Control Room of the Future

Navigating an Eventful End of Year: New Alliances, Market Shifts, and a Landmark COP 28 Agreement

| 2022 | 23Q1 | 23Q2 | 23Q3 | 23Q4 | 24Q1*** | ||

|---|---|---|---|---|---|---|---|

| Crude Prices ($/bbl)* | Brent | 100.8 | 81.2 | 78.3 | 86.7 | 83.7 | 82.7 |

| Rig Count | World | 1834 | 1900 | 1797 | 1760 | 1739* | - |

| Consumption/ Demand (mb/d)* | Total | 99.8 | 100.0 | 100.9 | 101.3 | 101.8 | 102.0 |

| OECD | 46.0 | 45.3 | 45.7 | 46.0 | 46.5 | 45.9 | |

| non-OECD | 53.8 | 54.7 | 55.2 | 55.3 | 55.3 | 56.1 | |

| Production/ Supply (mb/d)* | Total | 101.0 | 101.1 | 101.5 | 101.7 | 102.7 | 101.2 |

| OPEC | 3.4 | 33.5 | 33.8 | 34.6 | 35.2 | 34.7 | |

| non-OPEC | 66.6 | 67.6 | 67.7 | 67.1 | 67.5 | 66.5 | |

| Production – Consumption | Excess (+) / Deficit (-) | 1.2 | 1.1 | 0.6 | 0.4 | 0.9 | -0.8 |

In 2023, the global oil market experienced notable changes, including fluctuating crude oil prices and a consistent rise in both consumption and production. Brent crude prices fluctuated significantly, hitting a monthly average low of 74.8$/bbl in June and surging to 93.7$/bbl in September. Global oil consumption steadily increased, reaching 103.2 mb/d in December, alongside an increase in production to 103 mb/d during the same month. While the 2024 forecast suggests stable prices, ongoing monitoring of production trends is necessary, given the uncertainty associated with geopolitical factors. In the last quarter of 2023, Houthi attacks on shipping vessels in the Red Sea raised concerns about heightened oil prices, prompting companies to reroute ships around the southern tip of Africa. BP responded by halting all oil and gas shipments through the Red Sea, a crucial channel connecting Europe to Asia and East Africa, situated just south of the Suez Canal. The potential prolonged closure of the Suez Canal raises worries about increased freight costs and delivery times, contributing to concerns of a potential inflation shock for the global economy. The impact on oil prices was evident, with Brent crude surging approximately 4% to reach $80.75 a barrel following US and UK airstrikes on Houthi rebel sites in Yemen.

| Average price Q4 | Q1 2024 Future | Q2 2024 Future | Q3 2024 Future | |

|---|---|---|---|---|

| Henry Hub (US) [$/MMBtu]* | 2.74 | 2.67 | 2.20 | 2.66 |

| TTF (Europe) [€/MWh]** | 40.70 | 27.86* | 27.40* | 27.78* |

| JKM (Asia) [$/MMBtu] | 15.13 | 9.56 | 8.38 | 8.81 |

In Q4 2023, global natural gas prices rose, fueled by heightened winter demand. Despite this increase, prices remained below the averages observed in 2021 and 2022, mainly due to sufficient stored reserves and better supply conditions. European TTF spot prices rose by a significant 20% during the quarter, averaging just below USD 13/MBtu. However, they continued to trail significantly behind the fourth-quarter averages of 2022 and 2021 by 55% and 60%, respectively. Factors contributing to this included a sustained year-on-year reduction in demand, a stable LNG supply, and elevated inventory levels.

Similarly, Platts JKM prices in Asia followed suit, surging over 20% to an average of USD 15/MBtu in Q4 2023. Despite this increase, the prices were still 50% lower than the corresponding period in the previous year. This deviation was influenced by decreased competition with Europe for spot LNG cargoes, coupled with high storage levels across northeast Asian markets and increased nuclear availability in Japan.

