Fortune 100 response to DE&I pressures

The FCPA’s jurisdiction has been expanding for the past decade. Non-U.S countries now need to be aware of this crucial American regulation. A strong FCPA compliance program and a “culture of compliance” can help your firm successfully face the challenges presented by the FCPA domestically and abroad

The Foreign Corrupt Practices Act of 1977, ("FCPA"), was established for the purpose of making it unlawful for persons and entities to make payments to foreign government officials to assist in obtaining or retaining business.

To be in compliance with the FCPA, firms and individuals must adhere to both the anti-bribery provisions and accounting provisions of the FCPA.

The anti-bribery provisions of the FCPA make it illegal for a “U.S. person, and certain foreign issuers of securities, to make a payment to a foreign official for the purpose of obtaining or retaining business for or with, or directing business to, any person. Since the 1998 Amendment of FCPA they also apply to foreign firms and persons who take any act in furtherance of such a corrupt payment while in the U.S.” An example of an FCPA violation of the anti-bribery provision would be if a US Computer Company CEO sends payments/bribes to a Chinese company in order for the Chinese company to purchase computers solely from that US Computer Company.

Aside from cash payments, gifts and entertainment can also be cause for FCPA concern for companies. Companies are allowed to give gifts to clients to show appreciation and as a token of esteem, but as a general rule, gifts and entertainment to clients should be under $250 per gift. Please also take into account the local laws where the company plans to provide the gift. An example of a “gifts and entertainment” violation would be as follows:

A Chinese businessman is in town for a meeting. Your company decides to treat him to a night out. Your company buys him Hamilton Musical tickets that retail for over $1000. The gift over $250 is an example of an FCPA violation.

The FCPA, in addition to Anti- Bribery Provisions, also illustrates accounting provisions. The accounting provisions of the FCPA apply to all activities of the entity, not just areas at risk for foreign corruption and bribery. These accounting provisions, which were designed to operate in tandem with the anti-bribery provisions of the FCPA, require corporations covered by the provisions to “(a) make and keep books and records that accurately and fairly reflect the transactions of the corporation and (b) devise and maintain an adequate system of internal accounting controls.” There is no materiality to the accounting provisions of the FCPA. Therefore, any transaction, even ones of nominal amounts, can result in FCPA violations.

The Securities and Exchange Commission (“SEC”) and the Department of Justice (“DOJ”) are both responsible for prosecuting and enforcing regulations contained in the FCPA.

Critics of the FCPA have found that the regulation can discourage U.S. firms from making foreign investments. Additionally, critics of the FCPA hypothesize that firms conducting M&A in developing nations face a tremendous level of scrutiny from regulators.

In more recent years the DOJ and SEC have been prosecuting firms with little to no ties to the United States for FCPA violations. It is expected that the DOJ and SEC will have increasingly extraterritorial jurisdiction over foreign actors.

Over the past 10 years, the DOJ and SEC have made it abundantly clear that the FCPA Anti-Bribery Provisions have jurisdiction over “foreign persons and foreign non-issuer entities that, either directly or through an agent, engage in any act in furtherance of a corrupt payment while in the territory of the United States.” The DOJ and SEC have been giving loud signals that all bribery and corruption even vaguely associated with the United States will be pursued with the entire strength of the law.

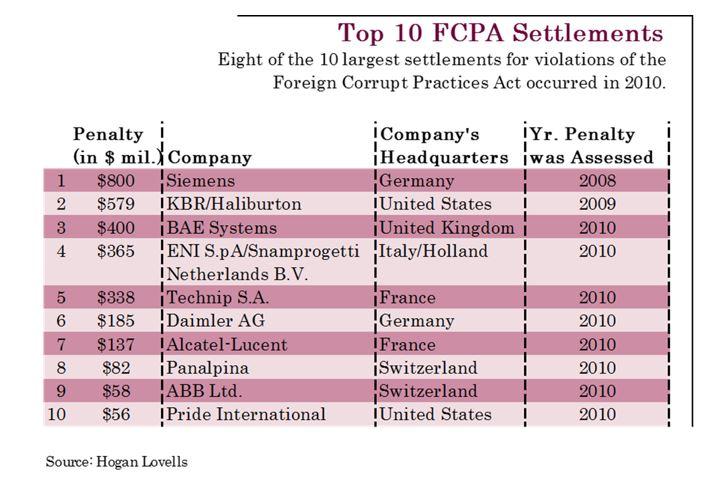

On June 28, 2010, Technip, a French construction and engineering firm, was indicted by the DOJ and SEC for plotting to bribe Nigerian government officials to win over 6 billion dollars in contracts. Technip settled with DOJ and was ordered to pay $338 million in criminal and civil fines.

In July 2010, the SEC charged an Italian company and its Dutch Subsidiary, ENI S.PA. as well as Snamprogetti Netherlands B.V., respectively, with scheming to bribe Nigerian officials with cars filled with cash in order to win construction projects. ENI and Snamprogetti agreed to jointly pay $125 million in fines to the SEC and Snamprogetti will pay $240 million in fines to the DOJ.

The most recent example of the expanded jurisdiction of the FCPA is that a Brazilian petrochemical manufacturer, Braskem S.A, agreed to pay $957 million in fines. Braskem S.A. made an estimated $325 million in profits directly related to bribes paid to a Brazilian State-owned petroleum company, Brazilian legislators, and other political party officials. These examples show the increased scrutiny of international entities engaged in bribery.

Even minor contacts with the U.S. may subject a foreign entity or individual to fall under jurisdiction of the SEC and DOJ for FCPA violations. Foreign companies and individuals that do any business with U.S. companies should be familiar with the FCPA Anti-bribery provisions. Conduct that may be common in a foreign nation could be viewed as illegal by the SEC and the DOJ. Foreign entities and individuals that fail to properly educate themselves on the FCPA risk criminal and civil actions.

U.S. companies that conduct business with foreign entities or in a foreign country must follow the provisions set out by the FCPA (increasingly the FCPA is applying to non-U.S. companies as well because the DOJ and the SEC are attempting to cut down global corruption). An effective FCPA compliance program is the best protection a corporation can take to prevent corrupt payments to foreign officials and ruinous fines by the SEC and DOJ.

According to the publication “A resource guide to the FCPA”, the DOJ and the SEC outline the most important elements of an FCPA compliance program, which are as follows:

While there will always be a risk that an entity can make corrupt foreign payments, a comprehensive compliance program is an efficient tool to mitigate the risk.

The Board of Directors and Senior Management should have a role in the prevention of bribery and foreign corrupt payments for their companies. The Board of Directors, at a minimum, should know about the FCPA compliance program and assist in the program’s effectiveness. Ideally, directors should promote a culture of FCPA compliance and demonstrate to management and the employees the seriousness of the FCPA. Directors should make compliance a high priority topic at board meetings and conduct meaningful discussions. “A company culture of compliance will provide employees in foreign countries—where customs and practices may differ significantly from those in the United States—a value system by which to judge conduct that may not be clearly addressed in guidelines or by their local management.” For the majority of corporations, the Board of Directors has direct oversight over the FCPA compliance program, regardless of any compliance or risk committees. The effectiveness of the Board’s FCPA compliance program should be evaluated in the end of year review process. Lastly, the Board of Directors and Senior Management should at a minimum ensure they are well versed in the FCPA. They should receive training, testing, and be competent on the subject.

Sia Partners offers compliance professionals with extensive FCPA experience. Sia Partners can assist your company’s FCPA Compliance Program with the following:

The Anti-Bribery and Accounting provisions laid out by the FCPA must be followed by any company conducting business in or with a foreign jurisdiction. Large fines, and enforcement actions threaten any company that does not maintain a comprehensive FCPA Compliance program. A culture of compliance is crucial for a successful FCPA compliance program and that starts from a tone from the top. Board of Directors and Senior Management should consider the entity’s FCPA compliance program with the utmost seriousness. The jurisdiction of the DOJ and SEC over FCPA matters has grown and includes non-U.S. entities with even a slight association to the U.S. Recent fines indicate that the reach of the FCPA has expanded and now non-U.S entities must adhere to the FCPA. Expect to continue to see the SEC and DOJ expand its jurisdiction to foreign corporations. As foreign corruption is a serious criminal and bi-partisan matter, it is not expected that the new Trump Presidency in the USA will have any effect on existing FCPA legislation and prosecution.