SEC Division of Examinations Releases 2026…

Market Trends: the Federal Reserve’s recent embrace of a hawkish monetary stance poses the question of how long current actions can continue and how those actions will impact market participants.

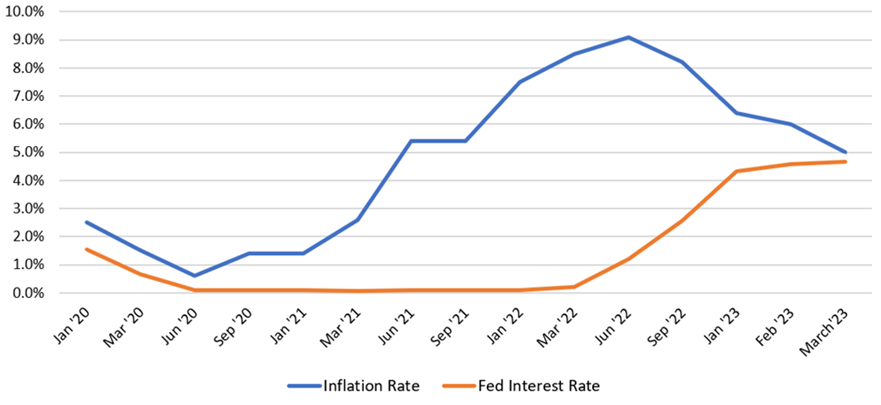

The 2008 Financial Crisis was followed by a prolonged period of expansionary monetary policy, by the Federal Reserve, exemplified by low-rate term structures. The period observed one of the longest historical bull markets. More recently, global inflationary pressures presented policy challenges that were magnified by rising commodity prices and supply chain disruptions that were exacerbated by the COVID-19 Pandemic. These impacts resulted in the central bank’s dramatic course change on monetary actions. The Federal Reserve’s recent embrace of a hawkish monetary stance poses the question of how long current actions can continue and how those actions will impact market participants.

Despite a downward trend in inflation, the Fed has incrementally continued rate increases 2023, including as of March (from 4.75% to 5.00%).

U.S. reported inflation numbers for the 12-month period ending March was 5% (down from 6% in February), the slowest pace since May 2021. According to Ms. Uruci, chief U.S. economist at T. Rowe Price: “There are signs in the details to suggest we’re making some progress toward slowing inflation...it’s not where it needs to be, but it’s progress.” Moreover, while Fed Chairman Jerome Powell acknowledged that inflation was beginning to ease, he argued however it would be a lengthy process and cautioned that interest rates could rise more than markets anticipate if the economic data did not show results. The chairperson was quoted, “The disinflationary process, the process of getting inflation down, has begun and it’s begun in the goods sector, which is about a quarter of our economy…but it has a long way to go. These are the very early stages.” The Fed is facing one of the most challenging times since the 1970’s, as it tries to tame inflation while minimizing negative economic impact.

The Federal Reserve’s effort to tame inflation through increases in overnight lending rates have been a major headline of financial markets. According to many senior Fed officials, 2023 is widely expected to be a continuation of 2022 actions. In fact, even though reporting indicates inflation is cooling down, the Federal Reserve appears hesitant to halt actions or reverse course.

Furthermore, according to senior officials at the Fed, a rate pivot is unlikely because inflationary pressure exceeds targeted thresholds and has transitioned from goods to services. Indeed, Raphael Bostic, President of the Atlanta Fed recently argued that given the expected increase in wages across the service sector, we will not see any rate cuts soon, and potentially not even in 2024. Watson Tower Watson’s November company survey results reflected expected wage increases of 4.6% for 2023. Using wage growth as a barometer, and the stated inflation target of 2%, signs continue to point to contractionary monetary policies in 2023.

While inflation figures have declined from 2022 levels, Chairman Powell March comments from the Federal Open Market Committee (FOMC) indicated that rates were ‘likely to be higher’ than initially anticipated. Market future rate curves agree. While the future curves data has shown a slight pullback, it continues to price in upward expectations. The majority opinion appears to be that the Fed will move forward in 2023 with higher rates.

