SEC Division of Examinations Releases 2026…

Considerations for a Next-Gen Model.

The Wealth Management industry continues to see a steady migration of assets away from self-directed and brokerage toward managed accounts and advisory solutions. This is not a new phenomenon, according to a 2022 Cerulli report, assets in managed account programs grew 24% in 2021 to a high of $10.7 trillion. Firms also experienced a strong year in 2022, with all programs posting year-over-year growth of over 19%. Over the last decade, investor reliance on advisors, and interest in more comprehensive financial planning, has substantially increased and all signs point to this continuing.

Today, firms face ongoing pressure to adapt their models to serve customer needs better, while leveraging new products and technology to stay competitive and efficient. Over the next several years Wealth Management, and more specifically, the Managed Solutions provider model will have no choice but to evolve. A key finding from the more recent 2023 Cerulli report discusses how:

“it is essential that providers and advisors make proactive efforts to help their clients understand the breadth of capabilities available to them and feel comfortable raising questions about any aspect of the wealth management experience to increase engagement and reduce attrition.”

As client needs shift and the demand for customization proliferates, products, services, and interactions will develop in what we see as three key areas. Each of these areas can be viewed through the lens of achieving customization at scale:

With the wealth management industry continuing to evolve and look for new ways to deliver an improved customer experience, Unified Managed Accounts (UMA) have continued their steady growth in popularity.

As an investment account, UMAs allow investors to consolidate various asset classes into a single account structure. This can help to address several pain points for investors and advisers, including:

Portfolio Allocation: offering streamlined investment management, ensuring each investment stays within the overall financial plan, and supporting investors' ESG (Environmental, Social, Governance) objectives.

Reporting: providing more comprehensive portfolio reporting and performance features.

Tax and Fee Savings: facilitating tax-loss harvesting and offering reduced advice-based fees

UMA assets have grown fivefold over the last 13 years, now encompassing 22% of total managed account assets. Given these distinct benefits, along with additional conveniences such as consolidation of accounts and assets, and greater efficiency and transparency, UMAs will remain a key trend in wealth management going forward.

The next generation of this trend is “householding”, where clients consolidate their assets into a single Unified Managed Household (UMH) account. This allows advisers a holistic view of the household’s accounts, assets, and objectives under one umbrella, driving things like convenience, improved performance, and tax savings.

According to a recent Cerulli report, 72% of wealth managers said consolidating to a UMH account is a priority. UMH accounts will allow wealth managers to move away from transactional brokerage relationships towards fee-based assets. Managing at the household level rather than individual accounts could add as much “as 200 basis points to a portfolio” (Investment News).

However, the UMH transition process is not without its challenges. Firms must develop an ecosystem and CRM that allows for an integrated experience. Common pain points include integrating data from diverse investment options into the client profile and a proposal generation system, offering account analysis tools for advisers to monitor underlying investments, and streamlining the management of holdings, taxes, fees, and performance reporting to clients. Overcoming these operational and technological challenges demands substantial investments of time, talent, and resources.

Firms must also ensure that a client’s individual risk picture is considered when the accounts of multiple household members are viewed together. Should a client trust a single adviser to manage their entire household, or is diversity among financial institutions as important as diversifying investments in a portfolio? What will regulators say about it? While many are convinced that householding is the future, it remains a work in progress.

In today’s environment, advisors across managed solutions and advisory service practices face the daunting task of navigating diverse technology platforms. Each tool or solution is designed for a specific purpose, resulting in a fragmented landscape. The lack of a universal solution portfolio burdens advisers with repetitive tasks, hinders growth potential, and undermines client trust, as inconsistent and inaccurate data experiences become prevalent.

