SEC Division of Examinations Releases 2026…

A study on the current state of mobile banking in the EMEA region, North America, Asia and Australia, and a peek into the future.

The global digitization wave has taken the banking sector by storm and is seriously testing the flexibility and innovative capacity of banks worldwide. Driven by a multitude of factors, banks must react to new trends at an increasingly fast pace. Society and regulators have raised their expectations concerning the role of banks in Environmental, Social and Governance (ESG) topics. To ensure regulatory compliance, and to preserve their Social License to Operate, banks need to react swiftly and provide visible evidence of their efforts on their digital channels and mobile banking apps. New disruptive technologies, such as AI, are set to shake the foundations of the banking sector, leveraging Big Data and supporting an unprecedented degree of automation in daily banking operations. New market entrants, like Neobanks and FinTechs, offer best-in-class, digital-only experiences by focusing on specific parts of the banking value chain, while cryptocurrencies and decentralized finance continue to impact the evolution of the financial services sector.

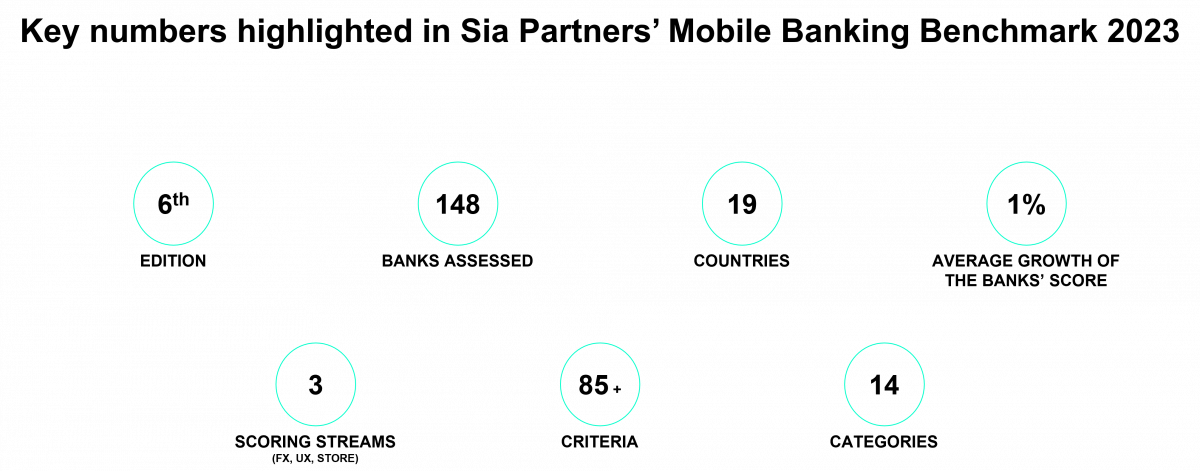

Due to this wave of digitization, mobile banking apps increasingly emerge as the main channel for clients to reach out to their banks. Therefore, having top-notch fully integrated digital customer journeys on as many banking products and services as possible, and smooth subscription processes for new clients, are key factors to ensure success in today’s digital world. To stay on top of these innovations in the banking sector, Sia Partners performs a yearly global benchmark on banking apps, searching for the most comprehensive, innovative, and user-friendly banking applications in the world. Sia Partners' 2023 Mobile Banking Benchmark assessed the performance of 148 banking applications in 19 countries across the EMEA region, North America, Asia and Australia. The banks were evaluated on more than 85 criteria, in 3 scoring streams: functionalities (FX), user experience (UX), and app store ratings.

The Benchmark methodology, based on the 3 scoring streams, follows an objective and transparent scoring method. A 4-point scale with standardized answer possibilities for each criterion guarantees comparability, transparency, and objectivity across banks.

50% of the final score comes from functionalities (FX). This scoring stream rates functionalities related to Accounts, Cards, Transfers, Payment Services, Personal Financial Management (PFM), Investments, Insurance, Credit, User Support, and Beyond & Open Banking.

30% of the final score is based on user experience (UX). We assess criteria related to convenience, design & ergonomy, and look & feel.

20% of the final score is retrieved from an average of Google Play store and Apple App store ratings, incorporating customers’ expectations and experiences on the application.

Our worldwide Mobile Banking Benchmark is a yearly exercise, and the criteria change year-on-year, incorporating the latest trends, and evolving with customer expectations.

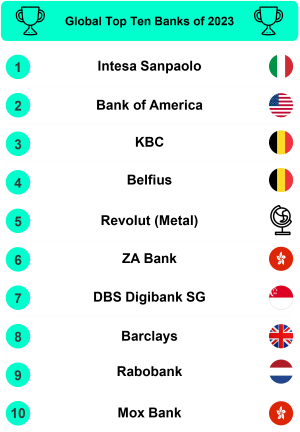

The results of 2023 are characterized by heavy competition for the podium between Digital Leaders. Intesa Sanpaolo (Italy) claims the gold medal in 2023, Bank of America (USA) jumps to silver, and KBC (Belgium) retains bronze. While European institutions continue to dominate the upper ranks of the leaderboard, non-European players are increasingly directing their attention towards digital banking. This is demonstrated by the growing competitiveness of their mobile banking applications and the top 10 places going to the US, Hong Kong and Singapore-based banking apps.

Overall, Digital Leaders distinguish themselves from the competition by providing a completely digital, end-to-end offering and innovative services, such as ESG-related features, and the implementation of Personal Financial Management, chatbots, and Open & Beyond Banking. Top performers continue to raise the bar, while digital laggards struggle to offer performant basic functionalities and a satisfactory user experience, which results in a significant gap between the best and worst performers.

The following ranking displays the Global Top Ten Banks of 2023:

The steps listed below are not necessarily a sequential path to be followed by banks. However, in practice, we observe that this kind of sequential path is followed by the majority of banking players.

Ensure that the appropriate back-end infrastructure is in place as a foundational building block to enable digital services. Get rid of the legacy IT systems;

Implement key daily banking functionalities, increase daily client interaction & enhance top/bottom line (revenue generation, save employee intervention cost);

Provide a smooth, intuitive & interactive omnichannel customer journey, (live) assistance, and moments of truth when developing mobile features;

Enable digital end-to-end (sales) journeys, for basic products (e.g. savings account) as well as subscriptions for advanced offerings (e.g. credit, insurance, investment, etc.);

Implement innovative (beyond banking, Personal Financial Management, etc.) services, bring added value to users and make the banking app the key app for everyday use;

Make your clients into brand ambassadors, resulting in high Customer Lifetime Value, favorable NPS scoring, and free word-of-mouth advertising.

Partner, Banking, Insurance and Actuarial Services | Brussels

Anthony is a Partner in our Financial Services practice. He leads Banking, Insurance and Actuarial activities to help our clients and consultants accelerate their projects and drive future-forward, sustainable impact and competitive advantage.