SEC Division of Examinations Releases 2026…

As of 2020, the net-metering mechanism will not be applicable in Brussels anymore for small PV installations. Prosumers (i.e. small PV owners) will therefore have to sell their excess production (mainly from PV installations) at the market price.

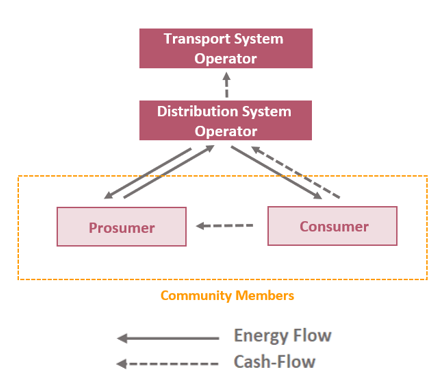

In the current situation, they would most likely sell it back to their supplier. However, this regulatory change can also be an opportunity for a new business model development within the energy sector: peer-to-peer (P2P) energy. In such business model, consumers and prosumers form energy communities in which the excess production could be sold to other members. The benefits are twofold as the prosumers could make an additional margin on their sale and consumers could buy electricity at a more advantageous price.

In the traditional model, the electricity is mainly produced by large power plants, passes through the transmission grid via high voltage lines then is either distributed to large consumers (typically industries) or transformed in medium/low voltage and distributed to smaller consumers via the local grid. All the contributions are taken into account in the supplier’s bill, which redistributes the corresponding amount to the different actors.

In a community-based model, the community members providing electricity to other members act as producers and suppliers, reducing the number of actors and simplifying the model trough (at first sight) an internal trading.

Figure 1: P2P energy trading model

Bypassing the supplier removes the associated commodity cost from the energy bill. This leads to a « P2P value creation » estimated to ~75 €/MWh for an average household1 with a fixed electricity price contract (Figure 2). This amount is then to be shared between the consumer and the prosumer, following an allocation key that they can freely define. For the purpose of this article, it is considered that the prosumer receives the same amount as the supplier buyback (30 €/MWh) as well as half of the remaining P2P value creation. Hence, the 75 €/MWh is assumed to be distributed as follow:

It should be noted that, in case the P2P system becomes important, the VAT and contribution to the renewables will be collected through another system, reducing the P2P value creation of 75 €/MWh.

![Contributions to the electricity price (Brussels, March 2018 [1])](/sites/default/files/styles/freeratiomedia_1200/public/image/picture/2020-06/p2p_fig2.PNG?itok=I5n-wNiO)

Figure 2 : Contributions to the electricity price (Brussels, March 2018 [1])

In 2018, the PV capacity for residential use in Brussels was around 10 MWp [2]. Assuming an average growth of 1 MWp per year [3], it should reach 12 MWp in 2020. Based on an overall production of 950 MWh/MWp [4] this gives an annual energy production of 11 400 MWh. Considering that one third of this production would be self-consumed by producers, the potential electricity that could be redistributed to communities would be 7 600 MWh, enough to supply electricity to more than 3300 households in Brussels (based on an average annual consumption of 2.3 MWh per household [5]).

Based on the P2P value split given above, Sia Partners estimates that the communities would spare a total amount of 570 000 €/year. An average household would spare about 52 €/year, which decreases the electricity bill by -11%.

An average prosumer with a solar installation of 2.28 kWp, would make an additional margin of 22.50 €/MWh compared to the supplier buyback model (52,50 €/MWh in total for the P2P model compared to 30 €/MWh for the buyback model). Selling its excess electricity to the community would increase its gain by +74% (76 €/year with the P2P model instead of 43 €/year with the supplier buyback). Furthermore, based on a Sia Partners study of profitability of Solar PV in the Brussels area, the P2P system would increase the internal rate of return of residential PV installation by 1,8% with Green Certificate system and 1,9% without2 (see Table 1).

If Wallonia and Flanders decide to change the regulation and also abolish the net-metering mechanism, the P2P model would also become profitable.

As for the disruption induced by Uber in the transport sector in 2015, barriers have to be levered for P2P communities to reach their full potential. The barriers are grouped in three categories:

Legal challenges

On paper, the community producers act like suppliers for the other community members. Rights and obligations of the different actors should also be clearly defined. On the prosumer side, several questions have to be answered such as: “Should their revenues be taxed?”, “Should an injection tariff be applicable?”.

On the community side, it is vital to identify its obligations to respect the electricity grid balance: “Should the community provide all the electricity supply”, “Should it be considered as a supplier or as a BRP (Balancing Responsible Party)?”. Future regulation might draw a distinction between an ordinary prosumer i.e. who dimensioned his installation for his own needs and only sells excess; and an intensive prosumer i.e. who oversized his installation in order to further take advantage of the P2P trading system. For instance, with the end of net metering in Brussels as from 2020, small prosumers (< 10 kVA) will be exempted from VAT on the excess electricity they sell.

Technical challenges

On the technical side, two main challenges have to be overcome. First, the Billing Process must be adapted. Today, all contributions are gathered by the supplier and redistributed afterward to the right actor. In the P2P system, the grid contributions also have to be collected without the traditional supplier’s involvement.

