SEC Division of Examinations Releases 2026…

Liquidity risk management is a key factor in a bank’s ability to remain stable during economic downturns.

A prime example of this is seen in the financial crisis of 2008 when many banks in the US went bankrupt even though they were well capitalized in accordance with regulations. The most important problem was that these banks could not raise enough funds to fulfill their financial obligations as they came due. The ability to fulfil financial obligations as they come due is liquidity risk management. In addition, liquidity risk is interconnected with market risk and credit risk, which impacts the overall economy. Since the financial crisis, the Basel committee has come up with a series of new guidelines, with the aim of improving banks’ liquidity risk management practice and the stability of the financial market.

Banks in China are faced with a challenging environment. Unlike their western counterparts, China exercises a “controlled economy”, where aspects such as interest rate and RMB exchange-rate are determined by the government. In addition, Chinese banks and public investors are relatively less experienced in overall risk management. In this article, we explore the liquidity risk challenges faced by Chinese banks under the external diverse risk factors such as the interest rate liberalization, shadow banking, RMB depreciation, and capital outflow. We also look at what actions that have been taken, or should be put in place, to mitigate the liquidity stress.

China’s GDP is unique in that its growth rate has remained close to double-digits for many years until recently. With the slowing of the world economy, China is struggling to adapt and transform its economic structure. China’s GDP growth rate has experienced a continuous slow-down. As seen in Figure 1, the trend of China’s GDP growth rate is of a decreasing pattern.

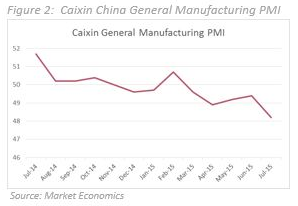

Moreover, the Caixin China General Manufacturing PMI, an indicator to Chinese economy, dropped to a two-year low of 47.8 in July 2015, as shown in Figure 2. This metric is an indicator of the health of the manufacturing industry, and is collected by surveying manufacturing enterprises on their purchasing activities and supply inventory. When demand for their products decreases, manufacturers will decrease supply orders as a result. A reading above 50 indicates expansion, while a reading below 50 represents contraction.

The Chinese workforce has been relying on the manufacturing industry and infrastructure investment to provide employment and avoid subsequent social unrest. However, the general public has reached a consensus that the current model of export-driven, manufacturing-oriented economy is not sustainable. Therefore, the government has been trying to direct the economy toward a consumption-oriented model. In this model, internal customer consumption should contribute to the bulk of the economic activities. The goal is for the manufacturing sector to gradually reduce in size while the service industry picks up the leading role. However, if the service industry cannot compensate for the decrease in manufacturing, we still expect to see a decline in economic activities, which then translates to lower profits for the banks.

In order to maintain a relatively stable economy and avoid dramatic drop in GDP growth rate, the Chinese government has employed (and will continue to do so in the future) a series of easy monetary policies[1], including adjustment of interest rates, reserve ratios, providing MLF (Medium-Term Lending Facility)[2],and so on.

Interest Rate Liberalization is another high-level tactic the government intends to adopt. It is global consensus that interest rates should be determined by market forces rather than controlled by the government. Under a controlled interest rate environment, a country might have inefficient allocation of financial resources. For example, during inflation, a controlled interest rate usually leads to a negative or very low real interest rate. Such low real interest rate encourages leverage and unproductive borrowing activities.

China’s interest rate has always been controlled by the central government, including lending and deposit rates. In recent years, China has come to realize the benefits of free, market-driven interest rates. While they have committed to the liberalization of interest rates, they continue to insist that the process has to unfold slowly.

As we have seen in Figure 3, in 2013, the lending rates are effectively fully liberalized. What is remaining is the liberalization of the deposit rates. Although we have seen large progress so far, over half of the surveyed financial institutions and senior executives anticipate that China will take another 5-10 years to complete the liberalization process[3]. China policy makers are afraid of the negative impacts on the banking industry if the interest liberalization process is too rapid. On the other hand, when the process is too slow, there are also many side-effects, one of which is the burgeoning of the shadow banking where people try to perform “regulatory arbitrage” through non-banking institutions. We will discuss this more in details later.

As seen with other international liberalization efforts, deregulation of interest rates might lead to higher interest rate volatility, higher funding costs, higher competition for deposits, more compressed net interest margin, and lower banking profits. Some of these impacts are already seen in Chinese banks.

The impact to small and medium-sized banks is more prominent than to larger banks. First, most of these small and medium-sized banks depend more heavily on wholesale funding markets than on the retail depositors. Wholesale funding sources are usually less stable and have higher volatility. It is also more affected by the interest rate liberalization process. As well, smaller banks are less experienced in adequately evaluating counterparty risk in their product pricing compared to the big banks. Both of these translate to increased challenges to smaller banks when managing their liquidity risk. This will be more obvious in the section of this article titled, Impact to the Banks.

As part of the grand plan to liberalize interest rates, the Chinese government also introduced a formal deposit protection scheme in May 2015. Under this scheme, up to 500,000 RMB deposited by individual or entity in each bank will be insured. This is to establish a legal framework to allow banks to default. Again, this is a dramatic shift in the mentality of both the banks and the public. The idea of “implicit guarantee” on the deposits or central government as last resort to bail out the banks will no longer exist. Both the banks and depositors need to fully evaluate the risks this imposes and demand an appropriate return accordingly.

One topic that is commonly linked to liquidity risks is the concept of “Shadow Banks”. They played an important role in the whole economy. A lot of the lending and borrowing activities take place through the “Shadow Banks”, and that accounts for a large portion of the overall economy. The Financial Stability Board (FSB) defines “shadow banking” as “credit intermediation involving entities and activities outside the regular banking system.” In general, the group of companies, commonly known as “shadow banks”, include trust companies, money-lenders, micro-finance entities, and even pawn-shops. Banks, although not included in the classification of “shadow banks”, are also heavily involved in shadow banking activities.

The popularity of shadow banking is mainly due to the supply and demand of the market as a consequence of restrictive regulations. One such restrictive regulation is the control on interest rate, mentioned earlier in this article. In addition, the traditional loan business is subject to strict regulatory supervision and control. Below are some examples of strict regulatory requirements:

As a result of the above mentioned regulatory requirements on lending, much of the credit ends up going to the state-run enterprises. For banks that have limited funding costs due to the cap on deposit rates, it is to their advantage to lend to state-run enterprises. State-run enterprises are assumed to have lower credit risk, and the support of the government if they run into trouble. On the other hand, the large demand from private sectors and SME for credit is left unsatisfied.

Chinese households desire a more favorable return on their capital. This is where shadow banking provides value-add, as they can usually provide a much higher rate to the depositor. It is this combination of the supply and demand that fuels this rapid growth of the shadow banking sector.

Many traditional banks are also heavily involved in shadow banking activities (in the case of those wealth management products) in order to keep the loans off their balance sheets. For example, Wealth Management Products (WMPs) are usually sold to the public on behalf of the trust companies. The trust companies make loans to the bank’s clients with the agreement that the bank will buy the loans back. This allows traditional banks to skirt around regulatory capital requirements as these loans do not exist in the bank’s balance sheet. This also gives banks greater flexibility in their pricing.

The volume of shadow banking activities in China is not huge compared to other world economies. However, what is alarming is the speed at which it grows. WMPs have been playing a major role in the shadow banking sector, as shown in Figure 4.

In 2014, issue rate of Banking WMPs grew at a fast pace. 291 commercial banks launched 68,500 WMPs, totaling 43 trillion RMB. Furthermore, when we look at the maturity of WMPs, as in Figure 5, most of them are in the 1m-3m bucket. Short-term WMPs put a large pressure on banks’ liquidity, as the banks need to raise enough cash to pay the obligations as they come due in the short term. This further exemplifies the need for enhanced liquidity risk practices across Chinese banks.

In summary, the main challenges posed by shadow banking include the following:

The recent sudden devaluation of the RMB against the USD (11 Aug 2015) has sent shock-waves across stock markets around the world. The move has been interpreted by some as China’s attempt to boost competitiveness of Chinese goods abroad in order to achieve the 7% GDP growth target. However, the real intent might be to make the currency more in line with its major trade-partners, as part of a move toward a freely-exchanged currency. Regardless of why the RMB was de-valued, it certainly broke the long time belief of many investors that RMB will continuously appreciate in the long run. The sudden devaluation led to a sell-off of the currency, because many people fear that it was the beginning of a sustained devaluation of RMB.

Foreign investment is also starting to leave china as expected return on capital is decreasing due to the RMB depreciation. Figure 6 shows China’s monthly foreign exchange reserve balance in the past few months. It had the biggest-ever monthly drop in dollar terms in August 2015. This is the result of the capital outflow. China uses the foreign exchange reserve to manage the exchange rate against foreign currencies. When there is an outflow of foreign capital, China needs to stabilize by buying RMB and selling foreign currency held in the reserve, resulting in the drop of the foreign exchange reserve balance.

This outflow of capital reduces liquidity in the market by decreasing the money supply. It could also lead to higher funding costs for banks, therefore also adversely affecting profits.

The NPL (Non-performing loan) rate of Chinese banks have been increasing from lower than 1% in 2013 to 1.5% in 2015 Q2, as shown in Figure 7.

Figure 8 shows the NPL rate across 6 major Chinese commercial banks.

