Sia Partners 2024 International Mobile Banking…

Balancing core operations with energy transition initiatives

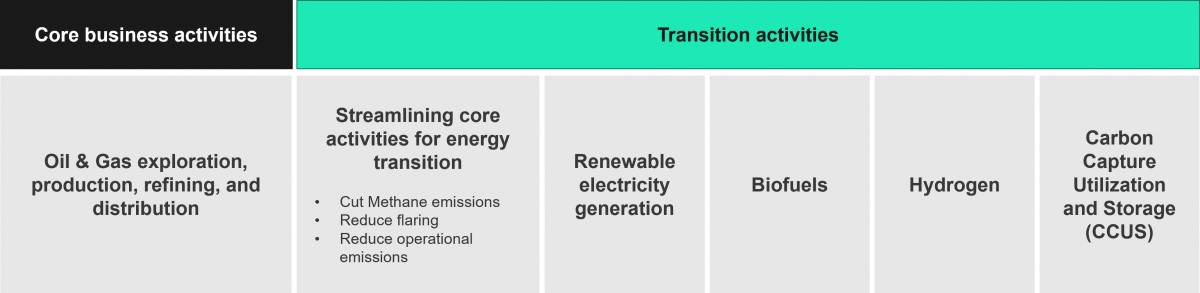

The Oil & Gas industry is facing heightened scrutiny amidst the global energy transition and the imperative to address climate change. Companies, rebounding from COVID-induced revenue declines, find themselves at a pivotal juncture, weighing the decision to prioritize investments in core operations or embark on substantial energy transition initiatives.

Sia Partners delves into the investment strategies of eight prominent players across the global Oil & Gas value chain (BP, Chevron, Equinor, Exxon Mobil, Saudi Aramco, Shell, Suncor and Total Energies) spanning from 2018 to 2022. The aim is to evaluate whether these companies adhere to conventional approaches or transition towards sustainable models, consequently influencing the industry's trajectory to achieve zero emissions.

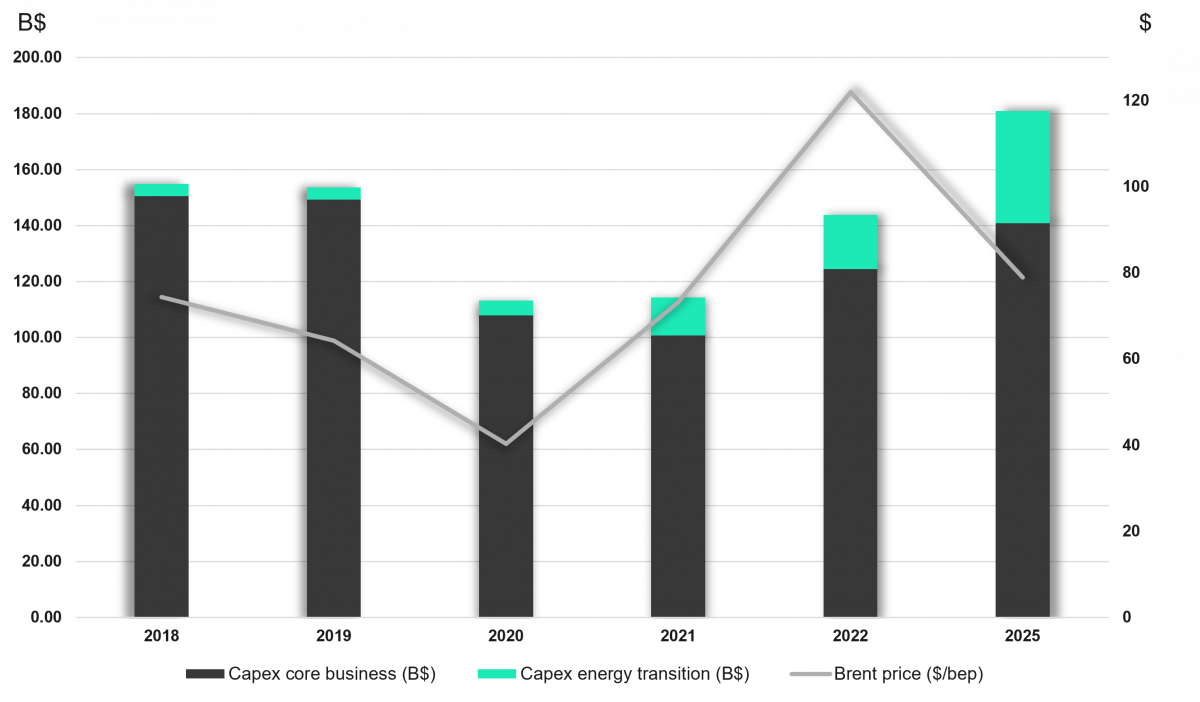

Following a revenue decline during the COVID-19 years, leading Oil & Gas companies have recovered remarkably, with record profits and positioning themselves for reinvestment. The cumulative investments of these eight companies are on the rise in 2022 and are anticipated to further increase through 2025. But where exactly are these investments being directed?

