Fortune 100 response to DE&I pressures

As a natural, next step for new vehicles, implementing a fluid second-hand market will be essential to support the growth of electric vehicles.

Being able to reassure the buyer about the condition of an electric vehicle, in particular its battery, will be a key factor to growing this market. There is therefore room to offer new services, both to sellers and buyers of used electric cars.

As sales of electric cars explode, the second-hand market will also become an attractive option to purchase an electric vehicle since it removes one of the two main obstacles to the acquisition of an electric vehicle, namely, the price. However, the second obstacle, which is autonomy, and more specifically, battery capacity, finds itself accentuated here. Battery performance decreases during the life cycle of an EV (Electric Vehicle); over a period of 10 to 15 years, they lose up to 25%-30% of their capacity. This uncertainty about the state of the battery raises questions when acquiring a second-hand electric vehicle. It can cause concern for the purchaser, but also for the seller, who must be able to properly measure the residual capacity of the battery to sell the vehicle at a fair price. Today, the used EV market is in its infancy and does not offer many benchmarks to its participants. As such, there is a position to establish oneself as an early player, to support those looking to sell or buy a used electric vehicle (UEV) by evaluating the condition of the vehicle battery. What are the high, value-added services that such an actor could provide?

The UEV market experienced strong growth in 2019, with a 55% increase in sales compared to 2018 [i]. In addition, 50% of new electric vehicles are purchased in rental form today [ii], in particular by companies that are speeding up the electrification of their fleets. These rental vehicles are then often put on the second-hand market at the end of the rental period, which lasts an average of 33 months. This return of leased vehicles will help stimulate the UEV market in the medium term. Finally, 68% of French people surveyed said they wanted to adopt more eco-responsible behavior following the COVID pandemic [iii]. These different elements suggest a growth dynamic that will accelerate in the UEV market, and therefore a growing number of UEV transactions.

It is difficult to accurately calculate the price of a used electric vehicle. Valuing a UEV is not as easy as valuing a combustion-powered vehicle. While pricing models are well proven for those, the UEV market is relatively young, and the pricing models used by UEV professional dealers - who account for 90% of UEV resellers - are in the early stages of development. Pricing is especially complicated due to the lack of insight into EV battery behavior over time, batteries which account for around 40% of the value of a new EV [iv]. Defining and accepting a good price is also delicate for the buyer, who may have doubts about the capacity and the performance of the battery. Here again, the youth of the market makes it difficult to gather feedback and comparative elements.

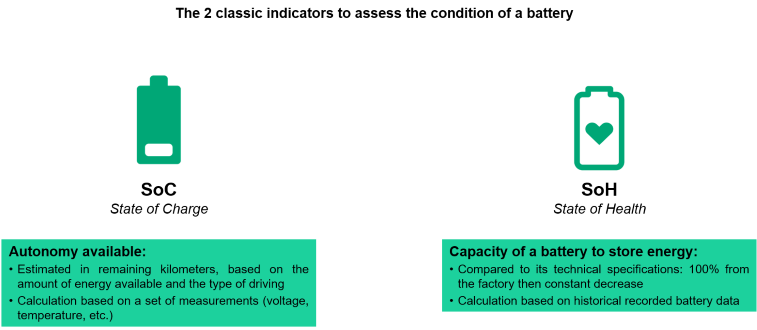

To be able to estimate the performance of a battery, it is necessary to use indicators. Nowadays, car manufacturers generally provide two key indicators to measure the condition of a battery: the State Of Charge (SoC) which indicates the remaining number of kilometers before the battery is fully discharged, and the State Of Health (SoH) which gives the residual percentage of battery performance compared to when it left the factory operating at 100% of its capacity. This last indicator is used by the manufacturers to determine whether or not to activate the battery guarantee.

These two indicators give an idea of the state of a battery at a given moment and for a given vehicle, however they are neither universal nor standardized. As the market for electric batteries begins to take off, battery and car manufacturers each have their own calculation method for these two indicators, which makes it difficult to compare the capacities of different electric vehicles. Moreover, these indicators can be complicated for someone who is not familiar with electric vehicles.

As a result, there is an opportunity to help both individuals and professionals during UEV transactions, by providing them with custom services to precisely evaluate the condition of the car, and to price it reliably.

