SEC Division of Examinations Releases 2026…

With intense competition and the emergence of new markets, airlines are redoubling their efforts to remain competitive. By increasing partnerships and alliances, particularly in Asia, they are strengthening their positions while minimizing risks and investments.

In a context of intense rivalry, airlines are facing multiple challenges: high fleet renewal and maintenance costs, advent of new business models, or regulatory changes. Since internal growth or competitors’ takeover may be hard, airlines often choose to cooperate with each other. These partnerships exist in more or less complex forms and constitute crucial levers for airlines to enter a new market or strengthen their position in fast growing areas like Asia.

After the airline deregulation in the 1980s, airlines have been facing a rapidly-growing international demand. Travellers were asking for a wide range of potential destinations but traditional airlines wasn’t able to cope with the demand; Therefore, airlines needed to find business partners able to expand their network coverage.

The development of low-cost companies also got in the way of legacy carriers. In America as in Europe, the traditional network airlines have to compete against the so called “no frills” airlines on short-haul, medium-haul and recently long-haul routes. In order to remain competitive, legacy carriers have to reduce their overall costs while guaranteeing a constant or even better level of service.

In order to face these two main challenges legacy airlines seek to create synergies between each other. Since regulatory framework limits cross border mergers they alternatively adopt different types of cooperation which vary in complexity and scope.

Cooperation levels varies depending on stakeholders’ strategy. However, the majority of them consists of one – or more – of the following agreements: interlining, codeshare, and grouping of loyalty programs.

Interlining is a voluntary commercial agreement between two airlines to handle passengers traveling on multiple flight legs operated by those airlines. This agreement allows passengers to switch from one flight operated by the first airline to another flight operated by the other airline without picking up their luggage or checking-in a second time.

The cooperation between two companies can go a little further with codeshare agreements. These are commercial arrangements in which two or more airlines share the same flight. The marketing airline has the ability to publish and sell the seats offered by the operating airline under its own identification number. This cooperation offers a greater selection of flights and thus a greater network coverage.

Finally, the agreement may relate to the airlines’ loyalty programs. The grouping of loyalty programs and lounges access allows travelers to accumulate the loyalty points and therefore to access the same benefits and service quality while traveling with different airlines.

These three types of agreements form the basis of all bilateral alliances between airlines but also multilateral alliances. Three major strategic alliances exist: Star Alliance, SkyTeam and Oneworld. These global alliances account for 61% of worldwide sales [1] and promise many benefits: increased connectivity, cost savings and an enhanced customer experience through a consistent level of service. The members of these strategic alliances work together on a multilateral basis to create the broadest possible common network and thus a greater potential for economic benefits. Although widely used within alliances the codeshare is however not an obligation and two airlines of two different alliances can develop a bilateral code-sharing or interlining agreement subject to validation from the concerned alliances.

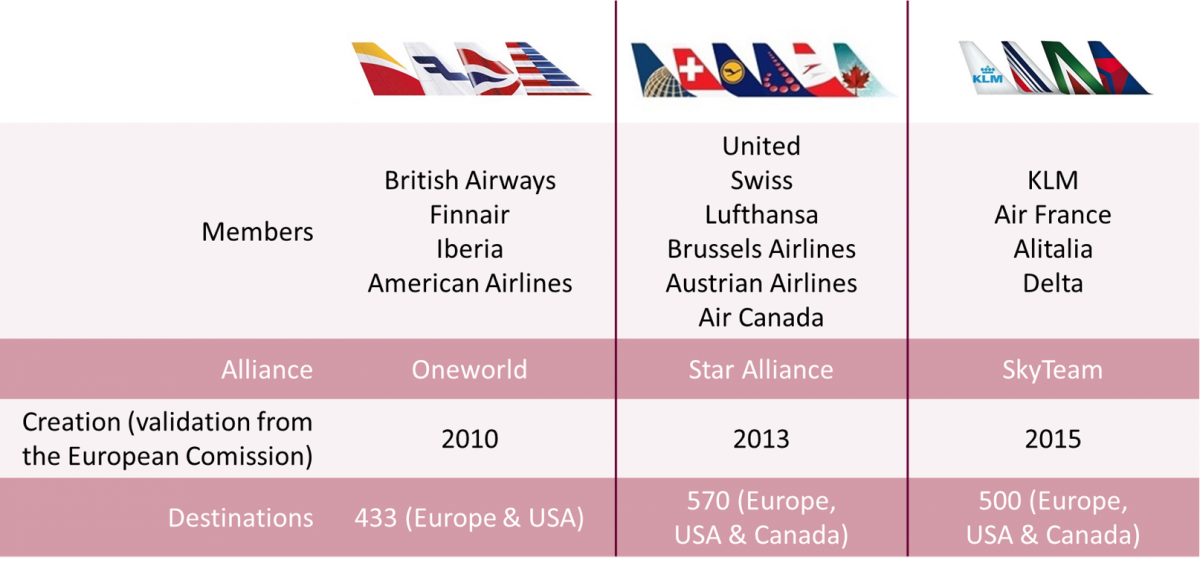

Table 1: The major strategic alliances [2]

