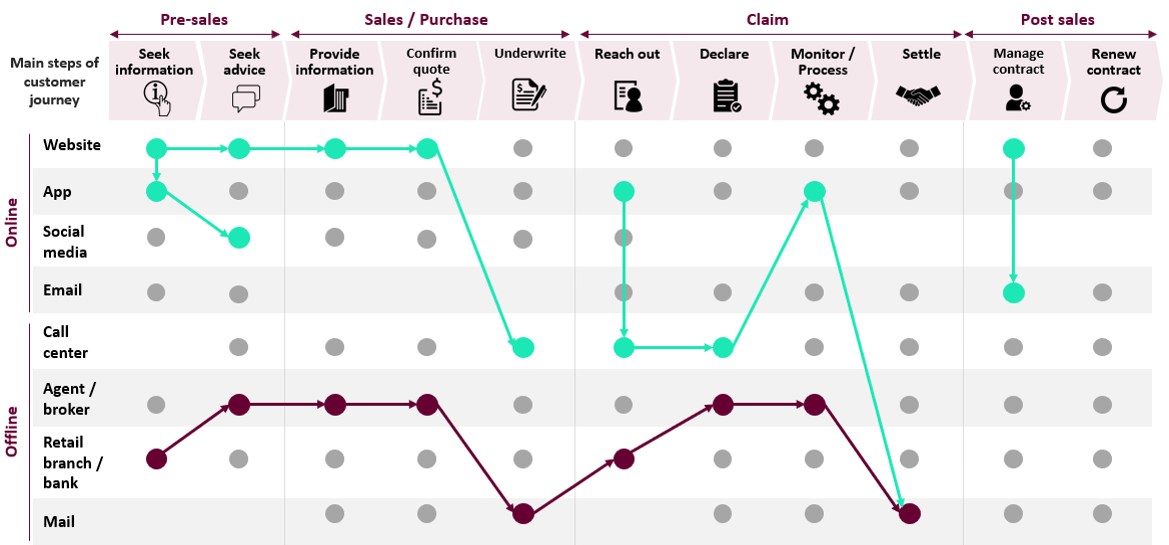

Customer journey mapping is the visualization of an interaction from the customer's perspective (figure 1). It describes the experiences of a customer during the proverbial journey that a customer makes to orientate himself, to purchase a product or a service and to make use of it, channel independently during all contact moments. The customer journey is defined as the sum of all experiences that a customer gets from interacting with a company or brand.

There are many different ways to describe the existing relationship between a customer and a company, depending on whether the question is addressed to the company’s accountant, the lawyer or the customer service representative. When focusing on customer interactions, we identify and differentiate between three perspectives, all equally important in added value to the overall understanding;

1. How it should go: a view on the process.

Most processes that deal with customer interactions are designed by process architects a long time ago and from an internal point of view. At Sia Partners, we start with examining these processes in detail to get a proper understanding of the different steps involved, as well as the relation and interaction with other internal processes that are triggered. In addition, we investigate the various communication channels that are being used and examine the necessity and cohesion of those channels to get the broad view.

2. How it goes in practice: a view on the data.

Processes generally evolve to fit the customers’ or organizational need at that specific moment. Data mining gives us the ability to present the customer journey fact-based by analyzing the data. The technique is used to track the individual customer throughout and across the different communication channels. As an example, it can be made precisely clear at what moment the customer decided to call the customer contact center after he couldn’t find the information on the customer portal. Data scientists and marketing intelligence specialist can bundle these individual journeys together resulting in customer behavioral patterns.

