Fortune 100 response to DE&I pressures

Due to the increase in technology capabilities, human traffickers have become smarter which has made identifying Human Trafficking red flags even more imperative for Financial Institutions. Negligence in correctly identify Human Trafficking could lead to negative reputational risk and large fines.

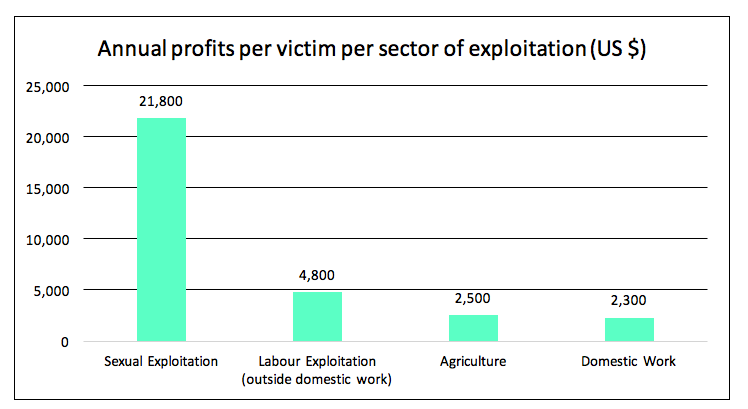

Behind Drug Trafficking, Human Trafficking has become the fastest growing and most profitable international illicit crime in the world. The International Labour Organization (ILO) stated that in 2016 an estimated 40.3 million people were in modern slavery, including 24.9 million in forced labor around the world. An estimate US$150 billion is generated each year from the theft of their labor globally. Human Trafficking is the recruitment, transportation, transfer, harboring, or receipt of people through force, fraud, or deception, intending to exploit them for profit. Figure 1 below is a diagram of the annual profits per victim of exploitation in 2014.

Figure 1: Breakdown of annual profits (in the millions)

Men, women, and children of all ages and from all backgrounds can become victims of these crimes, which occur in every region of the world. Traffickers often use violence or fraudulent employment agencies and fake promises of education and job opportunities to trick and coerce their victims. Migrants may be transported by air, sea, and/or land over international borders and through different routes to avoid detection. Human Trafficking can be conducted through a variety of activities involving the victimization of vulnerable individuals including:

Sexual Exploitation: Sex trafficking is the most prevalent type of human trafficking. Women and children are taken or duped and forced to commit commercial sexual acts for profit by the human trafficker.

Forced Labor or Slavery: Modern-day slavery is the forced labor of individuals who are coerced to work through violence and intimidation.

Removal of Organs: Transnational organized crime groups lure vulnerable people under false pretenses to have their organs removed either voluntarily or by force. These organs are then sold and jeopardize the health of the donating victim as well as the recipient.

Debt Bondage: Debt bondage is another form of human trafficking in which an individual is forced to work to pay a debt. Often victims are transported from other countries with the promise of work or a better life, only to be victimized into forced labor until a debt is paid.

While Human Trafficking might seem to only be an issue for other countries such as Asia, Africa, and/or South America, Human Trafficking is a very present challenge for the United States as well. Money Laundering linked to Human Trafficking is one of the most significant illicit finance threats facing the United States. The below diagram displays the distribution of cases related to Human Trafficking across the United States.

Figure 2: Human Trafficking Cases by State (2019)

Governments around the world and international bodies, such as the United Nations, have long recognized the importance of fighting against human smuggling/trafficking and modern slavery, as well as related crimes, and protecting victims. In this regard, several laws and regulations have been adopted by countries and internationally. Some of these laws and regulations are the Bank Secrecy Act of 1970 (BSA), USA Patriot Act of 2001, and the Trafficking Victim’s Protection Act of 2000 (TVPA). The TVPA, which was first enacted in 2000, imposes criminal liability on any corporation that financially benefits from Human Trafficking if such institution turns a blind eye to such schemes.

The below chart diagrams the rise in Human Trafficking Cases uncovered since the TVPA was enforced. The rise in Human Trafficking cases in recent years is further reason Financial institutions need to be vigilant with who their customers are. Failure to identify such illicit activity can have more than financial consequences as there are reputational impacts as well.

While there are certainly some completely un-banked traffickers, a significant portion passes through legitimate financial services businesses and cryptocurrencies. Federal laws, including the Bank Secrecy Act and the USA PATRIOT Act, mandate that financial institutions monitor for and report suspected illegal activity. The handling of funds generated by Human Trafficking can constitute money laundering and lead to significant fines for financial institutions for not detecting and reporting such illicit activity.

For example, a major European bank was fined US$150 million in penalties by the New York State Department of Financial Services for compliance failures related to the bank’s lack of oversight in dealings with accused child sex trafficker Jeffrey Epstein. Similarly, an Australian Bank was fined US$920 million by the Australian Transaction Reports and Analysis Centre for failures in AML reporting, record keeping, and detection, including transfers indicative of child sex trafficking.