The increase in NPL is a result of the general economic downturn, falling properties prices, and poor operating conditions of SMEs (small and medium enterprises).

In the meantime, the Provision Coverage Ratio of Chinese banks have continued to trend downwards, as shown in Figure 9. This can be explained by the fact that the banks are not willing to take a loss by recognizing non-performing loans despite some borrowers having a higher chance of default. Regulators require the banks to keep at least 150% provision coverage ratio. If this trend continues, banks will be forced to increase the provision for their loan loss, further reducing their profitability.

As shown in Figure 10, the interbank lending rate has been rising since the end of 2014. The Central Bank of China lowered the benchmark interest rate on 22th Nov 2014, thus suggesting both borrowing and lending rates should be lowered as well. Despite that the benchmark decreased, the monthly weighted average interbank lending rate rose from 2.82% to 3.49% from Nov. 2014 onwards. According to government report in 2014, even though nominal interest rates were lowered, real interest rates were still high due to the imbalance of supply and demand. The high demand and insufficient supply made the real interest rate remain at a relatively high level. This indicates that the liquidity released to the market was not large enough to cover the gap between funding supply and demand. At a later stage, the Central Bank of China lowered the reserve ratio and released more funds to deliver the message that China entered an easy monetary policy period. Regardless of efforts by the Central Bank, the interbank lending rate remained high until the end of the first quarter in 2015 when more easy monetary policies were implemented. Due to the distorted development of the banking industry, liquidity problems facing the banking system as a whole in mainland China might not be easily solved by the Chinese government’s actions.

Currently, the Central Bank of China has multiple options for adjusting to changes in market liquidity conditions beyond only changing regulatory requirements. For example, it introduced the concept of a Standing Lending Facility (SLF), which allows all banks to approach the Central Bank of China for funds when it cannot be sourced from the market. This is meant to reduce the funding rate volatility and help banks to better manage their liquidity risk.

Figure 11 shows the performance of the 6 largest commercial banks in China from 2013 to 2014. The Loan-to-deposit ratio of all banks, except for CMB, has increased from 2013 to 2014. Every bank’s loan-to-deposit ratio is approaching the upper-limit, 75%. Meanwhile, the return-on-average-equity was lower in 2014 than in 2013, even though all the banks have expanded their loan portfolios in 2014. The data indicates that the profit margin of these major banks is becoming narrower. Compared to the other 5 banks, CMB has the deepest drop in return-on-average-equity. This can be explained by having a higher wholesale funding rate. As explained previously, the higher wholesale funding rate has a larger effect on the smaller banks than on larger banks.

The Central Bank of China has been lowering nominal interest rates since Nov. 2011. According to the data on Wind, net interest spread of commercial banks in mainland China has decreased significantly since the easy monetary policies were implemented. The spread has lowered to a level where the banks could hardly make a profit. Most of the largest commercial banks in mainland China obtained a profit growth rate of 0% in the second quarter of 2014.

The narrowing of net interest spread imposed pressure on banks’ abilities to make a profit as well as their abilities to cope with liquidity stress. Narrower profit margin means that the disposable cash flow of banks is decreasing, and therefore has a higher chance of not meeting the cash outflow demands of their financial obligations.

In 2008, Chinese regulators first introduced Basel II into China. Since the economic crisis, the Basel committee further released Basel III guidelines in 2010. Following the Basel III release, Chinese regulators also issued a series of guidelines and regulations to implement Basel III in China. The requirements on CAR (Capital Adequacy Ratio) calculation (both the definition of capital and the additional risk coverage in trading book, CCR, CCPs), Leverage Ratio, Liquidity Indicators and so on, put a higher demand on Chinese banks’ risk management and reporting capabilities.

Specific to liquidity risk, China Banking Regulatory Commission (CBRC) issued “Liquidity Risk Management of Commercial Banks” in 2014. In that regulation, the liquidity coverage ratio (LCR), loan-to-deposit ratio, and liquidity ratios were laid out to improve the bank’s liquidity risk management practice. Commercial banks need to meet the 100% Liquidity coverage ratio provision (High Quality Liquid Assets / Net Cash Outflows over 30 days) before the end of 2018, but there is a transition period before the deadline to allow the banks to gradually reach the 100% requirement.

Due to stricter regulatory requirements and more focus on improving their capability in liquidity risk management, the banks need to take steps to adapt to the new situation. The steps that can be taken are classified into the following categories:

First, they need to build or revamp their existing enterprise risk management system to comply with simulation and reporting aspects of the regulation. Many of the Chinese banks are still handling this in a relatively manual manner. The new regulations place higher demand on the extensiveness of data to be collected, responsiveness of the simulation run, accuracy of the reported results, and complexity of the modelling involved.