In a recent interview with CNBC, JPMorgan's Chief Executive Officer Jamie Dimon said, “I actually think rates are probably going to go higher than 5%... there's a lot of underlying inflation, which won't go away so quick”. Consequently, with inflation remaining stubbornly high (confirmed in the latest inflation report), investors can expect the Fed to continue increasing rates. According to Priya Misra, Managing Director and Global Head of Rates Strategy at T.D. Securities, “It’s a strong report. (That said,) it’s really hard for the Fed to respond by not hiking - or cutting, that’s crazy talk.”

However, there were contrary opinions, even before recent FDIC receivership actions and contagion fears. According to Charles Schwab’s rate model projections, interest rates are expected to slowly decrease across 2023, reaching 4% by the end of the year. The recent failures of Silicon Valley Bank and Signature Bank and general unease in the regional / mid-cap space (e.g., First Republic Bank and PacWest Bancorp), have investors second guessing the Fed’s appetite to continue raising interest rates given the uncertainty in the financial industry. Kathy Bostjancic, Chief Economist of Nationwide Mutual recently commented that “Inflation is no longer the sole focus for the Federal Reserve.” Indeed, according to top economists the banking failures and broader risks to the financial system will lead the Fed to consider additional factors, including the health of the financial system when deciding to raise interest rates.

Recent shocks in the banking sector have triggered global reactions from depositors, market investors, and credit rating agencies. While investors have questioned how aggressive U.S. counterparts would react, European Central Bank (ECB) President Christine Lagarde clearly communicated their institution’s focus would remain. The March ECB decision to raise three key European interest rates was a signal of continued inflationary focus. The council’s position was that Inflation is projected to remain “too high for too long,” per the ECB press release. Even so, Peter Bookckvar, Chief Investment Officer at Bleakley Advisory Group, opined that the combination of Credit Suisse’s and U.S. Bank actions, could spark a broader reexamination of the banking system among investors and force the ECB to address the health of the banking sector with the same urgency than it does with inflation.

Following the March rate decisions and Central Bank recapitalization actions, Switzerland’s largest bank UBS agreed on March 20th to the $3.25bn acquisition of its rival Credit Suisse. While issues have long simmered at Credit Suisse, recent events contributed to the orchestrated takeover. The emergency rescue deal was aimed at stemming financial market panic initially triggered by the failure of two regional American banks. Separately, pressure continues elsewhere where balance sheet issues persist. Credit default swaps for example have shown a marked increase in activity for institutions showing relatively weaker balance sheet positions. While the sentiment of many is that markets are overreacting, questions of overall stability persist.

With the Fed’s recent (March 22nd) quarter-point hike from 4.75% to 5%, officials are clearly having to deal with three conflicting challenges: the risk of runaway inflation, the need to avoid damage to the economy and now also the threat of turmoil in the banking system. While the Silicon Valley Bank and Sovereign bank failures each displayed unique components, an oversimplified postmortem was that the issues arose from or were related to regulatory and internal risk management weaknesses. These weaknesses made the banks vulnerable to the changing rate climate and marketplace skepticism about the strength and soundness of their balance sheets.

Based on recent changes in the forward curve, a more curtailed set of rate increases are now being priced into expectations for 2023. Impacts on financial stability of the banking system or perception of weakness of individual banks are now factors that cannot be ignored by either the Fed or by Bank leadership. In these circumstances Bank leadership may need to change strategy.

Firstly, high rates increase interest income on lending books but also simultaneous pressure funding costs both on deposits and on wholesale funding. In total the central bank levers being applied to slow inflationary measures have negatively impacted corporate debt financing and retail client opportunities, which affects margins.

Second, returns on assets under management will be reduced in the short term. Less favorable markets and trade volumes will drive down transaction banking and asset management fees. Moreover, M&A and Equity Capital Markets (ECM) fees are likely to decrease during this period of economic uncertainty.

Third, implications for U.S. financial institutions include possible mark-to-market losses on certain credit instruments and government debt held in securities portfolio. Rising rates and widening government yields will impact financial institution's ability to monetize their bond portfolio. As a result, institutions will continue to replace their investments and reshuffle their portfolios to higher yielding coupon bonds, but this will take time.