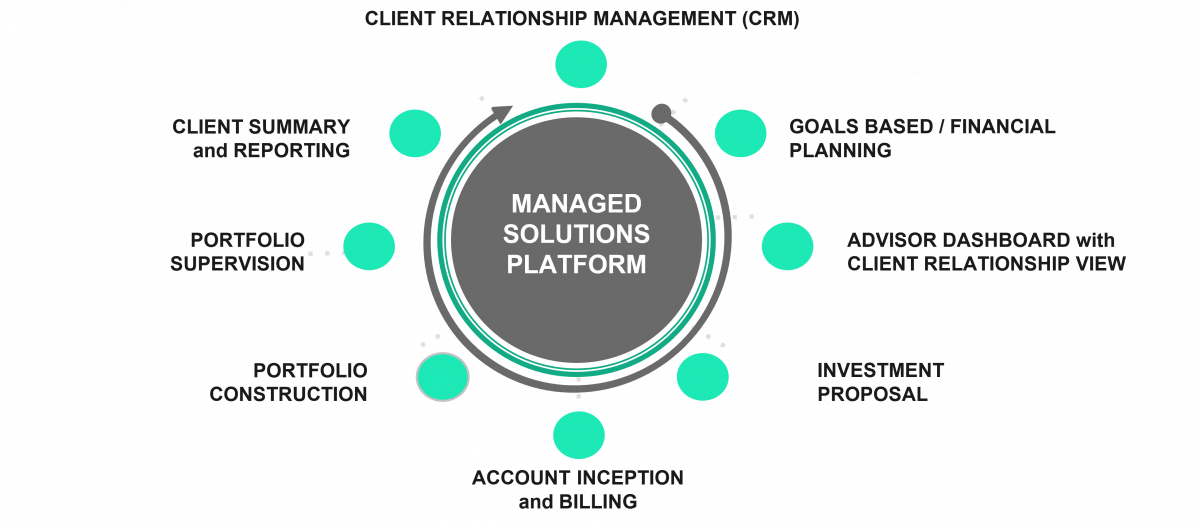

The impact of limited integration is tangible, with 94% of practice management professionals, according to Cerulli Associates, citing productivity challenges arising from technology fragmentation. To address these challenges, firms are directing investments toward core technology, client, and portfolio management. This strategic approach involves consolidating activities, insourcing processes, upgrading functionality, and implementing enhanced controls and reporting mechanisms. In doing so, financial institutions aim to overcome the problems associated with disparate technology platforms by developing an ecosystem that allows for an integrated experience. Key components to this integrated CRM include client profiling, account opening, goal and relationship-based advice, portfolio construction, fee billing, monitoring and supervision, and harmonized guidelines across product solutions.

Developing integrated platforms raises the question of whether to build in-house or opt for third-party solutions. Understanding the considerations for both approaches is essential.

Customization Control: In-house development provides full control over customization, tailoring the platform to specific business needs.

Integration Challenges: Building in-house may pose integration challenges with existing systems, requiring dedicated efforts for seamless connectivity.

Resource Investment: Internal development demands a substantial resource investment, including skilled personnel, time, and financial commitment.

Flexibility: In-house platforms offer flexibility in adopting additional tools but may face limitations in compatibility with external solutions.

Vendor offerings for managed accounts are evolving rapidly with innovative solutions continuously coming to market. Firms may decide to leverage vendors who provide comprehensive end-to-end solutions or a more targeted, specialized solution to a specific function, or some combination of the two. Some examples of industry leaders include Charles River, Aladdin, and Envestnet. On the other hand, emerging players such as Altruist and Smart Leaf offer more targeted solutions and specialize in portfolio rebalancing. When selecting a vendor(s) it is important to consider current and forward-looking implications.

Considerations for Using Third-Party Vendors:

Cost Efficiency: Partnering with third-party vendors can be cost-effective, as businesses only pay for the services they utilize.

Rapid Scaling: Third-party solutions enable faster scalability, providing a competitive edge in dynamic markets.

Outsourced Expertise: Leveraging third-party expertise is beneficial, especially when specific functionalities like background screening are required.

Limited Customization: While cost-effective, third-party solutions may lack full customization, potentially restricting adaptability to unique business requirements.

In summary, firms must consider and balance customization vs. standardization and its impacts on scalability. Targeted client selection combined with new technologies gives firms the best chance to offer an effective, integrated, and scalable solution. The choice between in-house development and third-party vendors depends on customization needs, integration challenges, resource availability, and budget considerations. Each approach has its merits, and firms must weigh these factors carefully to determine the most suitable path.

