Investments in Decarbonization: A strategic lever…

This article sheds light on the state of the Global Luxury industry, its dependence on the Chinese Consumer and the hurdles ahead on the path to recovery.

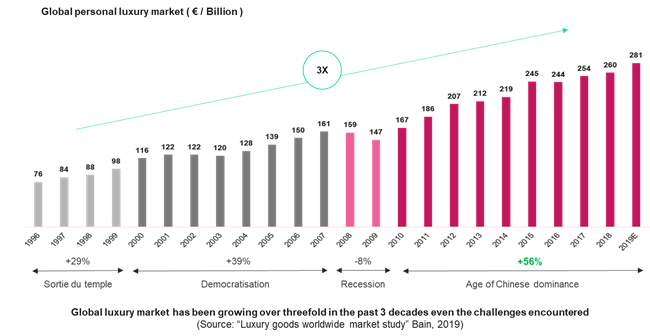

For the better part of the last decade, China has been the El Dorado for the global luxury industry, driving its growth to reach a market size of €281 billion in 2019. Mainland China alone contributed €30 billion to global luxury revenues while globetrotting Chinese consumers spent close to €100 billion in premium high-quality products, accounting for almost 90% of the global luxury market growth. [1] The industry’s consistent growth and China’s ever-increasing appetite for luxury goods and services bolstered both short and medium-term forecasts, with pundits predicting the industry to reach a market valuation of almost €350 billion by 2025 despite clear signs of a slowdown in the Chinese economy.

While neither the looming fears of Chinese economic downturn nor that of a global recession managed to dampen the industry outlook, the recent outbreak of the novel coronavirus (Covid-19) has thrown the spanner in the works, potentially leaving all predictions off the mark. With Chinese cities, large and small, going into lockdown and outbound tourism dropping to an all-time low, the luxury industry may be facing a crisis of unparalleled proportions. Major luxury groups from Kering to LVMH shuttered their stores across China and reported a significant drop in sales globally [2]. The luxury industry is bracing itself for arguably its toughest year since the financial crisis of 2008-09.

In this article, we explore the state of the global luxury industry, its dependence on Chinese consumers and the hurdles lying ahead on the road to recovery.

The luxury industry has seen unprecedented change in the last three decades from being a €76 billion industry in 1996 to growing over threefold to a whopping €281 billion by the end of 2019. These “Trente Glorieuses” witnessed the industry’s transformation from a constellation of small, family-owned artisanal businesses, heavily focussed in the Western world to a global market place with strong growth to the East, with China at its heart.

The 2010’s marked the age of Chinese dominance on the global luxury market, as China’s domestic luxury market grew from around €15 billion in 2010 to €30 billion by 2019.[1] This phase is entwined with the Chinese growth story and the emergence of the high-spending, globe-trotting Chinese Millennials on whose back the luxury industry piggybacked to its current market valuation. All major Luxury Houses had indeed scaled up their investments and resources in China over the last decade, hoping to reap the rewards that lay ahead, in many ways leaving the Chinese consumers and the Mainland market to determine the fortune of the entire industry.

Four months ago when Sia Partners hosted an expert panel discussion in Hong Kong about the Changing Dynamics in the Chinese Luxury Market, a strong sense of optimism on the industry’s outlook for 2020 and beyond was prevailing within the audience. Although the on-going unrest in the SAR was posing a threat to the upward trend in the region, the strong growth recorded across the border in Mainland China was keeping the mood upbeat. Little did one know that a few months down the line the industry would have to face arguably its biggest challenge to date.

What began as a mysterious viral pneumonia that infected a few people surrounding a wet market in the central Chinese province of Hubei in late December, quickly spread across the Mainland before the world could take notice. Within the next month, the number of cases went up exponentially to around 10,000 worldwide with China going into a lockdown, cities and towns ring-fenced into quarantine and outbound trips dropping by 73% over the Lunar New Year [3]. As industries and sectors across the board are feeling the pinch in China, the luxury world finds itself faced with a double whammy – China represents its fastest growing market and (travelling) Chinese consumers its largest customer segment.

