Control Room of the Future

Sia Partners conducted an in-depth analysis of investment applications worldwide. It stands out as one of the most extensive benchmarks in the market, evaluating a wide range of elements including functionalities, user experience, pricing, and available products.

Investment applications have rapidly transformed the retail investment market by providing individual investors with easy access to the stock market. Over the years, the development teams behind these apps have created comprehensive platforms offering customers advanced trading tools.

Sia Partners’ Investment Application Benchmark offers an in-depth analysis of investment applications worldwide. It stands out as one of the most extensive benchmarks in the market, evaluating a wide range of elements including functionalities, user experience, pricing, and available products.

We have been recognized by clients and media for our Mobile Application benchmarking studies. Similar studies have been conducted for Mobile Banking applications and Non-life Insurance applications.

Our approach is both international and customer-centric, ensuring a comprehensive and inclusive assessment. We aim to encompass as many key elements as possible in our evaluation. The primary assessment categories include:

Functionalities: Evaluating the range and effectiveness of features provided.

User Experience: Assessing overall ease-of-use, design, and customer satisfaction.

Products & Markets: Analyzing the variety of investment products and market access available.

Pricing: Comparing the cost structures and value propositions.

Innovation: Reviewing the uniqueness and forward-thinking aspects of the applications.

Overall, our assessment includes over 150 objective criteria for each application, providing a thorough and detailed analysis. Each criteria is scored, which provides us with an overall ranking of the investment application internationally.

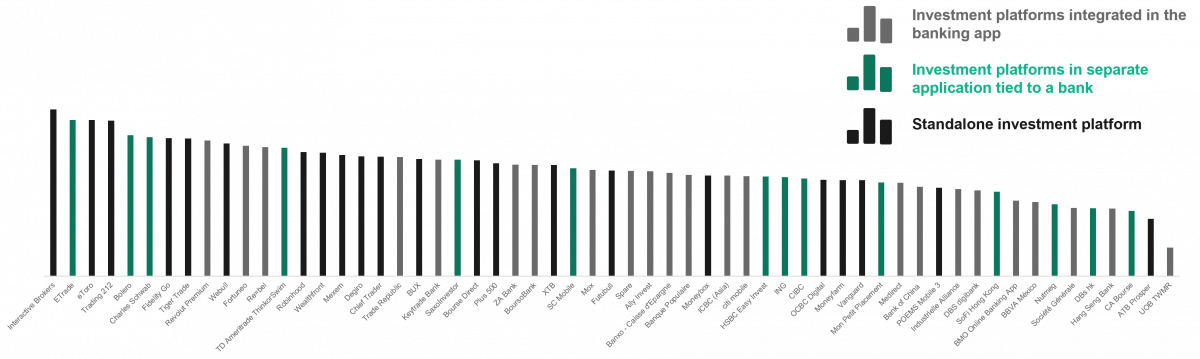

Below, you will find the Sia Partners' 2024 investment application ranking. The applications are color-coded to indicate their type and whether they have connections to a bank. This visual representation helps to quickly distinguish between various categories of applications and understand their affiliations, providing a clearer insight into the landscape of investment apps.

An important caveat is that all these applications offer a good investor journey to their customers and adhere to the minimum requirements to be included in the benchmark.

Note: TD Ameritrade has recently been incorporated into Charles Schwab.

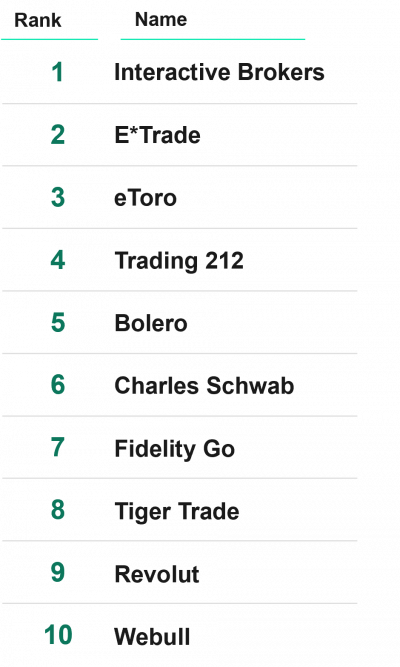

While last year's investment application benchmark was predominantly led by U.S.-based applications, this year sees an increase in non-U.S. apps breaking into the top 10. Despite this shift, the U.S. continues to dominate, with five out of the top ten applications originating from the region.

