Control Room of the Future

Price variability is nothing new in the hospitality sector. For almost 30 years, hotels have been using Revenue Management (RM) strategies to optimize their income. In the recent years however, techniques have evolved.

Price variability is nothing new in the hospitality sector. For almost 30 years, hotels have been using Revenue Management (RM) strategies to optimize their income. In the recent years however, techniques have evolved: while, initially, RM was basic and manual, tools available today use much more refined and complex models, like demand forecasting or revenue optimization. Many revenue management companies are specialized in helping hotels to adjust their fares in order to maximize their revenue.

New players have entered this market in the last months; most notably online intermediaries such as Online Travel Agencies (OTAs). Initially limited to distribution, these companies have started to offer additional solutions to their client hotels to adapt their prices in real time.

This article focuses on the new practices in Dynamic Pricing, and on the questions related to these evolutions: why have these intermediaries taken interest in the Dynamic Pricing market? What exactly are they offering? Finally, what is the impact on hoteliers and property owners’ bottom line?

Revenue Management was initially introduced in the 70s, with airlines being the first to use pricing and capacity management principles to optimize their incomes. Today Revenue Management techniques are widely used in various sectors, such as travel, and in particular in the hospitality industry. All industries using RM have the following criteria in common:

In Revenue Management models, prices are not set as “cost + margin” but depend on different parameters related to forecasted demand, competition, etc. The price of a hotel room will be defined based on the season, the day of the week, the competition, the hotel’s expected occupation rate, the number of days before the stay, etc.

Hotels’ interest in revenue management is simple: using demand forecasts to adapt prices allows them to maximize the hotel occupation as well as the revenue per room and total revenue [1]. For instance, during off-peak periods, hotels will rent out the room at a lower price, rather than leaving the room empty (provided the price still exceeds the room’s fixed and variable costs, e.g. cleaning and laundry). On the contrary, when demand is high and the hotel is likely to be sold out, it is more profitable to raise the prices.

Studies have shown that going from flat pricing (always the same price for the same room) to variable pricing can increase the overall revenue up to a theoretical maximum of 55%.

Whereas airlines have used Revenue Management for almost 50 years, the hospitality sector introduced RM at a much slower pace: the first hotels to use RM implemented it after 1990. A few reasons can be put forward to explain this late adoption, starting with the complexity of the hotels’ ecosystems: often the hotel management is split between several entities (owner, operator, asset manager, brand manager), which results in substantial complexities and problems. Similarly, hospitality IT systems have been fragmented which made it very challenging to integrate a Revenue Management tool. And there is also the risk that fluctuating prices may not be well-regarded by customers, and thus a fear of losing loyal clients. For airlines, fluctuating prices are already generally accepted.

Nowadays, it is the standard for a hotel to adapt their prices to capture demand. The most widespread practice is the use of a reference price, which is called Best Available Rate (BAR) and is supposed to be the same on all the different distribution channels such as the hotel’s website, OTA’s websites. Prices are then set in stages, using discounts of the BAR (for example, a promotional rate is 10% less than BAR, an OTA package rate is 20% less than BAR). This results in a finite number of possible prices for a given product or service.

Strictly speaking, this traditional approach of pricing cannot really be called Dynamic Pricing as there are very few price points, based on promotional rates.

Many hotels have started to use more complex models: they take into account an increasing number of variables, for instance a more refined customer segmentation. Thus they use a more dynamic pricing, by allowing more price points (e.g.: a 1% deviation from the BAR is now possible).

Even with those advanced methods, prices are not specifically yielded per room type or distribution channel. Rather, all prices are modified based on changes in overall demand, with a fixed deviation of the BAR. This implies that when the demand for a specific room type increases, hotels raise the prices of all their rooms even if the demand for the other room types remains flat. However simple to integrate, this strategy can prove itself insufficient to capture all the potential demand.

It can be increasingly observed that hotels and property managers free themselves from the BAR-based pricing methods and begin to use Open Pricing methods.

Open Pricing is an innovative pricing strategy encouraged by Duetto, a start-up launched in 2012 specializing in dynamic pricing for hotels. It values every room type and every distribution, customer segment and/or channel independently to maximize revenue, and to avoid closing off any channel. For instance, when demand is high, instead of closing off the usually discounted channels, one can just dynamically price the offer on these channels to keep the hotel available (but at a higher rate) for those who shop only on these channels.

With open pricing, hotels can also price the room types independently. Instead of always having the same price gap between, for example, a standard room and a suite, hotels can set these prices depending on the forecasted demand for each individual room type.

Whereas hotels are just beginning to consider open pricing, vacation rentals (rent of long-term rooms or houses) that practice revenue management already use it by default as every room is different and so the average price of every room is different.

