Control Room of the Future

Sia Partners has partnered with the Capital Markets community to conduct a survey on the involvement, interest, and sentiment of Gen AI within Corporate and Investment Banking & Capital Markets. We have analyzed the results with our Subject Matter Experts in Data Science and published them here!

Sia Partners has partnered with members of the Capital Markets community to conduct a survey on the current and expected impact of Generative AI on Corporate and Investment Banking / Capital Markets.

The ultimate goal of the survey is meant to gauge involvement, interest and sentiment around GenAI in CIB. The results of the survey are in and we have analyzed them with our Subject Matter Experts in Financial Services and Data Science. We are excited to publish our analysis of the survey here!

For nearly a decade, Sia Partners has focused on developing solutions based on advanced technologies including Artificial Intelligence/Machine Learning to enhance the impact of our consulting assignments. Currently, we are leveraging Generative AI technology with our proprietary solution, SiaGPT, to improve business operations.

Our technology provides a simple prompt interface, allowing users to extract relevant information from documents and data sets to generate unique content in a safe and secure environment. Given our experience with AI and ability to deploy a fully functioning Generative AI solution, the Corporate & Investment Banking (CIB) team at Sia Partners wanted to explore further the Generative AI landscape and how firms are anticipating the use of the technology. Focusing specifically on how Corporate and Investment Banking firms are thinking about, developing, and using Generative AI, Sia Partners distributed a survey.

Sia Partners partnered with members of the Capital Markets community to conduct a survey on the current and expected impact of Generative AI on Corporate and Investment Banking / Capital Markets. The responses from participants spanned the US, Canada, Europe, and Asia across different functions within Corporate & Investment Banking, including sales, back office, middle office and other support areas. The ultimate goal of the survey was to gauge involvement, interest and sentiment around GenAI in CIB. The results of the survey are in and below is our analysis crafted with our Subject Matter Experts in Financial Services and Data Science.

Expected Impact

Respondents were very optimistic about the impact of Generative AI within their firm with over 60% expecting “game-changing” or significant impacts from Generative AI in their area. While many respondents (60%) confirmed that they are still learning about Generative AI, over 70% are actively working with management to explore opportunities.

Use Cases

As the investigation into the best ways to leverage Generative AI continues, implementation of Generative AI looks to be careful and calculated. 51% of respondents reported that they had identified two or fewer use cases for the tool in their area of CIB, and only 12% had more than 5. When asked about the implementation timeline, 49% confirmed an expected implementation in 2025 or later, with the remainder ranging from already implemented to 2024. As some respondents identified that use cases have been rejected due to various risks, the delayed implementation schedules could be due to consideration of the possible risks of this new technology or a need to improve the data and information that would train the Generative AI tool. While the technology is constantly improving, there remains a crux for banks that tools are only as good as the data on which the tool is trained. As for the areas where implementation has already taken place, results of the survey show that 31% of respondents have already implemented at least one use case.

Within CIB, our survey results indicate that Operations, KYC/Onboarding, and IT/Data Office tasks are the top 3 areas where Generative AI will have the greatest impact. These results are in line with Generative AI’s ability to create content based on context and the data that the tool was trained on. In KYC/Onboarding, we see complex policies that need to be understood by KYC analysts and properly applied to a wide range of cases – Generative AI could provide on-demand answers to questions while they’re reviewing a file. In Operations, we see large amounts of data from various sources that need to be consolidated, validated, and entered into back office systems – Generative AI can create summaries of the data to guide the back office through account set-up.

Traditional AI vs Generative AI

In some of the survey questions, we gave the respondent the ability to provide free-form responses or additional color on the answer provided. There were some free form responses that suggest there may still be some confusion as to the use cases that will benefit most from Generative AI and those that would likely be solved through more traditional AI, such as RPA (robotic process automation) or Machine Learning. Generative AI separates itself from traditional AI like RPA through its ability to make human-like inferences about data it was pre-trained on.

Development Strategies

One of the crucial questions when introducing new technology revolves around the approach to implementation: in-house build, third party or a joint effort. We asked which LLM the respondent was expecting to use when building their use cases. As expected, the highest two were GPT at 45% followed by internally developed models at 38%*. (*Please note that there is some overlap between the two, meaning that many are planning on using more than one model.) Additionally, 42% had not yet defined which model they were going to use

Confirmed Assumptions

These results shine a light on the primary domains where we expect Generative AI to make a transformative impact within Corporate and Investment Banking (CIB). Operations, Know Your Customer (KYC), and onboarding processes emerge as focal points, alongside the pivotal role of IT and data management offices.

An overwhelming 89% of respondents express enthusiasm towards harnessing Generative AI's capabilities in text generation, underlining its potential to streamline communication and documentation tasks. Notably, a quarter of responses also highlight the growing interest in leveraging Generative AI for image generation, possibly in the context of crafting insightful reports and dynamic dashboards.

In summary, Generative AI is poised to transform the way CIB professionals work, opening up new avenues for efficiency, creativity, and strategic decision-making. Implementation appears slow and methodical with most of the anticipated benefits not yet capitalized. As firms learn more and gain comfort around Generative AI, the impacts will continue to grow and the landscape evolution will likely start taking shape in 2025.