Some companies choose to increase the level of cooperation by creating a joint venture in order to maximize the benefits of the alliance. The challenge is to tackle other markets by sharing the capital invested and the risks while reducing the possible political barriers to entry. This form of cooperation is a close substitute for a merger because it involves coordinating the main functions of the airlines on the routes concerned including planning, pricing, revenue management, marketing and sales. Joint ventures are typically created between two specific regions, such as the Lufthansa group which is both a member of the J+ joint venture, with ANA (All Nippon Airways), and A++, with United and Air Canada. Similarly, American Airlines is a member of a transatlantic joint venture with British Airways, Finnair and Iberia on one side, and a trans-Pacific joint venture with Japan Airlines on the other side.

Table 2: The three main trans-Atlantic joint-ventures [3,4,5,6,7]

This form of partnership has attracted many airlines in recent years and now covers a major part of global air traffic. Indeed in 2017 the market share of the three largest joint ventures (shown in Table 2) on long-haul trans-Atlantic routes is estimated at 73% [8]. The trans-Atlantic joint venture of Air France - KLM alone accounted for 20% of the overall trans-Atlantic capacity in the first half of 2017 with 250 trans-Atlantic flights per day [6]. This market share is set to increase further in 2018 thanks to the strengthening of the joint venture with Delta, following the entry of the carrier into Air France – KLM’s capital.

These joint ventures can in fact be reinforced by an equity investment increasing the link and the relationship between the actors. For example, since 2012 there have been numerous equity investments between Delta, Air France - KLM, China Eastern and Virgin Atlantic (see Figure 1). These equity investments bring the "Transatlantic" joint venture (AFKLM, Delta and Alitalia) closer to the Delta-Virgin Atlantic joint venture. Air France - KLM, in the framework of the "Trust Together" plan, has indeed decided to reinforce its commercial integration with its main partners, allowing it to profit from a broader market position, to benefit from a pooled distribution network but also to offer a global offer to its customers in each market.

Figure 1: The various equity investments between Delta, Air France – KLM, China Eastern and Virgin Atlantic [6] Example: In December 2012, Delta has acquired a 49% stake in Virgin Atlantic

Some of the global alliances have decided to open up to low-cost companies. Star Alliance for instance launched the Star Alliance Connecting Partner program in May 2017 with Juneyao Airlines. This program enables low-cost carriers, either independent or subsidiaries of an airline member, to create commercial links with three or more members. Frequent customers of the alliance can then benefit from services and privileges of the same level of quality on itineraries involving at least one member company and one partner company.

Finally, a new form of partnership is being developed by low-cost companies: the virtual interlining. Initiated by easyJet with the Worldwide by easyJet program, virtual interlining differs from interlining or codeshare by combining routes operated by several low-cost or regular airlines. Tickets are distributed on the easyJet booking platform. Correspondence is facilitated by complementary services offered by partner airports, such as London-Gatwick with GatwickConnect or Milan-Malpensa with ViaMilano. The low-cost airline Norwegian and the full service airlines Corsair and La Compagnie are among the first to join the program. The British low-cost airline has already planned to include seven other airports in its Worldwide program such as Paris Orly and Paris Charles de Gaulle.

The Asian market offers strong growth potential for airlines. According to the International Air Transport Association (IATA) [9] and provided that governments do not harden the barriers to entry, passenger traffic is expected to nearly double by 2035 from 3.8 billion to 7.2 billion passengers with Asia-Pacific region being the main driver of demand and accounting for nearly half of the passengers transported.

In ten years or so China should even surpass the United States to become the largest market in terms of traffic from, to and inside the country. India would take third place at the expense of the United Kingdom, while Indonesia would enter the top ten instead of Italy.

Over the same period, among the five markets with the fastest growth in terms of additional passengers per year, should be found China first, followed by the United States, India, Indonesia and Vietnam.

It seems therefore crucial for airlines to position themselves in this growing market.

European regular airlines have understood this and are seeking tactical and strategic partnerships with Asian carriers to expand their destination networks in this region and gain market shares. These partnerships often start with codeshare agreements but the joint venture model most effectively tackles this burgeoning market and bypass the region's entry barriers. Most of these partnerships are concluded between members of the same alliance.

