Agentic AI: Are you ready?

With the rise of digital banking solutions like mobile banking and e-banking and new players like Neo-Banks entering the market, branches are seeing a decline in number of visitors.

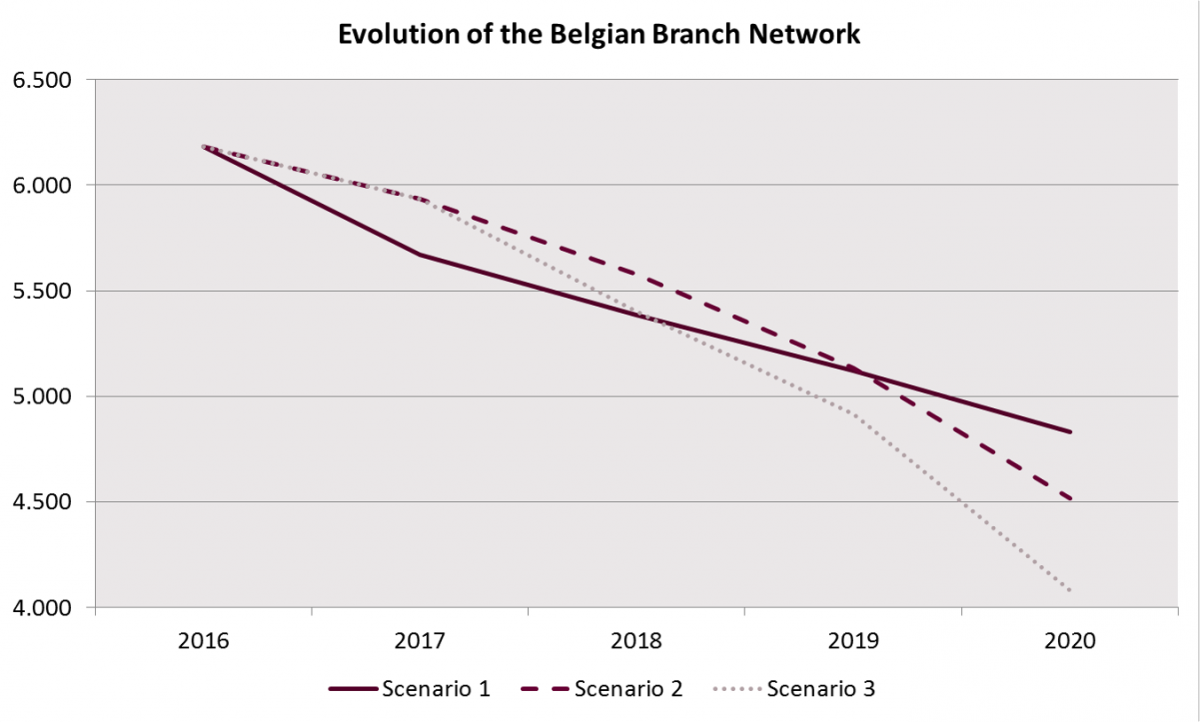

With the physical model under pressure, banks need to adapt to the digital age. To meet changing customer needs, the branch model is being transformed. Sia Partners estimates the Belgian network to reach 4.500 branches by 2020. This is equal to 27% of the branches closing in comparison with 2016.

Historically the first point of contact for the customers has always been the physical network of bank branches. People would come to their local branch for all their banking needs like depositing money, wiring payments, opening loans and discussing financial advice with their banker. Due to the digitalization of the banking landscape customers visit their branch less and less. Most if not all banking activities can be done at home on the computer or on the fly with your phone through the mobile banking application. According to a survey from Spaargids.be and Santander Consumer Bank[1] the adoption rate of mobile banking for young people is above 80%. On top of that one quarter of the population is unhappy with the opening hours of their branch. Studies have shown that adoption rates for mobile and pc banking are only going to increase in the near future. A BeoBank article[2] reveals that 3 Belgians out of 5 will use even more online bank services in the future.

