Irish biopharma at an inflection point

Sia Partners conducted a comprehensive analysis to evaluate global investment applications, revealing which platforms offer the most user-friendly and holistic experience for investors.

Over recent years, there has been a remarkable surge in the popularity of investment applications. This shift can be attributed to multiple elements such as lower interest rates, technological advancements, and inherent advantages of these apps, such as user-friendly interfaces, minimal entry barriers, and cost-effectiveness. This surge in popularity has sparked significant innovation, funded by large capital investments dedicated to online investment platforms.

Sia Partners’ Investment Application Benchmark is a comprehensive analysis that aims to evaluate investment applications on a global scale, providing insights into which platforms deliver the most holistic and user-friendly experience for investors. The study is conducted annually.

We have been recognized by clients and media for our Mobile Application benchmarking studies. Similar studies have been conducted for Mobile Banking applications and Non-life Insurance applications.

Sia Partners adopts a global perspective in evaluating investment applications through our comprehensive Investment Application Benchmark. This in-depth analysis encompasses various aspects such as User Experience, Functionalities, the Range of Products, Costs and Fees, and User Perception. Acknowledged as one of the most extensive independent studies in the market, our benchmark meticulously considers over 100 elements. Each application undergoes a thorough assessment with complete access, ensuring a detailed and unbiased evaluation. In 2023, 48 different applications were assessed from 13 different countries.

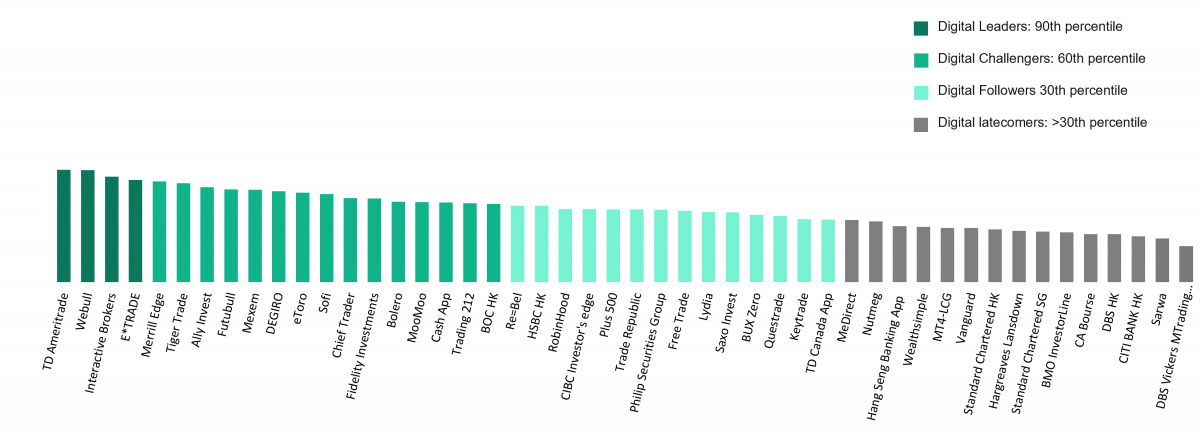

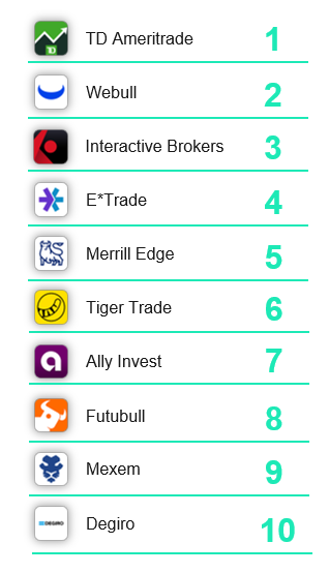

Below you can find the overall ranking of applications assessed in our 2023 edition of the Investment Application Benchmark.

US based investment apps took the top spots in 2023 with the Top-3 consisting of (1) TD Ameritrade Think or Swim, (2) Webull and (3) Interactive Brokers. These applications have the highest total score of all 48 apps included in the study.

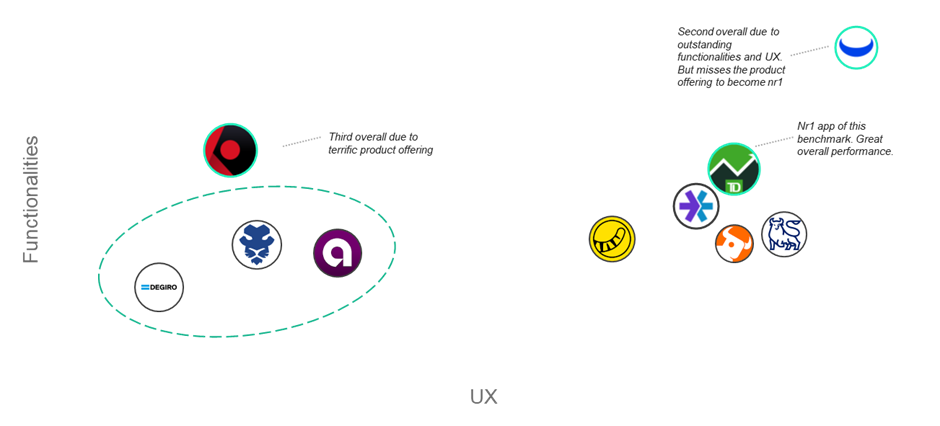

Remarkably, the Top-3 consists of applications each demonstrating a different area of strength. TD Ameritrade Think or Swim attributes its success to its robust performance across all categories. In contrast, Webull excels in functionalities and user experience but falls short in the diversity of products offered. Conversely, Interactive Brokers boasts an extensive range of products, yet it sacrifices on functionalities and user experience.

Securing a notable position just below the Top-3 is the widely recognized E*Trade by Morgan Stanley. Despite delivering an all-around robust performance like TD Ameritrade’s Think or Swim, this application scored lower across all categories.

The graph below shows the performance of the global Top-10 investment applications. The x-axis indicates the total scoring on UX, while the y-axis shows the total scoring for functionalities. The size of the logo (bubble) indicates the total product score. The logos circled in light green bold are the “Digital Leaders” of the benchmark. The other seven are considered “Digital Challengers”.

The Digital Leaders mainly differentiate themselves from the competition due to best-in-class functionalities and product offering.

Deep-dive into Top-10 investment applications. Scale adjusted to Top-10 investment applications.

In terms of look and feel, all top performers share a seamless digital onboarding process and emphasize minimizing unnecessary data inputs for the end user. The top performing apps in our benchmark also differentiate themselves by offering a wide range of products and low fees.

Breaking into the Top-10 as the first non-US-based application is Tiger Trade, claiming the 6th spot. Degiro, a Germany-based investment platform, closes the Top-10, and is the first Europe-based application in our list.

Overall, US investment applications lead charts and offer the most comprehensive mobile investing experience according to our benchmark. Overall, this is due to the fierce competition in the US wealth-tech market, requiring US companies to constantly keep innovating and assigning dedicated resources to the development of their mobile apps.

Sia Partners' benchmark serves as a valuable guide and offers insights into the market for financial institutions’ digital services and platforms. At Sia Partners, we support our clients in their journey throughout the whole process, from identifying opportunities and developing digital strategies to the implementation and integration of new technologies.