SEC Division of Examinations Releases 2026…

The world is changing. So should your talent strategy.

A future-proof talent strategy must anticipate and address the next generation talent needs, and is critical to enable sustained business growth.

It is no longer news that insurers today are operating in an increasingly complex and fast changing environment. Some examples are:

“Super app” Grab in Southeast Asia has grown from its original business of ride-hailing and expanded to consumer insurance business via a tie-up with Chubb offering travel insurance to its customers.

A major insurance player in China has expanded from insurance to healthcare and even housing.

More recently, with the widespread COVID-19 pandemic, we see how critical the digital channels are to help sustain business amid the lockdown orders and social distancing measures globally.

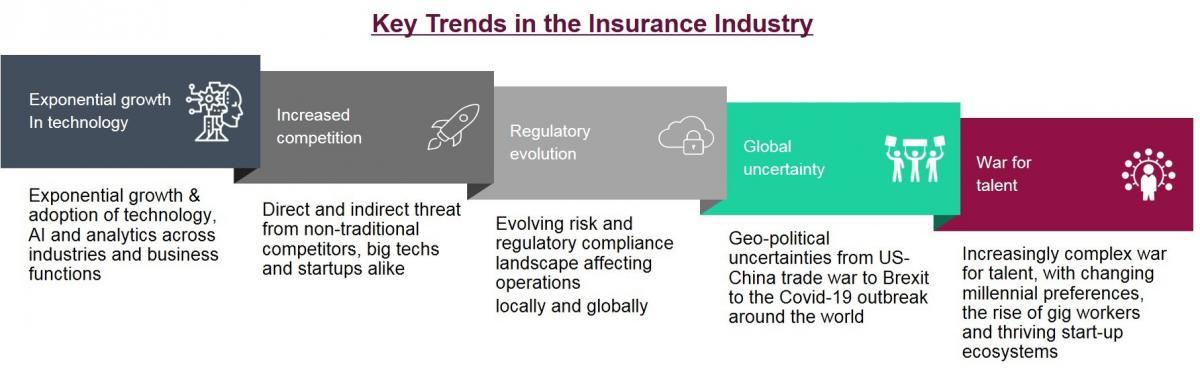

At Sia Partners, we have categorized the key trends in the insurance industry today as follows:

When change is the only constant, the increasingly rapid disruptions are jeopardizing the traditional business models for insurance. At Sia Partners, we believe insurance companies struggling to adjust to the pace of change and adapt talent strategy to disruptive innovations are losing out to their peers.

While the future of the insurance industry will undoubtedly be shaped by many of the disruptive forces, the challenges ahead also present unprecedented opportunities. With the advancement and commercialization of robotic process automation (RPA), data analytics, blockchain, and AI etc., the next generation of insurers are better equipped to enhance efficiency, deliver a more customer-centric experience, and create more value-added roles.

One of the opportunities that no insurer should ignore, is the power and potential within its workforce. With the emergence of gig economy, there is real opportunity to capitalize on developing the skills that are unique to the evolving talent market and generate exponential value to insurers.

At Sia Partners, we see how technological disruptions, and more recently, the global pandemic of COVID-19 is changing the way our clients work across the global. Increasingly we see the need to evolve the business and operating models in this constantly changing and ever more challenging environment, calling for a new generation of talent to drive value creation within the insurance industry.

So as an incumbent player in the insurance market, where do you start?

The "Bare Minimum"

The "Bare Minimum"

The "Bare Minimum"

The "Bare Minimum"

Organizations need to adjust to the pace of change and adapt talent strategy to a disruptive innovation to sustain future business growth. They must rethink how they attract, develop, and retain a new generation of talent to drive value creation within the industry in the decades to come. To do so, insurers need to understand their talent competencies and requirements, invest in the HR digital tools and technologies, enhance experiences of a new generation of talent, and adopt a people-centric change management approach while embracing the disruptive opportunities.

Sia Partners’ HR Transformation offerings provide dedicated support to the HR function to navigate the challenges. We provide our clients with our unique blend of best practices and expertise across Digital, Data Science, UX Design and Agile Change management.

JITIN SHARMA

Head of Insurance Advisory

+ 65 9066 0387

jitin.sharma@sia-partners.com

STACY SONG

Senior Consultant

+ 65 9383 6854

stacy.song@sia-partners.com

VISHNU SURESH

Senior Consultant

+852 9560 4755

vishnu.suresh@sia-partners.com