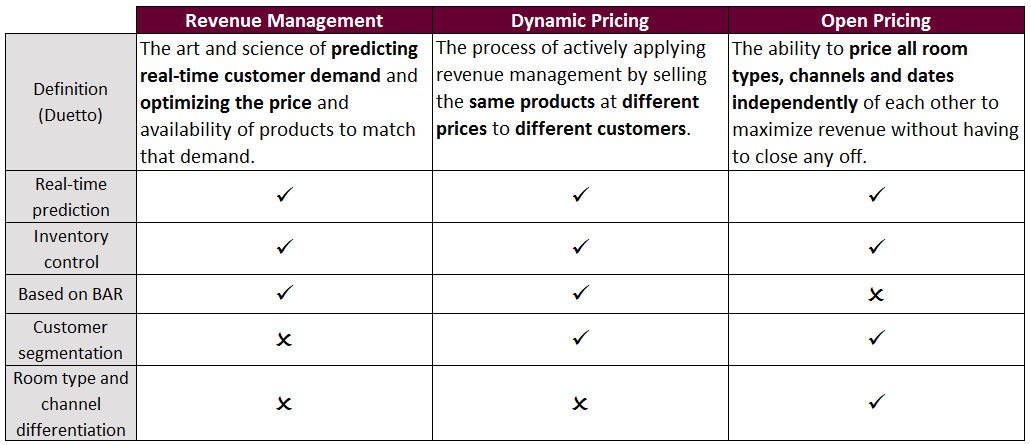

Differences between traditional RM, dynamic pricing and open pricing

Several options are available to managers who want to have a revenue management strategy:

Online intermediaries - OTAs and other intermediary actors such as Airbnb - are increasingly entering the market of hotel and vacation rental revenue management. These intermediaries tend to integrate revenue management tools through three different approaches: a partnership with existing RM providers, by acquisition of the same, or through the creation of a proper RM tool.

Airbnb offers property owners the possibility to register for third-party subscriptions of specialized RM software companies (partnership model) such as BeyondPricing, PriceMethod, Everbooked, PriceLabs, etc. These firms typically offer simple and automatic pricing methods to lighten the burden of Airbnb hosts in return for a fixed monthly fee or of a percentage of the profits of the property owners. With this model, Airbnb receives a fee from these RM companies for all hosts who use their RM system and it increases customer satisfaction as the customer can choose himself which software tool he wants to opt for.

Booking.com, on the other hand, is using an acquisition model in order to integrate revenue management in its online booking platform. Priceline, the parent company of Booking.com, acquired Price Match, a RM software company, in 2015. The technology of Price Match is integrated in the BookingSuite tool of Priceline. The advantage of an acquisition model is to be found in the additional revenues from the subscriptions paid by other OTA’s, hotels or property owners, and in the increased opportunities of tapping into a new market.

Aside from offering third party subscriptions of specialized RM tools, Airbnb also developed its own RM system. A third possibility for online intermediaries is thus to act as Airbnb and start from scratch with a self-made pricing tool. The main challenge of creating a new RM technology is the established power of current revenue management firms as the real data is in the feedback loop of having lots of clients in your system. Existing systems may thus already have too big of a lead to make this type of integration a success for online intermediaries.

The first and foremost reason for this increasing interest of online intermediaries in revenue management and dynamic pricing practices is clearly the increased revenue that comes along with this type of activities. What’s more, the return of the online intermediaries’ traditional services also depends on the prices defined by the hotels or property owners. Online intermediaries thus all have interest in optimizing the hotel and vacation rental prices, to increase their overall turnover. When a hotel or property owner has difficulties to get his room rented because of incorrect pricing, the online intermediary can optimize that price (for which it receives a fee for technology use), get the room rented and receive a commission from the host or hotel. This means double profits for the online intermediaries.

Online intermediaries also face increased competition, not only from other online intermediaries but also from direct bookings. Hotels tend to invest more and more in their own marketing in order to increase the amount of direct bookings over bookings through intermediaries, because commission charges of online intermediaries are extremely high (up to 15% - 30%). Hotels ask the same price for direct reservation as an intermediary and thus they end up with less revenue per booking with the latter. More and more meta-search tools, such as “Book on Tripadvisor” and “Book on Google”, facilitate direct reservations with a search-engine program based on CPC (“Cost Per Click”). When users have clicked on the link of a hotel in this meta-list, they are instantly redirected to the hotel’s website in order to complete the reservation. Online intermediaries aim to counter this trend with an integrated RM system as lock-in method for hotels and property owners as incentive to keep using their services.

Next, there is the hotel- and vacation rental data that is of great value to the online intermediaries. When their clients subscribe to their pricing tool, most of the time, hotels and hosts need to enter confidential data in order to get the best pricing results. Clearly, online intermediaries are eager to exploit this data for their other activities.