Financial Institutions not only have to consider the negative monetary impacts Human Trafficking can have on them but also reputational impacts. Financial Institutions found to be ethically negligent in allowing funds from Human Trafficking to be funneled through their firm risk their reputation in the financial industry. Loss of reputation can impact clients’ trust in the firm which could lead to loss of clients and loss of revenue.

The financial industry understands that tougher fiscal investigations, more coordinated freezing of criminal assets, and digital payrolls can help combat Human Trafficking and Smuggling. Financial institutions face a lot of hurdles when trying to identify Human Trafficking including identifying transactional indicators (red flags), reporting, and updating policies and procedures.

The Organization for Security and Co-Operation in Europe (OSCE) compiled, analyzed, and synthesized the red flags into a Financial Investigations Tool comprising of almost 600 different indicators in 57 categories.

Financial Crimes Enforcement Network (FinCEN) in the United States issued Advisories (#FIN 2014 – A008 and #FIN 2020– A008) where FinCEN identified financial and behavioral red flags of Human Trafficking to be utilized in evaluating customers’ financial activities and outlined four (4) common typologies used by traffickers.

The starting point for effective financial investigations is the use of Human Trafficking red flags. These red flag indicators often relate to the spending habits of a customer of a financial institution. Using relevant red flags is key to tell institutions what to look for and increase the likelihood of accurate reporting. Unfortunately, Human Trafficking cannot be identified by one single red flag as payment schemes traffickers use are complex and often payment comes in various forms. For example, Traffickers often purchase large quantities of prepaid cards in cash and use those cards to purchase virtual currencies, travel tickets, food, or hotels. Peer-to-peer payment systems like Venmo, PayPal, and Zelle are also used to transfer funds quickly. Payments related to Human Trafficking are usually conducted in one of three ways:

a) Pay in Advance: This form of payment is often made by relatives of unaccompanied minors.

b) Partial Payment: before departure and another portion upon arrival.

c) On Arrival: full fee is paid on arrival.

With various methods being utilized by traffickers to cover their illegal activity and movement it is often difficult for Financial Institutions to identify the activity correctly.

Sia Partners has experience in identifying and assessing Human Trafficking red flags, as well as writing Suspicious Activity Reports (SARS) to report such illicit activity.

Identifying Human Trafficking suspicious activity and red flags requires adequate Training and up to date Policies and Procedures. Criminal perpetrators are constantly developing new techniques and more advanced crime tactics to avoid detection and prosecution. It is imperative Financial Institutions are kept up to date on the latest bills passed by the government and ensure their training and policies and procedures reflect these changes. Lack of adequate training or outdated policies and procedures can cause red flags to be missed and Human Trafficking to go undetected or labeled as something less minor within a SAR.

Financial Institutions can assist law enforcement in identifying cases of Human Trafficking by SARs. However, due to the complexity and anonymity of the Traffickers payments, financial systems often experience very low reporting numbers due to an over submission of SARs that contain no real value, a lack of investigator training, or lack of appropriate tools in place to identify and report promptly suspicious transactions to law enforcement. Law enforcement and prosecution face several challenges in combating Human Trafficking such as lack of cooperation from victims, language barriers between victims and law enforcement, and time in gathering adequate information and facts to prosecute, hence law enforcement often relies on information provided by SARs to help in their investigations. It is therefore crucial for Financial Institutions to have adequate reporting against Human Trafficking.

There are over 25 million victims of Human Trafficking around the world, and this is estimated to be a US$150 billion global industry.

Human Trafficking can come in the forms of Sex Trafficking, Forced Labor/Slavery, or the purpose of removing organs.

The Trafficking Victims Protection Act imposes criminal liability on any corporation that financially benefits from Human Trafficking. Financial Institutions can be civilly liable to victims if evidence shows the company financially benefited in the involved trafficking scheme.

Financial Institutions found to be negligent in allowing funds from Human Trafficking to be funneled through their firm risk reputational consequences. A negative reputation can lead to loss of clients and revenue.

Due to the complexity of payment methods traffickers utilize, identifying red flags can be difficult, and identifying one red flag might not be enough to uncover all the illicit activity that might be occurring.

Updating an institutions’ training materials can help assist employees in identifying when Human Trafficking is occurring in a customer’s account.

Enhancing an institutions’ policies and procedures can assist with lessening the risk of red flags of illicit activity going undetected and will assist employees in reporting accurate and helpful Suspicious Activity Reports to law enforcement.

Financial institutions face the risk of being vulnerable to Traffickers who use their accounts for illicit activity which may result in fines and negative reputational impact. Our consultants are subject-matter experts in transactional monitoring and identifying red flags indicating Human Trafficking. Our capabilities include:

Other articles, recently published by Sia Partners, continue the Regulatory Compliance theme explored by our experts: