Modernizing Voluntary Corporate Actions with…

ABOUT HANG SENG INSURANCE

Could you give us a glimpse of your career until Hang Seng Insurance?

I have been with Hang Seng Insurance since 2011, after seven years as Chief Actuary of HSBC in Shanghai. Overall, I have over 20 years of experience in the bancassurance industry, switching from a technical background to the business side.

Who are Hang Seng Insurance’s clients?

We have the advantage to lean against the huge HSBC group customer base (3.5 million customers in Hong Kong) and thus, to target clients with an existing banking relationship. Our high level customer segmentation is aligned with the HSBC one:

A similar segmentation, but a customer mix local vs. Mainland leaning the other way. Why do the latter come to Hong Kong? Financial services, shopping, medical care and education. If Hang Seng cannot compete with international banks on the first one, our health and wealth proposition makes the difference on the two last.

Over the past years, we deepened this need-based approach by refining how relationship managers recognize our customers’ lifestyle priorities. Our job is to identify needs and respond with the right products and underwriting processes, depending on segment sub-sets.

What does Hang Seng Insurance offer to its customers?

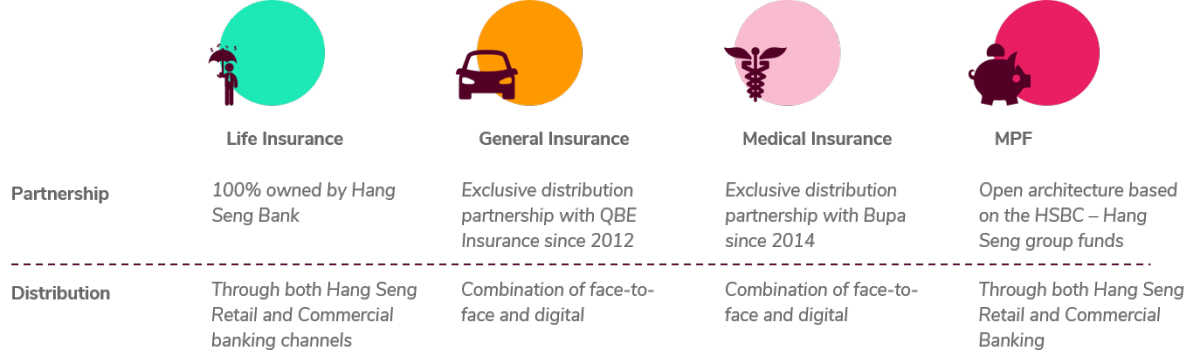

Hang Seng Insurance business is based on four pillars:

Focus on Medical - Being a key coverage gap in Hong Kong, Medical drives business opportunities as people look for further cover. However, where Life requires an underwriting and investment expertise, Medical is about network management (doctors, clinics, and hospitals). We had to either on-board a dedicated team, or partner with experts. We went for the second option with Bupa, renowned for its network (they include for instance Quality HealthCare Medical Services, as one of the Hong Kong’s largest private clinic networks).

How does Hang Seng Insurance differentiate itself in terms of distribution?

My experience in the bancassurance industry allows me to say that an agency model is far different from a partnership one. Where the first is more of a hunt, the second is about farming. As we build on an existing customer base, our main challenge is to improve our penetration rate.

When you ask about distribution strategy, I answer that the key for a bancassurer is segmentation. As farmers, we feel which soil is good to grow what. Understanding customers first, allocating channels in a second step, recommending products then and design processes in the end. This sequence is our mantra.

How do you target the different customer segments?

By way of example, we serve our Life customers according to their risk appetite and financial experience. As no investment product can be sold to “green zone"1 clients, we rely on Hang Seng branches General Banking Officers to convey our insurance offer. In the “red zone”, our relationship managers take the reins to address the High Net Worth segment.

As a bancassurer, how do you leverage cross-selling opportunities?

We dig into cross-selling opportunities between bank and insurance through propensity models. However, let’s imagine a bank client who domiciles his payroll and mortgage monthly instalment on his Hang Seng Bank account. We are in a capacity to assess his financial health and avoid anti-selection.

The problem resides in the huge number of attributes available. Do we have mortality tables associated with each customer profile? No, we only got our classic criteria such as male/female, smoker/non-smoker that are yet to apply with valid association. Our mission is to build meaningful models from scratch which is not easily available in other incumbents. Once it’s built up, it’s hard to copy, and that’s a differentiating factor. Three challenges come out of this premise:

Besides offering a better product match and prices, collaborating with the bank allows us to better understand our clients’ risk profiles, allowing us to customize our interactions and improve our omni-channel journeys. Imagine we have a 5-page online process, telesales can help to manage drop-off in real-time based on our preferred risk. Data sharing allows our channels to not compete, but complement each other.

Which initiatives is Hang Seng Insurance working on in the digital distribution space?

We are launching our first online Life product in Q4, a cancer plan distributed through the Hang Seng online platform. A good bet to start with, as anyone can easily feel the need for such products. Amongst other Life products, I have not found any online success so far, which there must be a reason behind!

Still, I believe that compared to pure agency insurers, Hang Seng is in a better position to develop Life insurance online. Two reasons: we have very little channel conflict thanks to our distribution mix, and we have both big data and online platforms as a bancassurer. Platforms are the foundation of any digital strategy. You may have the best product in the world, if you have no platform it is pointless.

Today, digital in banking is used more for transactions and servicing. Tomorrow, it will be much more extensive, enabling the sales function with smart association for instance – when we sell a mortgage, we want to be able to recommend the insurance policies that relate to it (domestic helpers, home content, mortgage reducing term, etc.). We are looking at strengthening the digital origination and opening. I believe that digital is much more than just a support to the sales process.

What will be Hang Seng Insurance main challenges over the next couple of years?

Our greenfield is digital. Even though my business will survive without digital for two years, it’s easy to fall into the trap of “it’s not urgent”, as it will be very hard to catch up. Hang Seng has all its key edges at current including the critical mass, the banking relationship and the data to drive a very good branding, and it’s time to invest in digital.

1 As defined by the Hong Kong regulation authorities