Fortune 100 response to DE&I pressures

Banks have a crucial role to play in financing a green transition while also being vulnerable to the risks resulting from climate change. This article will focus on seven main challenges which await banks regarding climate change.

Over the last hundred years, the human population has contributed to an acceleration of climate change. This does not solely entail higher temperatures, but also a higher frequency and intensity of extreme weather events which has major consequences for the global economy. The European Investment Bank (EIB) is one of the world’s main financing institutions to tackle climate change by financing the transition to a more sustainable economy. The EIB does so by investing in and lending to sustainable projects. In order to achieve the EU’s ambitious goals up to 2030 regarding climate actions, trillions of investments in sustainable projects and companies are needed [1].

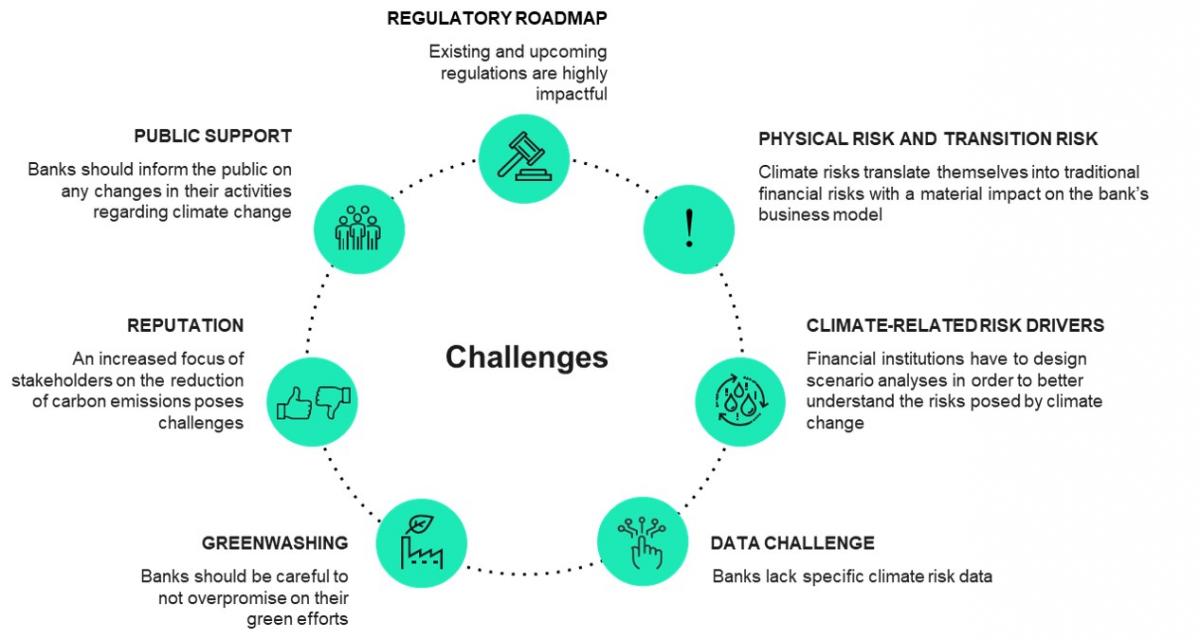

Currently, less than 10% of European firms are in line with the Paris agreement regarding the well-below 2 degrees Celsius pathway. Moreover, there is a lack of over €4 trillion which is needed to achieve Europe’s goals on climate action. Banks represent 95% of all corporate lending in Europe and as such, are perfectly positioned to make a significant and positive contribution to the transition to a sustainable economy. Moreover, the EU is leveraging the financial sector’s considerable influence to ensure a positive contribution to combat climate change through new regulation. Such regulation enforces banks to take climate-related aspects into account throughout the entire organization. As such, climate change provides a variety of challenges and opportunities for the banking sector. Banks have an important role to play in financing a green transition while also being vulnerable to the risks resulting from climate change and the regulatory efforts it takes to comply with new EU regulations. This paper will focus on seven main challenges which await banks regarding climate change. If handled appropriately, banks will not solely comply with climate risk-related regulations, but they will also be able to create and sustain long-term value. Below, a brief overview of the challenges is provided.

Figure 1: Overview of challenges for banks regarding climate change

Due to the EU’s ambitious goals regarding actions on climate change, numerous regulations have been drafted and are being drafted for banks to comply with. The high impact of these regulations on the organization, combined with the (relatively) short timeframe in which they will have to be implemented, will be challenging for banks.

Three of the main regulatory requirements are the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy, and the Sustainable Finance Disclosure Regulation (SFDR). These regulations aim to tackle a lack of legibility, greenwashing, and to meet investors' transparency requirements regarding Environmental, Social, and Governance (ESG) actions and policies. The objectives of these three regulatory requirements are as follows:

The diagram below depicts the synergies between the three regulations.

![Figure 2: Synergies between the EU Taxonomy, the CSRD, and the SFDR [2]](/sites/default/files/styles/freeratiomedia_1200/public/image/picture/2021-08/Fig%202_0.jpg?itok=sCy1bNCX)

Figure 2: Synergies between the EU Taxonomy, the CSRD, and the SFDR [2]

Physical risks appear from an increased frequency of impactful climate events. These risks can be either acute or chronic. Acute risks are the consequence of direct climate events such as storms, floods, and drought. Chronic risks are the result of long-term climate events such as the rise in sea levels. Transition risks appear from the adjustments towards a carbon-neutral economy. These adjustments concern new climate-related policies and technologies and a shift in the market sentiment.

Both of the aforementioned risks impact economic activities and, as such, the financial system. Direct impact occurs through, for instance, the devaluation of assets whereas an indirect impact can stem from macro-financial adjustments. Moreover, both physical and transition risks can translate into liability risks due to legal claims on the bank and reputational risks due to inaction.