But does this mean that physical branches are doomed to disappear? We do not think so. According to that same article of Beobank[3] there are still reasons for customers to visit their branch. 70% of bank customers prefer personal contact and interaction especially when it comes to big amounts and advice on complex products like loans, investments and insurance. Some complex products can also only be subscribed to by going to the physical branch. So the bank branch is here to stay, but the model has to evolve.

The traditional model of a branch network is slowly fading away. Banks have to rethink their branch strategy. The branch of tomorrow has a new role in the lives of the customers and a new format adapted to their needs is required. Sia Partners envisions two types of new network structures:

The branch of tomorrow also needs a new format. We identified a few key elements:

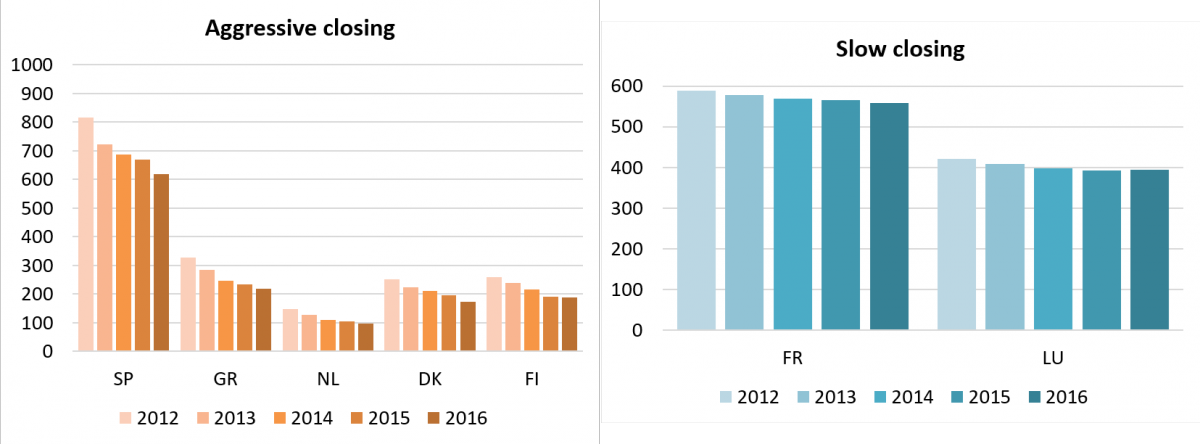

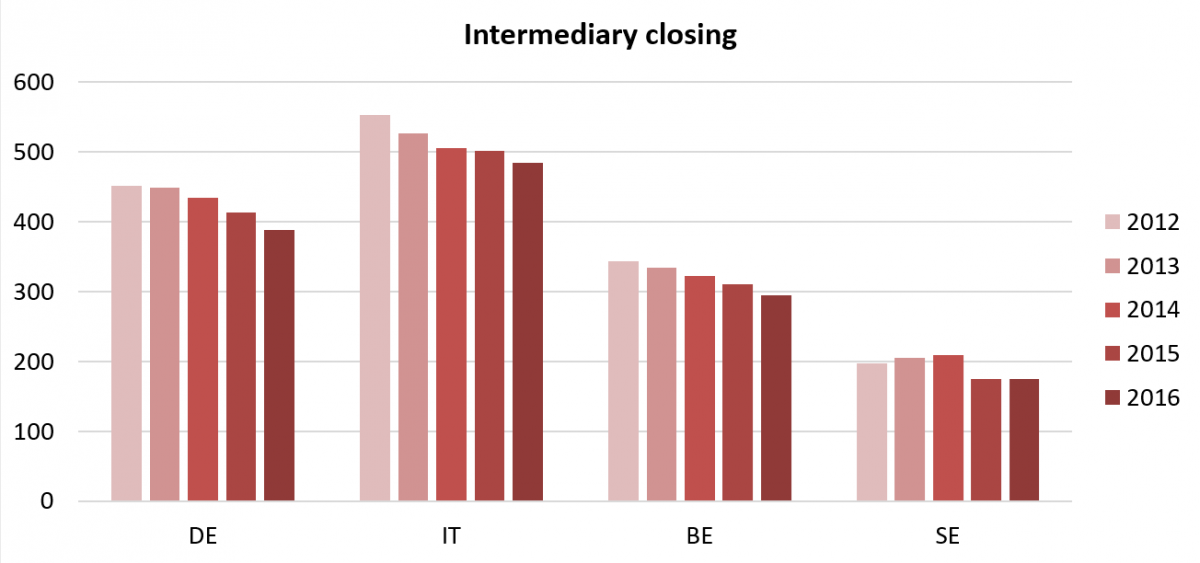

We analysed data from ECB[4] from 2012 to 2016 to identify the closing behaviour of EU countries. We categorized their closing behaviour in three groups:

