Fortune 100 response to DE&I pressures

The latest studies by the International Air Transport Association (IATA) project a doubling of air traffic by 2025. This growth is driven by the effects of the massive liberalization of the sector since the early 1990s, the growth of low-cost connections and the rapid growth of emerging markets.

At the same time, public authorities which have historically been involved in the development and management of public infrastructure face severe budgetary constraints and an increasingly competitive environment.

This insight focusses on the arrival of private investors and operators in the airport market segment and describes the main trends of the past 25 years.

Following the privatization of (national) airlines, the first wave of privatization for airport companies was in the 1990’s (Vienna 1992, Copenhagen 1994, Rome 1997, Auckland 1998, ...). This industry, of which the ownership and management until then had been dominated by national governments, is gradually shifting towards the private sector. Privatization can take various forms (public shares offering, concession model etc.), and airports that were previously perceived as public service infrastructures are becoming true commercial organizations focused on their operational and financial performance.

In 2016, it was estimated that about 500 [1] commercial airports around the world were (partially) privatized. Although this figure has grown at a high pace in recent years, there are still large differences between regions: while Europe and Asia are experiencing a rapid movement towards privatization, the majority of airports in North America, the Middle East, and Africa are under government ownership and control.

In its latest report on European airport ownership [2], the Airport Council International (ACI) indicates that 40% of the continent's airports were fully or partially privatized in 2016. These privatizations concerned mainly the major European airports; 3 out of 4 passengers today in Europe travel via a privatized airport.

Fig.1: Ownership of European Airport has gradually shifted towards more privatization.

100% Private:

One or more private commercial organizations own the entire airport operator. For this study, it should be noted that a commercial organization of which the shareholding is fully or partially financed by public capital of a country other than the one where the airport is located will be considered as a private investor.

Example: London Heathrow Airport (UK)

Private-public mix:

The airport operator is an independent commercial enterprise whose shareholding is shared between private investors and public institutions of the country where the airport is located. This model is called a public-private partnership (PPP).

Examples: Lyon Airport (France) and Brussels Airport (Belgium)

100% Public:

The airport operator is owned by one or more public bodies in the country in which the airport is located.

Example: New York JFK Airport (USA)

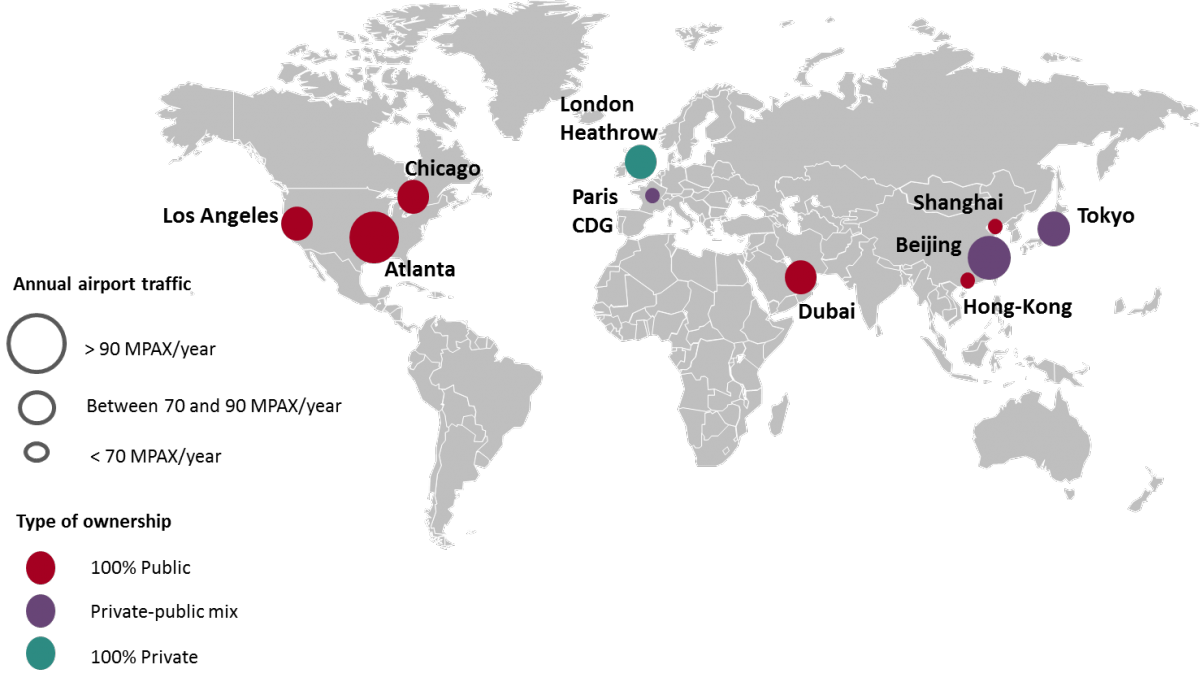

Fig.2: Shareholding structure of major world airports.

Of the world's top 15 airports, only 2 are operated by fully-private operators: Heathrow and Istanbul. While all major European airports have opened their capital to private players, the fastest-growing airports in Asia and the Middle East are supported by massive investments from governments aimed at making these platforms the new global air hubs.

The term "privatization" is used in the airport market to define activities as varied as the transfer of capital to an airport operating company, or the transfer of management for a given period of time. The type of privatization will have to be chosen according to the specific needs identified by the public seller(s). Sia Partners provides a list of possible structures based on relevant experiences in the aviation market.

Some of the main forms of privatization include the following:

Opening of capital through the issue or sale of shares on the stock markets

Preferred airport type: International hubs

Examples: The first privatization of this type took place in 1987 with the 100% IPO of the British Airport Authority (BAA).

In 2006, the French state initiated the partial privatization of Aéroports de Paris (ADP) through the IPO of around 30% of the capital.

The launch of airport companies on the financial markets significantly reduces the need for public (tax payers’) capital. Simultaneously, such capital increases can consequently be made available to finance new development projects.

This mode of privatization is particularly suitable for activities with low investment risk (sound financial position and stable economic environment), but with high capital requirements.

Direct sale via a public call for tenders

Preferred airport type: All, except small and midsize regional airports

Examples: In 2005, the Hungarian state sold 75% of Budapest airport to the English BAA.

This model allows public players to transfer the operational management, financing and commercial development of an airport to a private company or consortium following a public call for tenders. Given the full responsibility of the new partner in the operational and commercial management of the airport, it is very often requested that the actor has significant experience in airport operations and development.

Long term concession

Preferred airport type: All, except small and midsize regional airports

Examples: In 2016, the consortium formed by Vinci, Predica and Caisse des Dépôts bought the 60% of the capital of Aéroports de Lyon for 535 MEuros which was held by the French state. In 2014, the Chinese-Canadian consortium formed by the Chinese fund Symbiose and the Canadian operator SNC Lavalin bought the 49.9% of the capital of Toulouse airport for 308 MEuros which was held by the state.

The concession agreement allows a private operating company to manage the airport for a specified period of time, usually between 30 and 40 years. Alike direct selling, the right to operate the airport under concession is usually awarded following a public call for tenders.

The concession makes it possible to spread the risks between the private operator and the public grantors. The most common case is the assumption of day-to-day operations, traffic development and infrastructure financing by the concessionaire. The government then bears the risks associated with terrorism, regulatory changes, or other cases of force majeure.

Ownership of infrastructure remains in this case in the hands of the public partners (government).

In the majority of cases, the grantor (government, local public authority, etc.) is remunerated through the payment of an annual fee expressed as a percentage of the annual turnover or the operating profit. At the same time, the government may impose a certain level of service on the concession holder throughout the time period and demand the payment of compensation if the objectives are not respected.

The Public Service Delegation (PSD)

Preferred airport type: Small and medium-sized regional airports

Examples: Regional airports under PSD (Vinci) in France: Dinard, Chambéry, Saint Nazaire, Toulon…

Small, regional airports often represent a much higher risk and don’t attract significant private investments. This is due to their structural loss-making activities and their dependence on public policies.

The framework of the ‘public service delegation’ makes it possible for the airport to benefit from the expertise of a private operator in the operational management and the commercial development. Major infrastructure works, however, remain the responsibility of the public owners.

Sia Partners works closely together with decision makers in the aviation sector. Based on our experience as a partner of many airlines and airport management companies, Sia Partners has identified ‘key success factors’ to provide strategic guidance.

Improvement of customer satisfaction

The traditional, public operators have only recently begun to develop a real expertise in customer satisfaction. On the other hand, private operators have the reputation to be more responsive to market developments and have been focusing on a "customer centric” approach for many years.

In some cases, the involvement of a private operator may also bring along the experience of customer satisfaction programs at other airports which are operated by the same group.

Better use of private capital

If IATA's traffic forecasts are met, global air traffic is expected to grow from 3.7 billion passengers in 2016 to over 6 billion in 2030. This fast-paced growth in traffic requires significant investments in infrastructure to maintain, or even improve, the level of service offered to passengers.

At the same time, we believe that airports must meet the changing needs of their customers, be it airlines (the growth of low-cost airlines requires a thorough review of how airports operate) or the passengers.

Making capital available to private investors facilitates the financing of the significant and necessary infrastructure projects while limiting the impact on public finances.

Performance improvement

The privatization of an airport creates an environment where it is possible to set up managerial practices focused on operational and economic performance. Airports are typically facing the pressure of airlines for lower prices, but also face increased competition with other airports. The operational performance of airports will be crucial to preserve their economic sustainability.

Create a partnership based on trust

Airports participate actively in the development of the region in which they operate. They are in some cases one of the largest employers in the region and play a strategic role in developing both the economic and touristic activity. It is therefore important that the new private operator would implement a development model which favors consultation and integration with key stakeholders (local public authorities, airlines, economic actors, tourism organizations, etc.).