Additionally, an inflationary environment significantly impacts the liquidity of financial institutions. In fact, the implementation of a quantitative tightening (QT) program by the Fed has led to bank reserves and deposits falling, and customers seeking higher-yielding alternatives for their cash. Fitch Ratings estimates deposits to decline by another $1.6tn this year. One can conclude that the policies of the Fed have had a direct impact on the liquidity problems encountered by financial institutions since the beginning of the year. As a result, the Fed and other foreign central banks (The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank) have adopted measures to enhance access to dollar liquidity; namely a switch from weekly to daily auctions of dollars: a measure needed to preserve financial stability and prevent market tensions from affecting the economy.

In short, an environment of high interest rates has had significant industry interest rate margin and transaction revenue implications. Inflation puts a strain on the cost base, with salaries, overheads, and outsourcing costs pressures. Industry participants able to transform and improve efficiency will cope more readily. The dramatic shift of central banks' actions to address inflation will have a lasting impact as enterprises are forced, under an increasingly volatile market, to rapidly transition.

Following the increase in inflation, central banks began tightening monetary policy to cool their respective economies. However, the significant increase in interest rates combined with an uneven management of interest rate risk. These factors and others have led to unintended consequences for financial institutions.

The recent collapse of Silicon Valley Bank, triggered by ill-fated investment decisions and subsequent depositors bank run, highlights market challenges. This is especially apparent in a contractionary monetary policy environment. SVB grew over the pandemic; aided by the frothy tech sector, to be the 16th largest bank in the U.S. During this period of exceptional growth, concentration risk became a factor. The long duration positions and sale of large positions at a realized loss spooked clients and the broader market participants.

Furthermore, accounting guidelines dictated by FASB (The Financial Accounting Standards Board) regarding held-to-maturity (HTM) debt securities played a critical role in the collapse of SVB. Indeed, SVB held bonds that they considered to be “held-to-maturity” which depreciated in value when interest rates increased, producing losses for the asset side of their balance sheet. Nevertheless, according to current accounting guidelines, bonds that are HTM are not required to be measured at fair-market value on the balance sheet. As a result, if a bank has significant losses (in the case of SVB, when interest rates increased dramatically relative to when the bonds were issued, the bonds SVB held were worth less to potential buyers) it is challenging for investors awareness. The proportion of those losses is not reflected on the balance sheet. SVB for example had $91bn of held to maturity (HTM) debt securities that had a fair value of $76bn. Consequently, it is advisable that to promote greater transparency for investors and mitigate potential shocks across the banking industry, in a rapidly shifting monetary policy, the FASB’s accounting rules for held-to-maturity (HTM) debt securities should be revisited.

In addition to SVB’s unfortunate investment decisions, the absence of robust regulatory oversight appeared to have played a role in the collapse. Indeed, in the year leading to the failure of SVB, the San Francisco Fed identified issues - namely how the bank managed its exposure to changes in interest rates and whether it would have enough cash in a crisis, and flagged this to SVB. The San Francisco Fed escalated the issue via Matter Requiring Attention (MRA), which in turn was brought to the attention of SVB’s board. Furthermore, the MRA was escalated to a Matter Requiring Immediate Attention (MRIA), following the approval of the chief examiner at the San Francisco Fed, which highlighted “egregious” instances of risk management. Nevertheless, neither management nor regulators appropriately addressed these red flags, and no corrective actions were undertaken to mitigate this exposure. On March 10th, 2023, the Federal Deposit Insurance Corporation seized control of SVB. Then on March 27th, 2023, First Citizens acquired the assets of the failed bank at a discounted price of $16.5bn, while also handling $56bn in deposits.

In response to the failure of SVB, the Bank Term Funding Program (BTFP), a new Federal Reserve program crafted to support American depositors by making additional funding available to banks was implemented. The BTFP is planned as a one-year temporary emergency measure. The program offers loans of up to one-year in length to qualified borrowers committing collateral eligible for purchase by Federal Reserve Banks in open market transactions.

Overall, sudden shifts in interest rates coupled with an inadequate management of interest rate risk can have unintended consequences on financial institutions, as highlighted in the case of SVB. Banks “maturity transformation” function (i.e., borrow short, lend long) means that many institutions are exposed to interest rate and liquidity risks and profitability challenges in a rising rate environment.

Sia Partners works closely with our clients, using efficient teams and flexible processes that focus on rapid, incremental changes that deliver quick wins. The organization is also well positioned to provide strategic enhancements and professional insight for long-term success of our Corporate and Investment Banking service network.

Partner | New Jersey

25 years experience in Financial Services, Capital Markets and Institutional Banking.