In the United States, Henry Hub prices recorded a 5% increase to an average of USD 2.7/MBtu in Q4 2023, marking their lowest Q4 levels since 2020. Contributing factors included continuous growth in domestic natural gas production, reduced demand for heating due to mild weather conditions in Q4, and high inventory levels, resulting in prices 50% below their Q4 2022 average.

Looking ahead to mid-January 2024, forecasts show that TTF prices are expected to be about 20% lower than their 2023 levels throughout 2024, around USD 10/MBtu. Asian spot LNG prices are projected to stay higher than European hub prices, with JKM averaging USD 1/MBtu above TTF. This is expected to encourage more LNGs to enter the Asian markets. Meanwhile, in the U.S., Henry Hub prices are predicted to rise by 15%, reaching close to USD 3/MBtu.

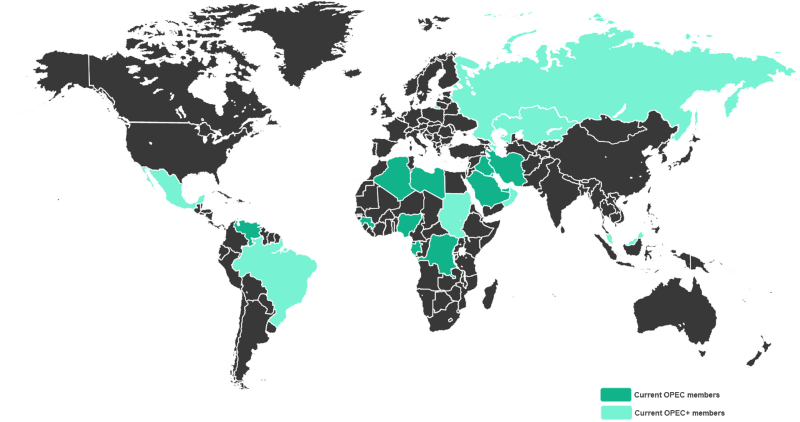

In recent months, significant developments have unfolded within the OPEC+ alliance.

OPEC+ will welcome Brazil as a new member. Brazil, producing about three million barrels of oil daily, declared its membership during the November OPEC+ meeting in Vienna.

At COP 28 in Dubai, President Lula affirmed Brazil's commitment to join OPEC+ to encourage major oil-producing nations to shift away from fossil fuels. Additionally, Brazilian mines and energy minister Alexandre Silveira de Oliveira highlighted the benefits Brazil has gained from the stability in oil and energy markets ensured by OPEC+'s agreement but clarified that Brazil would not necessarily follow the same production quotas as other members.

Should Brazil decide to curtail its oil production, U.S. producers could potentially benefit from higher prices. However, this prospect appears unlikely; Petrobras CEO Jean Paul Prates has stated that Brazil's status for publicly traded companies prohibits it from adhering to OPEC+ production quotas. If this holds true, it suggests that production levels are unlikely to change for both Brazil and the U.S. Nevertheless, both countries could still enjoy the advantages of a stable market facilitated by the growth of OPEC+.

This news has also sparked criticism from environmental advocacy groups, especially in light of a public oil exploration project by the state-owned company Petrobras near the mouth of the Amazon River.

OPEC, or the Organization of Petroleum Exporting Countries, was founded in 1960 with the primary purpose of coordinating petroleum policy among its member countries to assure stable oil prices and profits. OPEC now comprises 12 countries, largely from the Middle East and Africa, that produce approximately 39% of the world's oil.

OPEC+ consists of both OPEC member countries and certain non-OPEC states (11 members as of today), establishing a coalition with big non-OPEC oil exporters such as Russia. It was established to improve collaboration among OPEC and non-OPEC oil producers in regulating oil production levels to address global market concerns.

OPEC experienced a membership change when Angola, Africa's second-largest oil producer, declared its departure from the organization. This move stemmed from disagreements over output targets, as Angola declined to fully support the agreed-upon arrangement. Tensions heightened as the UAE increased its 2024 baseline while reducing Angola's, exacerbating strains within the group.