Hence, an airport's commercial strategy should make it possible to enlarge the economic and touristic attractiveness of the region for instance by developing a proactive cargo strategy at the airport which supports the local industry. In parallel, the private operator could integrate an HR office that facilitates the training and employment of local workers.

Some operators also recommend the setting up of advisory panels, bringing together the main local economic players and stakeholders to integrate them into the decision-making process.

Choose a tailored approach toward privatization and remain realistic

Sia Partners believes that it is essential for the public authority to choose a mode of privatization adapted to its own needs and to the airport strategy. A trade-off may for instance be made between partially retaining some of the public control and the search for a maximum investment by the private operator.

In the context of a concession or a public service delegation, the success depends to a large extent on the quality of the governing agreement. At the same time, it is critical that the interests of the public authorities are protected and that a positive dynamic will be maintained for the private operator by encouraging infrastructure improvement and operational excellence.

In this perspective, the sharing of responsibilities between public and private players ought to be balanced and the operational performance objectives (waiting time at security, number of delays per year, perceived cleanliness of the infrastructure ...) should therefore remain realistic so it does not discourage some private groups to submit their candidacy as an operator.

Develop an appropriate regulatory framework

The evidence we gathered highlights that the selling public authority should ensure that the regulatory framework in place is in line with the expected type of privatization. Often, a specific law on the regulation of airport companies is required as a prerequisite to start a privatization process.

In France, the law of April 20, 2005 restructured Paris Airport into a public limited company. One year later, the company was able to open up its capital successfully to private investors.

Once the framework is in place, the ability of governments to provide some stability in the regulatory environment will favor the interest of private investors.

Fig.3: Footprint of major European-based global operators.

With the highest airport density in Europe, the French market offers a wide array of airport ownership structures. This case study presents how the ownership and management of French airports evolved in order to meet the changing demands of public authorities and travelers.

The trigger for the privatization movement of French airports, the airport reform act of 2004/2005, transferred the ownership and management of about 150 aerodromes to the local authorities. National and international airports, as well as those of overseas territories, and military aerodromes, were excluded in this process. In 2006, these 150 aerodromes had received 9.2 million passengers (6% of the national total).

This transfer acknowledges the State's recognition of the role of local and regional authorities in the development of airport infrastructures. They become responsible for the airport’s strategic development and can independently choose their management model and operator.

It is in this context that private operators such as Vinci and SNC-Lavalin (now Edeis) have been entrusted with the operation of many small regional airports such as Rennes, Quimper Caen, Pau...

Prior to 2005, the 12 major French regional airports were state-owned and operated by the CCIs under the concession model.

The 2004/2005 airport reform allowed the CCIs to transfer the operational management to specially set up companies, initially with public capital where the State remained the major shareholder with 60% of the capital.

In a second phase, the French State can decide to privatize these platforms by selling all or part of the capital that it holds in the operating companies to private companies.

To date, 3 major regional airports have been privatized this way following calls for tenders: Toulouse Airport (2015 - Consortium of Symbiose and SNC Lavalin), Nice Airport (2016 – Consortium of Atlantia, EDF Invest and Rome Airport) and Lyon Airport (2016 – Consortium of Vinci Airports, Predica and Caisse des Dépôts).

In all cases, the state merely sells its shares of the operating company. As a results, the state remains:

Paris Airport currently operates the two main French airports, including Paris Charles-de-Gaulle, Air France's international hub and the second largest European airport in terms of passengers. The strategic importance of these two aviation hubs justifies a different management by the French State.

Following the airport reform of 2005, the French government proceeded the next year to the partial privatization of the ‘Société Anonyme Aéroport de Paris’. This first capital increase raised over 600 million euros. About 30% of the capital was then transferred to private investors, the remainder going to employees of ADP (2.4%) and the French State (68.4%).

Later, the share of the French state diminished twice, once in 2008 (as a result of a strategic partnership with Amsterdam Schiphol) and then again in 2009 (after selling some of the capital to the Strategic Investment Fund). Now, the share of the French state represents only 50.6%.

The challenges of a new phase of privatization

The airport law of 2005 does not allow the State to go below 50% of the capital of Paris Airport.

A further reduction of the state’s capital to attract private investors will require a particularly detailed analysis, particularly in view of its highly strategic role at the heart of the French economy.

Increased traffic, pressure on airport revenues and the scarcity of public financial resources: the airport industry is currently facing many challenges. In this context, the operational expertise and investment capacity of major private airport operators represent an attractive opportunity for public decision-makers. Therefore, Sia Partners advises that the complex privatization process should be performed with regard to the particular situation of the airport and the area which it serves. Under these conditions, a partnership can be built which is beneficial to all involved partners.

[1] Airport ownership and management, S.D. Gleave, 2016

[2] The ownership of European airports, ACI, 2016