Research and Report

Wind Farms: Reach Renewable electricity targets

2 minutes read

The Power Spot Market is up and running on the European electricity network.

Europe is moving towards one copper plate for its electricity network, with an ever-increasing volume of cross-border electricity exchanges. Countries are further interconnected together, and renewable energy integration requires short-term prediction and exchanges at a European level to maintain the equilibrium of the grid. Power Exchanges offer an organized and transparent marketplace for energy actors to buy and sell their energy, and for facilitating cross-border exchanges. Spot Power Exchanges can now operate on the same bidding zones and must reinvent themselves to differentiate from each other, bringing many opportunities to all market players.

For more than 20 years, the EU Energy regulations have aimed to build a sustainable and competitive internal electricity market by encouraging cross-border electricity exchanges and the development of renewable energy sources.

The energy transition in Europe has led to increasing renewable energy development in recent years: wind and solar PV production has already increased respectively by 49 % and 40% between 2014 and 2019. Even more ambitious targets have been set through the REPowerEU plan, with an increase of the European renewables target for 2030 from 40% to 45%. It also includes over 320 GW of solar PV newly installed by 2025, over twice today’s level, and almost 600 GW by 2030.

The intermittent nature of Renewable Energy Sources (RES) leads to electricity production that is difficult to predict and therefore endangers the equilibrium of the grid. In that context, short-term European electricity exchanges are becoming more relevant than ever: they enable market players to address the variations in renewable production close to real-time, fully exploiting the use of interconnectors to counterbalance national surpluses and deficits across countries for energy sourcing at optimized prices.

The EU has set an interconnection target of 15% by 2030: each country should be able to physically exchange at least 15% of its electricity production with its neighbours. In its Ten-Year Network Development Plan 2020, the ENTSOe is planning to reinforce the European cross-border exchange capacities by 2040 with a considerable amount of planned investments: €17 bn until 2030, and an additional €28 bn from 2030 to 2040. These infrastructure investments will lead to higher volumes of cross-border trading.

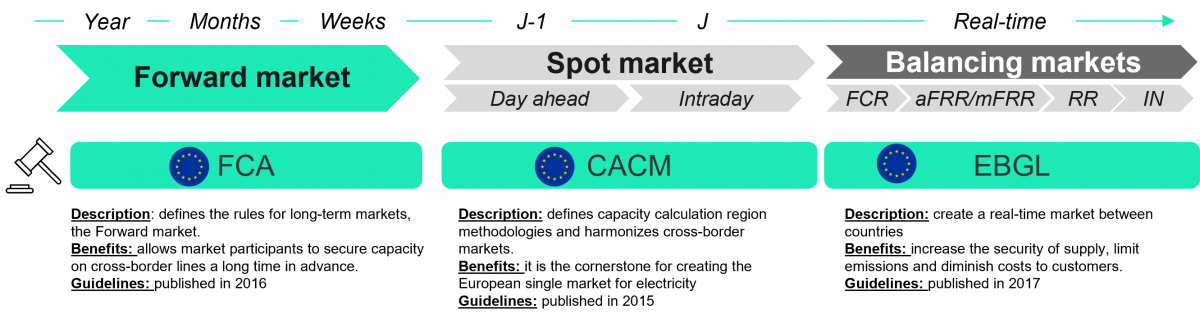

Electricity markets in Europe are based on different timeframes. While the forward market, operating in the long term, is the traditional platform for almost 90% of energy exchanges across and within European countries, the short-term markets are playing an increasingly relevant role in the electricity sector. These can be broken down into:

The Spot Market constituted of the Day-Ahead (DA) and Intraday markets (ID)

The balancing markets, which is concerned with close-to-real-time exchanges to equilibrate the network with largely smaller volumes of exchange than the spot market.

The Capacity Allocation & Congestion Management (CACM) guideline developed by the European Network of Transmission System Operators for Electricity (ENTSO-E) provides a harmonized framework for cross-border market operation aiming to increase competitiveness and facilitate renewables integration. It includes coupling projects of the spot market across Europe:

Yet, with the impacts of the pandemic and geopolitical crisis this past year, electricity prices in European spot markets have more than tripled in 2021 compared to the previous year, and reached unprecedented peaks since early 2022, reaching over 400€/MWh monthly average price.