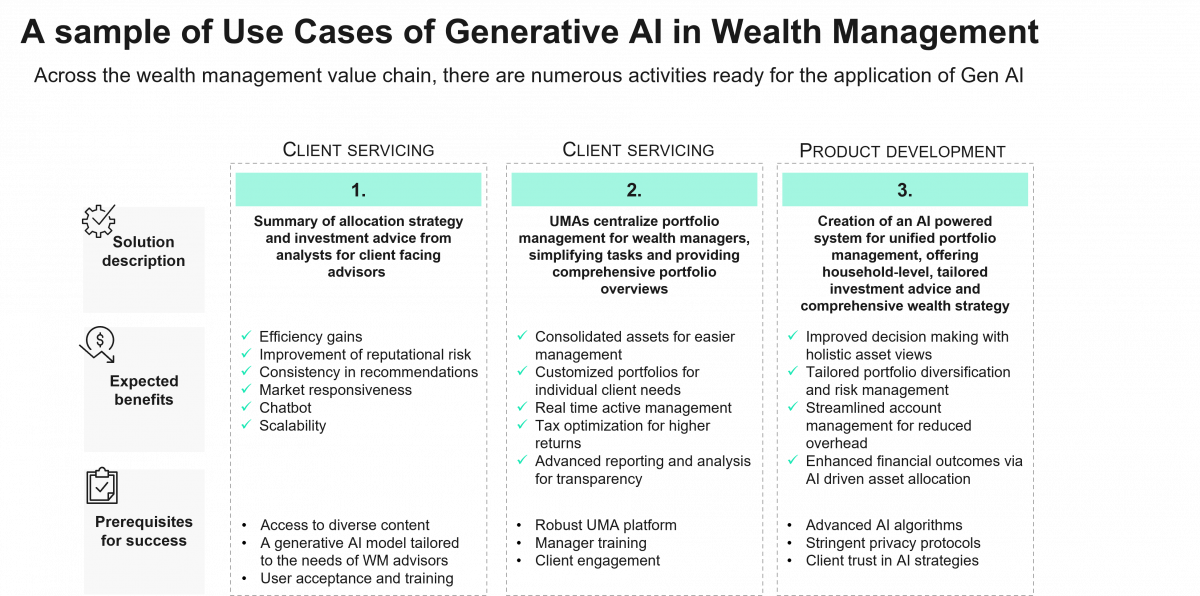

Integrating Artificial Intelligence (AI) into wealth management has begun to fundamentally transform managed solutions, with early impacts seen across portfolio personalization, performance optimization, and risk automation. AI's ability to dissect extensive market data enables precise investment decisions and agile adaptations to client needs, showcasing its pivotal role in evolving managed solutions towards heightened customization and efficiency. Predictive market trends, powered by machine learning, can also enable quicker responsiveness to economic changes.

Among the key impacts of AI, one of the prevalent themes is the use of AI in optimizing UMAs and model portfolios. Using advanced analytics and dynamic rebalancing, aligned with client goals, AI can enhance customization and efficiency, as demonstrated by firms like J.P. Morgan, BlackRock, and Fidelity.

Additionally, by automating tasks like data entry and reconciliation using robotic process automation (RPA) and natural language processing (NLP), AI reduces human errors and allows managers to focus on strategic asset management. AI-powered chatbots and virtual assistants can also deliver personalized and prompt responses to client inquiries, leveraging sentiment analysis and machine learning algorithms for efficient client engagement.

This technological integration enhances client interaction and streamlines processes, making wealth management more efficient and client-centric.

Exploring the wealth management sector reveals a diverse group employing AI-driven solutions:

Fintechs and Robo-Advisors like Betterment and Wealthfront are pioneering automated, AI-based advisory services.

Banks and Financial Institutions such as JPMorgan Chase & Co. and Goldman Sachs integrate AI for enhanced market analysis and personalized investment advice.

Asset Management Firms like BlackRock and Vanguard employ AI for investment decision improvements and efficient portfolio management.

WealthTech Startups such as SigFig and Addepar focus on innovative AI applications for wealth management.

Embedding Artificial Intelligence within the wealth management framework reveals a spectrum of opportunities and challenges for firms. AI-driven systems are set to transform investment advice, offering personalized strategies based on client goals, risk tolerance, and market trends through predictive analytics and machine learning. AI's automation also simplifies tasks like portfolio rebalancing and tax optimization, freeing advisors to concentrate on client needs and relationship building. As AI continues to evolve, clients stand to benefit from an unparalleled level of personalized and efficient advisory support. Achieving this requires significant technology and talent investment, as well as careful navigation of ethical and regulatory landscapes to ensure responsible and effective use.

Sia Partners has a breadth of experience in the financial services industry. Our firm helps clients redesign their target operating models, assess their day-to-day processes, roll out new product offerings, and implement improved efficiencies across the organization. Keeping in mind the many challenges that businesses already face in today’s climate, it is vital to work in an organized way. Therefore, Sia Partners is at your service to provide frameworks and roadmaps that will help you work as efficiently as possible.

As the managed solutions space continues to evolve firms should consider the changes this brings to their clients and the services they provide. Sia Partners recognizes the need for support in this area, so we have incorporated the best practices from around the world into our offerings. Sia Partners can provide the knowledge and expertise necessary to assist clients in decision making, and implementing these next-generation strategies. Our approach augments business advisory services with our Heka.ai automation and artificial intelligence capabilities to provide clients with industry-leading consulting and technology services and solutions.

Partner, Banking | New York

Bharat is a Partner in our Wealth & Asset Management practice. He leads large-scale implementations & provides advisory services to help our clients & consultants keep up with evolving & disruptive trends in the industry in order to glean efficiencies, reduce risk and gain a competitive advantage.