Control Room of the Future

Over a decade ago, the Federal Reserve Board (FRB) adopted and implemented Regulation W (Reg W). Since then, much has changed in the Banking world, and for many institutions, and even the Regulators, Reg W took a back seat to newer, more pressing regulations.

As a result of increased regulatory scrutiny, recent issues cited by Regulators, and the projected increase in “Transactions with Affiliates”, Banks are increasing their overall focus on their Regulation W compliance programs.

In 2003, the Federal Reserve issued Regulation W (Reg W), which implemented sections 23A and 23B of the Federal Reserve Act. Sections 23A and 23B and Reg W were implemented for two main purposes:

In 2012 and in light of the banking and regulatory environment, the Federal Reserve issued a Supervision and Regulation Letter which stated to reduce a firm’s impact of potential failure, firms should “implement and maintain effective policies, procedures, and systems to ensure compliance with applicable laws and regulations. This includes compliance with respect to covered transactions subject to the Board’s Regulation W, which implements Sections 23A and 23B of the Federal Reserve Act and limits a bank’s transactions with its affiliates.”

A supervisory letter published by the FRB in 2002 sums up Reg W very fittingly, saying it “includes 70 years’ worth of interpretive guidance furnished by the Board and its staff concerning statutory requirements that are fairly brief, but extremely complex in application.”

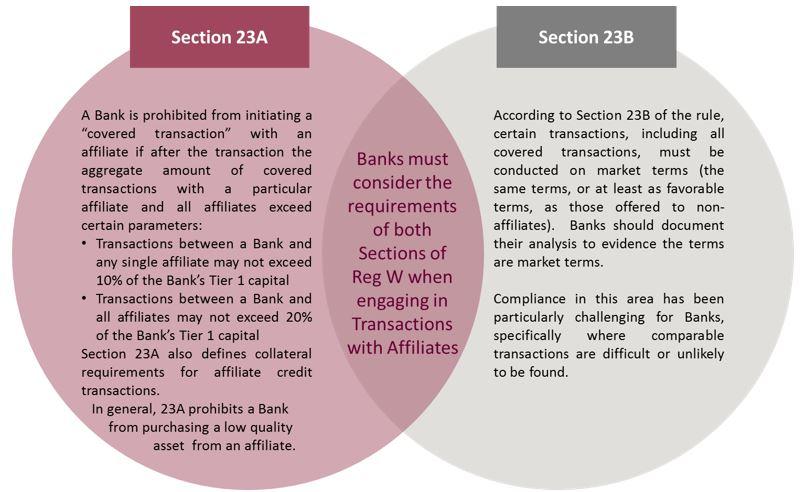

In our experience, Banks occasionally treat an affiliate transaction as a 23A transaction or a 23B transaction. Banks should review all affiliate transactions to ensure that they meet the requirements of both sections of Reg W.

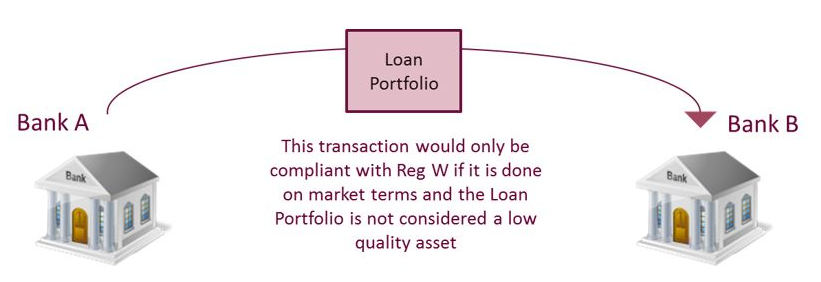

If Bank A, a subsidiary of Bank B, wants to sell Bank B a portfolio of loans, this transaction must be done on market terms to not disadvantage either party, and the Loan Portfolio must not be considered a low quality asset.

Through our Reg W experience, Sia Partners has identified 6 key components for a comprehensive and effective Reg W Compliance Program.

One particularly effective strategy to address the governance of a Reg W Compliance program is to design and implement a Reg W subcommittee charged with oversight responsibility for the Reg W compliance program, or add Reg W oversight to a previously created regulatory oversight committee.

Banks should perform an assessment to identify areas with known covered transactions as well as areas that have a high likelihood of conducting covered transactions. These areas should be the areas with the most robust testing and monitoring programs.

Specifically, controls and checks should subsequently be implemented in these areas to assess whether the transaction is allowed under the Regulation and to determine if proper collateralization is in place.

There appears to be an overall lack of awareness of Reg W and its implications on Banks, particularly in the Front Office. It is essential to train key personnel within Banks, including Front Office and support functions, to equip them with knowledge of the Regulation and its ramifications.

A robust training program can protect the bank from breaches and other risks stemming from non-compliance and can enforce accountability and ownership by all stakeholders.

Through our experiences we have found many Banks’ current inventory of policies and procedures relating to Transactions with Affiliates (Reg W) to be vast and decentralized.

Banks should establish a Policy and Procedures Framework. Many times policies and procedures are created as needed and not fully incorporated into a Bank’s framework. See below for an example of a Policy and Procedure Framework.

As Banks quickly implement or enhance compliance programs for new regulations or regulations with a renewed focus, roles and responsibilities are often times distributed to the most convenient function and not the most effective function.

An effective Reg W Compliance Program reviews the current roles and responsibilities of the various stakeholders and assesses if they are the best fit.

Typically, Banks’ Reg W transaction identification, submission, approval, monitoring, and reconciliation processes are extremely manual. To enhance the Reg W Compliance Program, Sia Partners suggests automation where appropriate based on an assessment of the Bank’s Reg W systems and processes.

One effective strategy is to leverage current systems, such as a case management system for affiliate transaction identification, monitoring, tracking, and approval.

As Regulators bring compliance with Reg W back into focus, banking entities are forced to bolster their efforts to comply with this increased scrutiny. An effective Reg W Compliance Program will be essential to ensuring Banking Entities stay out of trouble.

Sources:

Copyright © 2016 Sia Partners. Any use of this material without specific permission of Sia Partners is strictly prohibited.

Banking Entities will face two major challenges in enhancing their Reg W compliance programs: