Fortune 100 response to DE&I pressures

A study on the current state of mobile banking in the world and a peek into the future.

The digitization of banking services across the globe is evolving faster than ever before, driven by a multitude of factors. Rampant inflation leads to consumers looking for tools that help them keep closer track of their budget. Increased focus on ESG performance of corporations forces banks to take action for a healthier planet. Big tech applications have heightened client expectations when it comes to frictionless digital solutions. New technologies like crypto and decentralized finance are leading to the redesign and rethinking of financial services. Tech-savvy new entrants like Neobanks offer smooth and fast digital-only experiences. Fintechs often focus on one specific part of the banking value chain, specializing helps them to offer best-in-class products and services. Finally, banking customers have more control than ever about who has access to their data thanks to regulatory pressure.

All these factors lead to digital channels, and especially apps, becoming a quintessential part of customer journeys for banking products and services.

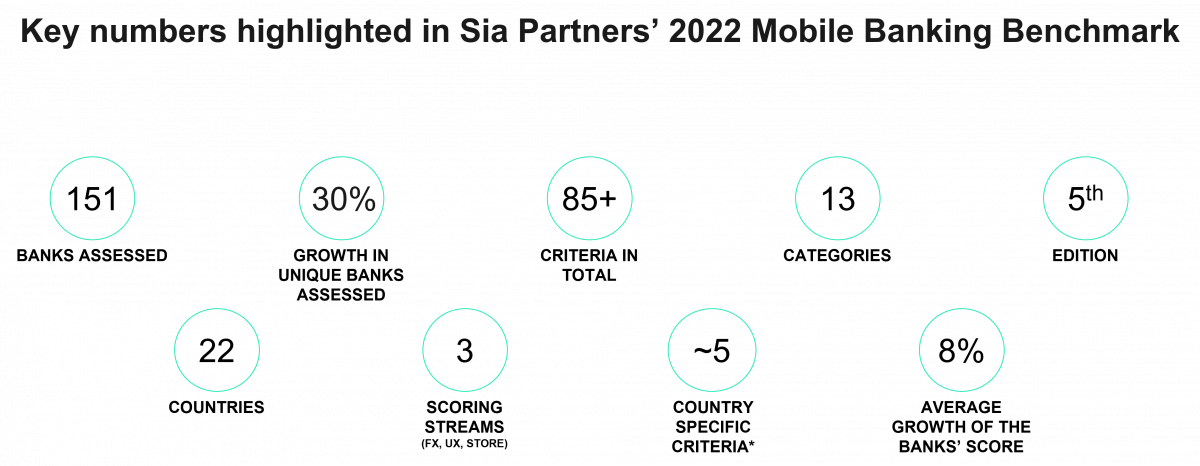

Each year, Sia Partners performs a benchmark on banking apps, searching for the most complete, innovative, and user-friendly banking applications in the world. Sia Partners' 2022 Mobile Banking Benchmark assessed the performance of 150+ banking applications in 22 countries across regions (EMEA, North America, Asia & Australia). The banks in scope of the study were evaluated on more than 85 criteria in 3 scoring streams: functionalities, user experience, and app store ratings.

The Benchmark methodology, based on the 3 scoring streams, follows an objective and transparent scoring method. A 4-point scale with standardized answer possibilities for each criterion guarantees comparability, transparency, and objectivity across banks.

Our worldwide Mobile Banking Benchmark is a yearly exercise and the criteria are changing year-on-year, incorporating the newest trends, and evolving with customer expectations.

European banks dominate the ranking as digital leaders and change positions amongst themselves in a fight to take the podium. Revolut Metal (Neobank) is the winner of this year’s Mobile Banking Benchmark, with Intesa Sanpaolo (Italy) and last year’s winner, KBC (Belgium) ranking in the top three positions. Representing 80% of the top 10 banks, Europe clearly has cutting-edge banking applications. Overall, digital leaders offer best-in-class customer support as well as frictionless end-to-end customer journeys in their applications, even for non-daily banking functionalities such as credit and investments. Additionally, they often incorporate innovative services that go beyond traditional banking services in their apps.

We see large gaps between the applications of different banks. Whereas digital laggards still struggle to offer performant daily banking functionalities like transfers, cards, and accounts; digital leaders are pushing innovations in Personal Financial Management (PFM), ESG, open banking, and beyond banking functionalities.

The following ranking displays the Global Top Ten Banks of 2022:

The steps listed below are not necessarily a sequential path to be followed by banks. However, it can serve as a guideline towards success and is followed by the majority of digital leaders.