1. Aggressive closing behaviour with rates over 24% like Denmark, Spain, Finland, Greece and the Netherlands

2. Intermediary closing behaviour with percentages between 12 and 14% with 13% being the average European rate: Germany, Belgium, Italy and Sweden

3. Slow closing behaviour between 2012 and 2016 with rates below 10%. Countries like France, Luxembourg and UK show this behaviour

Figure 2 - Number of Branches Per Inhabitant for a sample of EU countries (ECB)

With 12% of branches closed between 2012 and 2016, Belgium has a rate aligned with the ‘intermediate closing rate’ behaviour in the EU. It is also very close to the 13% average EU rate. To dive deeper into Belgium’s closing rates, we took data from Febelfin[5]. This allowed us to analyse regional behaviour as well as the individual behaviour of a sample of Belgian banks.

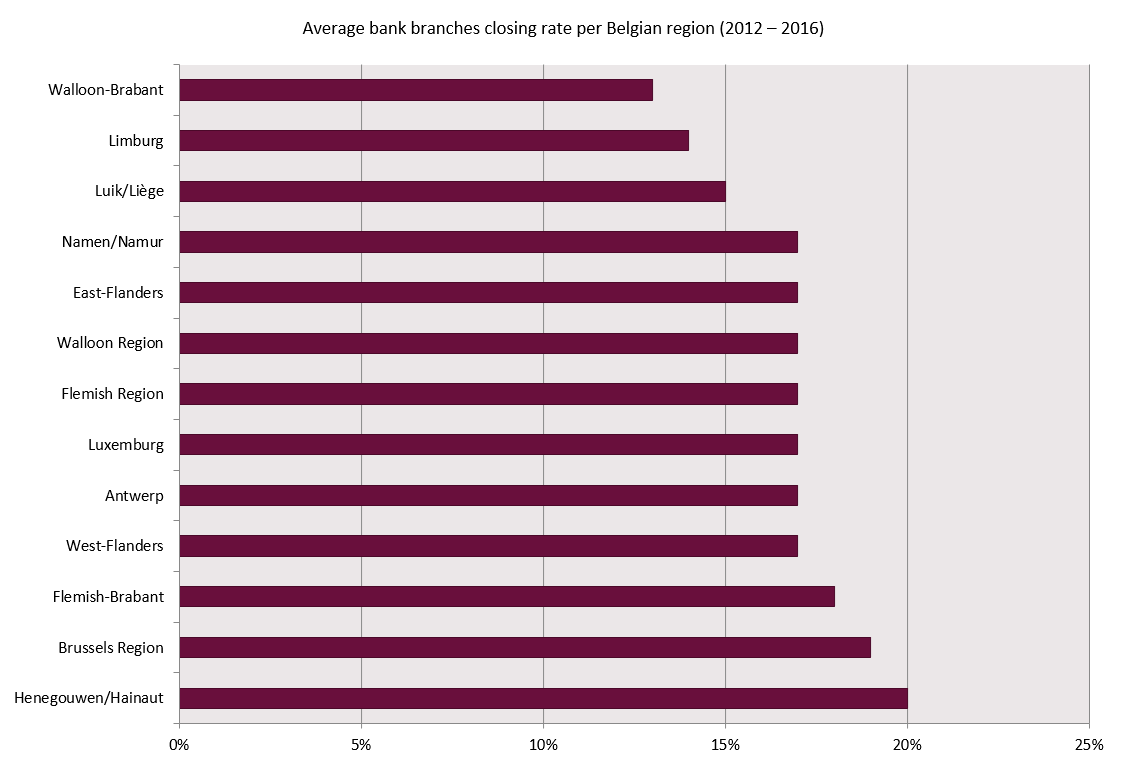

From a regional perspective we found that Brussels had the biggest closing rate in comparison with the other two regions (Flanders and Wallonia). The lowest rate was observed in Walloon-Brabant with 13% and the biggest closing rate with 20% occurred in Henegouwen (Hainaut)