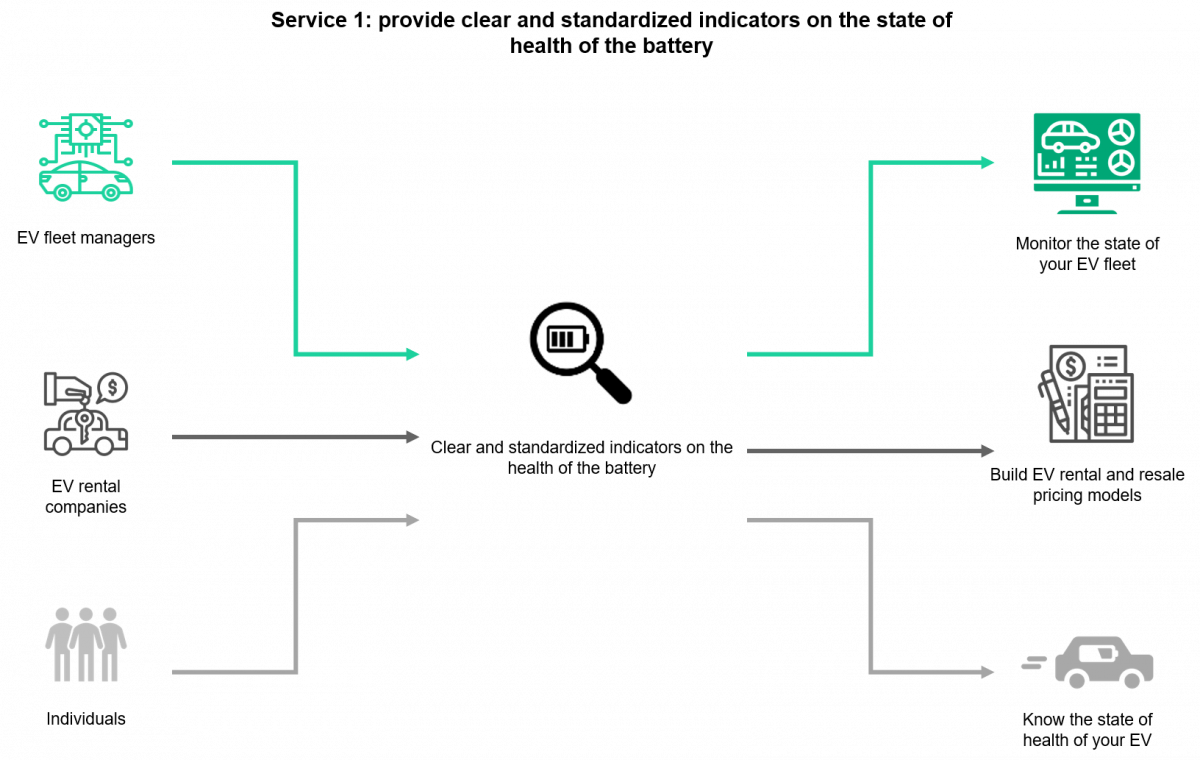

A service that could answer the need for clarity would consist of offering users simple and standardized indicators of the state of the battery. Those indicators would be based on raw data from the battery and would be calculated systematically and identically for any type of vehicle. The goal is to allow EV users to monitor the health of their batteries and be alerted in case of performance loss. Such a service would help anyone who owns an EV and wishes to monitor its value. For example, it allows rental companies to anticipate the residual value of EVs, and therefore to build their rental and resale price models accordingly. It allows fleet managers to continuously monitor the state of their fleets and anticipate maintenance or replacement periods. It allows individuals to be informed in real-time, and in a clear and understandable way on the state of their EV, whether it is new or used.

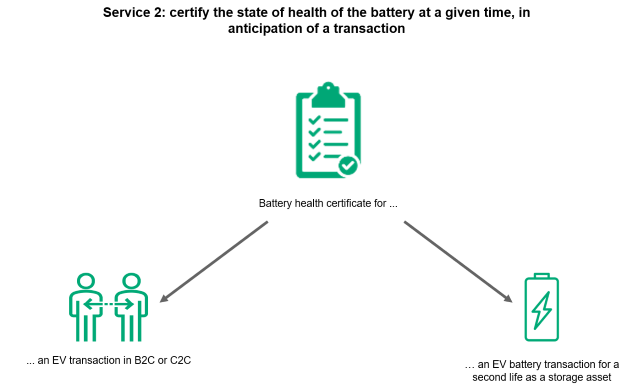

Another service that would be valuable is certifying the health of a battery at a given time. A certification would reassure the purchaser of a UEV by giving more transparency to the transaction and would give the seller a basis to accurately estimate the residual value of the battery. This type of service, which is already beginning to become popular, will interest all players in the second-hand market such as second-hand professionals, auction sellers, individuals looking to sell or buy a UEV - all those who need readability on the state of health of a UEV. In the long term, this certification may also intervene when the battery transitions from its first life inside an electric vehicle to its second life as a stationary storage asset within the electrical grid.

Who could offer these services to increase activity on the UEV market? Car manufacturers of course, but also car experts, or even energy companies, whose neutral position on the automotive market might prove useful. For them, this is an opportunity to integrate these services into a wider range of EV-related offers such as electricity contracts, installation of charging stations, charging pass ...

In a growing UEV market, all stakeholders need help to understand and monitor the state of battery health. This offering can include two services: providing reliable and standardized indicators allowing continuous measurement of a battery’s capacity and certifying the residual value of a battery at a given time in anticipation of a UEV or a battery sale. Such services can be provided by car manufacturers, but would also prove valuable for other players in electric mobility such as energy companies.

[i] Source: Clean automobile

[ii] Source: Sia Partners' assessment based on data published by CCFA

[iii] Source: YouGov survey

[iv] Source: Sia Partners article