Air France-KLM

This is particularly the case for Air France which has opted for a partnership strategy.

The Indian market case is a perfect example. After a long search for a partner in India, and while Star Alliance (whose rival company Lufthansa is a member) resumed discussions with Air India, Air France finally signed a bilateral partnership with Jet Airways in May 2014. Since then the relationship has continued to grow. In March 2016 Jet Airways moved its European hub from Brussels to Amsterdam, enabling a connection system with KLM. On several occasions, as in October 2016 and October 2017, Air France – KLM and Jet Airways have extended the scope of code sharing to offer an increasing number of Indian destinations to customers of the group. Simultaneously the pooling of loyalty programs (already existing between Flying Blue and Jet Privilege) has been extended to Delta Skymiles. Finally, an "extended cooperation agreement" has been signed at the end of November 2017, a partnership format very close to the joint venture, which is legally prohibited in India. By bridging two partnerships (with Delta on one side and Jet Airways on the other), this agreement offers an expanded network and improved connections between India, Europe and North America, while reducing operational costs. Progressively developed, this successful partnership covers now 44 Indian cities and 106 European destinations [10] and puts the Air France - KLM group in a good position to compete against the Gulf airlines in the Indian market.

Air France - KLM is also at the forefront in China thanks to its very close relationship with China Eastern. The group announced in July 2016 that its joint venture with the Asian airline, signed in 2012 and originally limited to Air France was extended to KLM, allowing better connections to Shanghai, with more than 41 weekly flights to this city [11]. Just recently, the Chinese airline acquired a 10% stake in the capital of Air France – KLM. This investment (along with the Delta one) will enable the group to improve its financial health, strengthen its position in the Asian market and create new operational synergies.

Lufthansa group

Lufthansa group is also pursuing a growth strategy geared towards Asia. The group announced last October the launch of a joint venture with Singapore Airline whose agreement was signed back in 2015. The partnership includes a sharing of revenues on all flights operated by the two companies (including Swiss International Air Lines) between Singapore and Düsseldorf, Frankfurt, Munich and Zurich. The codeshare agreements have also been expanded, strengthening the company's position in the Southeast Asian and Southwest Pacific market. This agreement is in constant progress: the group has announced at the end of March 2018 the reopening of the Munich - Singapore commercial flight after a break of six years, as well as a joint effort with Swiss regarding the program of frequent members Singapore Airlines HighFlyer

This agreement is the third joint venture agreement with Asian airlines and therefore reflects the group's desire to strengthen its position in Asia. The first joint venture agreement, signed in 2012 with All Nippon Airways, the largest Japanese airline in terms of passengers carried, covers 196 flights a week on 11 different routes [12]. The second joint venture, set up with Air China in 2016, reflects the objectives of the agreement signed in 2014 with the first Chinese company: to facilitate connections by proposing adapted schedules, to optimize the connections between their loyalty programs and to propose common rates. The partnership also includes the other two companies of the group, Austrian Airlines and Swiss International Air Lines.

International Airlines Group

IAG, holding company of British Airways, Aer Lingus, Iberia and Vueling, is also trying to strengthen its position in Asia. For example, British Airways announced the creation of a joint venture with Japan Airlines and Finnair in early 2014. Iberia, the Spanish company of the IAG group, joined the joint venture at the end of 2016. Regarding the Chinese market, the company signed in August 2016 a first partnership with China Eastern, involving codeshare agreements and optimizing connections between their loyalty programs [13]. A second partnership was born at the end of 2017 with China Southern, facilitated by a bilateral agreement between Britain and China, allowing an increased number of flights between these two countries. These two partnerships are not anecdotal because they involve airlines from different alliances, IAG in One World and the two Chinese companies in Sky Team, proving the efforts made by the European companies to strengthen their position on the Asian market.

These partnerships between major regions strongly benefit to Asian hubs by improving their attractiveness. Similarly to the developments which took place in Europe , Asian legacy airlines have adopted a strategy to best serve their hubs while resisting to the pressure of low-cost airlines in the region. Many of them have opted for the development of low-cost subsidiaries. This is notably the case for Singapore Airlines with the creation of Scoot and Tiger Air, now operating under the same name Scoot, or ANA with Vanilla Air. They have also pushed for the development of multi-hub strategies with the proliferation of joint ventures involving local players: JetStar throughout Asia, Vistara in India and NokScoot in Thailand.

Just like network carriers, some Asian low-cost airlines find through the partnerships a solution to the extension of their network and to the strengthening of their position in the strained Asian market. The model of strategic alliances, previously restricted to regular companies, has recently been adopted by low-cost carriers, as shown by the creation in February and May 2016 of U-Fly and Value Alliance.