Angola's reputation for occasional unpredictability within OPEC became evident through multiple walkouts during secretariat meetings. Angola’s oil minister, Diamantino Pedro Azevedo, officially communicated the decision to state broadcaster TPA. He emphasized that this decision was not taken lightly while stating that remaining in OPEC would force Angola to cut production, a move that contradicted the country's policy of avoiding decline and respecting contractual agreements.

The 12-member organization witnessed several membership terminations over the years. Indonesia's departure in November 2016 was followed by Qatar's exit in January 2019 and Ecuador's withdrawal in January 2020. Gabon, initially a permanent member since 1975, left the group in 1995 but rejoined in 2016.

Fereydoun Barkeshli, President of the Vienna Energy Research Group, expressed concerns about potential cascading effects within the group. Barkeshli suggested that the United Arab Emirates might be contemplating a departure as well, warning that the alliance could be on the brink of collapse. The developments raise questions about the future viability of OPEC in the ever-evolving landscape of global energy dynamics.

In 2023, the O&G industry encountered a total of 1571 M&A deals in 2023 (Global Data analysis). Two particular deals made headlines in major publications.

The sector's largest transaction happened in October when ExxonMobil announced the acquisition of a 100% share in Pioneer Natural Resources. The deal is expected to be completed in June 2024, with an equity value of US$59.6 billion and an enterprise value of US$64.5 billion. This is the largest upstream transaction since Exxon's $53 billion merger with Mobil in 1999, establishing Exxon as the main producer in the Permian basin, a major worldwide oilfield that accounts for around 11% of total basin output.

In fact, Pioneer stands as the third-largest oil producer in the expansive Permian Basin, spanning regions of Texas and New Mexico. ExxonMobil's strategic move to acquire a 100% share in Pioneer aims to solidify its dominance in the region, projecting a substantial increase in production volume to 1.3 million barrels per day once the deal reaches its completion.

The collaboration between the two companies is anticipated to generate double-digit returns while reducing environmental impacts, in accordance with their shared vision for sustainable and efficient operations.

However, market reactions were evident as ExxonMobil shares experienced a 4% decline during early trading at 11 a.m. Eastern Time on Wednesday, contrasting with a modest uptick of less than 1% in Pioneer's shares following the announcement.

Two weeks after the ExxonMobil transaction, Chevron secured a 100% stake in Hess, a company heavily engaged in oil and gas exploration and production in offshore Guyana. Valued at US$60 billion, this deal is slated for completion in June 2024. The main goal of this acquisition is to broaden Chevron's portfolio by acquiring Hess's assets in the offshore oil block "Stabroek," located off the coast of Guyana. This South American nation holds the world's largest per capita crude oil reserves, and the Stabroek block itself is estimated to encompass an impressive 11 billion barrels of oil equivalent. Through this transaction, Chevron secures 30% of its exploitation rights for the Stabroek block.

Expanding its reach further, the agreement also grants Chevron access to the resource-rich Bakken Basin in North Dakota, known for its abundant shale oil. Simultaneously, Chevron establishes a significant presence in the deep waters of both the Gulf of Mexico and the Gulf of Thailand. This strategic move positions Chevron as a key player in the Bakken Basin, known for its shale oil resources, while concurrently solidifying its footprint in the deep-sea energy landscapes of the Gulf of Mexico and the Gulf of Thailand.

After years of uncertainty, the Netherlands ceased production in Groningen, Europe's largest gas field, due to seismic activity caused by gas extraction. As recently as the early 2010s, the field alone supplied almost 10% of the European Union's total natural gas consumption. Although an energy crisis delayed the field's closure, ongoing earthquakes in the area made it untenable to keep the field operational. Caused by the pockets of vacuum formed when the gas was extracted, earthquakes have increased in number in recent years, causing extensive damage and angering the local population. A parliamentary enquiry last February pointed to the government's failure to properly manage the extraction process. However, the government is keeping a handful of gas installations until 2024 and will restart them in the event of a particularly severe winter.

