Fortune 100 response to DE&I pressures

During President Trump’s administration, the US has seen a surge of sanctions against various nations, entities and individuals.

The recent sanctions programs by President Trump’s administration have come to conflict with foreign policies of some traditional allies in Western Europe, specifically related to the US’s Iranian, Russian and Cuban sanctions programs. The need for a robust and comprehensive sanctions compliance procedure has never been as great as it is now. The largest monetary government enforcement actions and fines of the past five years have been sanctions related.

The US administration uses the sanctions as a low-cost and low risk foreign policy tool and hence is enforcing sanctions more frequently. The EU and US are growing apart on sanctions policy and companies are forced to abide with sets of blacklists. Furthermore, the US is encouraging its allies to use their sanctions policies with the extensive use of so-called secondary sanctions aimed at pressuring non-US companies to stop business with countries under US sanctions. The major surge in US sanctions have been directed at countries like Iran, Russia and Cuba.

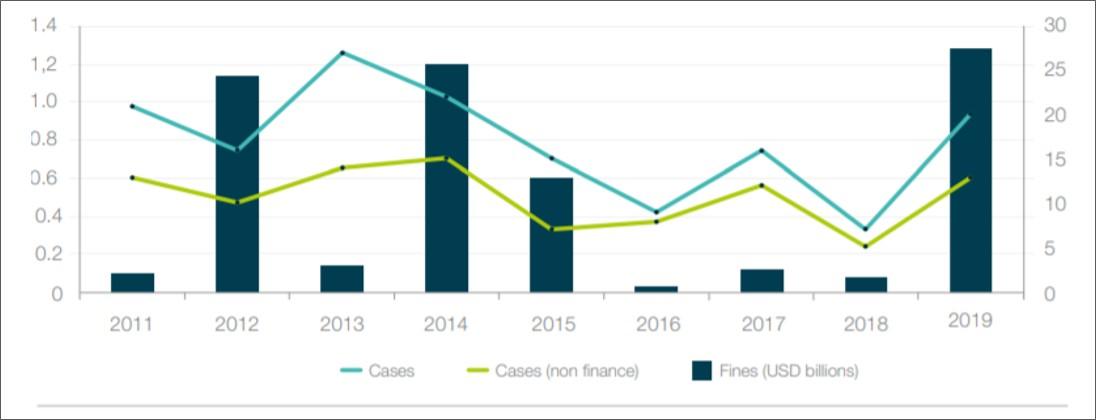

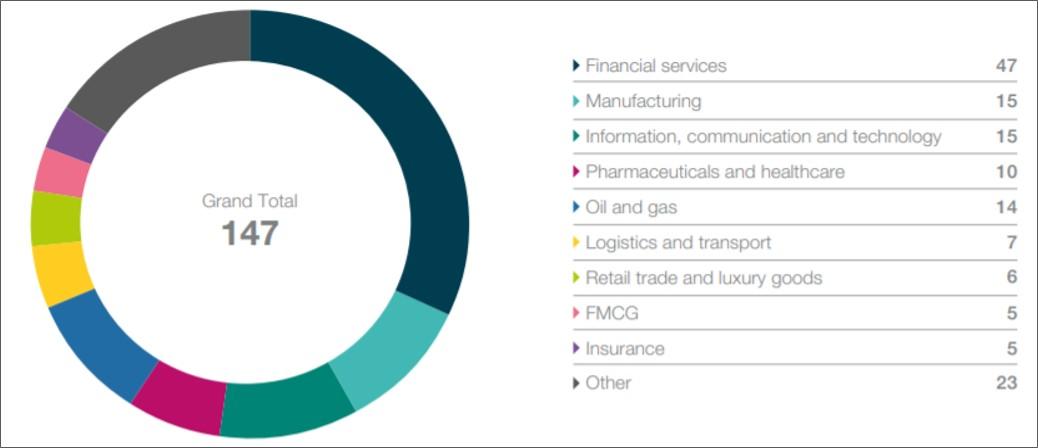

Figure 1 - The numbers: OFAC enforcement actions by sector (2011-2019) [1]

The increase in sanctions over the past few years have led to an increased attention for the need for up-to-date sanctions screening tools. With the increasing number of sanctions, there is also a need for frequent updates to the sanctions list for the compliance team as it has strict liability.

In 2019, the US increased its sanctions on Iran as part of its “maximum pressure” policy as a result of unfinished nuclear talks and security concerns. With increasing security incidents by Iranian affiliates against US assets in the Gulf, the sanctions program is likely to be ramped up. After coming into power, President Trump’s administration, steadily added more sanctions - imposing 700 on a single day in November 2018.

In addition to an increase in sanctions on Iran, Russia’s annexation of Crimea, involvement in the eastern Ukraine conflict, military intervention in Syria, and domestic human rights and corruption issues that escalated after Moscow’s possible interference in the 2016 US election have all contributed to the increased US sanctions on them. With the possibility of Russia supporting China in its trade war with the US, the sanctions are likely to increase. This creates an advantage for companies with less exposure to US sanctions risks, primarily Chinese, Japanese and Korean entities, as well as entities from the Middle East, over their US and Western European peers on the Russian business market. [2]

Due to the increasingly complicated sanctions, there is a need for a sophisticated and highly intelligent sanctions screening tool.