The second issue is related to the coexistence between the community and traditional suppliers. To avoid billing errors, a clear distinction should be made between the energy supplied by the supplier and the energy supplied by the community members. This could be solved with the following process:

Both the supply and consumption of each community member are smartly monitored in real time. This near real time measurement ensures that the amount of electricity consumed by the community corresponds to the excess production of prosumers. Smart meters could be used for this near real time measurement

Internal trading transactions are created and recorded in a P2P database

The energy supply of the community-provided electricity is compensated on the electricity bill emitted by the traditional supplier based on the transactions recorded in the P2P database. This point aims at solving the supply coexistence issue by specifically watching when the electricity is consumed to identify the right supplier to pay.

Figure 3 : Possible P2P billing process

Organisational challenges

For the community to be effective, rules and agreements between all members have to be developed. These rules can be articulated around three pillars:

Regarding the electricity price, a trade-off has to be determined such that it remains a win-win operation for all involved parties. From a consumer perspective, the P2P energy contribution has to be lower than the traditional price. From a prosumer perspective, the P2P energy contribution has to be higher than the typical buy-back price for excess electricity.

Secondly, entrance and the exit of new members within the community also has to be regulated, especially if the community has the obligation to provide electricity to the members. Possible criteria could be linked to the installed production capacity or the average consumption. An agreement to remain within the community could also be useful to guarantee eventual community obligations.

Distribution rules have to be developed to tackle situations in which supply does not match consumption. These rules aim to determine who will benefit from the electricity community first. Two main trends could be adopted: a value maximization model (benefits of the community being maximized) or a fairness maximization (active members are supplied first). A trading system based on bids is also an alternative.

Communities with different business models have emerged in the recent years. These existing models propose solutions to overcome identified challenges. Among the existing actors, four have been retained to illustrate how existing business models have overcome the challenges:

Even if the concept of P2P is global, actors such as Power Ledger and SunContract are aware that, due to national legislation, the P2P exchanges could only occur within a given country. As rights and obligations of prosumers are determined by regional legislation, P2P communities would have to adapt their model to match the regional specificities.

Regarding to the responsibilities of P2P communities, two trends are observed:

Smart meters could solve the challenge related to the energy origin. Using the Power Ledger platform explicitly requires smart meters for instance.

Regarding the billing process, two approaches have been identified:

In P2P trading platform, the traditional supplier is involved to provide electricity to consumers and all transactions are made with cryptocurrencies. However, this only partially solves the billing process challenge as P2P trading platforms consider exchanges of electricity only and do not take grid contributions into account.

Organizational challenges are very specific to communities. Engie NL and Vandebron establish contracts with the community members that clearly fix the organizational rules. P2P platforms have an approach based on bids made by consumers and prosumers. Distribution and price are determined by these bids. However, rules to entrance and exit of the community are not clear yet. It is to be noted that, the entry/exit challenge is less problematic when the community reaches a critical size.

Other companies/communities are emerging such as:

Depending on the community’s obligations, Sia Partners sees the potential emergence of three scenarios based on how the community energy share would be coordinated:

The legal challenges and the required billing process adaptation are the main barriers to the set-up of a P2P communities. However, the traditional suppliers’ core business is to manage these constraints and they could adapt their business to match the community’s needs. This would require a limited adaptation of their billing process as suppliers remain unique and could collect the other contribution as well. The community billing would be simplified as the supplier has access to all the data and could therefore handle the compensation themselves. Hence, traditional suppliers could anticipate the trend and propose a solution by themselves before the emergence of P2P energy communities. In this context, traditional suppliers still have a key role to play in a P2P energy framework. By partnering with communities, they could acquire and attract new customers.

In the recent past years, the number of prosumers has increased and is expected to further increases in the future. With the end of net-metering in Brussels as from 2020, prosumers will have excess solar production to sell. A possible alternative to the proposed buyback by supplier is to sell the excess to members of an energy community. Setting up a P2P community can enable up to 11% of energy bill reduction for consumers. Prosumers could observe a profitability increase on their solar installation of nearly 2%.

However, legal, technical and organizational challenges have to be overcome for P2P communities to develop. Based on existing cases, traditional suppliers have a role to play in these communities and help tackle most of the existing challenges.

In the long run, the largest competing scenario for P2P energy trading is self-consumption (which remains more profitable as there are extra grid cost savings and the value creation is not shared), possibly driven by batteries. On the other hand, the rise of other decentralized energy sources (e.g. B2B solar, local wind turbines, CHPs) could increase the number of actors willing to enter such a community.

[1] MEGA, “Carte tarifaire - Clients résidentiels Bruxelles,” March 2018. [Online] [Accessed 21 March 2018].

[2] Elia, “DONNÉES DE PRODUCTION PHOTOVOLTAÏQUE,” 2018. [Online].

[3] APERe, “Observatoire Photovoltaïque,” February 2018. [Online] [Accessed March 2018].

[4] European Commission, “Photovoltaic Geographical Information System,” 2017. [Online] [Accessed April 2018].

[5] Brugel, “Rapport Annuel 2016 - Droits des consommateurs résidentiels et fonctionnement des marchés électricité et gaz,” Brussels, 2017.