Fortune 100 response to DE&I pressures

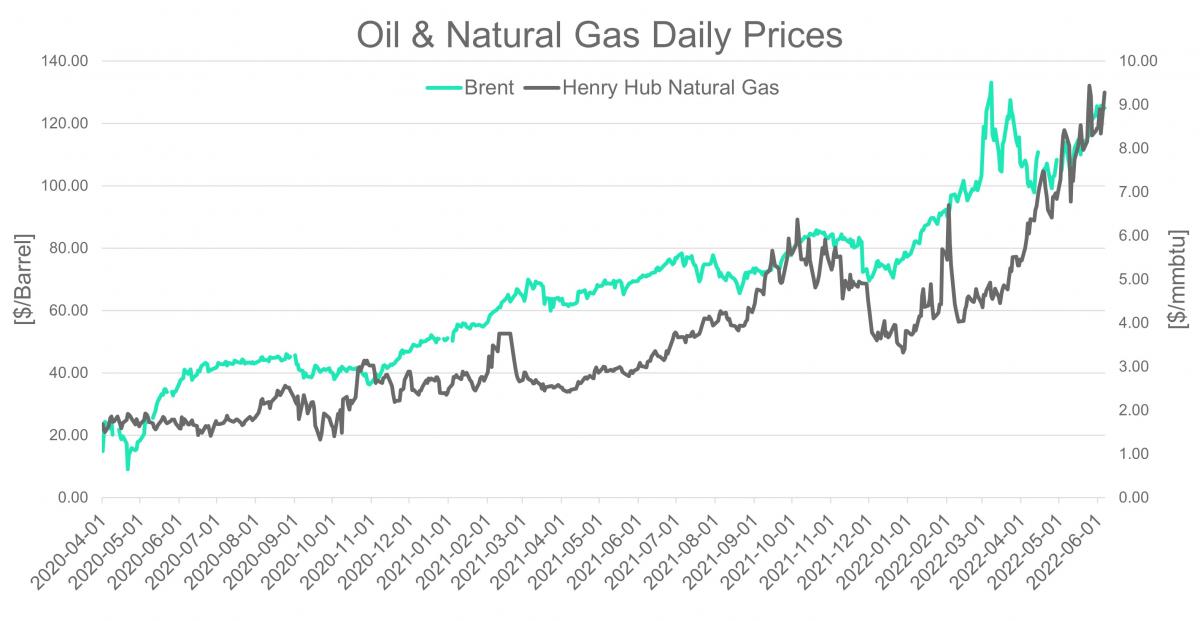

The global rising rate of inflation and the now months-long conflict in Ukraine have influenced oil & gas market dynamics in Q2.

| 2020 | 21Q3 | 21Q4 | 22Q1 | 22Q2 | 22Q3 | ||

|---|---|---|---|---|---|---|---|

| Crude Prices | Brent ($/bbl) | 41.80 | 73.50 | 79.60 | 92.00 | 118.00 | 116.70 |

| Rig Count | World | 1,352 | 1,421 | 1,537 | 1,669 | 1,636 | 1,703* |

| Demand (mmb/d) | Total | 91.9 | 98.8 | 100.5 | 98.9 | 98.8 | 100.0 |

| OECD | 42.0 | 45.8 | 46.7 | 45.9 | 45.4 | 46,3 | |

| non-OECD | 48.8 | 53.1 | 53.8 | 53.0 | 53.4 | 53.7 | |

| Supply | Total | 93.7 | 96.3 | 97.9 | 99.3 | 98.9 | 99.7 |

| OPEC+ | 47.9 | 49.3 | 50.9 | 52.1 | 50.9 | 49.0 | |

| non-OPEC+ | 45.9 | 47 | 47.1 | 47.2 | 48.0 | 42.7 | |

| Excess (+) / Deficit (-) | 1.8 | -2.4 | -2.6 | 0.4 | 0.1 | -0.3 |

Global crude prices continue to rise and will remain high throughout Q3. Oil’s supply-demand imbalance has diminished over the past quarter; however, low crude oil inventories in Europe and North America combined with the start of the “driving season” could widen the imbalance once more. US inventories fell by 1 million barrels MoM in May to 420 million barrels, around 14% below the five-year average. The US also faces critically low refinery capacity (the lowest level since 2015), which could further exacerbate prices.

| Location | Spot Price | This month future | Next month future | Next 2 coming months futures | Same period last year |

|---|---|---|---|---|---|

| Henry Hub (US) [$/mmbtu] | 8.310 | 8.145 | 8.138 | 8.097 | 3.084 |

| TTF (Europe) [€/MWh] | 87.900 | 88.500 | 89.390 | 91.500 | 25.700 |

| JKM (Asia) [$/mmbtu] | 22.625 | 24.075 | 25.640 | 26.955 | 10.440 |

Natural gas prices are close to reaching 10-year highs and have more than doubled since the beginning of 2022. In addition to inflation and ongoing geopolitical tensions, Europe and Asia are rushing to fill their reserves before winter, adding additional upward price pressure for LNG.