For example, the data required for classifying assets (i.e. what qualifies as the high quality liquid assets, HQLA) might not exist in the current database. How to get and use this new data to meet the LCR calculation requirements is a challenge for the banks. Significant changes to the bank’s business processes might be necessary to collect the data.

Banks also need to be able to stress-test their portfolios and let users understand what the potential liquidity impact is under different scenarios. The stress scenarios can be firm-specific, market-wide, or a combination of both. In addition, users in the bank would like to know what the impact (in terms of the LCR changes) is under different counteracting strategies.

The implementation of liquidity risk management systems in China is still far from satisfactory, mainly due to the lack of motivation in developing a comprehensive risk management system. Banks are guaranteed an interest margin (due to the interest rate control), and thus guaranteed a certain profit. It is generally believed that banks are implicitly backed by the central government. Even if they were in financial difficulty, they could still count on the central government to bail them out.

However, with the progress in interest rate liberalization and the changing attitude of the government towards bailing out the banks, the previous assumptions will not hold much longer. Therefore it is imperative for Chinese banks to build or revamp their existing risk management systems to cope with the new challenges.

Second, the models used to predict customer behavior might need to be re-evaluated for their validity under the current regime. The customer behavioral models include the prepayment rate in mortgage payment, runoff rate of term deposit, loan withdraw rate of facility, and so on. If such models do not already exist, new models need to be developed and incorporated into the risk management system so that the correct future cash flows can be accurately forecast.

Banks should also take this opportunity to properly build up their FTP (Fund Transfer Pricing) models to ensure that liquidity cost is also built into the FTP calculation.

There is in general a lack of expertise in the risk management domain across Chinese banks. The commercial banking industry in China has a short history as they were previously state-owned. In addition, their profits were also guaranteed by the government so there was no need to consider risk management before. There is also limitation on their practice to rely on third-party consultants as consulting experience in other parts of the world is not easily applied to China. Therefore, Chinese banks are required to improve their own expertise in the risk management domain.

Third, in order to remain compliant with the LCR or other regulations, banks might need to adjust their business strategies. Such strategies include both short-term and long-term initiatives. On their balance sheet, banks might choose to extend the maturity of liabilities, or move them from wholesale to retail funding. On the assets side, they might choose to reduce the maturity of the loans such that they fall under the 30-day point of LCR (to reduce the net cash outflow within the 30-day limit), or switch from less-liquid assets to more liquid government bonds.

The challenge here is that China has limited collateral options in regards to liquid government bonds when compared to western banks. According to Fung Global Institute, the turnover ratio for China’s government bonds ranges from 0.3 to 1.9, compared to 10 for the US Treasury market, and 5.9 for Japanese government bonds. Turnover ratio is a measure on how often a bond is traded on the secondary market. Higher turnover ratio means that the bond is more liquid.

The foreign currency exchange restrictions in China further hampers the transferability and convertibility of RMB with other foreign currencies under a stressed environment. This also needs to be taken into account when Chinese banks are devising their strategies.

We believe that this liquidity pressure on the banks will last for a relatively long time due to the economy’s downward pressure and policy changes implemented by the Chinese government.

Given the changing economic structure, prevalence of shadow banking, and the anticipated capital outflow, lower banking profits are expected in the future. Chinese banks are already experiencing more volatile and high funding costs, deteriorating asset quality, and smaller net interest margin. These attributes reinforce the need for liquidity risk management strategies within the banks.

Policy-wise, in the long term we anticipate that the government will continue to improve regulations in response to the changing economy (the change from a more export-oriented and investment-driven economy to a consumption-based and domestically-driven economy).

In the short term, some contradictory actions have been used to manage the economy. For example, the Central Bank of China has lowered interest rates and the reserve ratio to provide more liquidity to the market. At the same time, it also used foreign reserve funds to support the exchange rate of the RMB, leading to a decrease in liquidity. These moves might seem contradicting at first, but their purpose is to maintain the stability of the market in the short run. The central bank will continue to implement these short-term measures as it sees fit.

As the government is developing a more market-driven and healthy banking industry, the assumption that the banks would always be supported by the central government is gradually disappearing. This requires the banks to improve their credit analysis and risk scoring capability to better align their risk and return. In addition, they need to improve their information systems and data management capabilities to gain more insightful and responsive analysis to the liquidity situation. In the long run, the banks need to adjust their business strategies to keep up with changes in external market, government policies, and regulatory environment.

[1] An easy money policy is a monetary policy that increases the money supply usually by lowering interest rates or other measures.

[2] MLF (Medium-Term Lending Facility) is a mechanism that allows individual banks to borrow money from the central bank.

[3] This is according to a survey done by PriceWaterhouseCoopers.