Furthermore, physical and transition risks are prudential risk drivers which can be translated into credit risk, operational risk, market risk, and liquidity risk. The materiality of these risks affects an institution's business model, particularly when the business model is dependent on sectors that are vulnerable to climate and environmental risks. Below, an overview created by the ECB is shown, which presents examples of climate and environmental risk drivers.

![Figure 3: An overview of climate-related and environmental risk drivers [3]](/sites/default/files/styles/freeratiomedia_1200/public/image/picture/2021-09/Fig3.jpg?itok=5uFSgD84)

Figure 3: An overview of climate-related and environmental risk drivers [3]

As climate exposed risk types are becoming increasingly relevant indicators, banks will more often include these risk drivers into risk management and modeling methodologies. The impact of climate risk drivers on banks can be observed through the traditional risk categories as discussed in the previous chapter. Banks should incorporate these climate risk drivers in models throughout the whole credit lifecycle at pricing, product origination, monitoring, or predicting the impact of a default. Furthermore, scenario analysis and stress testing can estimate the impact of an increase in climate risk on the P&L and on the balance sheet.

Climate risk drivers can have multiple characteristics which need careful consideration. Below, a list of such characteristics is provided. [4] [5]

Financial exposure

Real economy

Timeliness

The below figure depicts that in order to have a good estimate of both physical and transition risk drivers on exposures, financial institutions have to apply tailor-made scenario analyses to have a better understanding of the climate risk drivers.

Figure 4: Including Climate risk drivers into modelling landscape

As previously mentioned, most traditional banks face insufficient data availability and quality in their legacy systems. In order to become an increasingly data-driven organization, banks need to improve their data governance strategy. Dealing with specific climate risk data is no exception, relevant climate data are missing or not granular enough in many cases. [5]

This data gap on climate exposure is critical for risk management. Banks are required to have quality data points at the product origination and throughout monitoring phases. The first step to achieve this is a bank-wide dedicated climate risk policy framework. The second step is to create a common understanding of definitions, where the EU taxonomy regulation will provide clarity. Finally, data governance should be structured in a way that collected data will be of high value. Data availability might be an impediment in many cases. Building up a relevant and reliable ESG database from clients and external sources takes time and effort.

Governments and regulators should also enable the creation of publicly available climate datasets. One of the considerable initiatives is Copernicus. This EU-funded program aims to collect and make publicly accessible global, continuous, autonomous, high-quality, wide-range Earth observation data to enable better understanding and mitigation of climate change.

Greenwashing covers the activities and policies of a bank that are meant to create a perception that the bank is concerned about the environment and climate change, whereas in reality, the bank’s business is not environmentally sound.

The European Parliament has approved the aforementioned Taxonomy Regulation in 2020. The regulation determines which financial investments can be deemed environmentally sustainable. The legislation will make sure that people cannot be sold fake green investments any longer, and instead, money can then flow to actual sustainable businesses. The Taxonomy Regulation does not solely aim to prevent greenwashing but also aims to prevent any misallocation of investments and to ensure investor protection. The regulation contains requirements on transparency, methodologies, management of conflicts of interest, internal control processes, and dialogues with companies that are subject to sustainability ratings.

Hence, the challenge for banks related to greenwashing is two-fold. First, banks should be careful not to take part in greenwashing by overpromising their green efforts. Second, banks should comply with the Taxonomy Regulation, preventing greenwashing. The latter might be challenging in terms of time, effort, and costs.

The growth in stakeholders’ focus on corporate action regarding the reduction of carbon emissions and other sustainable actions can result in increased reputational risk. As was mentioned previously, reputational risk can arise due to the passivity of banks to act upon the mitigation of physical and transition risks. The manifestation of such reputational problems related to climate change and how they influence a bank’s operations to differ by the sectors in which the bank operates. In particular, banks are under growing scrutiny in relation to their lending or investments in the fossil fuel industry and especially in new coal mining. More importantly, by funding renewables, banks do not mitigate the criticism regarding their support of the traditional fossil fuel industry (i.e. financed emission). As such, a bank that invests in (or lends to) businesses that contribute to higher carbon emissions may deal with a decrease in client and employee loyalty, and investor divestment. Consequently, banks are incentivized not to finance environmentally controversial activities, or more generally, activities that detract from the transition to a lower-carbon economy.

Banks are key players in the global financial system and, as such, their activities regarding climate change are important to the public. As mentioned in the previous paragraph, the growth of the stakeholders’ focus on banks’ actions – or inactions – concerning climate change has increased the reputational risk of banks. However, besides a reputational aspect, banks directly influence clients and other stakeholders by implementing changes with respect to climate change. For instance, new regulations on loan origination force banks to take ESG-factors into account and to report on them. For collateral, this could mean that banks report on energy labels of real estate. The realization of these changes directly affects their clients and therefore banks face the challenge of timely and effective communication to their stakeholders. Proper management and execution of this communication will help to keep the public engaged and onboard.

[1] European Investment Bank (2021) Climate and environmental sustainability.

[2] Sia Partners (2021) Regulatory changes to meet investors' transparency requirements in the context of Green Finance. Retrieved from: https://www.sia-partners.com/en/news-and-publications/from-our-experts/…

[3] European Central Bank (2020) Guide on climate-related and environmental risks. Retrieved from: https://www.bankingsupervision.europa.eu/legalframework/publiccons/pdf/…

[4] Basel Committee (2021) Climate-related risk drivers and their transmission channels.

[5] Dutch Central Bank (2020) Climate risk and the financial sector: sharing of good practices.