Source: St. Louis FED, 2022, Bent & Henry Hub Natural Gas Daily price - Historical data

Spurred on by geopolitical tensions, accelerating inflation, and uncertain global economic growth, WTI hit $117/bbl on the New York Stock Exchange on May 31st (the highest price since 2008). High oil prices should endure as demand remains constant and Russian oil exports to Europe have and will continue to decline. If Chinese demand recovers following the end of the strict lockdowns in Shanghai, oil prices could rise even further.

The EU announced that it would ban seaborne Russian oil imports (representing almost ⅔ of European oil imports) by the end of 2022. While this partial ban is designed to negatively affect Russia’s economy, the EU will also be adversely impacted as member states search for reliable alternative crude sources to avoid shortages and even higher prices.

On June 2nd, OPEC+ members agreed to increase production by 648,000 bbl/d in July and August. While the production increase will help temper rising prices, the new deal has been subject to criticism due to Russian output increasing by 114,000 bbl/d. Saudi Arabia, the coalition leader, assured the market that the Kingdom would be able to fill any potential supply gaps caused by other OPEC members’ inability to meet their respective output objectives.

In parallel, higher oil prices have supported the recovery of the US shale sector. Despite substantial increases in crude prices, shale oil output stands at 11.8Mbbl/d, a 9% decrease compared to pre-Covid levels. Producers are reluctant to significantly ramp up production for short-term gains despite the Biden Administration’s calls for increased production. The industry has placed a greater emphasis on capital discipline to pay off debts, maintain free cash flow, and ensure consistent positive returns to its shareholders.

Natural gas prices have been characterized by upward price pressure and volatility

With unprecedented volatility in the natural gas market, commodities trading units are seeing enormous margin calls. Henry Hub futures hit a 14-year high on May 25th, 2022, when gas prices reached $9.45/MMBtu due to warmer than expected weather and record levels of LNG exports to Europe. Shell announced a $7 billion cash outflow to avoid the closure of its hedging positions. This same position required only $1.1 billion a year ago (Reuters, 2022). Oil majors and utility companies signed a letter in March urging European Central Banks to provide liquidity support to help them cope with the extreme volatility.

European gas pipeline import outlook worsens…

Since Russia announced that Russian energy importers must pay the federation in rubles, more and more European countries are seeing their gas inflow halted. Although the EU stated that it will not succumb to Russian demand for ruble-denominated imports, other global powers have complied with the request. The Russian ruble is now the best performing currency of 2022, having climbed by 143% against the dollar and 172% against the euro since Russia’s invasion of Ukraine in February. Having Russian currency reserves is now vital for securing Russian gas.

... resulting in an LNG surge in Europe

With vastly reduced Russian supply, the EU is rushing to fill their natural gas reserves at record rates. In March 2022, the EU was near record lows of LNG inventory (26.3%) compared to 39% on average during the same period the previous year (see exhibit 2). As of May 30th, 2022, inventory had risen to 47.2% compared to 37.3% a year ago due to the explosion of LNG imports from other countries. LNG terminals in countries with well-developed infrastructures, such as the UK, Spain, and France, are operating around the clock. The UK is now a net exporter of LNG as it imports gas from the US, Qatar, and Algeria and re-exports regasified LNG to mainland Europe via pipeline. Record discounts between TTF, Henry Hub, and NBP have led to lucrative arbitrage opportunities in the sector. While terminal operators and traders have benefited from arbitrage and near 100% operating levels, British regulators recently warned that safe operating levels had been exceeded. These events have demonstrated that a balanced distribution and loading infrastructure across Europe is vital for future energy security.

Despite minor supply gains, current LNG stores would only cover 27% of annual European demand. Increased LNG imports will not bridge the supply/demand gap. The European Union will have to buy Russian gas, ration supplies or pray for a mild summer and winter.

Source: AGSI+ - Gas Infrastructure Europe, 2022