With millions of Chinese citizens in self-imposed quarantine, more than half of all luxury stores are closed, with the rest mostly operating on reduced hours with little to no customer footfall. [4] This is resulting in lost sales and mounting cost of inventory. To add to their misery, some luxury brands have had to postpone their marquee events including the Shanghai Fashion Show slated for 26 March and Burberry’s Fashion Show planned for 23 April. As a consequence, a number of Luxury Groups have already started adjusting their sales estimations for the year.

In addition, Chinese consumers were making more than half of their luxury spending overseas. However, due to the Covid-19 outbreak, various countries started to enforce travel restrictions and flight suspensions for travellers coming from China, as illustrated in the map. These destinations are among the ones most coveted by Chinese luxury shoppers, directly impacting sales volume in these destinations. It is also generally reported that in the luxury stores in London, Paris and New York, customer traffic has been “far from normal”. [5]

Taking into account the above factors, drop in retail sales in China and globally, Sia Partners’ conservative estimates suggest the impact of Covid-19 to generate a loss in revenue to the tune of €14-18 billion, or roughly 6% of overall market revenue compared to 2019.

While a strong uncertainty remains regarding the eventual impact of such crisis on the industry, this dark cloud may not be without a silver lining. Indeed, Sia Partners’ analysis highlights clear signs that the industry could bounce back strongly once the virus is completely contained.

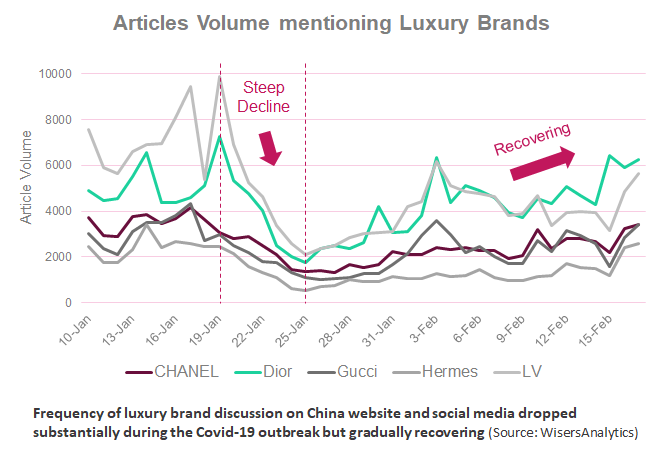

Even as stores of major Luxury Houses have shuttered down across China with new launches and fashion shows postponed, luxury consumers are still as engaged with the brands as before. The graph showing the volume of articles from Chinese websites and social media mentioning major luxury brands is a testament to the strong aspirations of the luxury consumers.

Even with frenzied fearmongering that the Covid-19 could potentially trigger a broad economic meltdown, global indices from Dow Jones to S&P 500 and SSE (Shanghai) to Nikkei have all been extremely resilient after the initial shock during the virus outbreak. Major luxury stocks: LVMH, Richemont and Kering have been trading down after the virus gripped Northern Italy but this has not led to panic sell-offs. While caution is the rule when analysing market capitalizations and their short-term evolution, the overall sentiment of the financial markets seem to be to follow a temporary wait & watch approach before a possible rebound.

According to data released by travel aggregator Trip.com early February, the volume of people searching for holiday deals for the May Day Holiday deals was up by 119% compared to last year. This is a clear indication that people are quietly confident the situation will get back to normal, skipping the Easter and Qingming period and postponing their next trip to early May.

As humans, we are programmed to invoke past precedents when faced with overwhelming events. With the Coronavirus, the first parallel one can draw would be to the SARS outbreak of 2003. While there are definitive similarities between the two events, the differences are just as stark. The novel Coronavirus, even though highly contagious has proved to be significantly less fatal than the SARS – giving hope that with proper care and containment the virus and its impacts can be reined in. On the economic front, China’s GDP in 2003 was one-fifth of what it is today, which does imply a Chinese slowdown can have far reaching consequences. But this also means the Chinese economy has matured and has larger reserves and buffers in place to stimulate and revive the economy if needed. And as it has been observed earlier, the global luxury industry too shall bounce back from these hard times and re-invent itself as it moves ahead into its next decade of possibilities.