These ten applications excel due to their extensive investment functionalities, excellent user experiences, and broad product offerings, providing a comprehensive investor experience while maintaining their own brand.

Notably, each of these applications has succeeded in offering complete investor experience while also delivering unique selling points to their clients. For instance, eToro's social trading feature, Revolut's seamless integration of its trading environment within its banking app, Trading 212's superior user experience, and Tiger Trade's availability of unique markets all stand out as distinctive advantages.

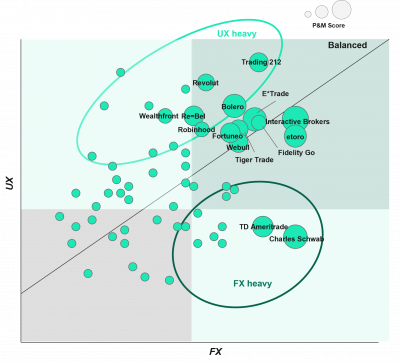

Not all investment applications have the same goals and target audience. Some cater to the needs of advanced investors, boasting a wide array of complex products and sophisticated analysis functionalities, other applications prioritize simplicity, aiming to provide a user-friendly experience tailored for novice investors. This divergence in focus underscores the importance of mapping out these applications based on their user experience (Y-axis) and functionalities (X-axis) scores, with the size of the bubble indicating the range of products and markets they offer.

Within this framework, we have curated a selection of the top 15 best-performing applications, each excelling in various aspects of user experience and functionality. While all of these top performers maintain a strong emphasis on both user experience and functionality, it's noteworthy that some exhibit a particular strength in one area over the other. This nuanced analysis provides valuable insights for investors seeking platforms that align closely with their preferences and expertise levels.

Most of the top 15 applications featured also provide low trading fees, with zero-commission trades being a prevalent feature among them. This cost-effective approach is appealing to a broad range of investors, from beginners to seasoned traders, as it allows for more frequent trading without the burden of high fees. This widespread adoption of low-fee structures further underscores the competitive landscape of modern trading applications, where affordability is a key drivers of user satisfaction and platform loyalty.

The landscape of investment applications is both diverse and competitive. Some platforms, like Charles Schwab and TD Ameritrade, cater to advanced investors with extensive functionalities, while others, such as Revolut and Trading 212, prioritize delivering a strong user experience for beginners. Meanwhile, our top performers Interactive Brokers, E*TRADE, and eToro succeed in balancing both aspects. This variety provides investors with more choices than ever before, ensuring that there are suitable applications for every type of investor.

This year's results underscore the competitive and innovative nature of the investment app market, offering valuable insights for investors seeking the best platform for their needs. The unique elements and strengths of each application highlight the tailored experiences available, making it easier for investors to find a platform that aligns with their specific preferences and expertise.

Platform providers, on the other hand, face unprecedented competition and are striving to deliver a comprehensive investor experience that combines extensive functionalities with a seamless user interface. To stand out, they are incorporating distinctive features such as lower fees, AI integration, social trading, and educational resources, thereby offering additional value to their clients. These enhancements not only attract a broader range of investors but also help providers differentiate themselves in a crowded market.

Sia Partners' benchmark serves as a valuable guide and offers insights into the market for financial institutions’ digital services and platforms. At Sia Partners, we support our clients in their journey throughout the whole process, from identifying opportunities and developing digital strategies to the implementation and integration of new technologies.