3. How it is being perceived: a view on the emotion.

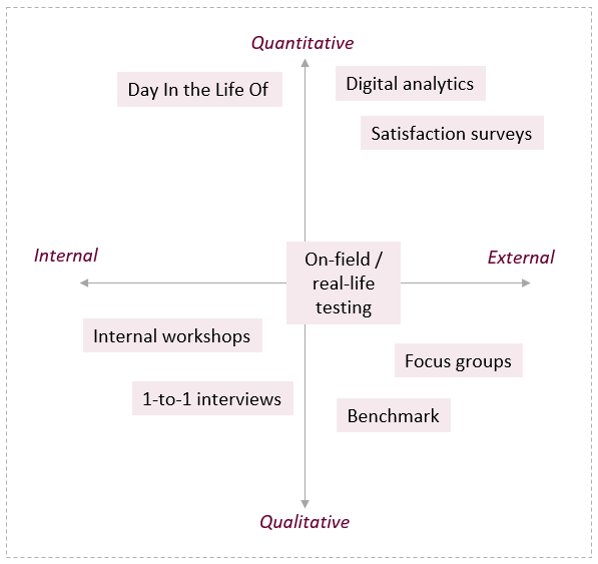

A process is designed on paper and the customer can choose to follow the predetermined path or not. However, both perspectives in itself don’t state anything about the experience that the customer gets from interacting with the company or brand. Depending on the objective and data availability, several tools and approaches can be used to determine the value of the offered customer experience (figure 2). The results are usually methodological expressed in the so-called ‘pains’ and ‘gains’. The combination of quantitative and qualitative methods, as well as a combination of internal and external methods, yield the best overall results.

Figure 2: Overview of methods to describe customer journeys and assess paint points

There are many methods to examine the current situation of customer journeys. Some well-known examples are the personas, empathy exercise, mind map, the 5-why method, the affinity map or mystery shopping. Due to the diversity, it can be useful to learn which methods align best with specific circumstances. Nevertheless, we firmly believe that the strength of our model on examining existing customer journeys lies in the combined use of all three perspectives; process, data, and emotion.

Consulting firms regularly express their thoughts on the future outlook of the financial services market and how disruptive technologies will change this market forever. Their predictions are mostly true and the impact of AI & Robotics technology might be even more significant than currently foreseen. However, equally valid is the importance not to be feared by this development. For the purpose of company survival, Horizon-3 innovations are essential, but to reach that moment in the future, one must not forget the current customers and their interactions of today. Generally, there is much to improve on current journeys, either with quick fixes on the ‘pain’ points or innovating on specific touch points where a significant market impact can be made. One of the most straightforward and pragmatic methods to do so is the technique of emotion curves.

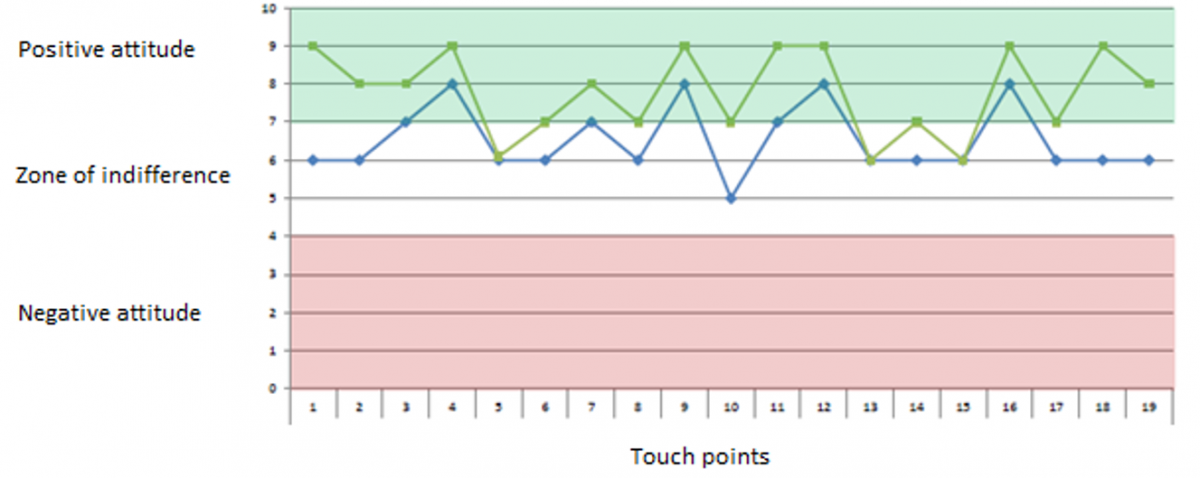

When lining up the touch points in the customer journey and rating each of them by a score of customer satisfaction, a line arises that is called the emotion curve. Aside from the emotion curve, a line can be drawn that reflects the desired emotion curve of the customers (figure 3). Logically, the difference between those lines will usually set the agenda for improving customer satisfaction.

