Fortune 100 response to DE&I pressures

Thanks to new technology like GenAI, and related regulations around open banking, data protection, and AI usage, banks can finally create ecosystems that focus on tailored services for different client segments. This is another step towards increased client-centricity in financial services.

Customers see personalized offerings in their social media feeds and on their retail sites. Many are wondering why they are not seeing the same thing from their bank and financial services providers.

Shifting customer demands are forcing banks to identify ways they can create value beyond financial services, and to interact with customers in a more personalized way. Banks must understand each customer at a granular level, anticipate their needs, and deliver tailored experiences. Imagine a banking system that knows your financial preferences and predicts your next move, offers personalized advice and integrates seamlessly into your daily life. That is the promise of hyperpersonalization.

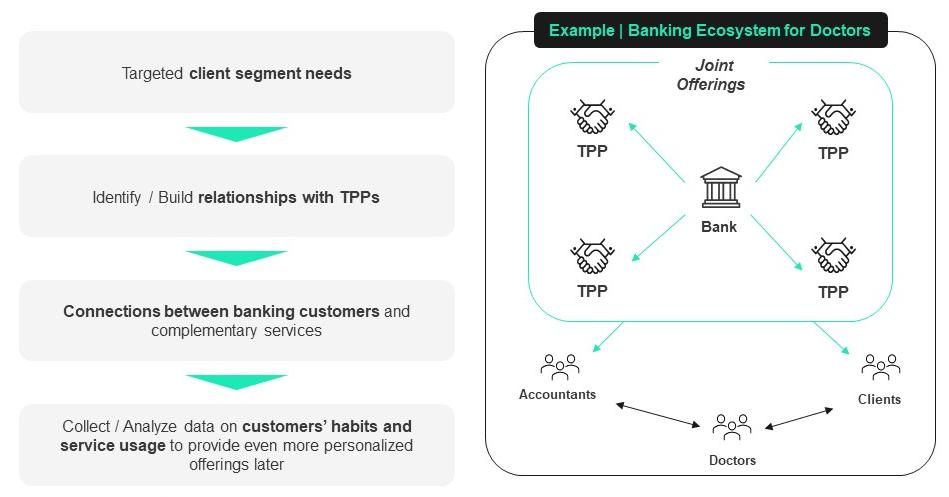

Banks can also go beyond providing financial services by building beyond banking ecosystems. Building ecosystems allows these institutions to provide value to their customers beyond the realm of financial services. Banks and other financial institutions can become an intermediary between their customers and other essential services. By building these ecosystems banks can offer a range of services that enhance our lives in ways we never thought possible.

Recent developments in regulation and technology will facilitate beyond banking ecosystems and hyper-personalized offerings. By learning to better protect and utilize data, banks and other financial institutions can build trust with their clients by ethically using customers’ data. These institutions can then build on that trust by providing innovative and tailored solutions that meet more than just their customers’ banking needs.

Traditionally, individuals and businesses use banks to meet their credit needs and manage their funds. This has put banks and other financial institutions at the center of their customers’ economic lifecycles. Banks can leverage the central relationships they have with their customers to build connections between their customers.

For example, a bank has several clients who are doctors with private practices, as well as clients who are CPAs. When tax season rolls around, the doctors will likely need help with their taxes. Banks can leverage their relationships with their CPAs to build connections between the two groups. These connections allow banks to provide additional services to their customers without having to build the capabilities to do so themselves.

Leveraging data analytics, banks and other financial institutions can provide additional value to their customers through TPPs. By developing robust security infrastructure and using data ethically, banks will earn their customers’ trust. When customer consent is given, banks can then use this data (e.g. transaction history, economic behavior, etc.) to identify services and products that would provide greater value for their customers. They can then approach TPPs who provide the identified services and build partnerships. Understanding customers’ economic behavior and their related financial needs is also a major asset for potential partners. It helps build partnership ecosystems, enabling new revenue opportunities for the bank.