Figure 3 - Average closing rates per Belgian region (Febelfin)

We took a sample of 7 banks active in Belgium and analysed their data. Based on the data we created three scenarios in which we estimate possible trends of closing behaviour.

Figure 4 - Number of Branches – Sample of Belgian Banks (Febelfin)

Based on media announcements found in the economic press we found the number of closures announced by the banks for 2017. We calculated the compounded annual growth rate over the period of 2012 to 2017 and the applied this rate to estimate 2018 till 2020. AXA Bank didn’t provide any numbers for 2017; instead they announced closing numbers for 2020. For them we worked our way backwards to estimate 2017 to 2019. Based on these numbers we predict a 22% closing rate for Belgium in 2020. This is equal to a closing of 1.353 branches and taking into account the announced closings of 2017 and the closings in the first semester of 2018 we expect another 697 branches to close between now and 2020.

Figure 5 – Evolution of Belgian bank branches (Scenario 1)

In this scenario we took a look at closing behaviour of Italy and Germany. We identified these countries as having similar closing behaviour to Belgium. We took the CAGR for 2012 – 2016 on the total number of Belgian branches according to Febelfin and applied to estimate 2017. Then we gradually build it up to 12% for 2020 which is based on the average closing rate for Italy, Germany and Belgium. We end up with a 27% closing rate for 2020 in comparison to 2016 with only 4.516 branches left (a decrease of 313 more branches than our previous scenario). This scenario is the one we believe to be the most likely.

In this scenario we took the aggressive closing behaviour of the Netherlands to look what would happen to the evolution of the Belgian bank branches. We start the same way scenario 2, but in this case, we ramp it up to 9% for 2018 and 2019 based on the CAGR of the Netherlands. Finally, we apply a 17% closing rate for 2020 based on the total number of branches in Belgium between 2016 and 2020 according to Febelfin. With a 34% closing rate for 2020 we estimate the banks to collectively close around 2.100 branches.

Figure 6 - evolution of Belgian bank branches

While the past does not always predict the future accurately, it does provide us with some insight on how the landscape is changing. The traditional branch model is slowly fading away in favour of the specialized branch model. Banks are restructuring their networks to keep up in this new digital world. We strongly believe that banks are going to continue closing branches over the next 3 years and this probably in an exponential manner. Eventually this will plateau once banks have found the optimal network structure and branch format. Physical branches will remain necessary but will fill different or specialized roles. We are already seeing the signs of transformation with ING introducing their new branch concept ‘Client Houses’[6] where customers can feel at home, grab a cup of coffee, get personal banking advice and even use it as a workplace or hold their own business or community meetings. ING plans to open 15 of these branches by 2020.

1. Beobank. (2017, April 03). Online bankieren zal bankkantoor nooit volledig vervangen.

2. ECB. (2018).

3. Febelfin. (2018). Cijfers.

4. ING. (2017). Annual Reports.

5. Sia Partners. (2018, May 30). Neo-Banks: tomorrow's banking has arrived.

6. Spaargids. (2017, December 18). Meer dan 80% jongeren bankiert mobiel.

[1] Spaargids.be, 18/12/2017, Meer dan 80% jongeren bankiert mobiel

[2] Beobank.be, 03/04/2017, Online bankieren zal bankkantoor nooit volledig vervangen

[3] Beobank.be, 03/04/2017, Online bankieren zal bankkantoor nooit volledig vervangen

[4] ECB. (2018).

[5] Febelfin. (2018). Cijfers.

[6] ING, Annual Report 2017.