As this article goes into publication, the jury is still out on when the novel Coronavirus will be completely contained and what its definitive impact on the economy will be. Rather than delving into speculations on the outlook for the luxury industry, the need of the hour is to focus on the strong bright spots that are shining through amid all the doom and gloom, and on what high-end brands can do to tap into these opportunities moving forward.

For the millions of people in China facing lockdowns and travel restrictions, their mobile phones connected to the Internet has become THE portal to the outside world more than ever before. And leading this trend are the Millennial and Gen Z netizens who also make for the biggest and fastest growing consumer segments for luxury. This presents an immense opportunity for the brands to connect with their customers and engage with them in a multitude of unique ways.

What matters most to (Chinese) luxury shoppers is the complete experience with the highest degree of exclusivity. Through virtual and augmented reality, Luxury Houses can take the latest products directly to the customers’ living room. Backed by AI-driven concierge through conversational chatbots, this can pave the way to hyper-personalized and engaging shopping experiences. The possibilities for innovation & service enrichment here are endless – from try-on delivery to Virtual Reality shopping with friends and family to gamified marketing campaigns. Some of the luxury brands or luxury e-commerce platforms are already on the path of delivering these digital experiences. For example, Dior and Gucci have Augmented Reality incorporated marketing campaigns, Gucci and YOOX Net-a-Porter Group are providing try-on delivery service in select regions, while Farfetch has offered a Show-to-door service.

In addition, through online immersive content, engaging campaigns and purpose-built apps that can be quickly deployed, Luxury Houses will have a great opportunity to not only stay connected with their customers and capitalize on online sales, but also entice customers back to the stores once the outbreak is behind us.

While luxury stores across China are shut with inventory piling up, across the border in Hong Kong brands are parting with their employees owing to lack of sales and exorbitant rents. Although there are no quick-fix solutions to this challenge, the road ahead will be less bumpy for Luxury Houses making wise investments based on data.

The future of luxury operations will be one where data helps decide everything from optimizing the balance between swanky flagships stores and pop-ups, to managing lean inventories and forecasting staffing rates based on modelled customer footfall. And all this while increasing the reach to customers through always-on digital aisles and data-driven personalized customer experiences.

For most of the past decade, China has been the driving force behind the growth of the global luxury industry, and the pre-virus predictions were that Chinese spending would skyrocket to almost 50% of the global luxury market revenues in the next 5 years.[1] However, the current situation makes one wonder as to what the impact of a crisis of this magnitude, in the China of 2025, would be on the luxury world .

While the situation at hand does not pose a potent threat to reverse the predictions on China remaining at the heart of global luxury in the near future, it will be prudent to think ahead to diversify to new markets to seek avenues for future growth. Emerging market economies have not jumped on the luxury consumption bandwagon yet, but with some efforts in creating market awareness and consumer education, it is only a matter of time till prestigious Maisons discover their new El Dorados. And hopefully make the coronavirus episode one of the many quickly-overcome hurdles when the Luxury world looks into the rear-view mirror a few years down the road!

1. “Personal luxury goods market grew by 4 percent in 2019 to reach €281 billion”, Bain, Nov 2019

2. “Gucci parent Kering closes half of China stores, takes sales hit from coronavirus” CNBC, Feb 2020.

“A former LVMH exec says the coronavirus outbreak is a 'disaster' for luxury brands as Chinese tourism evaporates” Business Insider, Feb 2020

3. “Coronavirus hits global tourism industry as Chinese stay at home”, Financial Times, Feb 2020

4. “Shuttered Stores, Fewer Tourists: Luxury Feels Coronavirus Effects”, The New York Times, Feb 20

5. “Luxury Brands Fear Sales Hit as Chinese Shoppers Stay Home”, The Wall Street Journal, Jan 202