Figure 3: The actual and desired emotion curve are represented in two lines. The gap between these lines mostly sets the agenda for improving the customer experience.

Managers repeatedly feel that the desired emotion curve should match a nearly perfect score of eight, nine or even ten and more noticeable, that this level of satisfaction should be constantly met throughout the journey. Apart from feasibility, this is not the best approach when allocating time and resources. A flat line of the patient’s heart rate means that we’ve lost the patient. As long as the experiences of the consumer vary not too much and do not become too negative, variability is good!

There are some valuable insights from this emotion curve. The emotion curve brings an understanding of the customer’s attitude towards his or her experience. Try to understand why the customer expresses this feeling and have a detailed look at the more extreme scores. Highly positive experiences are to be valued, and (over) negative experiences are to be turned around. This immediately gives direction on where to focus available time and resources.

Furthermore, the emotion curve is about making choices since one simply cannot address all touch points at the same time. In Retail, businesses often try to excel at the final moment to give the customer a lasting experience (IKEA is famous for having very cheap hot dogs and refillable drinks near the exit of their store). Making a choice where exactly to excel is crucial, yet tricky since it depends on the internal capabilities, the competition and the dynamics of the target group.

Once it is established at which point to innovate in the customer journey and where there should be a substantial improvement of the offered customer experience, one should decide how to utilize the innovation sessions. Depending on the objective and the horizon that are taken into account, different tools and methods are at our disposal.

One common technique that enjoys widespread attention in this field is Design Thinking. This term can be explained in different ways, but usually it entails a particular design challenge that is prepared in advance based on the insights on the current customer journey. The design session starts with creating a common understanding of the customer journey and participating in group exercises. After that, the design challenge is centered around a problem or opportunity within a particular theme. The basic rule is to sketch solutions and designs, whether it is, for instance, a new product, service or a website or chat interaction, taken into account the earlier established pains and gains. This technique is also referred to as ‘show don’t tell’. In several rounds, the whole group gives feedback, after which the ideas can be finetuned. With only a few ground rules, the playing field is nearly unlimited. However, setting up the challenge not too wide and not too narrow is key. To stimulate creativity, inspirational videos of leading brands or products can be shown.

The participating teams could consist of product managers, marketing and communication specialists and User Experience & User Interaction designers. We find that the combination of business and IT brings the best of both worlds together. Moreover, it can be worthwhile to include customers in the sessions for the outside-in perspective. The beneficial impact of having three or four customers with an opinion cannot be underestimated.

After the final presentations, the product owner chooses one or two best ideas. These ideas will be further developed in agile sprints into (clickable) prototypes. In turn, these prototypes can be brought into business as usual. The customer journey team will steer and drive innovation!

Sufficient knowledge about the customer is essential to build up a relevant experience for the customer from acquisition to management and maintenance. The customer profile is central to the customer journey and therefore the gathering of data itself.

Yet too often, we find companies struggling with a vast amount of (un)structured data, not knowing where to make the necessary improvements to make an immediate impact. Popularized with Agile methodology, our lesson here is to start small and build upon that.

This article gave a brief introduction to the basics of Customer Journey Management. It started with our definition, the different perspectives to get the current customer journey visualized, the emotion curve to establish priority and the design thinking method to innovate on relevant touch points along the journey.

Visualizing a part of the customer journey, understanding the underlying processes, customer data and emotion and making (incremental) changes is a continuous process. It is paramount to measure and visualize the impact of the changes – the response of the customer will create both team commitment and management support to continue and expand the operation.

Sources:

[1] https://www.frank.news/article/media/coolblue-eindbaas-pieter-zwart-e-co...

If you want to know more about our AI solutions, check out our Heka website: https://heka.sia-partners.com/