Our analysis reveals 2 key elements:

With investments on the rise, Oil & Gas companies are strategically directing their focus towards core business operations. In 2022, a substantial $124 billion was allocated to these activities, marking a notable 23% increase from the previous year and constituting a significant 87% of capital expenditures. Concurrently, although currently representing a smaller portion, investments in energy transition activities are experiencing rapid growth. In 2022, they accounted for 13% of total investments, showcasing a robust 42% increase from 2021 figures.

Looking ahead, projections indicate a further 17% uptick in core investments between 2022 and 2025, solidifying their position as a dominant allocation of capital expenditures at 78%.

Meanwhile, energy transition activities are poised for substantial expansion in the upcoming years. Projections suggest they will surge to encompass 26% of total investments by 2025, representing an impressive +108% increase in invested funds compared to 2022.

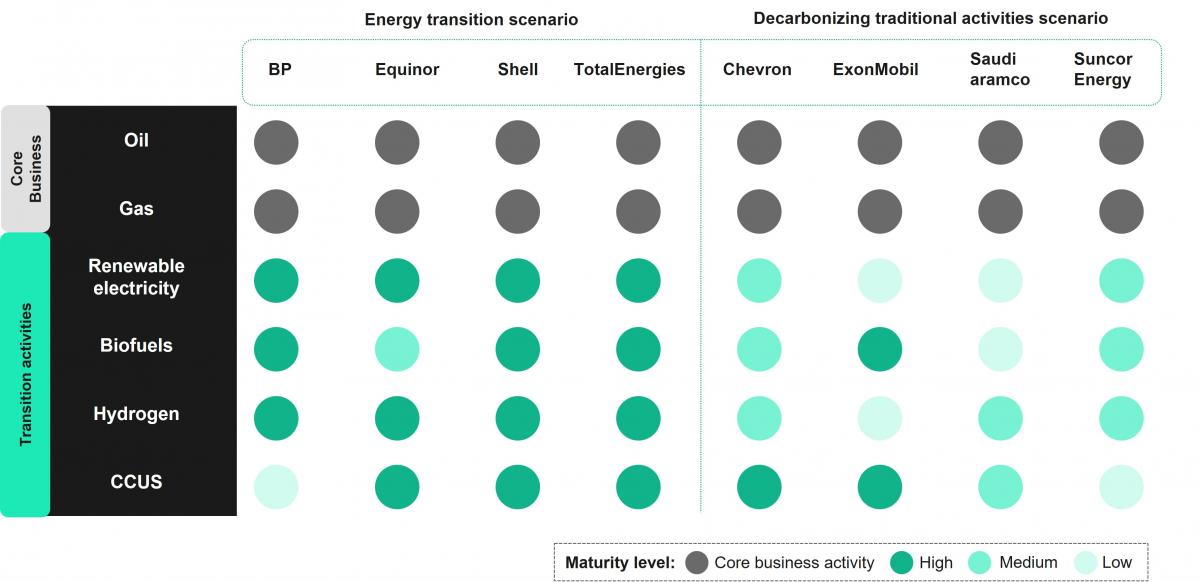

Within companies, 2 distinct groups seem to stand out in terms of their strategies:

Following a thorough analysis of global investments in both energy transition and core business, we will explore how companies distribute their investments among various identified subcategories.

Transitioning from our comprehensive examination of global investments in energy transition and core business, the subsequent section illuminates specific focus points. These segments dissect the strategies and investment endeavours pursued by key players in the Oil & Gas sector across several identified subcategories.

Considering the information provided, it's evident that investments in CCUS and H2 enjoy broad consensus among Oil & Gas companies. This stands in contrast to other renewable energy sources like wind and solar, which, while increasingly adopted, face challenges in widespread adaptation. This alignment underscores the industry's commitment to exploring diverse pathways toward sustainable energy solutions.

The detailed analysis of the activities carried out by market players confirms the presence of two groups within the industry: those embracing the energy transition scenario and those focused on decarbonizing traditional activities.

Oil & Gas companies have embraced two main strategies: one group persists with business as usual while intensifying efforts to mitigate emissions, while another is gradually shifting towards more sustainable practices. The distinction is evident in the resources allocated to transition activities and the advancement of these initiatives.

As the 2024 annual reports are unveiled, we anticipate discerning whether these trends endure or if companies are poised to enact significant shifts in their approaches.