Finally, online intermediaries face the threat of RM companies that possess technologies made to stimulate individual hotels and property owners to benchmark the usefulness of the online intermediary channels. These analyses could lead to hotels removing their listings from certain online intermediary websites. This is thus another incentive for online intermediaries to acquire RM technology firms. For example, before Priceline bought Price Match, Price Match disposed of a tool for hotels to tell when it became interesting for them to close down their OTA channels.

For hotel managers or property owners who make use of one channel, the main advantage of using an intermediary’s RM software is the convenience of having all services gathered at one place. But this argument of convenience brings along a lock-in effect. When the hotel or property owner aims to stop the partnership with that specific online intermediary, he will probably also lose its revenue management system. In addition, hotels and property managers face the risk that the online intermediaries will use their confidential data for other means.

Objectively, today the integration by online intermediaries can only effectively work when hotels or property owners make use of one distribution channel only. Multi-channel hotels need an integrated third-party system or a standalone revenue management system in order to manage the prices of its rooms on its different distribution channels. A large hotel cannot afford the time loss of daily check-ins on the extranet or web interface of the listing online intermediary website as it has other channels and direct bookings to manage.

But even for online intermediaries who target one-channel users, there are other challenges that should be taken into account. Of utmost importance is gaining the trust of hotels and property owners. Certain hotels and property owners believe that online intermediaries have an interest in prioritizing the optimization of the prices of certain key-client hotels who generate the most revenue and adjusting the revenue management of other hotels in the region negatively to suit that goal.

It is also difficult as a platform to decrease prices across the board of listings if the online intermediaries are not in parallel supporting that move with marketing practices. One can take the example of Airbnb. If Airbnb would suggest all hosts to drop prices but the number of Airbnb visitors would stay constant, it just means that everyone will make less money as everyone is getting the same advice and there are no additional travelers attracted to the Airbnb Platform.

In the years 2009-2012, the commissions paid by hotels for online intermediaries rose at nearly double the rate of the increase in hotel revenues. Because of these high commissions of OTAs, we see that hotels are trying to shift the market to direct bookings and meta-search websites. Hotels are increasingly using loyalty programs to drive more direct bookings. Some of these programs already offer special rates for members, which cannot be obtained via any OTA. This trend of increased direct bookings is likely to continue in the near future. Nevertheless, hotels should bear in mind that direct bookings also have an acquisition cost of direct marketing and sales spending: e.g. investments in Google Analytics, Facebook Insight.

Further, we are seeing more and more online intermediaries who try to obtain a full integration. They are hedging their bets for the future and aim to obtain revenues from every possible booking. For instance Priceline has the OTA-side covered with Booking.com as well as the meta-search bookings with Kayak, and for the direct bookings uses Buuteeq which is a digital marketing system for hotels to create and manage websites, mobile content, social presence, and online reservations. However, the flip side of the coin cannot be underestimated. Travelers using Kayak may end up buying on Expedia rather than on Booking.com. In general, these strategies face two major concerns. First, there is the trust issue. Most hotels are reluctant to hand over more power to OTAs. And second, hotels need to be able to access and utilize the RM software for all other platforms that they use, which is something that not all online intermediaries allow today.

Concerning the vacation rental industry, we predict a phase of consolidation in the near future. The higher the income of vacation rental companies, the larger the company’s budget and the higher the conversion rate will be on tools such as Adwords. This implies more power for the large vacation rental companies, which can be clearly seen when looking at the example of Airbnb.

Afterwards, on the long-term, the same trend as in the hotel industry will be observed where there will be more direct bookings in the vacation rental industry. Today we already see the first signs of increasing direct bookings in the vacation rental industry with the development of “brands” such as Interhome and Wyndham Vacation Ownership where travelers can do a direct booking.

Also in the RM software market, we will notice a trend of integration of all types of revenue generating services. TravelClick is already experimenting with different revenue generating services such as reservation-, web-, and business intelligence solutions.

We also believe that the revenue management market will most likely undergo a phase of consolidation. Therefore, RM firms that want to survive will need to dispose of a well-advanced pricing experience, which today surprisingly enough not all RM technology start-ups have. They also need software that understands the time shifts in the booking curve (i.e. understand when people book) and most importantly they need to integrate forward-looking predictive analytics into their technology. Traditionally forecasts are based on historical data. Forward-looking analytics take into account web-shopping behavior and analytics by channels and segments based on future pacing data. TravelClick launched Demand360, which was developed in the US partnering with Hilton, Marriott, Intercontinental, Hyatt and Starwood and gives hotel performance insights on future hotel data across channels and segments for a time horizon of 365 days. We believe that this technology will be the future for revenue management firms.

[1] It is also called maximizing the RevPAR (Revenue per Available Room), which is one of the main KPIs for hotel managers

Duetto – White Paper - Stop Guessing and Start Profiting: A Beginner’s Guide to Hotel Revenue Management

HSMAI & Duetto – White Paper – Opening the door to a new revenue

BeyondPricing - Interview on the growing interest of intermediaries in dynamic pricing (17/05/2016)