German state-owned energy firm Sefe (Securing Energy for Europe) secured a 50-billion-euro ($55 billion) gas deal with Norway's Equinor. The deal, the largest for Equinor in nearly 40 years, will supply Germany with 129 billion cubic meters of gas until 2039. The deal marks a milestone in Berlin's efforts to find a new supplier. Russia, the former long-term provider, first cut gas deliveries in 2022, later suspending them, which raised concerns about winter heating in German homes. Accounting for around 40-50% of Germany's gas imports, Norway is strengthening its position as the leading supplier to Europe's largest economy.

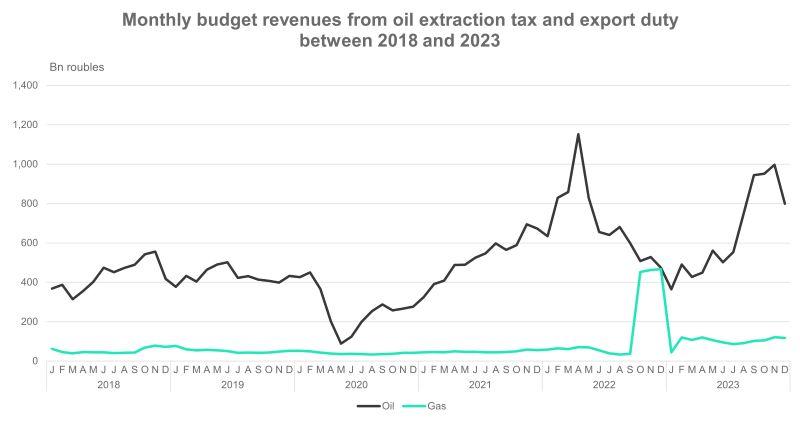

Following Russia's assault on Ukraine in 2022, Western countries imposed substantial sanctions on Russia's oil and gas sector. Effective December 5, 2022, the EU implemented an embargo on maritime imports of Russian oil, extending the ban to encompass all petroleum products from February 5, 2023. Simultaneously, the EU and the US banned investments in Russia's energy sector and limited exports of technology and goods to Russian energy companies. This coordinated effort, spearheaded by the EU, G7, and Australia, aimed to cap the price of Russian oil at $60 per barrel and curtail Russia's financial capacity to support its war effort. In 2022, oil and gas revenues constituted a substantial 41.6% of Russia's total revenues, amounting to nearly 11,560 billion rubles.

These stringent sanctions prompted Russia to revise its strategy for oil and gas. Notably, Russia diversified its export markets, with China and India emerging as key consumers, collectively absorbing 85-90% of Russia's oil exports. Additionally, Russia set up its insurance system and used a "shadow fleet" to transport crude oil. The revised strategy appears to be successful. Russia's Deputy Prime Minister for Energy, Alexander Novak, projected that the country's oil and gas revenues would reach nearly 9,000 billion rubles (around $95 billion) in 2023, resembling the pre-sanction levels of 2021.

The effectiveness of Western sanctions was compromised as Western insurance coverage for Russian oil shipments dropped from almost 80% in April 2022 to 31% in August 2023. This made it hard to keep Russian crude oil prices below $60 per barrel.

Despite these challenges, Russia's oil and oil product exports earned $18.8 billion in September 2023, the highest amount since June 2022, before Western sanctions were imposed.

Source: Ministry of Finance of the Russian Federation

In 2023, the global oil market witnessed the steady narrowing of the price differential between Urals and Brent crude. This trend, reaching its lowest point since the Ukraine invasion began, saw the difference drop from over $30 a barrel when the price cap was implemented to an average of just $10 in September. Russia's revenues were mainly driven by high global prices, partly due to its successful influence on prices within the OPEC+ cartel. While Saudi Arabia decreased production by 1 million barrels per day during the summer, Russia maintained its reduction of 0.5 million barrels per day, which began in February 2023.

The countries imposing the embargo on Russian crude and refined products, namely the G7, EU, and Australia, anticipate a one-third reduction in revenues from these exports in 2023 compared to the previous year. In addition to these challenges, the ongoing depreciation of the ruble, losing 40% against the dollar within a year since mid-2022, has added economic pressure on Russia. Concerns have also been raised regarding Russia's increasing dependence on China and India, both of which have displayed opportunistic behavior in obtaining rebates or preferential trade agreements. Russia's oil revenue now relies heavily on the economic well-being of China and India, and whether these countries choose to maintain trade partnerships.