Sia Partners tested and validated several use cases in CIB with Generative AI. Below are some of the use cases that we tested and were presented as part of the survey:

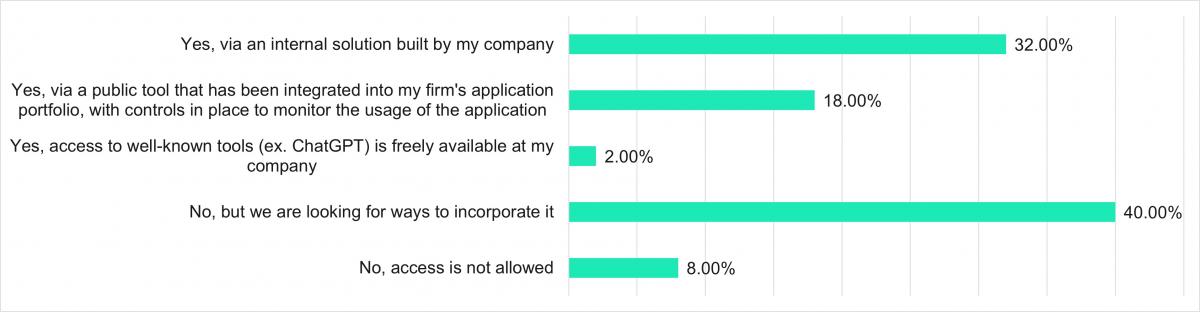

Are you or other employees using Generative AI today within your organization?

Many companies are not using it yet but are still looking for ways to incorporate it, which is something Sia Partners could potentially help with. Responses are split roughly 50%/50% with those who are using Generative AI and those who are not using it.

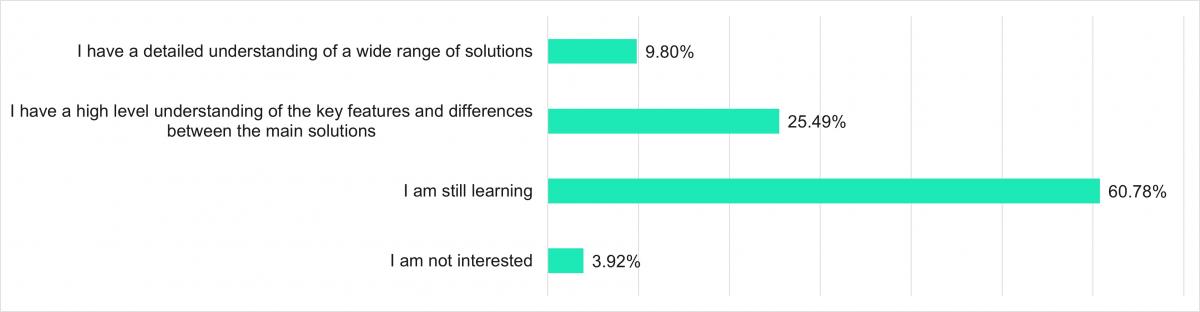

How knowledgeable do you feel about the key characteristics of Generative AI solutions?

Most people are still learning to use Generative AI. This shows that Generative AI is still in its infancy and can be used as supplemental information to show that many people still might not fully know the difference between regular AI and Generative AI.

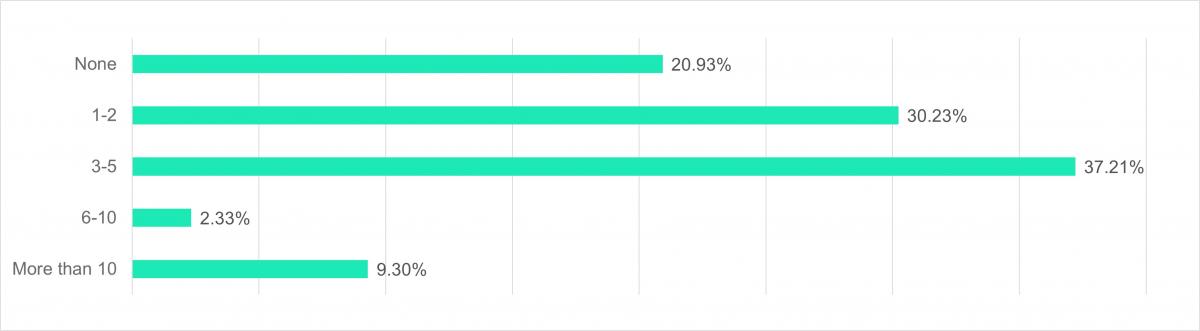

Have you identified any potential use cases in your area? If so, how many?

Although there is a lot of discussion about how Generative AI can be used, the number of use cases in most companies is still extremely low. This shows that there is still a lot of work to be done with exploring uses for Generative AI. Additionally, because the question asks about potential use cases, the low number shows that banks are still struggling to identify practical, specific use cases. This is an area that Sia Partners could be able to help with, by implementing specific use cases rather than having a generic number of use cases.

Which LLM are you expecting to use to build your use cases?

Unsurprising that OpenAI is the leader. Many of these firms have close relationships with Microsoft, and ChatGPT is the most well-known Generative AI. Other important observations are that internally developed and Not yet defined are large percentages as well. Other LLMs have very little usage.

What is your development strategy?

Building internally and developing with a partner are the two highest. Outsourcing to a vendor exclusively is extremely low, which indicates firms still want to have at least partial ownership of Generative AI development.

There is also some overlap between the three with 9 responses saying they are both building internally and developing with a partner, 2 responses that are both building internally and outsourcing to a vendor, and 1 response that is building internally, developing with a partner, and outsourcing to a vendor. The combination answers are high, which shows that firms could be developing their own use cases while using other operating models.