Fortune 100 response to DE&I pressures

The SECURE Act came into effect on January 1, 2020. The legislation brings changes for long-term retirement savings and affects people at every age. The primary aim of the legislation is to enhance financial security across the country. Here we look at how it impacts the Financial Services space.

The primary aim of the legislation is to enhance financial security across the country and ensure there is increased access to allow individuals to make retirement contributions.

The new law contains a laundry list of implementations that changes the retirement plan design, administration, and compliance requirements. Our focus will be on how it impacts the Financial Services space: Asset management industry and Broker-dealers realm-- fiduciary-related rules.

Overall, the SECURE Act will change the landscape for Retirement Plans and individual retirement accounts, which is set into effect, creates new business opportunities that will benefit all players in the market – plan administrators, plan sponsors, custodian, and individual investors.

In 2021, plan admins will be able to offer Multiple Employer Plans (MEP) to unrelated employers. This will allow numerous small companies to sign up for a centrally administered plan, which would reduce recordkeeping costs and potentially allow plans access to lower-cost investments options.

Part-time employees who work more than 1,000 hours in a single year or 500 hours per year for three consecutive years are now eligible to participate in 401(k) plans. These participants can be excluded from safe harbor contributions and various testing rules. Businesses may create a plan and adopt a creation day as of the last day of the taxable year, allowing employers more time to create the plan and allowing employees to receive contributions for the earlier year.

Combined Annual Reports for Group of Plan allows plans that are similar (same trustee, administrator, fiduciary, plan year-end, investment options) to consolidate Form 5500 filings, which would reduce administrative costs. Allowance of portability (transfer) of annuity investments from 401(k) to 401(k) or IRA. This will give the individual an option to not pay surrender charges and fees.

Annuities can now be offered in 401(k)’s by plan sponsors without fear of legal liability if annuity provider fails to meet their obligations. Plan fiduciaries are afforded an optional safe harbor to satisfy the prudence requirement with respect to the selection of insurers. The plan fiduciary can now rely on the insurer’s representation that it is compliant with state insurance laws.

Plan administrators must add a Lifetime Income Disclosure in the statements provided to the plan participants at least once during any 12-month period. This lifetime income disclosure requirement will become applicable more than 12 months following the later of DOL’s issuance of (i) interim final rules, (ii) a model lifetime income disclosure, or (iii) assumptions used to convert total accrued benefits to lifetime income streams.

Minimum distribution rules for beneficiaries of defined contribution plan and IRA accounts have been modified by eliminating the stretch option for certain types of beneficiaries. Under the new rules, most of non-spousal beneficiaries may be required to withdraw and pay taxes on all distributions within 10 years of the death of the original account holder.

Prohibition on contributions to a traditional IRA by individuals who are 70.5 years of age have been removed. For taxable year 2020 and beyond, the law removes the age limit at which an individual can contribute to a traditional IRA.

Minimum age at which retirement plan participants need to take required minimum distributions (RMDs) has been increased from 70.5 to 72.

Tax free distributions from 529 savings accounts can be availed to cover cost for certain apprenticeship, homeschooling, and up to $10,000 annually for qualified student loan repayments, and private elementary, secondary, or religious schools.

The SECURE Act has induced some of the most significant changes to the American retirement system in recent history. It will benefit plan administrators, plan sponsors, and increase individual investors' ability to save more for their retirement and create a mechanism for them to generate lifetime income, as well as giving the IRS an opportunity to increase revenues. Many of the enhancements are already in effect as of January 1st, 2020.

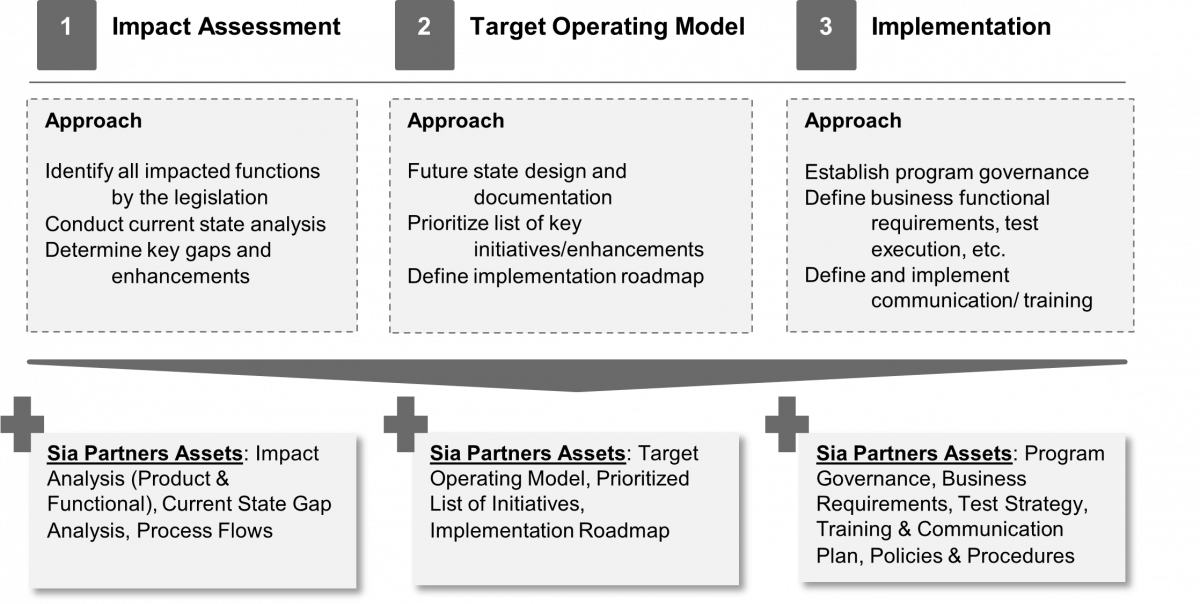

Plan sponsors and Wealth Management firms should gain an understanding and respond to those changes by making appropriate adjustments to their operating models.

Sia Partners will continue to analyze the impacts of the rule to determine how it impacts the operations and compliance of our customers.

Platforms

Firms need to understand the impacts and implement changes to their Advice tools, Retirement, Financial Planning and Trading platforms.

Product Offering

Plans admins should consider offering Annuities as an investment option for retirement. Multiple Employer Plans (MEPs) should also be considered as part of offerings to small businesses.

Compliance & Controls

Firms will need to adjust their existing policies, procedures and recordkeeping systems due to significant changes introduced to the IRAs, Retirement plan and 529 accounts.

Training & Education

Firms will need to educate and train the financial advisors and branch personnel about the impacts of the SECURE Act and how it if affects the retirement planning for their clients.

Communication

Custodians and Broker Dealers will need to communicate and educate clients about the changes and how it impacts their retirement planning.

Sia Partners has extensive experience delivering Retirement Solutions in the Wealth Management space and a strong understanding of the industry best practices to assist firms in their initiatives to comply with SECURE Act legislation.