Fortune 100 response to DE&I pressures

Maximizing Business Insights and Decision-Making through Efficient Market Data Management

As Financial Firms grapple with increasing demands for market data, dealing with the number and complexity of market data licenses and subscriptions can be overwhelming. The volume and variety challenges their ability to effectively manage costs, control user-access, monitor usage, and produce comprehensible reporting. A core foundational element is needed from which intelligence can be derived and add-value services can thrive. Specifically, the transparency and accountability to achieve strong cost management practices through a core knowledge center. The challenge - determining the level of investment required to achieve effective information and risk management controls (or how much to invest in Market Data Administration System?). The investment required is driven by three key variables:

“…15-20% savings in market data spend is achievable…”

The resources employed and structure needed directly impacts the success of any Market Data service optimization program. Get them wrong and firms suffer cost leakage, disjointed vendor management practices, and a weak information base from which critical decision-making occurs. Get them right and the often touted 15-20% savings in market data spend is achievable along with a highly transparent and skilled system. More often than not, Firms will underestimate the “Scope” and “Expertise” only to lack the justification to invest in the foundational element that leads to the benefits.

It’s clear that Market Data Administration is not “sexy” and therefore garners little attention as a valuable contributor to achieve financial goals. There is a tendency by many Financial Firms to take a minimalistic approach with regard to its scope and required expertise, leading to underdeveloped or highly inefficient administrative processes. This proves to be costlier in the long run as operational risks are poorly mitigated and licenses are under-utilized. By attempting to minimize the “cost” (investment in the tools and quality of resources employed) a Firm creates a false sense of security where decision-making and priority-setting is based on questionable operational intelligence.

“Long-term”, and “sustainability” are key. Unfortunately, those terms run contrary to the more simplistic (and somewhat glorified) “cut costs” mentality that persists in many organizations. The conversation needs to change into a Return on Investment discussion, to draw out the value that the information and intelligence available can provide. It’s too easy for people to sabotage the conversation by looking strictly at the cash outlay to build out a program. Especially when they are inexperienced or ill-equipped to understand the returns, let alone measure the scale of the problem itself. It’s what drives Firms to employ resources in “special projects” to save costs without consideration for how those costs quickly come back in because information and controls are weak. And that doesn’t take into account the bigger, enterprise-wide opportunities through a Knowledge Center that monitors, maintains, and guides strategic progress.

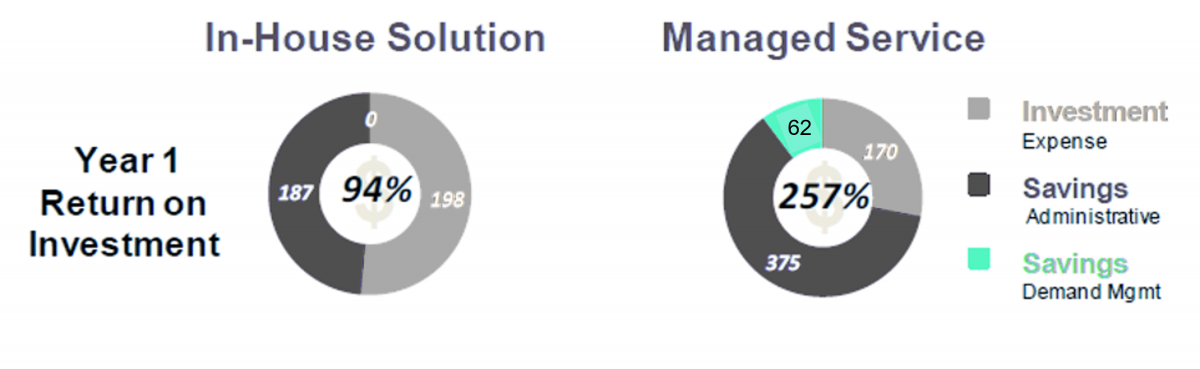

Cutting costs, unfortunately, is such a dominant theme that many aren’t even aware that the cost of implementing a sustainable cost management program with up to 200% ROI is achievable. With more favourable economic models emerging that focus heavily on Market Data Administration, and greater skill in the market data management space, firms now have available to them:

Whether a Firm adopts an In-house (centrally managed) program, or a Managed Service (outsourcing the Administration function), the benefits are substantial. They range from 90% to 200% ROI in the first year (Based on Sia Partners models for a Buy-side firm with $150 AuM, $15M market data spend, 500 users).

By understanding the scope of market data, and the expertise required to manage it, a Firm can base-line the cost metrics for an effective foundation (market data administration function) – achieving the right mix of resources, tools and operational structure to realize a sustainable program. It’s the difference between assuming all is under control vs. arming yourself with the ability to scale, adapt, and fully utilize market data services in the most efficient manner.

It’s the power of transparency, and it all starts with “taking inventory”