Control Room of the Future

Unfortunately, due to COVID-19, firms are operating in uncharted waters in more ways than one. While many of the “normal” things we are used to, such as gift giving, look very different this year, it is still important to remain compliant with all applicable rules and regulations.

Under normal circumstances, this time of year would be full of holiday parties and events, as well as exchanging gifts to show clients gratitude and appreciation. However, due to the COVID-19 pandemic and the impact it has had on the workplace, as well as in-person gatherings in general, the 2020 holiday season looks much different than it has in years past.

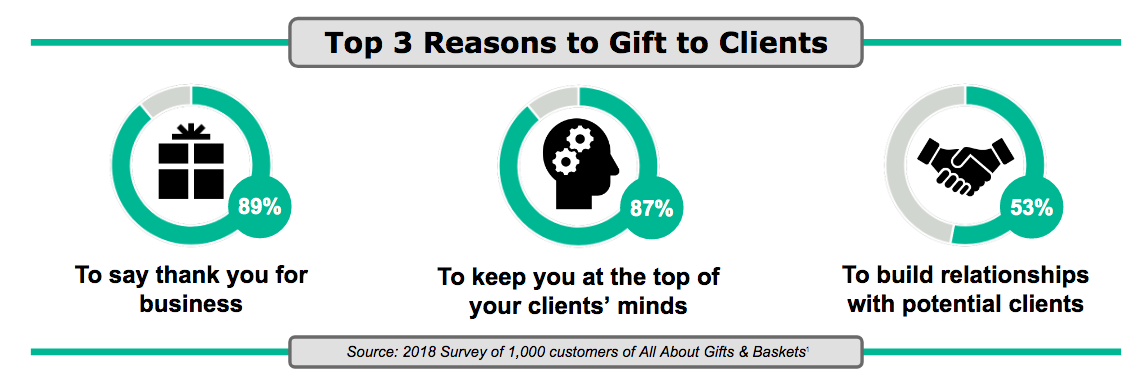

At the end of each year, the holidays are a time when we reflect on the prior year and look forward to the prospect of a new beginning that the new year will bring. In the financial services industry, and particularly in wealth management, the holidays also present a unique opportunity to show thanks to the clients that have placed their trust in you. However, before considering giving a gift to a client this holiday season, you must first consider the appropriate gifting protocols and regulations, both internally within your organization, as well as externally including any applicable rules and regulations.

Internally, an organization may want to consider having protocols and procedures in place to ensure all employees are remaining fully compliant with all applicable gifting rules and regulations. For example, some of these protocols and procedures can include mandatory trainings, annual attestations, and/or pre-clearance requirements.

When it comes to gifting to existing or potential wealth management clients, FINRA Rule 3220, also known as the “Gifts Rule,” lays out very strict guidelines regarding what is, and what is not, allowed. Specifically, the rule states:

“No member or person associated with a member shall, directly or indirectly, give or permit to be given anything of value, including gratuities, in excess of one hundred dollars per individual per year to any person, principal, proprietor, employee, agent or representative of another person where such payment or gratuity is in relation to the business of the employer of the recipient of the payment or gratuity. A gift of any kind is considered a gratuity.” [2] Additionally, the rule requires that broker-dealers keep a separate record of all payments or gratuities.

So, what does this mean in practical terms? First, and on a very basic level, a broker-dealer should have a record keeping mechanism to keep track of gift and gratuity giving. Next, a broker-dealer, or anyone associated with it, should be mindful of giving anything of value to another person when it has to do with business dealings. Personal gift giving, absent a business nexus, is outside the scope of this rule.

Let’s consider an example to illustrate one such business-related gift giving scenario. Broker-Dealer associated person Steve wants to gift each of his clients one $99 bottle of wine during the holiday season. As the value of each gift per person falls below the $100 limit, this gift would be considered permissible. However, imagine a scenario where Steve then gives one of his favorite clients a $50 fruit basket, in addition to the $99 bottle of wine. This would not be permissible as the total aggregate value of the bottle of wine and the fruit basket exceeds the $100 per person, per year limit outlined in Rule 3220.

There is, however, an exception to the $100 per person, per year limit. This limit does not apply to events or experiences in which associated members accompany clients. For example, Broker-Dealer associated person Julia purchases two $150 tickets to a baseball playoff game. If Julia gifted both of these tickets to a client, she would be in direct violation of Rule 3220 as the aggregate value of the tickets is $300. However, if Julia purchases these two tickets and takes a client while also attending, she is in compliance with Rule 3220, provided that the total cost of the tickets, as well as the frequency with which they are provided, do not raise questions of propriety.

There is no debating that the COVID-19 pandemic has forced organizations across all sorts of industries to adapt to the “new normal” of a remote workforce as quickly, and efficiently, as possible. Operating in an entirely remote environment can be beneficial, but can also present a host of issues and complications for organizations as they attempt to retain their existing clients, while attempting to bring in new clients. As such, FINRA issued guidance this past summer in the form of an FAQ [3], which seeks to address the role of Rule 3220 in a post-pandemic, remote environment.

In essence, remote events are permissible but Rule 3220 does not specifically address the manner in which events must be conducted. Considering the above examples of Steve and Julia, the scenario of a potential virtual event where food is provided to guests while employees also attend would more closely align with Julia’s situation, and therefore is not subject to the $100 per person limit. As long as the cost of the food and beverages, as well as the frequency with which they are provided do not raise questions of propriety and are not preconditioned on achieving a sales target, virtual events of this nature are permitted.

In order to remain fully compliant with all gifting regulations this holiday season and beyond, it is crucial for organizations to ensure that their employees are adequately trained on all applicable rules, procedures and protocols regarding gifting. As with many other business conduct areas, having an adequate supervisory system, including written procedures, adequate controls, a training program, and recordkeeping mechanisms is critical to remaining compliant.

To best protect an organization as a whole, as well as individual associated persons, it may be beneficial to consider the following best practices that we recommend regarding gifting compliance:

Gifting and entertainment, particularly during the holiday season, are essential elements of demonstrating thanks and appreciation to clients. However, it can often be a difficult and tedious task to navigate the various applicable rules and regulations. For this reason, we recommend establishing, and periodically assessing, regular processes such as procedures, controls trainings, and pre-clearances that can help firms remain in compliance, with the goal of detecting, preventing and deterring problematic conduct. It is also valuable to regularly remind employees of the resources available to them in order to help them remain compliant with all applicable gifting regulations.

At Sia Partners, we can offer our extensive experience in the areas of financial services and compliance. Leveraging our consultants, some of whom are former regulators, and their expertise, we can help firms develop and enhance written procedures and controls. Additionally, we can also help firms develop and enhance monitoring, reporting, and communication processes related to gifting, gratuities, and entertainment.

Amanda Lally

Associate Partner

+1 (415) 935-1257

amanda.lally@sia-partners.com

Zoya Ashirov

Senior Manager

+1 (917) 330-5526

zoya.ashirov@sia-partners.com

Stephen Dimarco

Consultant

+1 (718) 213-0422

stephen.dimarco@sia-partners.com

[1] All About Gifts & Baskets. 2018 Survey of 1,000 customers of All About Gifts & Baskets. (2018).

[2] FINRA, Rule 3220 (Most recently amended by SR-FINRA-2008-027 eff. Dec. 15, 2008.)

[3] FINRA. Gifts/Business Entertainment/Non-Cash Compensation FAQs. (2020, August).