Although initial sanctions were effective in reducing Russian revenues and stabilizing oil markets, the long-term effects are uncertain. Western nations hope that new regulations will continue to negatively impact the competitiveness of Russian exports

The COP28, held in Dubai, United Arab Emirates, from November 30 to December 13, 2023, marked a significant turning point in the global fight against climate change. Eight years after the signing of the Paris Agreement (COP21), the event brought together over 100,000 participants, nearly double the attendance of the last COP in Sharm El-Sheikh, underscoring the urgency felt by the international community regarding global warming.

The central objective of COP28 was to assess the progress of commitments made by states under the Paris Agreement and to set new goals to limit warming to 1.5°C compared to pre-industrial levels. The historic "Consensus of the United Arab Emirates" agreement, signed on December 13, lays the groundwork for a transition away from fossil fuels and reaffirms the goal of carbon neutrality by 2050.

The key topic of COP28 debates revolved around transitioning away from fossil fuels, particularly oil and gas. According to the International Energy Agency in 2023, a peak of fossil fuel production is expected by the end of this decade, with a decline in production in advanced economies and China offsetting growing demand elsewhere. However, UN Secretary-General Antonio Guterres emphasized that limiting warming to 1.5°C without a progressive elimination of all fossil fuels was impossible.

This reality is complicated by the dominance of the oil and gas industry in energy production, particularly in regions like Africa. For instance, in Nigeria, between 4.3 and 9.7% of the GDP is derived from oil and gas (National Bureau of Statistics, 2023). The upcoming transition is anticipated to be challenging due to the central role played by oil and gas in our economic systems. Nevertheless, the imperative to substitute these energies with greener sources is crucial for slowing global warming.

For the first time, a COP resolution calls for a transition away from fossil fuels in energy systems, done justly and equitably, with the aim of achieving carbon neutrality by 2050. Thus, COP28 brought to light the dilemma between the need to reduce our dependence on fossil fuels and the social and economic challenges associated with this transition. Countries heavily dependent on oil and gas, especially in Africa, must carefully balance their climate imperatives with economic development.

Over 50 oil companies, representing about 40% of global production, have signed the Oil and Gas Decarbonization Charter (OGDC) at this year’s COP. This initiative aims to achieve net-zero emissions in direct operations by 2050, minimize methane leaks by 2030, and eliminate excessive gas flaring by 2030. However, concerns persist about the actual implementation of these commitments, especially as 60% of global oil and gas production is not covered by this charter. Commitments have also been made to triple the capacity of renewable energy, including wind, solar, hydropower, and geothermal, and to double energy efficiency by 2030. Currently, the oil and gas industry allocates only 1% of its total investments (USD 1.8 trillion in 2023) to low-carbon energies. Four companies, Equinor, TotalEnergies, Shell, and BP, account for over 60% of these investments. This transition must be carried out to protect existing jobs while promoting the creation of sustainable ones.

Although progress has been made in financing and adaptation efforts in response to climate change, the global assessment of COP28 reveals a significant delay in reducing emissions. Countries' ambitions and improving funding to achieve carbon neutrality by 2050 is the privileged avenue for keeping global warming below 1.5°C.

Carbon capture was also a notable topic at COP28. Concerns persist about the cost of carbon capture technologies and how underdeveloped they are. The COP28 text specifies that they should be directed towards hard-to-decarbonize in sectors, such as heavy industry.

Azerbaijan, a major oil and gas-producing country like the UAE, was announced as the host of COP29, scheduled from November 11 to 22, 2025.

This year’s COP28 marks an important step in combating climate change, urging renewed effort and cooperation. While progress has been made, some commitments remain unmet, and challenges in ensuring fairness during the transition endure. Achieving carbon neutrality will demand sustained efforts and stronger global collaboration.