CNH Industrial N.V.

CNH Industrial N.V. is a Dutch manufacturer of agricultural and construction equipment and commercial vehicles with more than 60 facilities in 44 countries. With their scale and volume, the regulations, tariffs and sanctions blacklists change often.

As mentioned by Michael Going, the company’s chief compliance officer, CNH has gone outside for extra assistance and expertise, hiring external lawyers to help interpret new regulations and consultants to help improve the company’s compliance procedures and policies. Further, he quoted, “Those third parties can also bring a bit of a benchmarking perspective on things. ‘How are other companies dealing with that kind of situation?’” he said. “Even if it’s not in our industry, trade compliance activity is quite similar regardless of the industry.”

This industrial example gives us a perspective about the importance of an external compliance team and how a consultancy can offer much more compared to a firm’s internal compliance team.

Sanctions Violence by Apple

In November 2019, Apple, Inc. paid $466,912 to settle its potential civil liability for apparent violations of the Foreign Narcotics Kingpin Sanctions Regulations (FNKSR). Apple appears to have violated the FNKSR by dealing in the property or interests in property of SIS, d.o.o., a Slovenian software company previously identified on OFAC’s List of Specially Designated Nationals and Blocked Persons (the “SDN List”) as a significant foreign narcotics trafficker (“SDNTK”). Apple violated the FNKSR when it hosted, sold, and facilitated the transfer of SIS’s software applications and associated content.

Apple, in accordance with its standard compliance procedures, screened the newly designated SDNTKs against its app developer account holder names using its sanctions screening tool. During this screening, Apple failed to identify that SIS, an App Store developer, was added to the SDN List and was therefore blocked. Apple later attributed this failure to its sanctions screening tool’s failure to match the upper-case name “SIS DOO” in Apple’s system with the lower-case name “SIS d.o.o.” as written on the SDN List. The term “d.o.o.” is a standard corporate suffix in Slovenia identifying a limited liability company. Furthermore, Apple’s compliance process screened individuals identified as “developers,” but did not screen all the individual users identified in an App Store account against the SDN List.

This creates a strong case for a third-party service or consultancy to come in and strengthen the compliance service of a large corporation. The sanctions risk can be mitigated by conducting risk assessments, and exercising caution when doing business with entities that are affiliated with, or known to transact with, OFAC-sanctioned persons or jurisdictions, or that otherwise pose high risks due to their joint ventures, affiliates, subsidiaries, customers, suppliers, geographic location, or the products and services they offer. A strong fuzzy logic algorithm which detects several such minor company name corrections and prevents the transactions to occur is crucial. With Sia Partners new tool – Sanctions Challenger tool these problems can be overcome.

There are several potential areas where Sia Partners can assist your institution’s OFAC/Sanctions Program.

OFAC has very stringent rules for trading with the entities included in the various sanctions list. The technology at Sia Partners helps customers to keep up with the ever-changing list of the Specially Designated Nationals and other blocked people. Transaction monitoring Client screening are some of the most common use cases.

Sia Partners has introduced a new technology - Sanctions Challenger Tool. The tool enables the user to generate test cases that can be integrated into SWIFT format (and various specific tags), create reporting dashboards, and generate automated reconciliation of alerts to investigate false positives/ negatives. The tool will provide insights on how to properly tune the system and which type of enhancements should be made on the filtering process. This will help an institution to streamline the process of testing their sanctions screening platform, by stress testing various type of fuzzy name of variation of sanctioned entities (classified as High/Medium/Low risk of matching). This ready-to-use Software as a Service (SaaS) solution is system agnostic, and is using 10+ sanctions list (e.g. US, OFAC, UN, EU) refreshed daily.

The Sanctions Challenger Tool has been used by many large corporations, banks, insurance agencies in departments like compliance, payments/operations, onboarding, finance, and internal audit. With the multi-functional utility, the technology brings a lot to the compliance services and protects companies to avoid being caught in violations of sanctions.

Considering the recent economic volatility and varying global policies, there are growing challenges in the sanction compliance space. As the US sanction programs continue to evolve, sanctions technology will play a vital role in keeping up with the AML landscape. Companies have already incurred costs in the millions of dollars and US regulators are still pressing ahead with new initiatives and sanctions programs.

Technological advancement has become essential to keep up with the evolving landscape for sanctions compliance. This technology helps financial institutions to maintain low operational costs as well as improve the efficiency and accuracy of its sanctions compliance program.

Many companies have not yet assigned resources and enhanced their compliance program to address this surge in economic sanctions. These are a few key areas to focus your institution’s effort, in order to reduce the risk of non-compliance with the recent US sanctions programs:

Ultimately, sanctions compliance represents a significant regulatory risk that cannot be eliminated, but with attention to the details and robust implementation of a comprehensive sanctions procedure, the risks can be mitigated substantially.

DANIEL CONNOR

CEO US

(862) 596-0649

Daniel.Connor@sia-partners.com

JONATHAN GOLD

Manager

(914) 320-4039

Jonathan.Gold@sia-partners.com

AMAN JAIN

Junior Consultant

(646) 752-2098

Aman.Jain@sia-partners.com

RAJ PARIKH

Junior Consultant

(862) 872-8016

Raj.Parikh@sia-partners.com