A highly competitive market

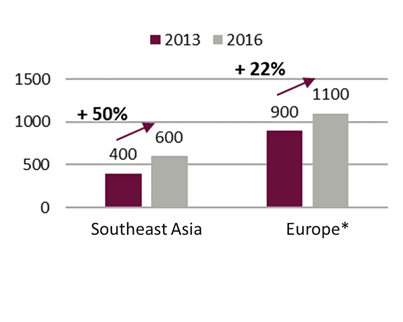

The creation of these alliances fits into the context of the South-East Asian air market where the low-cost airline model is a major success. The South-East Asia region is characterized by a fragmented market enjoying strong growth, particularly since the beginning of 2010. The fleet of the twenty or so low-cost airlines in the region has grown from 400 to 600 aircraft between 2013 and 2016 [15](see Figure 2). Among these companies some leaders have managed to emerge, benefiting from large domestic markets (Indigo in India or Lion Air in Indonesia) or from an extended presence through regional subsidiaries (Air Asia group or Jet Star group). This last category takes advantage of their networks and their hubs to put forward an international offer that improves their positioning in the region.

Figure 2: Fleet evolution of the main low-cost airlines in Europe and South-East Asia (2013 - 2016) [16] *Europe: EasyJet, Ryanair, Transavia, GermanWings, Vueling, Air Berlin, Norwegian

For smaller players, the creation of Value Alliance responds to the need to position themselves outside of their respective domestic markets by proposing a regional offer distributed jointly in order to compete with Air Asia or Jet Star.

With an organization that can serve 160 destinations from 17 hubs and supported by a fleet of around 175 aircraft [17], Value Alliance is an important low-cost player.

An innovative alliance

Value Alliance offers an innovative model with the creation of a common technology platform called Air Connection Engine and developed by the company Air Black Box. The specificity of this tool is that not only it allows to connect all the sales platforms of the various companies, but also and above all it enables to sell ancillary services such as seat selection, on board meal, or additional checked-in luggage, and this from any of the airlines’ websites. This is a real innovation in the field of alliances and all the more important for low-cost companies since ancillary services sometimes represent up to 25% of their turnover [18].

Unlike traditional alliances, Value Alliance has announced that cooperation is currently limited to distribution and sales. There is still no question of marketing integration, minimum standards to respect in terms of quality and services, pooling of purchases or even loyalty programs. These elements are neither part of the alliance strategy, nor of low-cost airlines’ in general [19]. The members of Value Alliance want above all to keep the simplicity of the technology.

Value Alliance is positioning itself as a serious competitor on the Asian market, but for the moment its network does not cover China yet, Vietnam or India, which are nevertheless growing markets. The challenge will be to rally as many players as possible to cover more destinations and to offer more flights.

With an average global growth expected at 3.7% over the next twenty years [20], there are still many levers to sustain airlines’ development. In this highly competitive sector, partnerships are key to increase market reach at lower costs and reduced risk. This finding is all the more true in the Asian market where despite the expected strong growth, numerous alliances are concluded to share costs and risks. As such, an eye should be kept on the low-cost alliance model adopted by U-Fly and Value Alliance as it is particularly innovative and likely to impact the balance of power between low-cost and regular airlines.

[1] IATA’s data, 2016

[2] Star Alliance, oneworld, SkyTeam

[3] Our partnership across the Atlantic, British Airways

[4] British Airways and Iberia’s Joint Business, American Airlines, October 2010

[5] Joint-Ventures, Lufthansa Group

[6] 1st Semester 2017 Results, Air France – KLM, July 2017

[7] Profile, Air France – KLM

[8] 2017 Annual Report, Lufthansa Group, March 2018

[9] IATA Forecasts Passenger Demand to Double Over 20 Years, IATA, October 2016

[10] Air France-KLM in India, Air France-KLM, 2017

[11] Air France-KLM strengthens its joint venture with China Eastern Airlines, Air France-KLM, July 2016

[12] Joint Ventures, Lufthansa

[13] British Airways takes off with China Eastern Airlines, British Airways, August 2016

[14] The response of European historic airlines to the low-cost offensive, Sia Partners, June 2015

[15] Southeast Asia’s low cost airline fleet expands by 13% in 2015 as short haul capacity growth slows, CAPA, January 2016

[16] Yearly reports, CAPA

[17] About Value Alliance, Value Alliance

[18] Are airlines ready to revolutionize online distribution? , Sia Partners, September 2015

[19] World’s biggest budget airline alliance takes off in Asia-Pacific, ThePhuketNews, May 2016

[20] IATA Data, October 2016