Power Exchanges are responsible for the wholesale electricity market exchanges. They consist of an online trading platform collecting orders from all market players, processing clearing prices and volumes, and a clearing house to ensure its transactions. They mainly operate on the spot market for day-ahead and intraday exchanges. In some cases, Power Exchanges have the license of Nominated Electricity Market Operators (NEMO): they are responsible for operating market coupling for a given bidding zone.

Historically, they were in a “natural” monopoly situation due to their geographical coverage: each country only had one trading platform to guarantee the equilibrium market price. Two main Power exchanges were sharing the European market: EPEX SPOT for Central-Western Europe (UK, France, Germany, Belgium, Netherlands, Luxembourg, Switzerland, Austria) and Nord Pool for North-Eastern Europe (Finland, Norway, Sweden, Denmark, Estonia, Latvia, Lithuania).

Power Exchange competition for the spot market has been established via the “Multi-NEMO Arrangements” (MNA) - stemming from the CACM regulation - which provides a legal framework for NEMOs to operate and therefore compete in the same bidding zones. The MNA entered into force for the SDAC in CWE bidding zones on July 2nd, 2019, and June 2nd, 2020 in the Nordic region: all NEMO’s order books are now forwarded to the centralized market coupling algorithm of the Single Day Ahead Coupling.

The advantage of such a measure is identified in the creation of an improved service offering and pricing, alongside enabling market participants to choose the Market Operator which best suits their needs. Competition between Power Exchanges is fierce, and they must reinvent themselves to differentiate from each other.

Now that Power Exchanges can compete in the same bidding zone, each one is trying to win new market shares.

EPEX SPOT and Nord Pool, the historical power exchanges respectively of Central Western Europe and North-Eastern Europe, are now competing in the same bidding zones. In 2020, EPEX SPOT has extended its offer to twelve countries, thanks to the launch of the EPEX SPOT trading offer in the Nordic region, starting in May for Intraday trading and in June for Day-Ahead trading. In 2019, Nord Pool launched day-ahead markets in Austria, Belgium, France, Germany/Luxembourg, and the Netherlands. In 2020, 3580 GWh of day-ahead orders were sold in France through the Nord Pool platform.

Furthermore, the MNA allowed for new Power Exchanges to enter the day-ahead and intraday markets. Nasdaq received the Nordic power spot market license on November 10, 2021, entitling it to carry out day-ahead market coupling operations; and local Austrian market platforms Energy Exchange Austria (EXAA) is entitled to operate in CWE.

Finally, OTC Platforms (Over-The-Counter platforms) are emerging to facilitate power trading for a wide range of clients. Those platforms allow local trading via a broker-dealer network as opposed to the centralized exchange proposed by Power Exchanges: products are traded directly between counterparties. ENMACC is a well-known OTC platform for Europe: it acts on the spot market, but also on Futures & Forward trading and Garanties of Origins exchanges.

The increased traded volume on day-ahead and intraday European electricity markets results in better liquidity of the market, with a price signal relevant and robust. This allows Power Exchanges to diversify their trading offerings, creating a large range of trading products on the following differentiating aspects:

Each market player can now choose a trading product tailored to their needs, and at an advantageous price. The choice of a specific trading system might be relevant as well: platforms must be reliable, easy to use, and automated. Finally, Power Exchanges can differentiate themselves thanks to customer care and support services, by making themselves available at any time, creating a dedicated communication channel…etc.

There is a large diversity of market players among power exchange members. They have their own specific challenges and opportunities, but they all benefit from spot markets, more so with the new trends and regulations of the power sector. Competition within Power Exchanges enables those market players to choose their platform, the type of contracts, and packaged services that suit their needs, together with more attractive fees due to competition.

In addition to Power Exchange competition, regulations are evolving and new technologies are appearing. This sets a favorable context for market players to reassess their power trading strategy by making the most efficient use of opportunities while complying with regulatory constraints.

In the context of an increasing share of renewables in the energy mix and the development of interconnection capacities, the creation of a competitive market for Power Exchanges is bringing many benefits to all market players: multiple offers are now available within the same bidding zone, opening the door to many opportunities.

The competitive landscape is fast evolving: the lowered barriers to entry allow for new players to come in, and new trading markets are developing, such as the local flexibility market. Power Exchanges must continue to reinvent themselves to keep market shares and address new markets.

Yet, regarding the European coupling projects for the spot market – SIDC & SDAC, one can wonder: does it benefit the final consumer? What is the Return on Investment of those projects? Due to the high volatility recently seen on the spot market, will market players keep their interest in this market? Or will they prefer other solutions such as Power Purchase Agreements, flexibility markets, or OTC platforms?