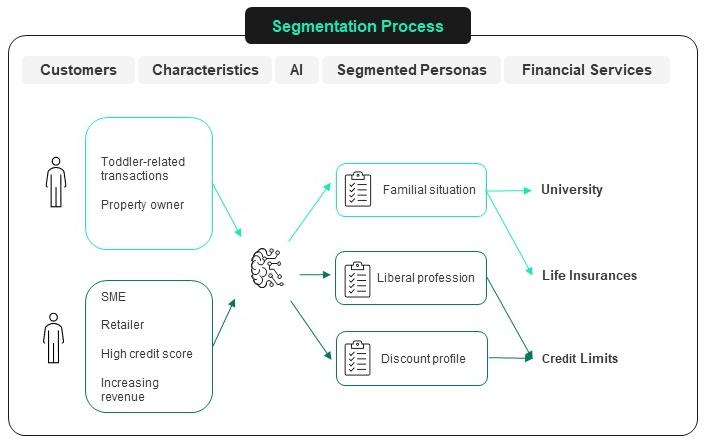

In addition to providing non-financial services through ecosystems, banks can also provide additional value through hyperpersonalized offerings. Hyperpersonalization goes deeper than beyond banking ecosystems and matches individuals with offerings that make sense for where they are in their financial journey.

For example, a bank could see from a customer’s transaction history that they have begun to buy diapers, baby food and other items for a young child. This could set off an alert that this customer has a new child. If the customer consented to personalized offerings, the bank could send notifications and offerings for products such as college saving funds or additional life insurance.

Another example could be for a bank that serves SMEs (Small & Medium-sized Enterprises). For a retail customer, based on the transaction history and balance sheets, the bank identifies the need for increased credit limits in Q4. Without the customer needing to make a request, the bank can preemptively meet the credit needs of the customer. This proactivity helps to improve the bank’s relationship with its customers, making retention and selling of additional services more likely.

Distinctive features to segment customers into non-mutually exclusive personas.

Dynamic cluster identification based on several variables.

Ecosystems and data pools allow an increase in product hyperpersonalization.

Customer Churn Prediction: preemptive retention strategies.

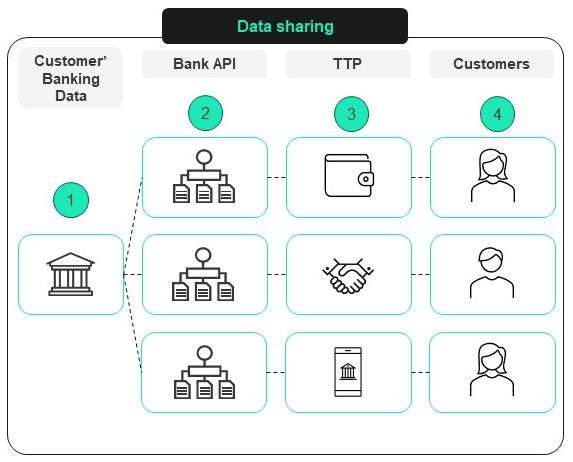

With data at the center of both types of offerings, firms must understand both the regulatory implications and technology investment required. Data has been at the forefront of recent governmental policy, especially in Europe. GDPR, PSD2 & PSD3 & PSR, as well as DSA (the Digital Services Act in the EU), have improved the regulatory structure of what companies can do with customer data in Europe. Customers now have more of a say in who can and can’t use their data. Banks and other financial services firms must build sufficient data security infrastructure, so customers feel like they can trust their financial service provider with their data. However, building trust and gaining access to a customer’s data is not enough on its own.

Firms must leverage standardized APIs and AI systems to enhance their capabilities to provide hyper-personalized offerings. Standardized APIs will allow banks and financial services firms to share data through predictable, protected methods with trusted TTPs. Making it easy for TTPs to receive and send data will be essential for retaining the right partnerships for successful long-term ecosystems and offerings.

Data collection and storage.

Data sharing with TPPs through standardized APIs.

TPPs connection to bank API pending necessary license and explicit customer agreement.

TPP access to secure information.

Creation and provision of offerings specialized to the customer's unique situation.

Learning to utilize AI is important in identifying and generating hyperpersonalized offerings. Training models to identify value-creation opportunities will require extensive amounts of time and investment. Manual reviews of AI recommendations will be essential early in the process. However, in the long term, AI models will be able to identify an opportunity for a unique offering and generate all necessary documentation and content. The firms that make the right technology investments will be the leaders in the financial service industry of the future.

As customers expect personalized experiences in every facet of their lives, from social media to retail, banks have a unique opportunity to become trusted advisors and partners on their financial journeys. Banks must act now: these strategies and offerings are paving the way for a future where every interaction is meaningful, every recommendation is relevant, and every financial goal is within reach.